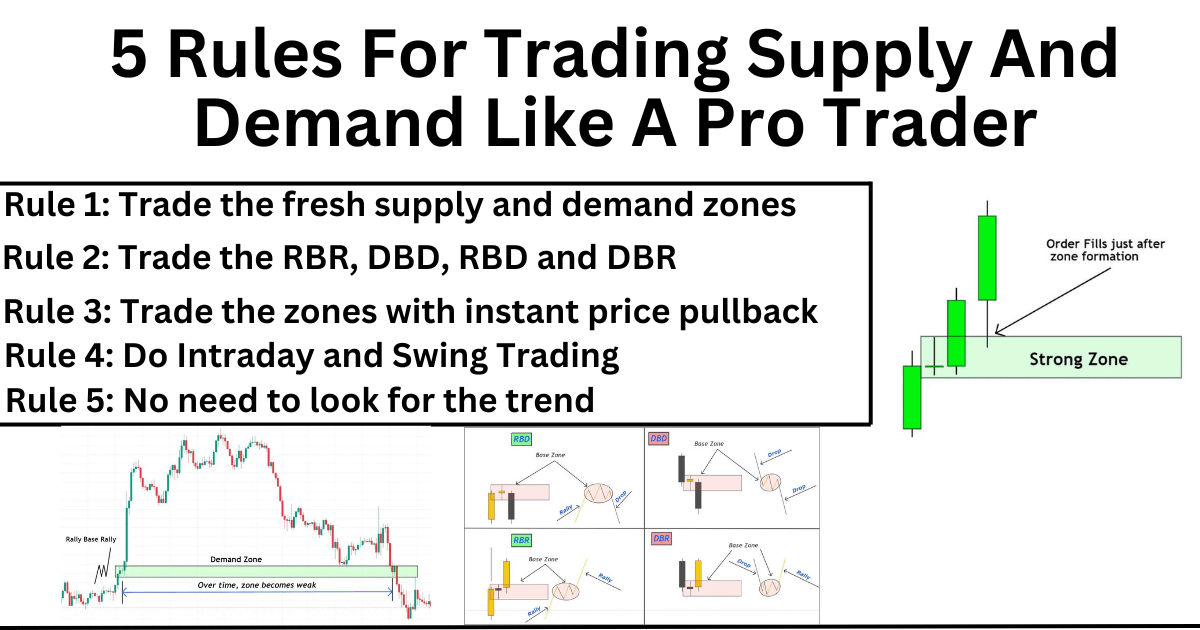

Supply and demand is the most basic concept of trading. It is valid for all types of markets in the world. It works not only in forex but also in cryptocurrency, stocks, indices and other financial markets. That’s why to become a pro trader. You must master the supply and demand trading concepts.

In this article, I will teach five rules of trading supply and demand that I have learned from years of experience. These five most important rules will also help you trade supply and demand zones.

Rule 1: Trade the fresh supply and demand zones only

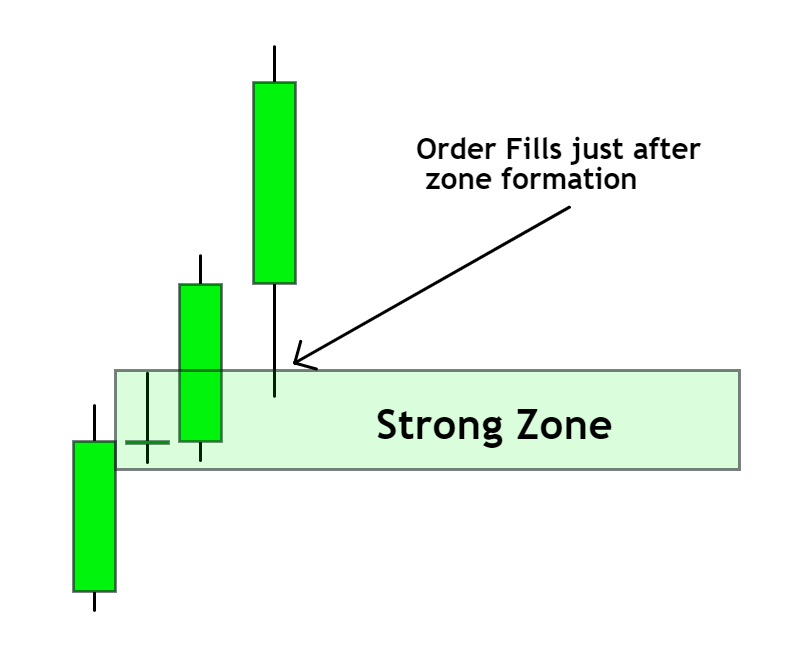

Fresh supply and demand zones are those zones that are untouched. After the zone formation, the price returns to the zone to fill the institutional orders. So it would be best if you only traded the zone on the first price pullback. Once the price fills the orders from the zone, it becomes invalid for future price pullbacks.

It is also possible that prices may bounce from the supply and demand zones more than once. But the probability of this process is lower. That’s why we will not use a zone after the first price touch.

For example, let’s assume there are 100 pending buy orders at the demand zone. When the price returns to the zone, it will fill almost 70 to 80% of the pending buy orders and make a bullish trend. However, only 20 to 30% of pending buy orders remain on the second pullback. Some traders will also remove pending buy orders, so the probability of a bounce is lower on the second price pullback.

You should keep this rule number 1 in mind to get high-probability trade setups.

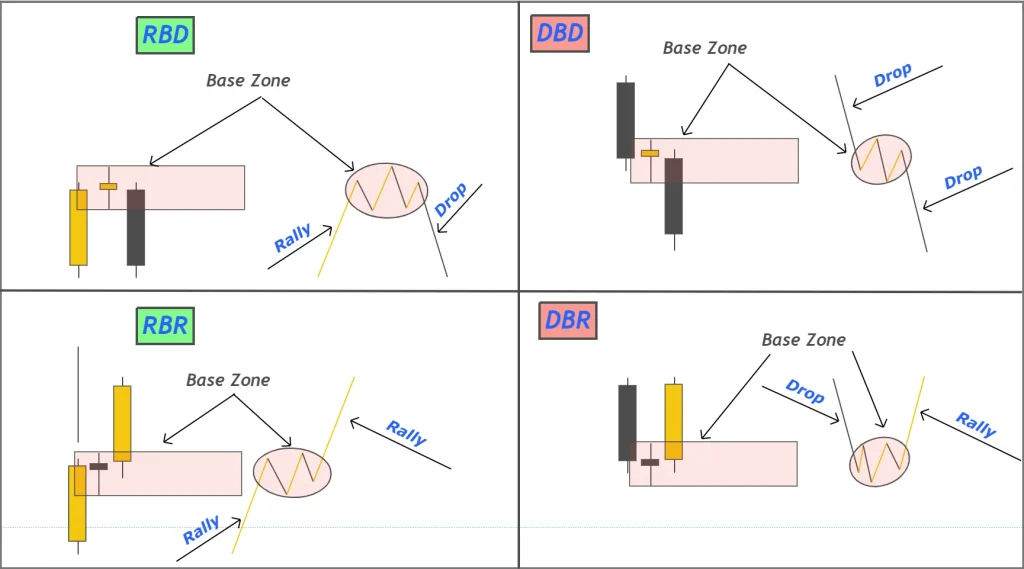

Rule 2: Trade the RBR, DBD, RBD and DBR concepts

Supply and demand are further categorised into four concepts in technical analysis, and those are:

Many traders will discourage you from using these concepts. However, these are building blocks of supply and demand trading in technical analysis. Instead of analysing these four concepts on higher timeframes, you should apply them to candlestick patterns, like the concept of the big candlestick and base candlesticks. This concept makes it easy to identify a perfect supply and demand zone.

You can use both methods (wave analysis and candlesticks) to determine the RBR, RBD, DBD and DBR. However, I suggest using the candlesticks only to determine the supply-demand zones.

Rule 3: Trade the zones with instant price pullback

Time is very important in identifying an accurate and high-probability supply and demand zone. The strongest zone is when the price instantly fills the pending buy orders. If the price takes time to return to the zone, the traders tend to lose interest in that zone, and the probability of a price bounce from the zone decreases.

For example, if a rally base rally demand zone forms and in the next candlestick price returns to the zone to fill the pending order and continue the bullish trend. This is the perfect and strongest form of demand zone. However, if the price makes a rally base rally demand zone and continues the trend for a few candlesticks without returning to the zone, the probability of a price bounce will decrease as time passes.

I recommend not trading a zone after 2 to 3 price swings.

Rule 4: Use supply and demand trading in Intraday and Swing Trading

I like the supply and demand zones trading the most because it allows me to leverage the profit potential by picking the ultra-high-risk reward trades. In this method, you sometimes get trades with 1:30 or 1:40 risk-reward trades. This is the main reason I like this trading method.

So to get such ultra-high-risk reward trades, you should trade on the lower timeframes, like 15M to 1H. I will not suggest trading it for scalping because of the fast market and higher spread rates of brokers. If spread and order execution Is not an issue for you, you can also use it for scalping trading.

The supply and demand zones give a very tight stop loss level and help to leverage the profit.

Rule 5: No need to look for the trend

Trading with the trend is the first approach toward successful trading. However, you don’t need to look at the trend while trading the rally, drop, drop, or rally base drop. Because these terms already form during a strong trend continuation or trend reversal.

The rally base rally and drop base drop pattern form during the trend continuation. However, the drop base rally and rally base drop pattern form during the trend reversal. You don’t need to analyse the trend of trading these four supply and demand patterns.

However, you can look at the higher timeframe to identify whether the overall market is trending or ranging. You can use it to take profit levels.

Trading with the trend is a good approach, but the attribute of these four supply and demand patterns is that these patterns form mainly during the trend continuation or reversal.

Our focus should be identifying the best and high probability supply and demand zone and trading to get an ultra-high-risk reward ratio.

My Recommendation: Use supply and demand indicator

This is not rule number 6, but I recommend using the supply and demand indicator. Because you will not be able to pick the zones accurately manually. Also, most people need more spare time to watch the market all the time. That’s why we have built a price action indicator based on the concept of RBR, DBD, RBD and DBR.

It identifies the high-probability zones in real time using fixed rules and alerts the traders once a demand or supply zone forms on the candlestick chart.

This indicator is for you if you want to automate your trading to some extent.

Click here to learn more about the supply and demand indicator.

The bottom line

Successful traders make rules and then follow those rules. Because our planet or nature is also working with a set of rules, a new trader should follow the rules to become a pro trader.

If you follow the above five rules, you are on the right path to becoming a profitable trader.

Kindly also learn supply and demand trading in depth from our blog.