Definition

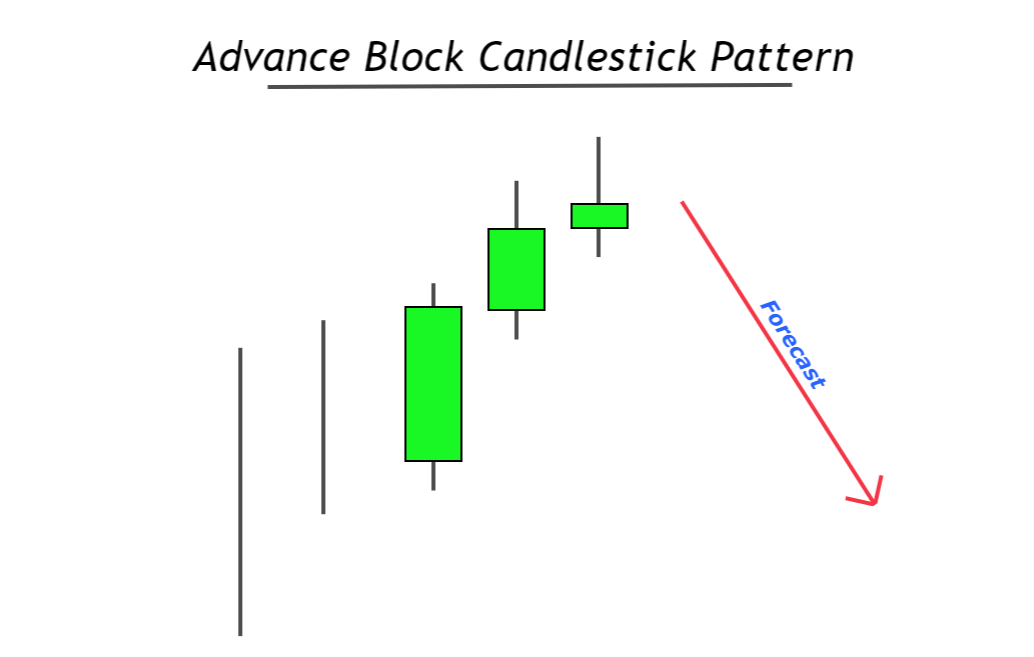

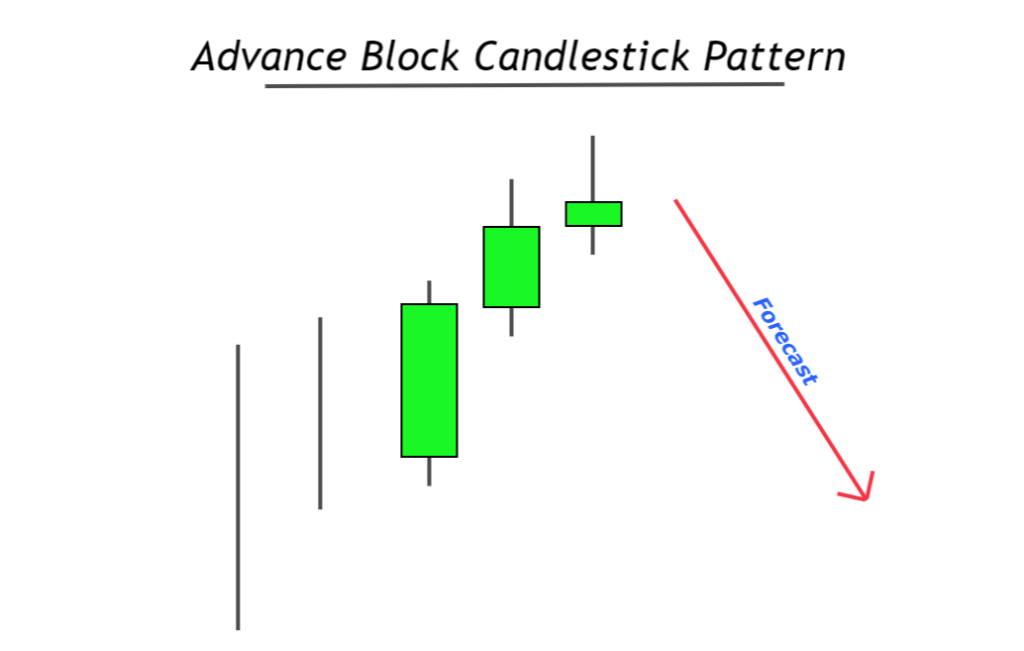

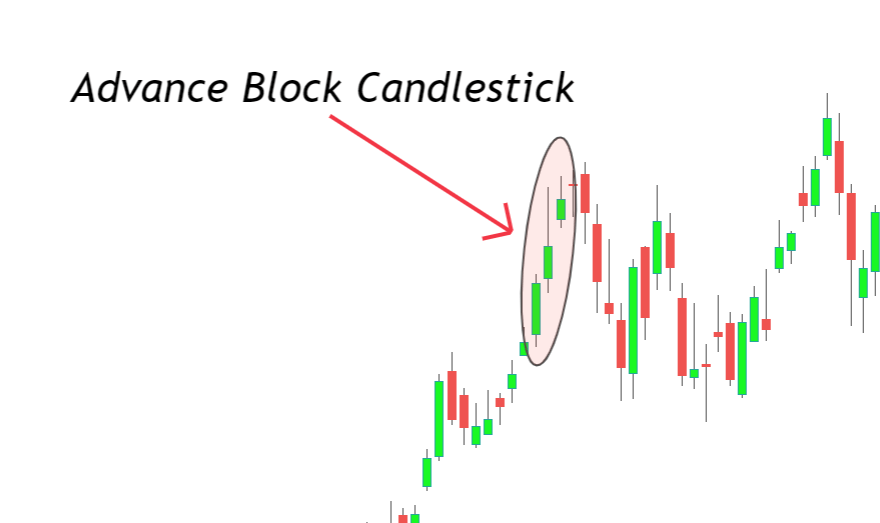

The advance block is a bearish reversal candlestick pattern that consists of three bullish candlesticks. It will turn the bullish price trend into a bearish trend. That’s why it will form at the top of the uptrend.

It is a single pattern that does not have an opposite pattern (bullish reversal) due to rare occurrences on the price chart. It would be best not to choose this candlestick pattern for day trading.

Find High Probability Trades with this ADVANCED Candlestick Patterns Course

The Ultimate Candlestick Patterns Course That Will Help You To Trade Better

How to identify advance block pattern?

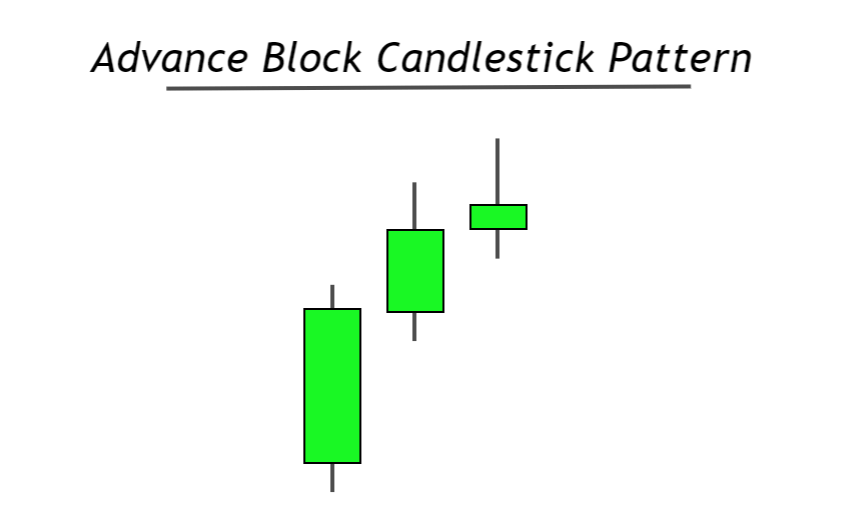

In the construction of the advance block, three bullish candlesticks should form in a specific sequence on the chart.

Here is the guide to find the advance block on the chart

- Step 1: The first candlestick will be a big bullish candlestick. It can be a marubozu candlestick. The big body shows the momentum of buyers pushing up the price.

- Step 2: The second candlestick will also be bullish, but it will have a low body to wick ratio. It will open within the previous candle’s range and close above the closing of the last candlestick.

- Step 3: The third candlestick will have the smallest body to wick ratio compared to the previous two candles. It represents a pause in an up trend.

Look at the image below for a better understanding of the pattern.

Advance block pattern: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 3 |

| Prediction | Bearish trend reversal |

| Prior Trend | Bullish trend |

Trading psychology behind the advance block candlestick pattern

The Advance block candle represents that the power of buyers is decreasing with time, and sellers will come into the market soon, and they will decrease the price.

In this candlestick pattern, the body of candlesticks decreases, and the size of wicks increases with time. It shows an imbalance created in the market, and the price trend is about to turn its direction.

Pro Tip: The candlestick’s body always indicates the momentum of buyers/sellers in the market. In comparison, the wicks/shadows of candlesticks show the imbalance of buyers/sellers in the market.

How to trade advance block patterns?

This candlestick pattern is used to indicate the weakening of the bullish trend. It is not recommended to use it for trading purposes.

Because a trend reversal is not confirmed until the price breaks the low of the first candlestick, you will have to wait for the price to break the low of this pattern. If the price does not break the low, it will be a false pattern.

On the other hand, we obviously cannot afford a big stop loss and small profit levels. The advance block pattern offers a meager risk-reward ratio. That’s why you should use it for technical analysis to confirm a bearish trend reversal and trade on a lower timeframe in the direction of the bearish trend.

Conclusion

The bottom line is that this candlestick pattern is for stock or indices traders only. It should not be used for intraday trading. The second fact you should remember is that the bullish trend will remain stronger if the price does not break the low of the first candlestick.