To determine upcoming Trends and to measure the strength or weakness of a trend, the Aroon oscillator is used. Money is in trading with the trend. So the main purpose of the Aroon oscillator is to forecast the beginning of a new trend. The trend is your friend. We can say Aroon is your friend!! Just joking.

What is Aroon?

Aroon is the indicator to identify the change of trend and strength of a trend. It was developed in 1995 by Tushar Chande who was born in India. No one knows when a new trend in the market will start. to forecast upcoming trends, the Aroon indicator was developed.

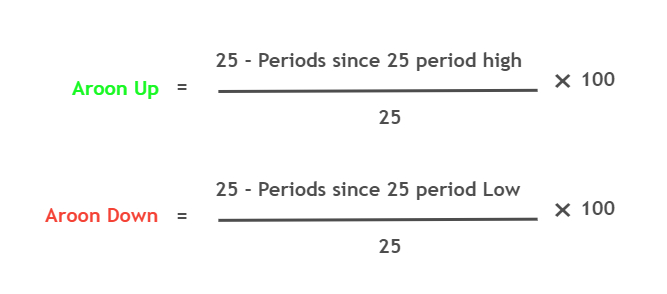

Aroon indicator formula

There are two terms used in the indicator to calculate Aroon up and Aroon down that is 25 period and periods since the 25 periods high.

Aroon Oscillator

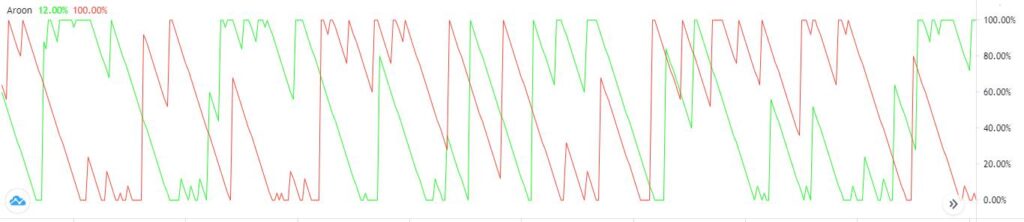

The Aroon indicator oscillates between 0 and 100. it consists of two lines categorized as Aroon up and Aroon down.

- Aroon Up: Bullish trend strength is determined and it uses a High of candlesticks in its formula

- Aroon Down: Bearish trend strength is determined and it uses low of candlesticks in its formula

This oscillator is technically giving us information about the formation of highs and lows in a trend.

The input parameter of Aroon is period. A simple period means a number of previous candlesticks from the recent one. In the daily timeframe, we can say period as a number of previous days. Aroon oscillator collects data of previous candlesticks and uses the formula to predict the next move in the market.

Aroon indicator settings

14 periods is the default setting of Aroon. According to Chande’s Recommendations, the Aroon indicator should have 25 periods as input to get optimum performance.

Pros of Aroon indicator

Aroon indicator has two main advantages

- The strength of a Trend can be measured

- Trend reversal can be predicted

How to use Aroon indicator

The usage of Aroon oscillator is very simple. 0 and 100 lines are reference lines and Aroon up and Aroon down lines will show trend strength or weakness.

- 100 level is an indication of a strong bullish or bearish trend.

- 0 level is an indication of a weak bullish or bearish trend.

- Aroon up shows the number of periods that have been passed since the last high was made during 25 periods.

- Aroon down shows the number of periods that have been passed since the last low was made during 25 periods.

Price is in a strong bullish trend when Aroon down is close to 0 and aroon up is close to 100 line. On the other hand, Price is in a strong bearish trend when Aroon down is close to 100 line and Aroon up is close to 0 line.

We will buy a currency pair when Aroon up is moving upward and Aroon down is moving downward to 0 line. A Buy signal will be generated when Aroon up will cross aroon down. if Aroon up moves close to the 100 line and Aroon down moves close to 0 line then the trend will be strongly bullish. During a strong bullish trend, we have to look for buy opportunities using price action strategies.

We will sell a currency pair when Aroon up is moving downward and Aroon down is moving upward. A Sell signal will be generated on the crossover. So During a strongly bearish trend, we will look for sell opportunities using price action strategies.

This indicator helps us to trade with the trend. Because only 1% of traders get success in forex. 1% of traders are trading with institutions or big dogs. So Aroon is the best indicator to increase the probability of a trade setup.

Aroon indicator trading strategy

I will explain a very interesting strategy using a trendline and Aroon indicator. I use only price action strategies because price action strategies make sense to me. Relying only on indicators will not work.

Price action makes some sense to me. Indicators help me to overcome psychological issues.

Now let’s start. First of all, if you don’t know about trendline breakout then click here to learn. Aroon is an indicator that shows the change of trend or validation of a trend. When the trendline will break then it will confirm trend reversal. But here we will add the Aroon indicator. We will also look at Aroon indicator crossover during trendline breakout. Aroon crossover will confirm our trade and we will place an order.

The main thing is how far to hold a trade. Aroon oscillator will also tell us about the take profit level. Our placed order will remain valid until an Aroon crossover against our trade. Stoploss level will remain the same (read trendline breakout strategy). Take profit depends on the Aroon crossover against placed order and Entry will be on trendline breakout and Aroon crossover.

This is a simple strategy. Look at the images below for a better understanding of strategy.

Use indicators with price action only

forexbee

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4.

Note: All the viewpoints here are according to the rules of technical analysis and for educational purposes only. we are not responsible for any type of loss in forex trading.