Definition

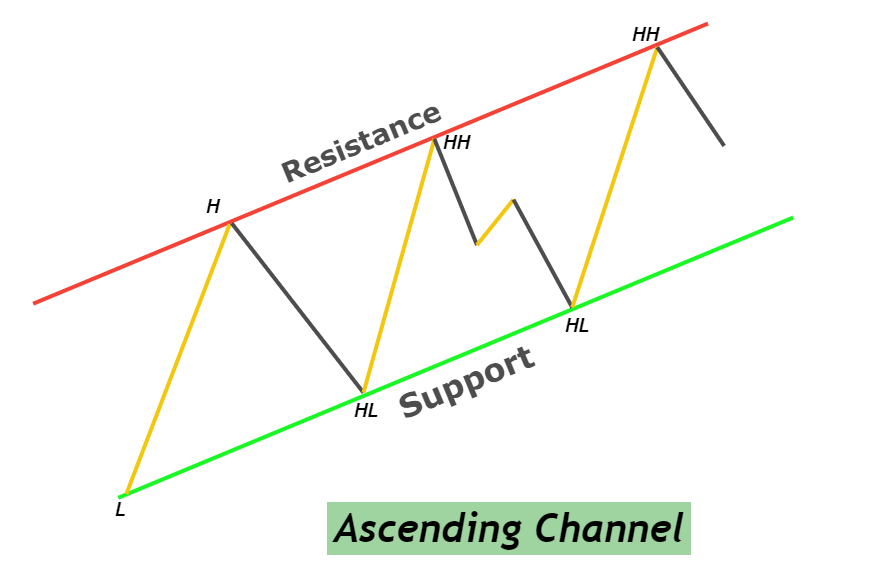

Ascending channel is a chart pattern that is made up of two upward parallel trend lines showing the bullish price trend on the price chart.

This is a type of channel pattern in trading. It is used to identify the bullish price trend and bullish trend reversal in technical analysis.

To learn more about other types of channels click here.

How to identify ascending channel?

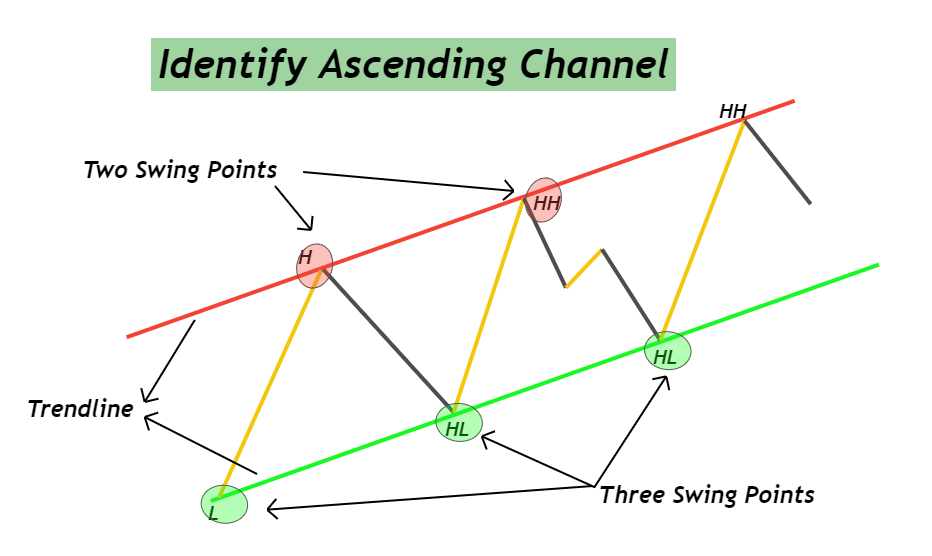

To identify ascending channel pattern on the chart, you need to understand the basics so you can draw this chart pattern correctly. Follow the following few steps to draw an ascending channel on the chart.

- The first step to look for at least three higher lows in a series making a bullish trend. Then draw a trendline meeting those three higher lows.

- Clone the first trendline and adjust the second trendline at the higher highs of price. Trendline can be adjusted using wicks or closing prices.

- Number of trendline touches represent the strength of channel. A stronger channel has more number of touches as compared to a weak channel pattern.

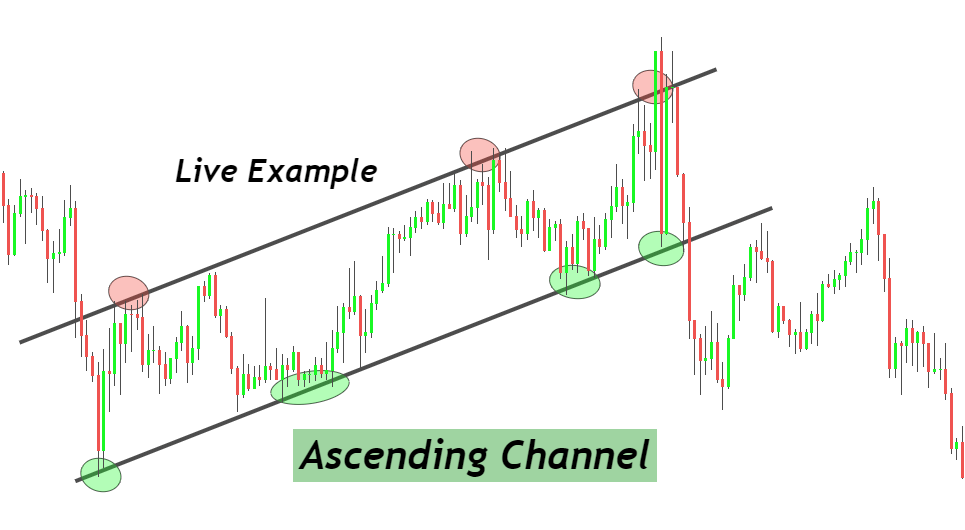

It is very simple to draw a channel but you should find swing points to draw the trendline. Practice the above steps 20-30 times by backtesting and analyzing the setups to master these channels trading.

Pro Tip: Keep in mind that candlestick should not close below the trendline while drawing a channel on the chart. Price closing below the trendline represents the breakout of the channel.

How does ascending channel work?

Ascending channel helps in identifying the direction of the market either it is in an uptrend or a trend reversal has been occurred. So there are two types of trends that can be measured using the ascending channel.

- Bullish trend

- Bullish trend reversal

If the price is moving up within the boundaries of the channel then the price is in an uptrend or the market is bullish. Boundaries of the channel mean two parallel trendlines.

on the other side, if the price has broken the lower trendline then it means a trend reversal has occurred. Now the price trend will be bearish.

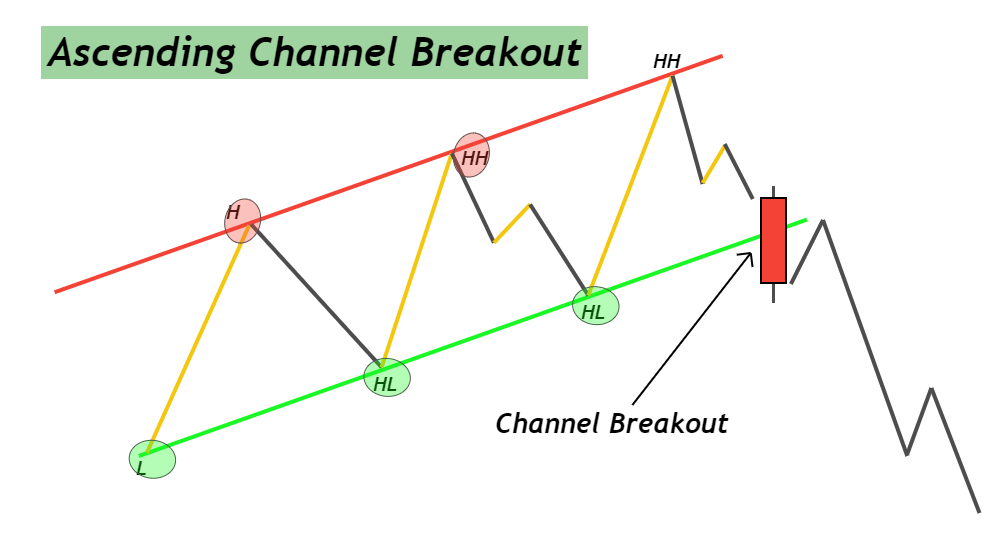

How to detect ascending channel breakout?

A channel breakout will happen when the candlestick will close below the trendline. To identify a valid breakout, a big bearish candlestick must breach through the trendline and should close opposite side. You can use this big candlestick strategy to avoid false channel breakouts.

Pro tip: Avoid ascending channel breakouts during oversold conditions

Trading plan

There are two ways to trade the ascending channel pattern in forex trading.

- Trend reversal strategy

- Multi-channel strategy

First of all, let’s discuss the stop-loss, take-profit, Entry, and risk management of ascending channel pattern.

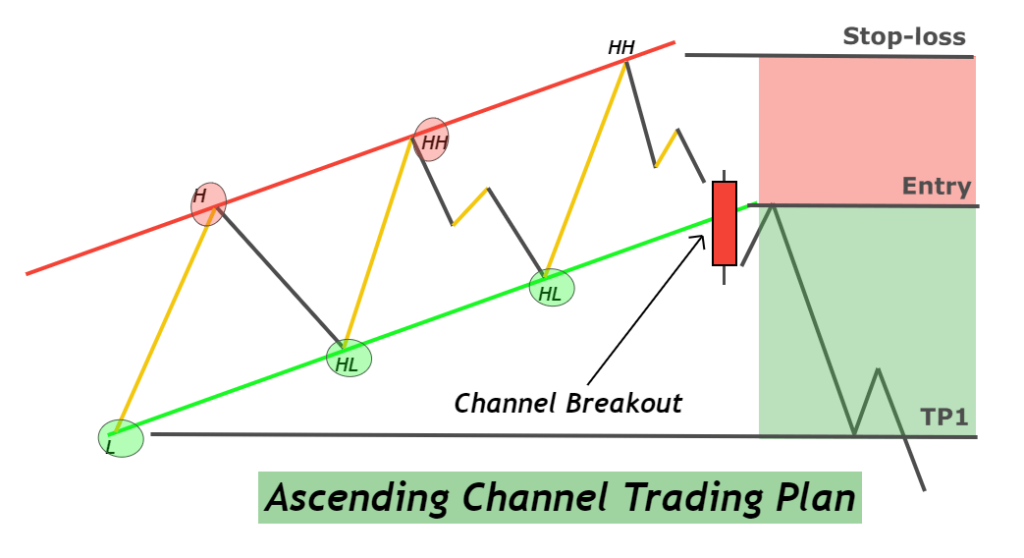

Open Sell Order

Open a sell order just after the confirmation of ascending channel breakout. You can also wait for the price to give a minor pullback and then place a sell order to increase the risk-reward ratio with a tighter stop-loss level. It also depends on the market conditions. Simply wait for a retracement before order entry if the RR ratio is low otherwise open sell order just after channel breakout.

Stop-loss level

Place stop-loss above the last higher high made by the price within the channel.

Target level of ascending channel

The first target level (TP1) should be at the level from where ascending channel starts. Now try to draw another descending Channel on the price and close the rest of the trade after descending Channel breakout in the bullish direction. This makes you a patient trader.

Risk management

The minimum risk-reward ratio for ascending channel pattern is 1:1. The risk size per trade should not be greater than 2% of the total account balance. If the risk-reward ratio is lower than 1:1 then wait for the price to retrace and then open a sell order until the risk-reward ratio becomes greater than 1.

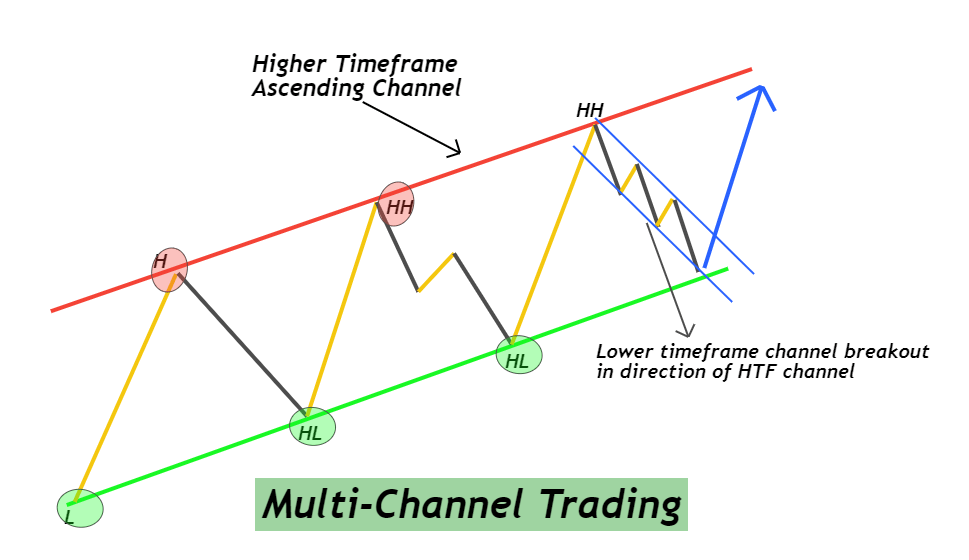

Multi-Channel strategy

According to a multi-channel strategy, a trader should trade lower timeframe channels in the direction of a higher timeframe channel to increase the probability of winning in a trade.

For example, an ascending channel pattern forms on a higher timeframe. Then on the lower timeframe, look for descending channel patterns and trade the channel breakout in the direction (bullish) of a higher timeframe.

This is the way to increase the probability of a trade setup by adding confluences. The addition of confluences filters best trade setups from the crowd and it is the best method to trade.

Conclusion

An ascending channel pattern is an important chart pattern you need to know to trade with big institutions and in the direction of the trend. It doesn’t matter what type of trading strategy you use to trade. But if you will draw channels on a higher timeframe and then apply your strategy only in the direction of the trend of channel then you will get a winning strategy.

Make sure to practice ascending channel pattern properly before applying it on a live account.

Salam

Sir I need complete pdf book of these all patterns with details..

I downloaded one pdf book but it is only with pictures

I need in details .please send at greatazeem4@yahoo.com