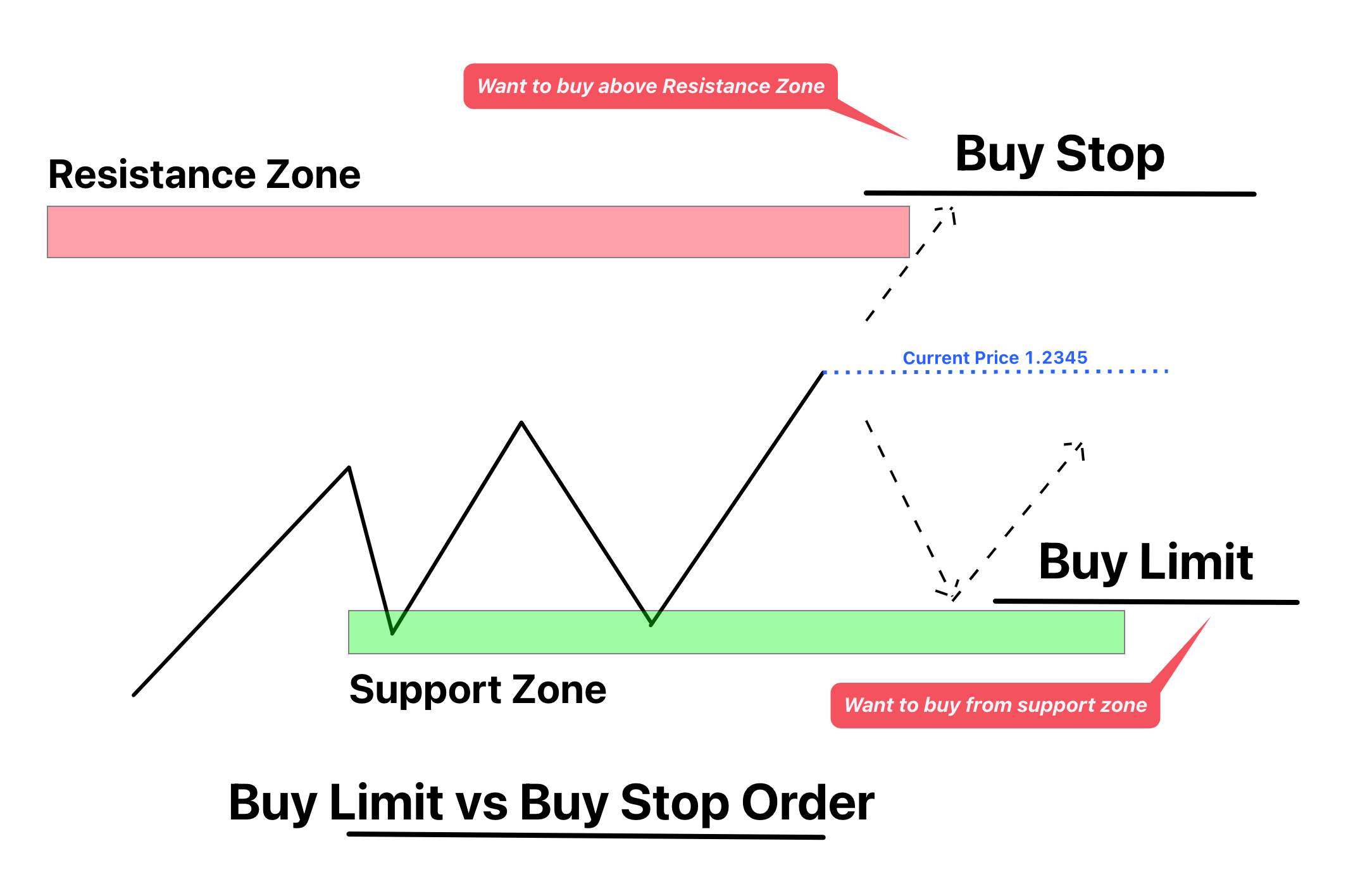

Buy limit order

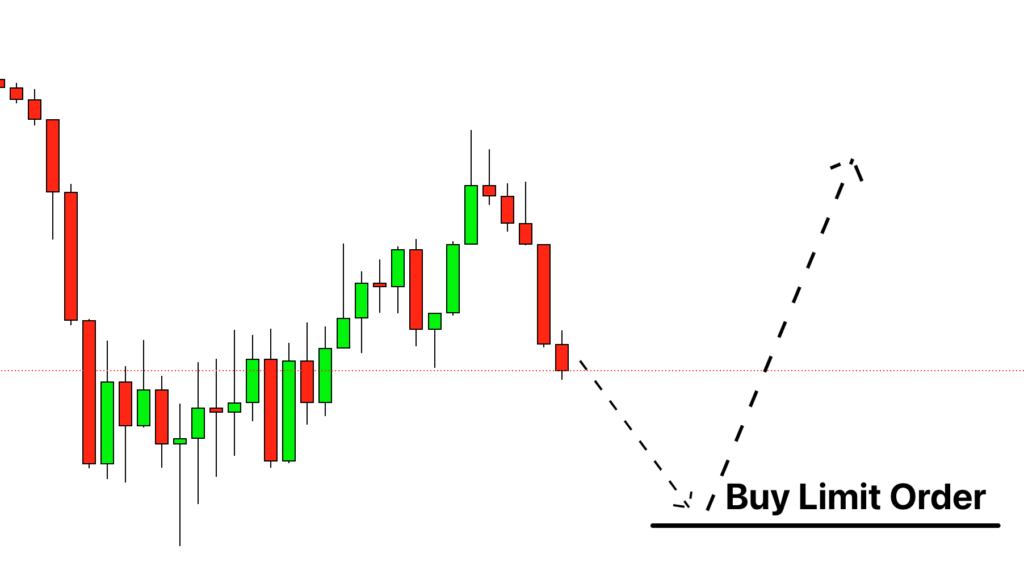

It is a type of order in which a buyer attempts to buy a currency pair, stock, or bond at a specific price or at a better price.

To understand the buy limit in a simple way if you are willing to buy a cell phone. Your budget is $100, and your desired mobile phone is being sold for $105. You will wait for the price to drop in your budget.

Once the price is dropped to $100 or lower, you will execute a move to purchase the mobile phone. So, as a buyer, you set your buying limit in your mind and wait for the product to drop. To execute a buy limit order, a trader will buy the asset at a specified price or at a lower price.

The buy limit order type includes,

- The setting of the buying limit

- Execution of the deal once the desired price is achieved

- No guarantee of the fulfillment of the order is given

- It depends on the availability of the sellers

- The price might not reach the limit you have set

| Pros | Cons |

|---|---|

| It provides better control to the investors as the price is set at a lower level than the current market. | As the investors set the buying price lower than the current market price, there is a chance that traders miss the chance of execution of a trade. If the market price doesn’t take a dip, the investors can miss the chance of completing a move. |

| It provides better entry points and positions to a trader while entering a trade. | An investor can miss several opportunities while waiting for the price to lower and entering into a trade. |

| This method provides the luxury of flexibility while entering a trade, as the trader can enter a trade at any given time of the trade. | Entry into a trade can be delayed as you must wait for the price to lower. |

| A trader doesn’t need to pay extra funds when the market spikes instead of decreasing. | Entering a trade at your offered price in a volatile market can be challenging. |

| Buy limit offers better budgeting by avoiding overpaying. | The price of the execution in a trade can be different from the desired price. |

It promotes patience instead of emotional moves while trading, greatly impacting forex trading. |

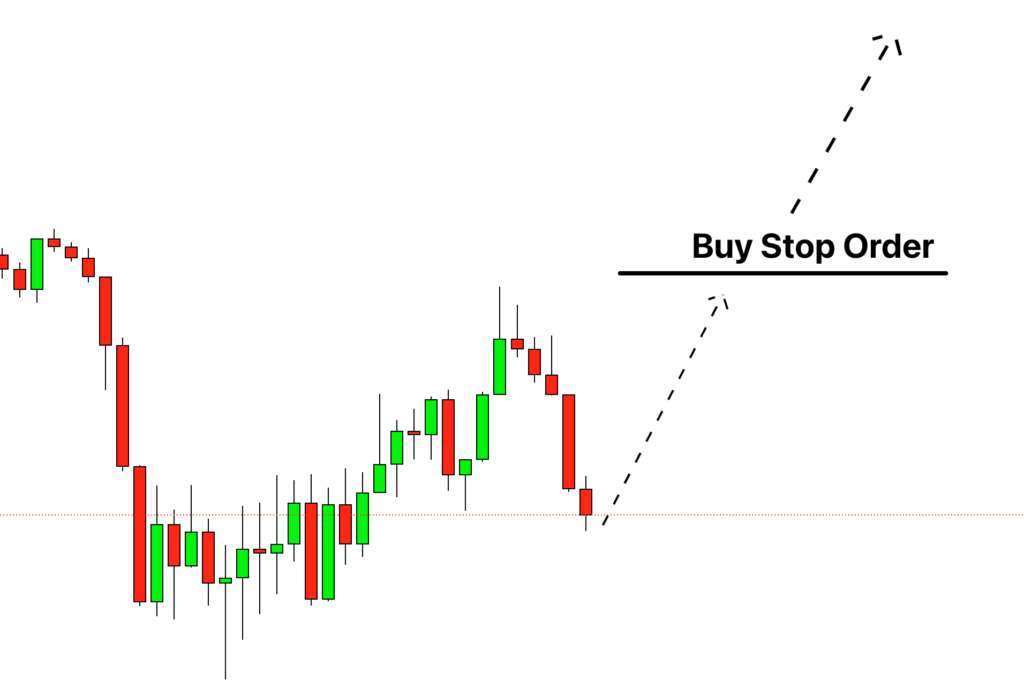

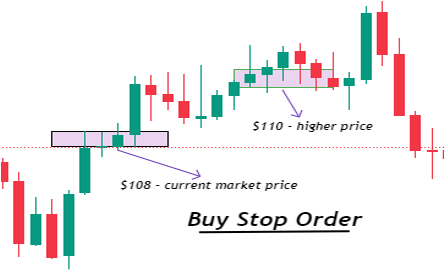

Buy stop order

It is the type of order in which a trader buys an asset at a price that is higher than the current market price.

In this type of order, a trader or investor expects an appreciation in the price of an asset in the future and tends to buy it even at a higher price than the current market price.

To understand the buy-stop order, let’s assume you are going to buy a currency pair, and you expect a future appreciation in its price. The currency market value of the currency pair is $20, and you expect that it will rise in the future. You place an order at $22 and believe that it will move up to $30 in the near future. Your broker will execute the trade for you once the price of $22 is achieved.

So, you end up buying the stake at a higher price than the current market, yet expect a significant amount of profits in the near future because of continuous appreciation in the asset’s value.

Buy stop order includes,

- The actual cost of the execution of a trade may be higher than the stop price.

- Buy stop order is usually opted for entry into a trade

- A trader buys at a higher price than the current market value

- It is considered an anticipation move

| Pros | Cons |

|---|---|

| It can help benefit the market breakouts when you enter a trade. | In a buy-stop order, the buying price is already higher than the current market price. When the price is achieved, the buy-stop order automatically converts into a market order. |

| It is beneficial in fast-moving trading markets. | A trader can buy at a higher price if the anticipated price is not achieved. |

| You can benefit from the rising trend of the market. | A trade might not have significant control while choosing a buy-stop order type. |

| It helps in capturing trading opportunities in no time. | False breakouts in the market can affect your trades. |

| Buy-stop order also provides flexibility as you can enter a trade anytime during a trading period. | It is challenging to execute a trade in a highly volatile market. |

| A trader can limit his potential losses by placing buy stop order. So, this method is used as a risk management tool. |

Comparison Table

A buy-limit order can be compared to a buy-stop order on the following factors.

- The objective of an order

- Activation of an order

- Execution of a trade

- Relationship with current market price

The following table will detail the comparison between a buy-limit order and a buy-stop order.

| Factors for comparison | Buy limit order | Buy stop order |

|---|---|---|

| The objective of an order | To buy at a specific price that is lower than the current market value | To buy at a price that is higher than the current market value |

| Activation of an order | It is activated when the price reaches the set limit or falls lower than the set limit. | It is activated when the price reaches or exceeds the set price. |

| Execution of a trade | When the threshold of lower price is achieved | When the threshold of the higher price is achieved |

| Relationship with price | When the price is expected to decrease | When is the price expected to appreciate in future |

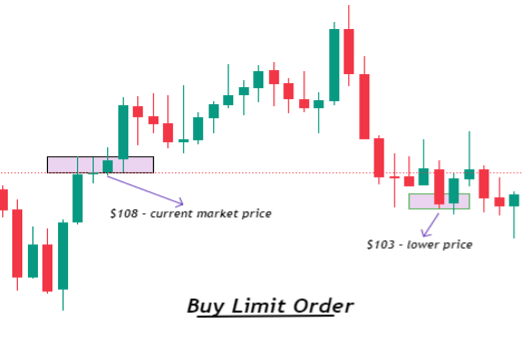

Example 1:

Suppose you are trading a currency pair, and the current market value of that currency pair is $108. To execute a buy limit order, you will set a desired price of $103, which is lower than the current market price. Once the threshold of $103 is achieved, your broker will execute the trade for you.

Example 2:

Suppose you are trading a currency pair, and the current market value of that currency pair is $108. To execute a buy stop order, you will set a desired price of $110, higher than the current market price. Once the threshold of $110 is achieved, your broker will execute the trade for you.

Uses

Buy-limit orders and buy-stop orders are two different trade strategies. Different conditions force a trade to switch between these two buying strategies.

The usage of these two buying order types is given below.

Uses of buy limit order

- If an investor expects a drop in the value of an asset, he tends to buy it at the lower market value to ensure his future potential returns.

- A trade uses the buy limit order method to ensure its security with a safe entry.

- As a trade buy at a lower level than the current market value, he can benefit better from future appreciation.

This method provides a better and more secure entry point to a trader so a trader can execute his moves more patiently.

Uses of buy stop order

- It is used to enter a trade by placing the order at a higher price than the current market value.

- It is used to benefit from the future potential gains in the market

- It is executed when the price of an asset is expected to rise, so it is more of a trend-following trading method.

This method provides better entry conditions in a volatile market where prices can move in any direction.

Conclusion

Buy-limit orders and buy-stop orders can offer different opportunities to a trader. If the market is rising and the asset’s price appreciates, the traders tend to choose a buy-stop order. If the future trend shows that the price of an asset is going to fall, a trader tends to choose to buy a limit order.

The choice of a trading method can impact your trade and trading opportunities. Your future profits and losses are directly proportional to your trading method.