The United States substantially impacts the world oil market regarding production and consumption.

Oil production has significantly increased in the US due to advancements in drilling techniques. The majority of US oil is obtained from Texas and New Mexico.

In the past, the United States of America was a major oil importer, but now it has made its mark in the export of crude and refined oil.

US oil has occupied a significant portion of the trading world as the united states of America export its oil to 180 countries across the globe.

Trading in the world scenario involves some specific patterns and methods. This can sometimes be complicated, but the simple principle behind every trading is “to buy” and “to sell.” One needs to find a specific unit or amount to buy and sell. The smallest change in the market, which can be observed or calculated to buy or to sell, is known as a “pip.”

In the case of US oil, the smallest unit or change in the oil market which can be calculated and observed is known as a change of one pip.

What does one pip mean in crude oil?

As we know, the smallest incremental change in the market is known as a pip. The US oil industry usually refers to one pip as ” barrel per inch of pipeline.”

A barrel is a container used for determining the volume of crude oil. A barrel is equal to 42 US gallons.

In terms of liters, a barrel contains around 159 liters of crude oil.

Now the concept of “barrel per inch of pipeline” must be clearer in your mind. It’s time to understand one pip while trading in US crude oil. To understand a pipeline, one must know that a pipeline is measured in,

- Diameter

- Length

- Capacity

As we seek to understand the capacity of a pipeline, the term pip is equal to the number of barrels of crude oil flowing through per inch in a pipeline for its diameter.

Example

A pipeline has a capacity of 200,000 barrels per day (BPD), and the diameter of the pipeline is 12 inches; we can find the flow rate by following the formula,

The flow rate of oil = barrels per day/ diameter of the pipeline

= 200,000/ 12

= 16,666.67 bpd per inch

Different industries may use different sizes of pipelines, so the value of one pip might vary from industry to industry.

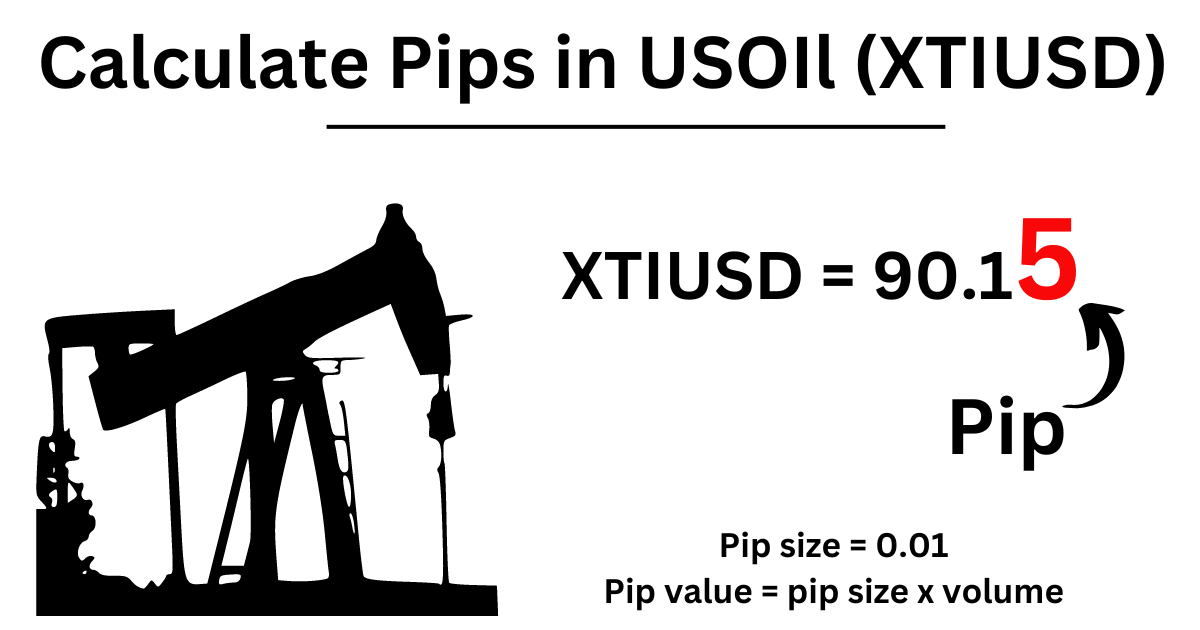

Calculate pip value in XTIUSD

The pip value for crude oil is usually taken up to two decimal places (0.01) compared to forex trading, which is up to four decimal places (0.0001).

Pip size in US oil = 0.01

The pip value in XTIUSD can be calculated from the following formula,

Pip value = pip size x volume

Volume refers to the lot size used in a trade. In the case of a standard lot, we take 100,000 units of XTIUSD.

How much is one pip in XTIUSD?

As mentioned above, one pip in XTIUSD is measured up to two decimal places.

One pip = 0.01

To calculate the pip value in the case of XTIUSD, we can use the formula mentioned above for pip value. The following example will help you to calculate one pip for XTIUSD.

Example 1

In the case of a standard lot,

Units of XTIUSD = 100,000

Pip size = 0.01

Pip value = pip size x volume

= 0.01 x 100,000

= $1000

So each pip change will be equal to $1000. In other words, for a standard size of a lot, while dealing with US oil, the smallest incremental change will be equal to $1000.

Example 2

In the case of a mini lot,

Units of XTIUSD = 10,000

Pip size = 0.01

Pip value = pip size x volume

= 0.01 x 10,000

= $100

So the smallest change in the pip value for a mini lot of US crude oil will be $100.

Conclusion

A pip or the smallest change in the case of US crude oil will be calculated up to two decimal places. A pip size for XTIUSD is 0.01, which helps you find the pip value. The accurate pip value calculation can help you determine the total cost of your trade, which directly affects your trading position.