Definition of Currency Correlation

The measure of the extent to which currency pairs move in the same or opposite direction is called correlation in forex.

Currency correlation helps to minimize the risk factor and increase the reward. Forex trading includes the trading of different currencies that are of different nationalities with one another.

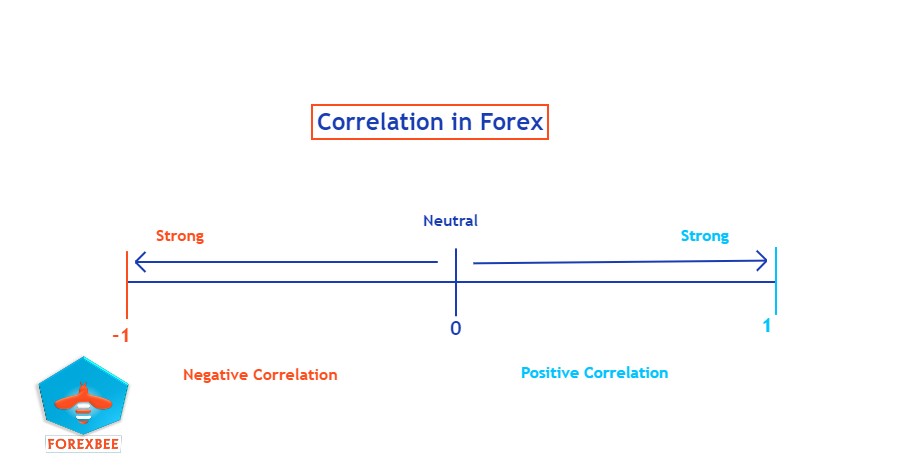

Simply correlation means the link between the two identities which comes to be in between the currencies when we are dealing with forex trading. The two possibilities here are that either both move in the same direction showing a positive correlation or in opposite direction showing a negative correlation.

How correlation coefficient works?

Correlation coefficients range from -1 to 1 showing perfect negative and perfect positive correlation respectively. But as this correlation value equals 0 means the currency pairs are not correlated with each other.

- The correlation value of 1 means both currencies will move in the same direction either bullish or bearish.

- A correlation value of -1 means both currencies will move in the opposite direction.

- Zero correlation value means there is no relation between currencies.

In forex, the pairs which usually have quote or base currency in common are correlated.

How to trade with correlation?

By using Currency Correlation you can find out the best setup of technical analysis. In short, you can pick a refined setup from different currency pairs. Correlation is the only way to filter false breakouts in the price.

Check out the three charts of different currency pairs and positive correlation due to USD as Base currency. They are moving in the same direction.

- USDCHF

- USDSGD

- USDJPY

By analyzing the above thee charts, answer these three questions to yourself

- which currency chart is concise and clear?

- Is there an early trend line breakout in any currency chart?

- are they moving in the same direction?

USDJPY is the best currency pair that has a clear and clean trading environment because there is no false breakout, unlike in the other two charts.

Why you should use currency correlation?

let’s analyze the above setups deeply. USDJPY is respecting the trendline and it’s moving downward peacefully. But in the USDCHF pair, there is a breakout in price after two swings. In USDSGD, price is also respecting the trendline and moving downward.

So it’s cleared that the early breakout in USDCHF was a false breakout. we have to wait for a breakout in every correlated currency pair. The price broke the trend line in two pairs too but it was a bit early to capture buyers. This was a false breakout. So correlation helped to avoid a false breakout.

This is a simple strategy to refine the best setups and increase the probability of a trade.

I hope you understood what I meant. Correlation in forex matters a lot to refine the best trading setups from different currency pairs.

Top 5 correlated forex pairs list

Currency pairs that usually move in the same direction and are mostly in correlation with each other are the following.

| CURRENCY PAIR | CORRELATED PAIR |

|---|---|

| GBPUSD | EURUSD |

| AUDUSD | EURUSD |

| NZDUSD | EURUSD |

| USDCHF | USDJPY |

| NZDUSD | AUDUSD |

Procedure to trade correlation

Trading correlated forex pairs are very easy and safe in terms of risk management.

- Filter out at least three pairs in correlation and then apply your forex strategy. Strategy can be based on chart patterns or support and resistance

- Pick the best pair with a clean environment

- Look for your confirmation in at least two pairs. confirmation can be a pin bar candle or engulfing candle

- Open order in the currency pair chosen already by following risk-reward rules

Forex correlation cheat sheet

There is a free tool you can also use to analyze the currency correlation on a single sheet that is called a correlation calculator.

Mataf is a website that is providing a free correlation sheet of all the forex currency pairs. The best method is to check the correlated pairs from this sheet and then analyze those currency pairs manually by following the procedure explained above.

Check out the currency correlation sheet

Manage your risk by correlation strategy

Using Correlation, risk can also be managed. like in the above example, three pairs were in correlation. I will surely place an order in USDCHF after the trendline breakout. but if I place an order in two pairs USDCHF and USDSGD by dividing Risk. if stop loss occurs if USDCHF and USDSGD hit TP then overall we will be in profit. This is the technique to decrease Risk Factors.

Forex Trading is not difficult but one should stay disciplined. Without discipline and Risk management we cannot profit in this business. Become a Smart Trader and Trade Like a pro instead of flowing with the trend.

There is no Correlation between Happiness and Amounts of Money

I hope you will like this Article. For any Questions Comment below, also share by below links.

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.