Cup and handle pattern in forex refers to a trend continuation chart pattern that resembles the shape of the cup and its handle. Chart patterns are natural patterns that repeat with time like everything in nature is also working in a pattern. The same is the case of a chart pattern.

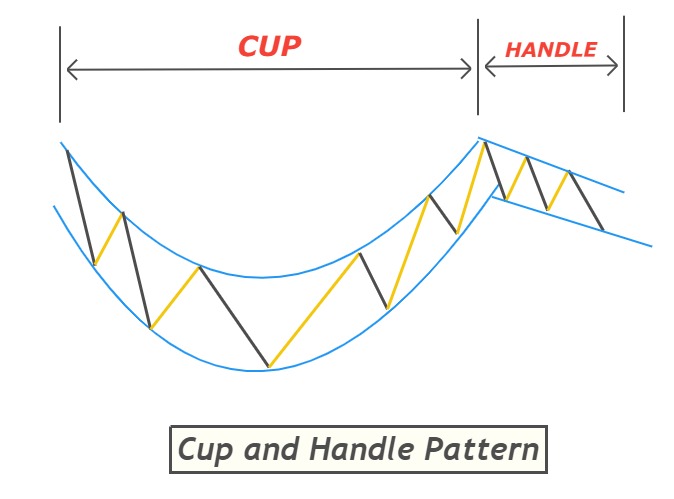

Cup and handle chart pattern

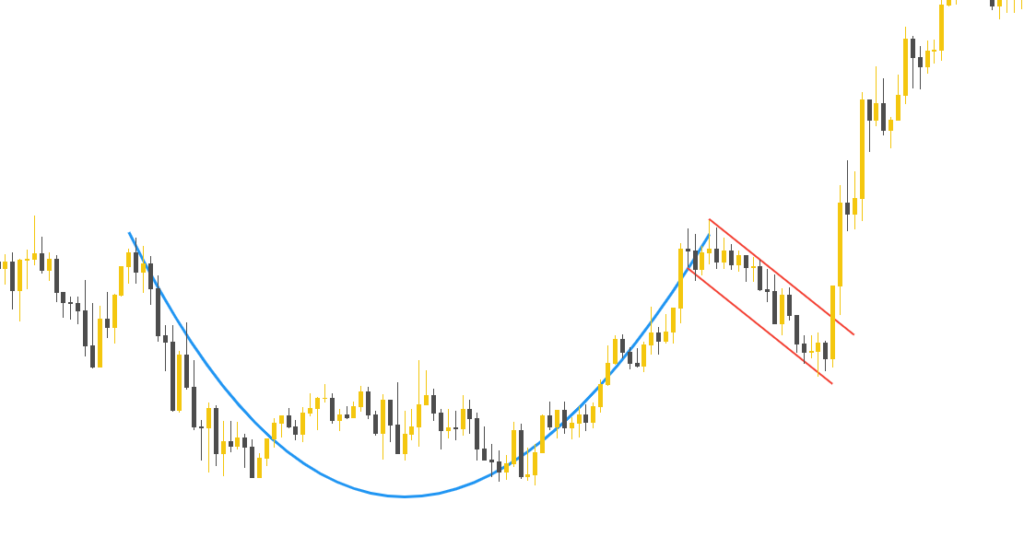

In this chart pattern, the bottom of the price pattern must be round like the bottom of a cup or a bowl. Remember it must not be a V-shape. After the formation of the round bottom, the handle must be inclined. We will look for a trend line break out of the handle of the price pattern.

The handle of this pattern mainly shows minor downward retracement before the start of a bullish impulsive move. Keep in mind that retracement is just a signal of the next upcoming big move. So always to capture a big move, look for a breakout of the retracement wave.

Look at the image below for clear understanding.

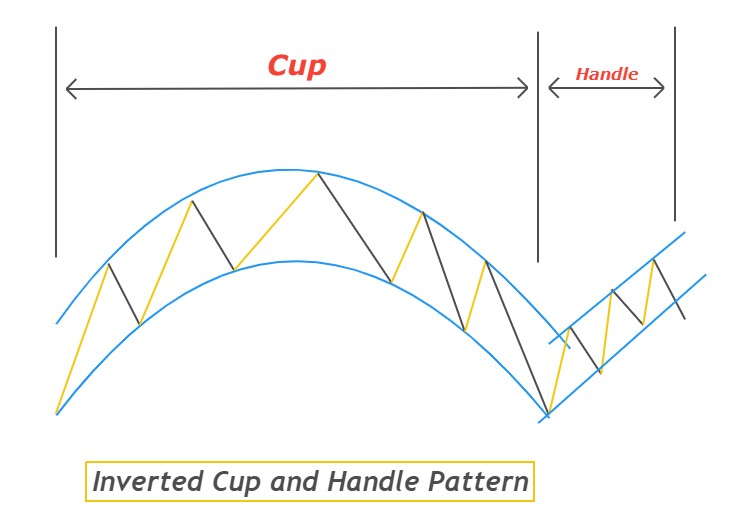

Inverted cup and handle pattern

As the name suggests, it is the same as the cup and handle pattern but the pattern is inverted. The cup and handle pattern gives a bullish signal. On the other hand, the inverted pattern gives a bearish signal. In an inverted pattern, the handle retracement direction will be upward.

How to trade cup and handle pattern

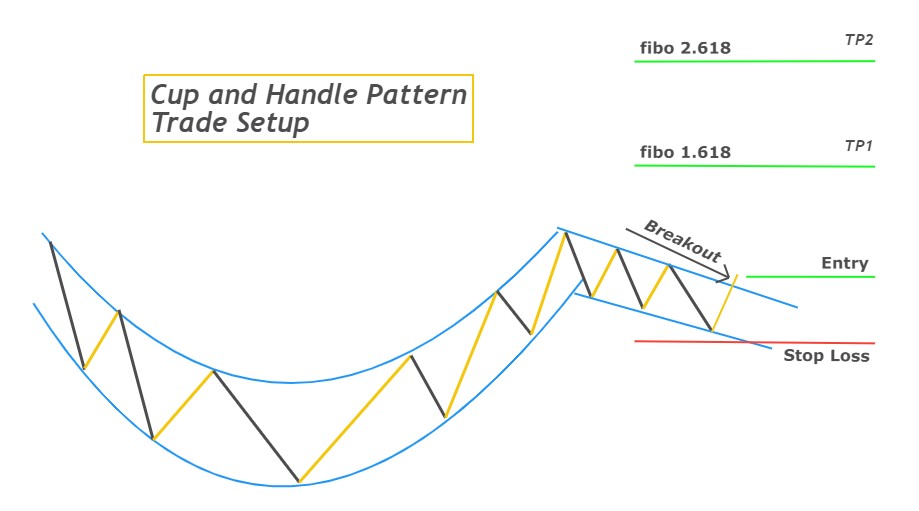

After figuring out a good pattern, the next step is to look for a trade entry price, stop-loss price, and target price.

The handle of the cup shape price pattern will be like a small flag. Breakout of this small flag with a big bullish candlestick is a confirmation point. Buy order will be placed after this confirmation.

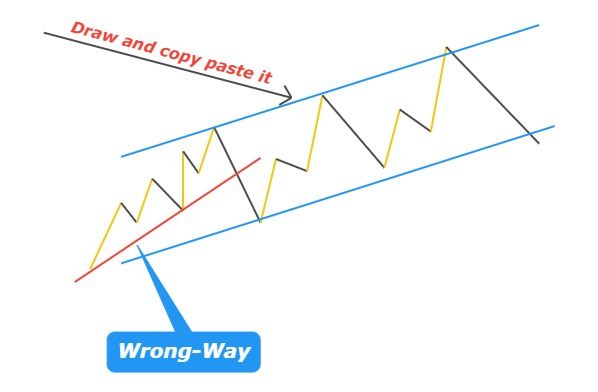

There is a simple way to draw a good trendline on the minor retracement because if you draw a wrong trend line then there are many chances of the cup and handle pattern failure. just draw the line on the highs of all the swings and copy-paste it to lows like in the image below (in case of inverted cup and handle chart pattern). Keep in mind patience is the key in trading. Waiting for confirmation is good if you have any doubt in your mind.

Let me show you how to draw handle of cup and handle pattern in forex trading technical analysis.

The Stop-loss level will always below the low of the small flag/handle pattern. On the other hand, in the case of an inverted pattern, stop loss will always above the high of the small flag/minor retracement pattern.

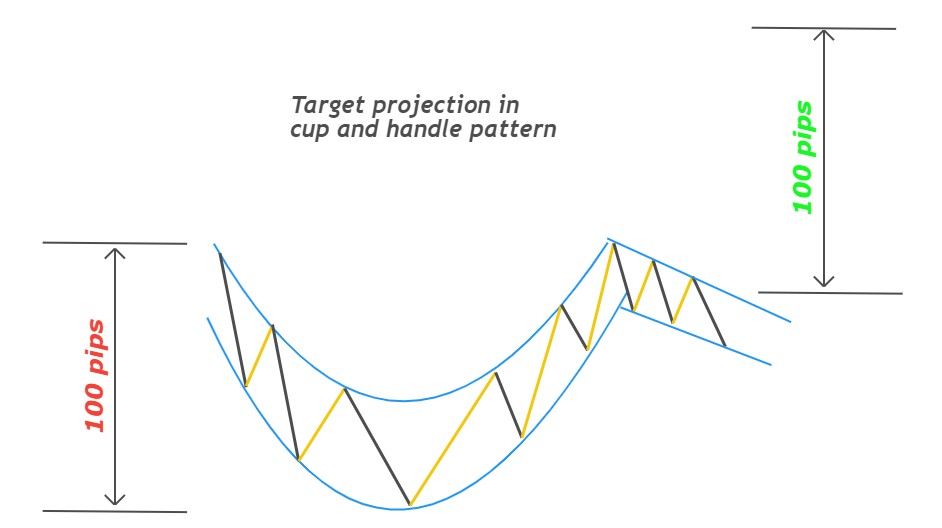

Measure target price

There are many ways I can show you to predict the target of the cup and handle chart pattern like using the Fibonacci tool. But I will show you first the best way usually used. And it is a projection method to measure the target price.

Depth of cup pattern/round bowl price pattern (unit in pips) will give us the target price. For example, if the depth of the cup pattern is 100 pips, then the target price will also at 100 pips. from the breakout of the small flag, 100 pips above will be the target price.

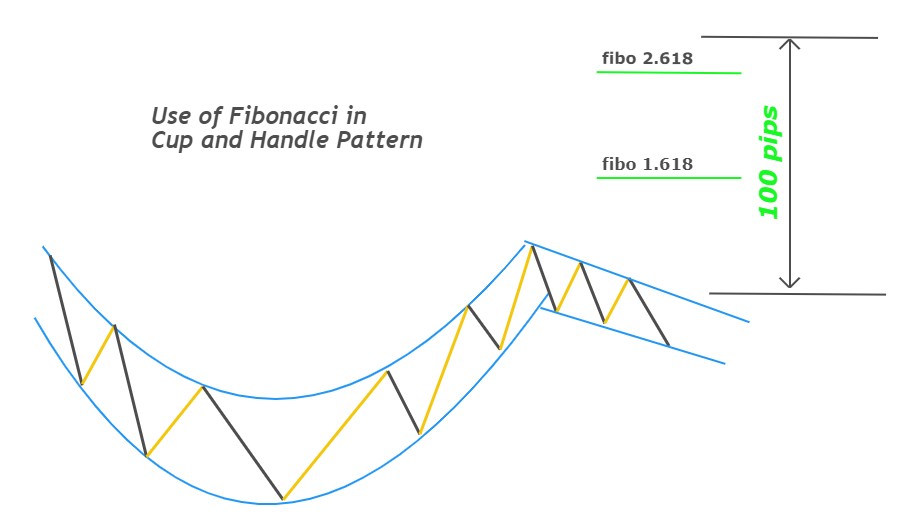

Use of Fibonacci

Fibonacci is the best natural tool. So, use the Fibonacci tool and disperse your trade risk by adding two take-profit levels. Draw Fibonacci only on the minor retracement of the cup and handle pattern and highlight fibo 1.618 level.

For example, first take profit level at Fibonacci 1.618 and second take profit level at 100 pips (100 pips is to just teach you it will vary pattern to pattern). Another best way is to move the second take profit level to the nearest strong Fibonacci level like in the image below.

There are many other ways to use this pattern in trading. For example, if you don’t want to use this pattern as a strategy then only use it to predict the price during technical analysis and then ride the trend in the predicted direction by applying your specific strategy in a lower timeframe. This is the best use of this pattern in intraday trading.

A live example of this chart pattern in forex has also been attached. keep it simple and try to backtest this chart pattern yourself first before using it for trading.

Never, ever argue with your trading system

Michael Covel

I hope you will like this Article. For any Questions Comment below, also share by below links.

Note: All the viewpoints here are according to the rules of technical analysis and for educational purposes only. we are not responsible for any type of loss in forex trading.