What is drawdown in forex

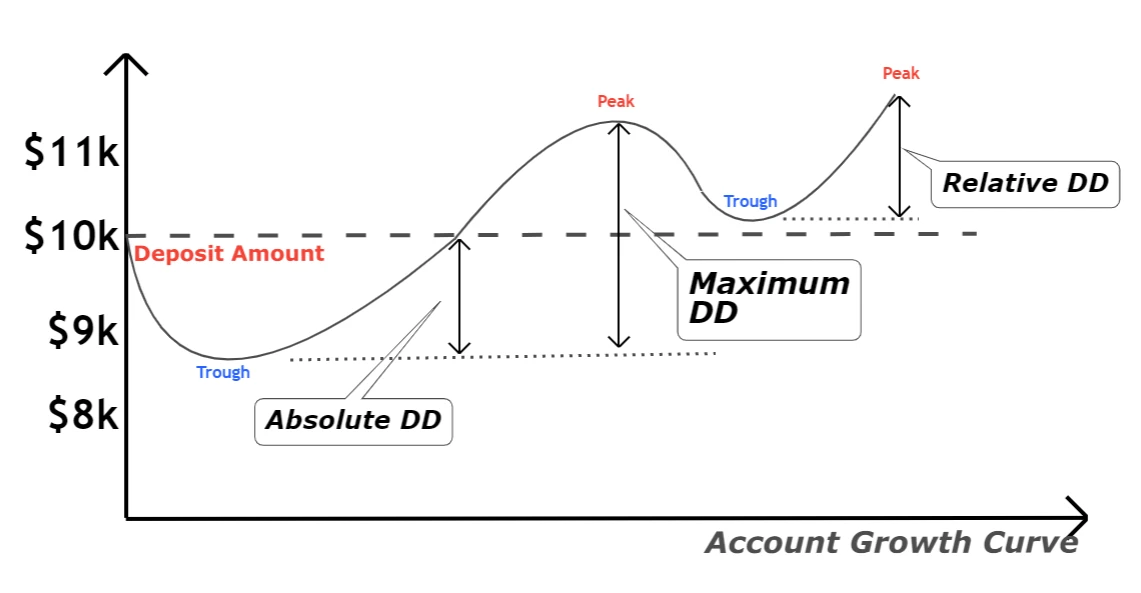

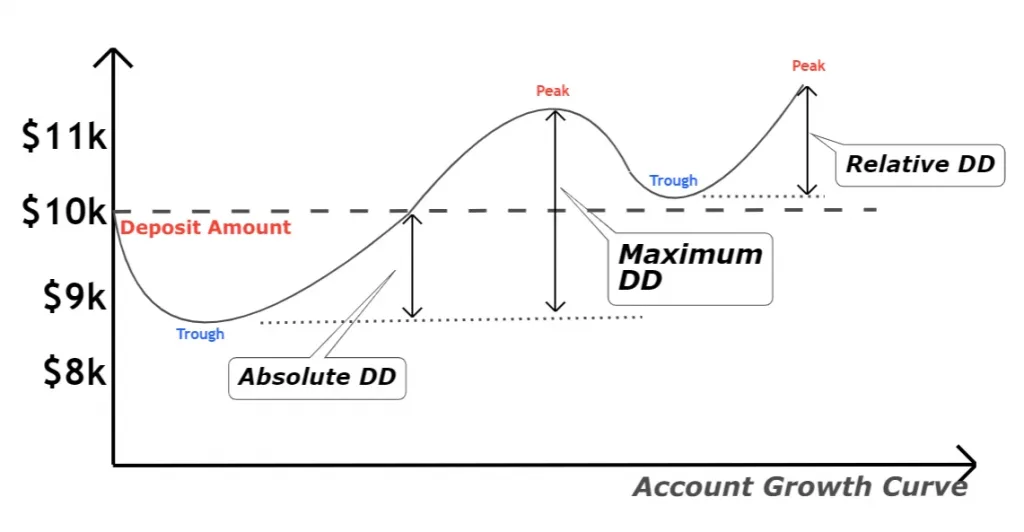

Drawdown in forex refers to the percentage of the amount of losing trades in a row. It is the amount that has been drawn from your account after losses in forex trading.

For example, the total balance in your MT4 account is $10,000. But after trading for few days, now your account balance is $9000. After few more days, you achieve to profit again and succeed in growing account from $9k to $11k. Now your total drawdown amount is $1k or 10% drawdown.

Types of drawdown DD in forex

There are three types of drawdowns used in forex trading mostly. You should understand these terms to check the performance of a portfolio before investing or trading.

- Absolute drawdown

- Relative drawdown

- Maximum drawdown

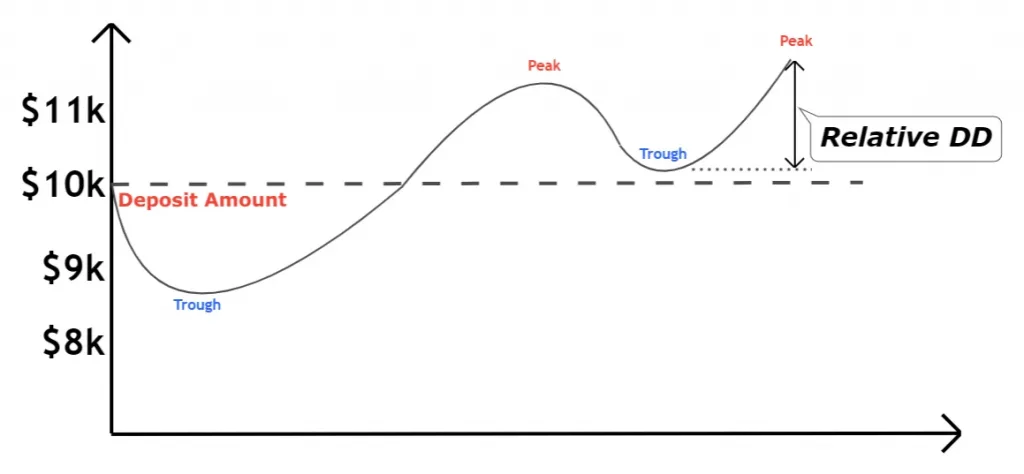

Relative Drawdown (DD)

Relative drawdown is the difference between the maximum equity high to maximum equity low. Remember I have used the word equity which means unrealized profit or loss. Relative drawdown is measured on the equity, it is not a fixed drawdown.

For example, you opened two positions in EURUSD currency pair with an account balance of $10,000. In the first 60 minutes, your account equity was $9500 but in the next 60 minutes, your account equity was $10,500.

Let’s assume, $9500 and $10,500 are the minima and maximum values consecutively. Then the difference between them is your relative drawdown.

formula

Relative Drawdown = Maximum value of equity – Minimum value of equity

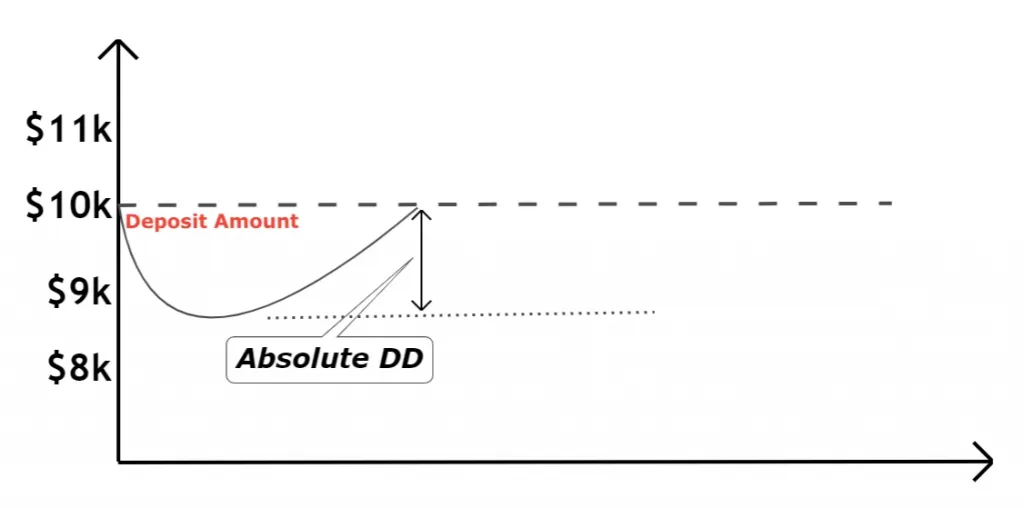

Absolute Drawdown

The difference Between the initial balance to the maximum loss in an account balance is called absolute drawdown.

For example, you grew your trading account from $10k to $15k after few months of trading. But unfortunately, due to some reason, your account balance falls to $10k from $15k. Now, your account is at a breakeven point. So total absolute drawdown will be zero because trading started from the initial balance and ends at the breakeven point.

Absolute Drawdown formula = Initial Balance – maximum loss in the initial balance

It helps a lot in determining the results of a trading account.

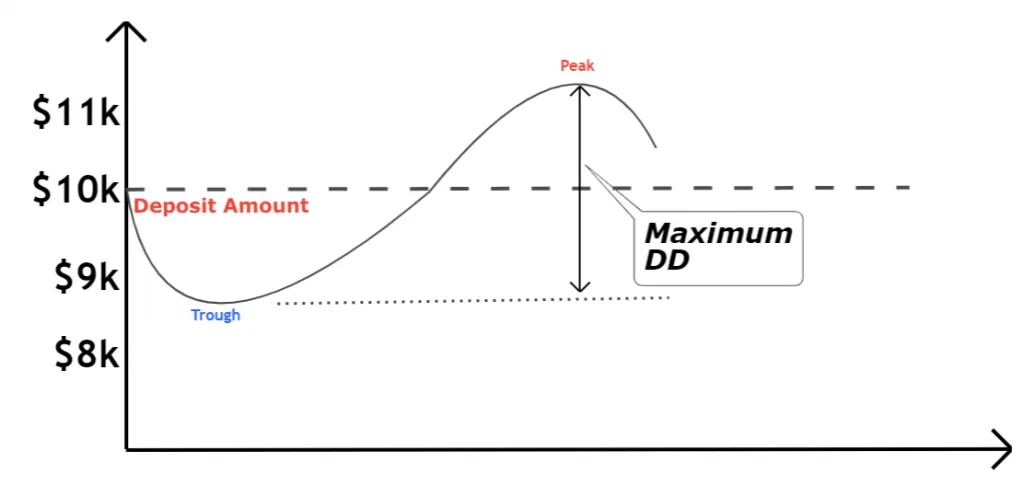

Maximum Drawdown

The difference between an all-time high to the all-time low of an account balance is called maximum drawdown.

For example, a trading account grows from $10k to $30k with few months. During this period account balance declines many times from the initial balance but the maximum decline was $7k. Now the max drawdown is $23k.

Max Drawdown Formula = all-time balance high – all-time balance low

Why drawdown is important in forex?

Understanding the drawdown is important while trading because it directly helps to determine the risk factor of a trading account.

Drawdown is directly proportional to the risk factor of a trading account.

- Higher drawdown means higher chances of losing your total account

- Lower drawdown means lower chances of losing your whole trading account

To copy a trading account or while investing in a portfolio, the first step is always to check the drawdown of that portfolio. Professional traders do not look for higher profits, but they look for minimum drawdown.

The first step to judge the performance of a professional forex trader is to look for the absolute and relative drawdown of his trading account.

How much percentage of drawdown is considered good?

It depends on the size of your trading account. If your account size is large, then 5 to 6% drawdown is normal, and you should keep it below the 6% always. But if your account size is small, then 15 to 20% is normal and drawdown above 20% is considered risky.

Drawdown creates a great impact on your trading career. That’s why focus to keep your balance safe. Small profit and less drawdown are better than losing your whole account after large profits.

How to manage drawdown of a forex trading account?

To manage drawdown, you will have to follow a good risk management strategy. Risk management means how much you risk per trade.

In trading, there is not any guarantee of winning each time. Sometimes you will lose and sometimes you will win. But there is a possibility of many losing trades in a row, and it will badly impact your trading performance and trading account.

To tackle this possibility, you will have to follow a risk management strategy of risking 2% or less on each trade. This will help you manage your drawdown. Because if you lose 4 trades in a row, then still your drawdown will be 8%. You can recover it easily. But if you are risking 5% or 10%, there are many chances of losing your whole account due to psychological issues.

Conclusion

Before investing in a portfolio, always check the drawdown of that portfolio. It will help you to check the risk profile of that portfolio. There are many other strategies to reduce drawdown. Plan for weekly and monthly risk tables. For example, the maximum drawdown must be less than 6% in a week (for a small account) and less than 10% in a month (for a small account).

This will also help you to reduce drawdown and emotional disturbance.