Introduction

A drawdown in trading means the percentage of the total amount a trader loses due to consecutive losing trades. it is also denoted by DD in trading. In forex trading, drawdown is essential to help you avoid blowing trading accounts.

A trading strategy is not just a piece of technical analysis. Still, the combination of many trading tools helps optimise the strategy, and drawdown is one of them.

If you’re building a trading strategy, you must calculate your strategy’s drawdown. There are chances that the strategy has a large DD which results in a loss of account balance. The DD also helps in managing the risk.

I will explain the calculation of the DD of a trading strategy and some other tips to manage the risk, so make sure to read the full article without skipping.

Types

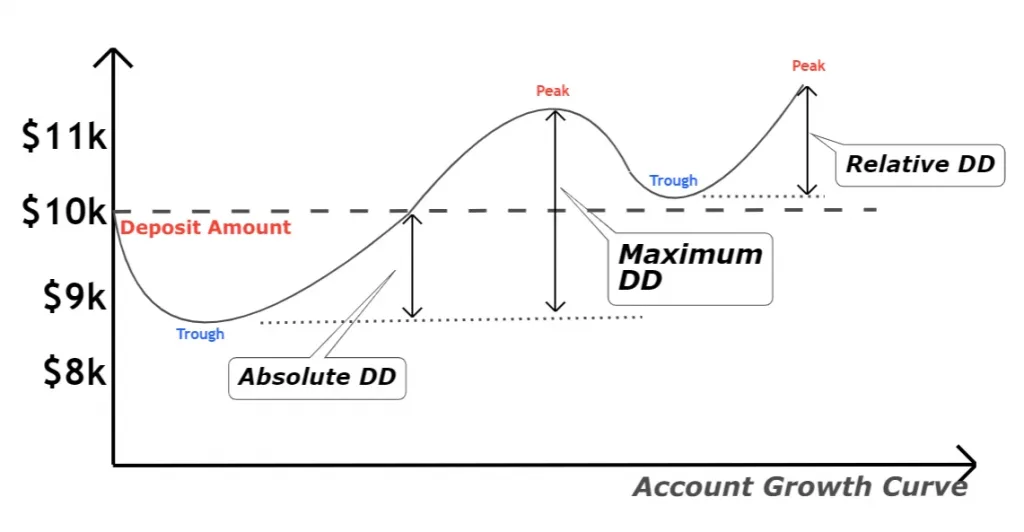

There are three types of drawdown in trading.

- Relative drawdown

- Absolute drawdown

- Maximal drawdown

Click here to learn each type of drawdown in detail.

How to calculate a simple drawdown of a trading strategy?

It’s straightforward to calculate the drawdown of a trading strategy.

You must backtest your trading strategy in both trending and ranging market conditions.

If the trading strategy lost ten trades in a row, the strategy’s drawdown is 10% (taking 1% risk per trade). On the other hand, if a strategy lost 15 trades in a row, it means the strategy’s simple DD is 15%.

Most of the trend trading strategies do not work in the ranging market. That’s why DD increases in choppy market conditions.

Importance of drawdown in a trading strategy

Many beginner traders blow their trading accounts because they don’t know about the DD or don’t calculate the strategy’s drawdown. Because the market conditions continue to change with time. If a strategy works in the trend, it may fail in choppy market conditions. A trader should prepare for all market conditions to survive in trading.

Let me explain with an example.

For example, a new trader trades with a pin bar strategy with moving averages. It works perfectly in trending market conditions. During the Asian session, price moves in the range and the pin bar strategy started failing during this condition. That new trader is also risking 5% per trade. After losing ten trades in a row, he lost 50% of the account balance.

Now psychology will overcome his emotions, and he will try to take revenge on the market, and he will lose his whole account balance.

However, suppose he has calculated the DD of the pin bar trading strategy that is 50% in sideways market conditions. In that case, he could stop trading during the ranging market and save his account.

That’s why calculating the drawdown is much more important.

What’s the acceptable drawdown for a strategy?

It varies according to your choice and account balance. Usually, the drawdown shouldn’t be greater than 20%. However, a 30% drawdown for small balance accounts is also acceptable. For big trading accounts, the DD should be lower than 10%.

To calculate the DD, you must backtest or live-test the trading strategy on the candlestick chart for at least six months to one year.

Manage the risks in trading

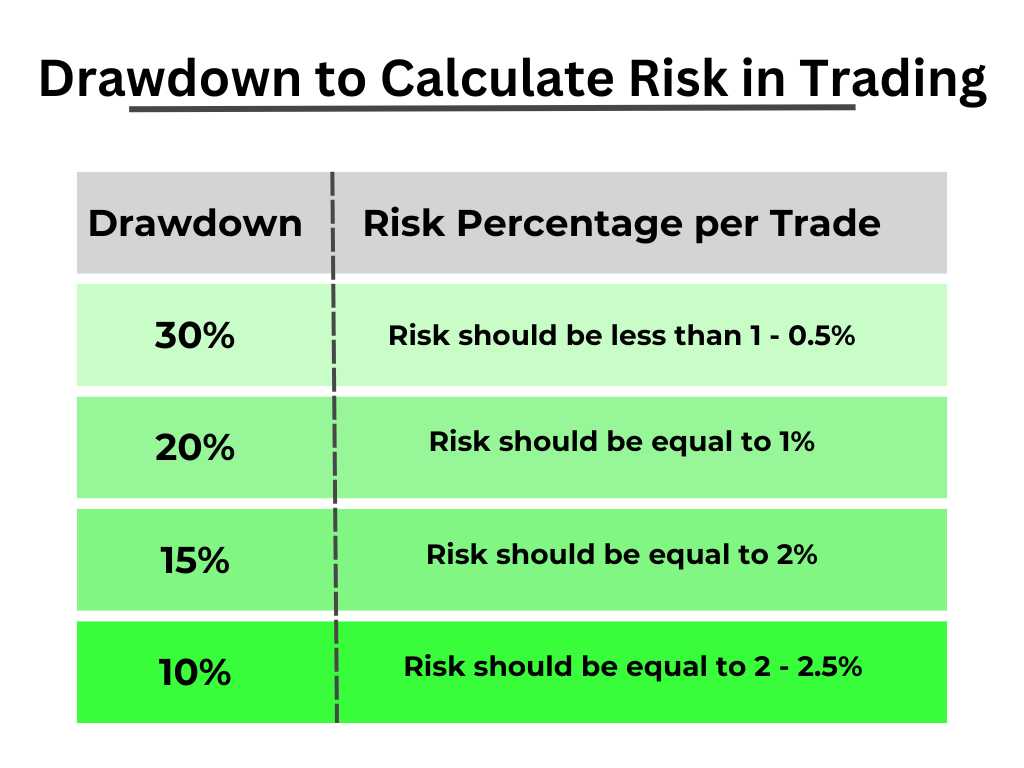

The drawdown also helps in managing the risk percentage per trade. For example, if a trading strategy has a low DD, you can also increase your risk percentage from 1% to 2% per trade to increase the profit potential.

However, if a trading strategy’s losing streak is higher, you can decrease the risk percentage from 1% to 0.5 or even lower. 0.5% per trade is also good in lower timeframes or during scalping trading because scalpers open many trades during a short time interval.

The bottom line

Calculating the drawdown of a trading strategy is the first step before trading on a live account. You must prepare yourself to deal with different situations in trading. That’s why DD can help you to filter the trading conditions and to manage the risk.

I recommend that new traders learn about the types of drawdowns and then apply them to their trading strategy before using a strategy on a live trading account.