Introduction

A Forex market session is the duration of the Forex activity. It is said that the forex world never stops during the 24 hours of day and night. It does not formally stop like a typical market.

The truth is, the forex market has some times of low or no activity. It works like a human heart that seems active all day and night but finds some rest between two heartbeats. There are times when the market is sky-high and when the market is a little slow. There are times when there is little to no activity in the market, just like a dead man’s pulse.

The important things to know about the forex market sessions are,

- The Forex market remains active 24 hours a day with a few passages of low to no activity.

- Forex market observes five days of peak activity, while two days (Saturday and Sunday) are usually quiet.

- There are four major forex market sessions

- There is some overlapping among the four major market sessions

- Trading activity during the overlapping sessions is usually at its peak as compared to regular activity

- Not all currency pairs are active during a specific forex market session

Importance of market hours in Forex

Forex trading is not all about learning how to trade and finding the appropriate investments. One of the important factors which can impact your profits and losses is “when to trade?”

A trader must identify the right time for the execution of his trading moves. The right move at the right time can positively impact your trading experience. The importance of market hours in forex trading can be elaborated from the following points.

Market opportunities

Different sessions offer different opportunities in terms of currency pairs.

Availability of peak market activity

Traders can benefit from peak market activities by understanding the overlapping between different sessions.

Bigger profit margins

Profit margins heavily rely on the volatility and liquidity of the market, so a trader can enhance his profit margins by understanding the market sessions.

Determination of the best time for trading

Different market sessions provide versatility in choosing your trading hours. So, a trader can determine the best time to trade according to his trading goals and preferences.

Better decision-making in terms of the global scenario

Global financial and political news and events can impact the forex market. The division of trading market sessions can significantly update a trader about the market activity to improve his trading decisions.

What are the four major market sessions?

Forex traders prefer to trade in different sessions instead of 24 hours daily. In an ancient forex system, market sessions are divided into three major sessions, which are,

- Asian session

- European session

- North American session

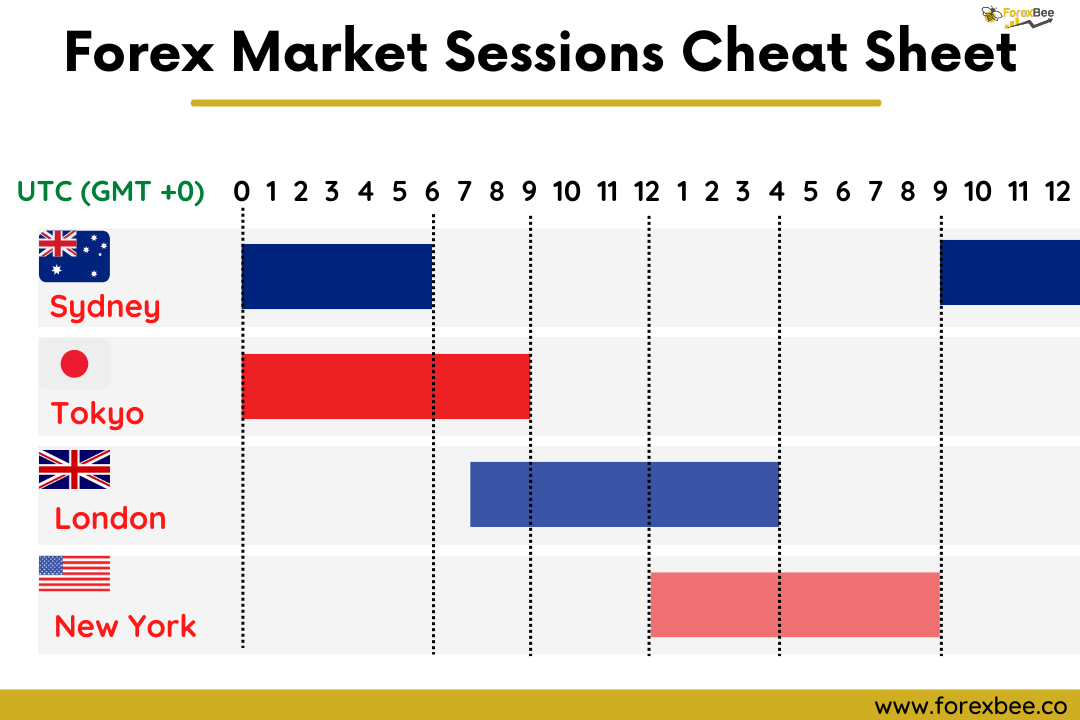

In the modern forex trading market, we prefer to divide market sessions into four significant sessions named after cities instead of continents. These four major forex trading sessions are,

- Sydney session

- Tokyo session

- London session

- New York session

Some sessions overlap each other and are responsible for significant market activity.

Sydney Session

The Forex market opens on Monday morning in New Zealand while most of the world is still under the effects of the hangover from the weekend party as it is still Sunday in most of the world.

| Start time | 10:00 PM GMT |

| End time | 7:00 AM GMT |

| Major currency pairs | AUD, JPY, NZD |

| volatility | Less volatile |

| Overlapping | Tokyo session |

It is an essential session as the news reports, economic releases, and different events in the Asian region can influence its volatility as well as set the tone for the upcoming session. The Sydney session gives traders a good and brief idea about the weekly trading activities.

The Sydney session overlaps with the Tokyo session for a few hours, which results in peak activity and high volatility. Traders can trade with major financial centers in Japan, Singapore, and Shanghai.

Tokyo Session

It is the second major session in the forex trading market. It is like a bridge between the Asian and European forex markets. Tokyo session is like a backbone that connects the head and abdomen of a body as it overlaps with the end of the Sydney session and the start of the London session.

| Start time | 12:00 AM GMT |

| End time | 9:00 AM GMT |

| Major currency pairs | AUD, JPY, NZD |

| volatility | Highly volatile |

| Overlapping | The Sydney session, The London session |

The trading tone is set in the Tokyo session as the rest of the day in forex trading depends on the activities in the Tokyo session. During this session, market volatility and liquidity are on the higher side, which provides new opportunities for traders.

Different economic and political events from the regions such as China and South Korea might influence the market activity during the Tokyo session.

London Session

It is called the European session. Trading volume in this session is vast, and market activity is very high as this session overlaps with two of the most important forex market sessions. The London session overlaps the end of the Tokyo session and the start of the New York session.

| Start time | 07:00 AM GMT |

| End time | 4:00 PM GMT |

| Major currency pairs | EUR, GBP, USD |

| volatility | Very highly volatile |

| Overlapping | Tokyo session, New York session |

Liquidity during The London session is very high as it involves huge trading volume and important financial hubs like London, Paris, Frankfurt, etc.

Different financial and regional economies and political news and events from Europe influence this trading session.

New York session

It is the most active and significant session of all. The New York session is also known as the American session. It is the major trading session, so its activity affects pricing, volatility, and liquidity globally.

| Start time | 12:00 PM GMT |

| End time | 9:00 PM GMT |

| Major currency pairs | USD, EUR, GBP |

| volatility | Extremely volatile |

| Overlapping | London session, Sydney session |

As a superpower, any news from the United States of America can influence the market activity in the forex world across the globe. So, the New York session is the major player in setting up the forex market tone.

Market activity during different market sessions

The comparison between market activity during the four major trading sessions can be compared as,

| Trading session | Sydney session | Tokyo session | London session | New York session |

| Trading volume | low | high | The Highest | Higher |

| volatility | low | medium | high | high |

| Liquidity | low | medium | Highly | high |

The above table shows that the London session exhibits the highest trading volume, volatility, and liquidity. The market activity during the London session is on the higher side.

Most traders trade in overlapping sessions to benefit from the different trading sessions and currency pairs.

Which session is the best to trade Forex?

Choosing a trading session depends on the following factors,

- Choice of a trader in terms of currency pairs

- The daily routine of a trader

- Market volume

- Liquidity and volatility

So, the best time to trade for a trader might vary from person to person, depending on One’s personal preferences.

The London session is generally regarded as the best as it overlaps with both Tokyo and New York sessions. Moreover, the ideal time to trade for some traders is the overlapping time between the London and New York sessions.

Conclusion

A trader must understand the concept of four major trading market sessions. Choosing a trading session can impact your trading experience. A trading session can impact your profit margins and potential losses.

Trading sessions are a huge opportunity for a forex trader to predict market activity.