Understanding types of Forex Orders is very important if you want to be in Forex for an extended period. All the Forex trading is done through brokers, and there are multiple brokers to choose from depending on where you reside, but most of the brokers operate globally. After selecting a broker, you need to place an order on your broker’s trading platform.

An order in Forex is simply an offer you send by using your broker’s trading platform to open or close a position if your specified conditions are met.

Below in this article, we a going to discuss the details of types of orders in Forex.

All forex orders come under two main types:

Market Order

This type of order gets fulfilled immediately against your broker’s price displayed on the dashboard.

Pending Order

This order will get fulfilled as soon as the conditions you provided are satisfied.

Market Order explanation

The market order is how you buy or sell currency at the best price available to you provided by your broker.

FOR EXAMPLE, in the USD/GBP pair, the bid price is 1.3903, and the ask price is 1.3906.

If you intend to open a position and buy this pair, you can do it at 1.3906. You will use your trading portal and click on buy now to fulfill your order at the actual price of 1.3906.

The same goes for selling a currency pair, but it will be done at a slightly lower price of 1.3903, and it will also get fulfilled immediately.

Notice that the bid price is always lower than the ask price for any currency pair in Forex.

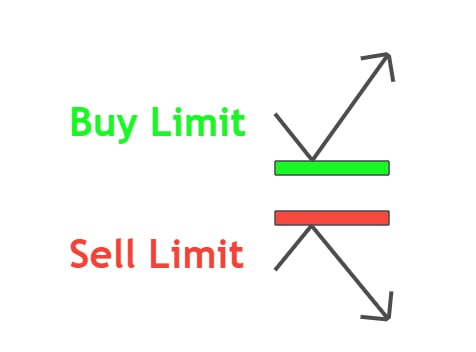

Limit Order

You will be using a limit order if you speculate that the market price will go up or down at a specific time. And you want to take advantage of that and buy currency pairs at a price below or above market price.

This will be done by setting a limit condition, and it gets fulfilled when the price crosses that “limit price”.

There are two types of limit order.

- You would set up a buy limit order when you want to buy certain lots of a pair of currency at a rate below the prevailing market price.

- You would set up a sell limit when you want to sell a pair of currency at a price higher than the existing forex market price.

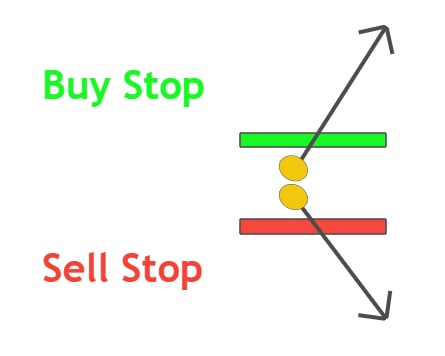

Stop Order

If you want to buy a currency pair on the way while the price is rising or you want to sell a currency pair on the way. While if the price is dropping then you will have to use a stop order.

There are two types of Stop orders.

Buy stop order

Place a buy stop order to buy the currency while the price is going up. For example, if EURUSD is trading at 1.3245 and you want to buy EURUSD at 1.3270 then place a buy stop order

Sell stop order

Place a sell stop order to sell the currency while the price is going downward. For example, if EURUSD is trading at 1.3245 and you want to sell EURUSD at 1.3230 then place a sell stop order.

Instead of waiting for the price to reach a certain level just use stop order.

Stop loss Order

The type of order which is used to limit the loss if the market goes against your analysis is called a stop-loss order. For example, you place a buy order in EURUSD. But price keeps on going in sell direction then you will place stop order which will delink your trade from the market.

- Place buy stop loss order in case of short position

- Place sell stop loss order in case of long position

Today is a Good Day to Try

Quasimodo

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4.

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.