Gravestone Doji is a type of Doji candlestick pattern that represents an upcoming reversal in the trend from bullish into bearish in forex trading technical analysis.

Gravestone Doji candlestick pattern has the same opening and closing price. The same opening and closing price means buyers and sellers have equal potential. But here candlestick wick structure will explain the scenario behind this pattern.

Doji Candlestick Meaning in forex?

Doji candlestick actually shows a pause in the trend. It shows a ranging market structure on the lower timeframe. Buyers and Sellers have equal potential. For example, if Price is forming higher highs and Doji candlestick forms then it means the uptrend has been paused. Actually market will be in the decision phase. Now next market will decide either to continue its trend or reverse the trend.

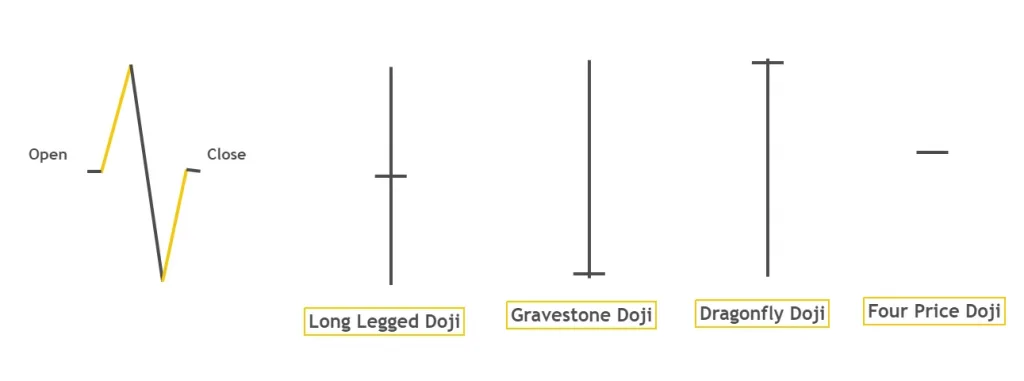

There are four Types of a Doji Candlestick

- Gravestone Doji

- Long-legged Doji

- Dragonfly Doji

- Four Price Doji

Gravestone Doji Candle Psychology

In the bullish trend, candlestick opens and forms a huge spike but before closing it returns to opening price and closes approximately at the opening price. A gravestone Doji candle has been formed. But what’s the psychology behind this pattern?

Let’s say the market is in a bullish trend (higher highs and higher lows) and buyers are pushing the price upward. Soon price comes in an overbought condition. After the overbought condition, the price has to take some rest or a reversal is the trend has to occur.

Stop loss hunting

But in the overbought condition, buyers give a huge spike upward again to hunt stop losses of retail traders. After stop loss hunting, sellers come in and bring the price down. Now candlestick has the same opening and closing price and sellers are in control. Also, the price is in an overbought condition. All these parameters confirm an upcoming reversal in trend. This is the simple psychology behind this pattern.

Remember: Always trade with a Logic. Never trade blindly.

Bearish Gravestone Doji

Bearish Gravestone Doji candle represents the change of trend from bullish into bearish if it forms in the overbought condition or at the top of the minor uptrend.

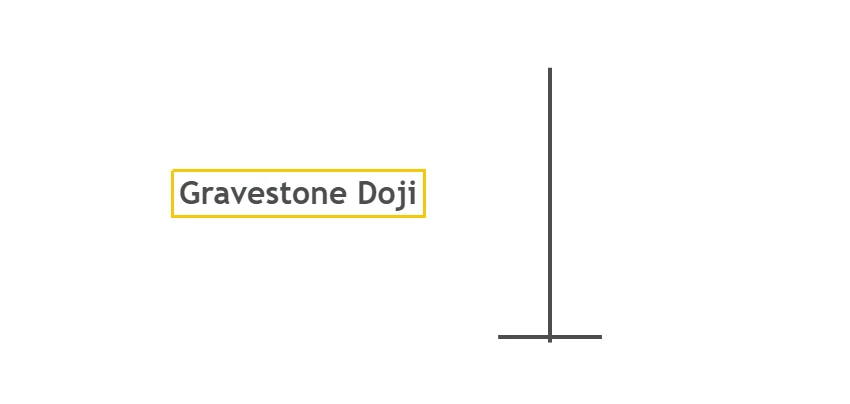

Candlestick Pattern Structure

This candlestick pattern has the same closing and opening price. Best bearish gravestone doji will form at the top of the minor uptrend. It has a long wick/shadow above the opening and closing price.

How to trade Gravestone Doji Candlestick?

There are two strategies to trade Gravestone Doji. One is to trade it with a chart pattern and this is recommended method for trading. The second method is to trade this candlestick pattern alone. The second method will be explained here because the first has already been explained in other chart pattern articles.

With the chart pattern, it will only confirm a trend reversal or it will act as a trade signal. But we will follow the chart patterns in all other parameters. This trading strategy has a high risk-reward ratio and a high winning rate.

Trading Strategy

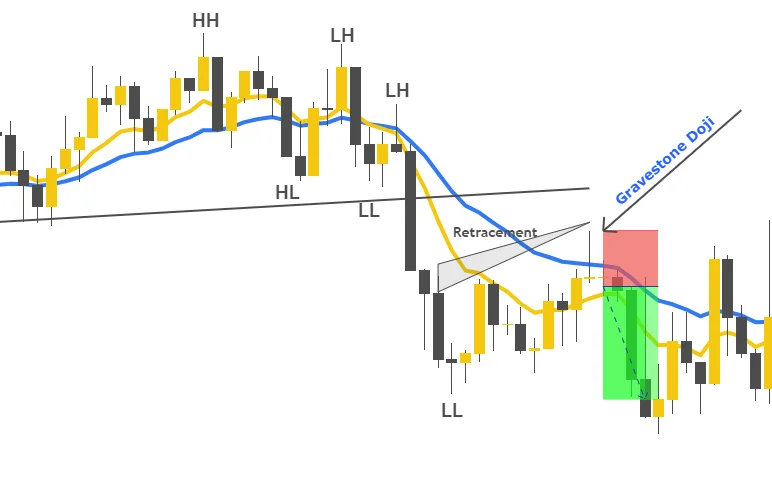

The second strategy is to trade gravestone Doji patterns with the trend only. Follow the following steps.

- Look for the direction of major trend (formation of Lower highs and lower lows). You can also use exponential moving average to identify the direction of the main trend.

- Identify the price retracement opposite to the main trend.

- The most important step is to look for an overbought condition (in case of a major downtrend). Two tools can be used to detect the overbought and oversold conditions. RSI indicator and Fibonacci tool (50% and 61.8% level only) can be used to find out overbought and oversold conditions.

- The final step is to wait for a good Doji candlestick pattern in the overbought condition.

This is the simple strategy to trade this pattern. Now let’s talk about stop loss, entry and take profit levels.

Entry

Place a pending order some pips below the low of Candlestick. Delete pending order in case if the order does not get filled after two further candlesticks formation.

Stop loss

Place stop loss above the high of the candlestick.

Take profit

Partially close the trade at 61.8% Fibonacci level of retracement wave and close the rest of the trade at the origin of retracement wave.

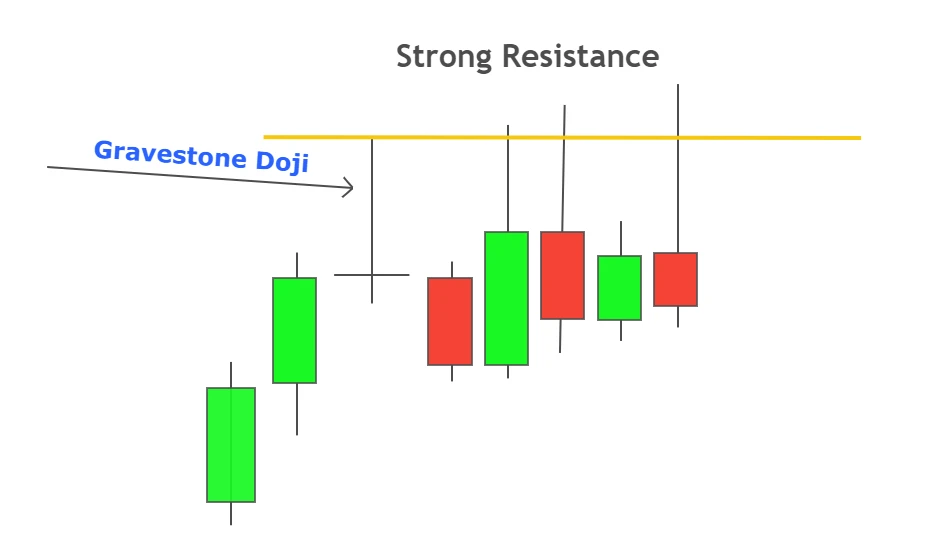

Gravestone Doji and Resistance level

The important and interesting fact of the Gravestone candlestick is that high of this candlestick acts as a strong resistance level. candlestick must form at the top of the uptrend. if it forms within a range of candlesticks then it will represent a sideways range only.

Conclusion

Gravestone Doji is the most widely used candlestick pattern in different strategies. But trading without any confluence will not make you a profitable trader. Always trade gravestone Doji candlestick pattern with confluence and follow a proper risk management strategy. Make sure to backtest the above strategy properly before trading it on a live account.

Gravestone Doji is a type of Doji candlestick and it is a bullish reversal pattern in technical analysis. it means it will reverse the bullish trend.

Doji candlestick represents a ranging market structure. A Doji shows a neutral market direction neither bearish nor bullish.

Dragonfly Doji is the opposite of Gravestone Doji. it turns bullish trend into bearish whereas dragonfly Doji turns bearish trend into bullish.

Gravestone Doji has the same opening and closing price whereas shooting star is similar to a bearish pin bar and it has a little body at the bottom of the candlestick.

Thnaks for makes thes type of article