Support and resistance levels in trading refer to key areas where more buyers are willing to buy a currency/stock and more sellers are willing to sell a currency/stock respectively.

Support and Resistance levels help traders to find out spots where the market will take a reversal and it will also help us to put a safe stop loss and take profit. In this article, we will discuss key points of support and resistance levels and a simple strategy to find support and resistance levels.

Support level in trading

Support level refers to a price level or zone from where, due to more demand and more buyers, a reversal in price trend from bearish into bullish happens. More demand causes the bearish trend to reverse. At this level, the price will decide either to reverse or to break this zone. So we will look for price action at this level to confirm a reversal in price. This is simply called the support level in trading.

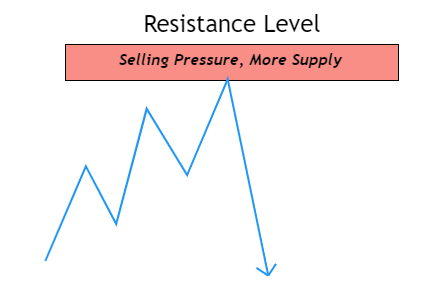

Resistance level in trading

Resistance level refers to a price level or zone from where, due to more supply and more sellers, a reversal in price trend from bullish into bearish happens. This is simply called a resistance level in forex trading

Which timeframe is best for support and resistance?

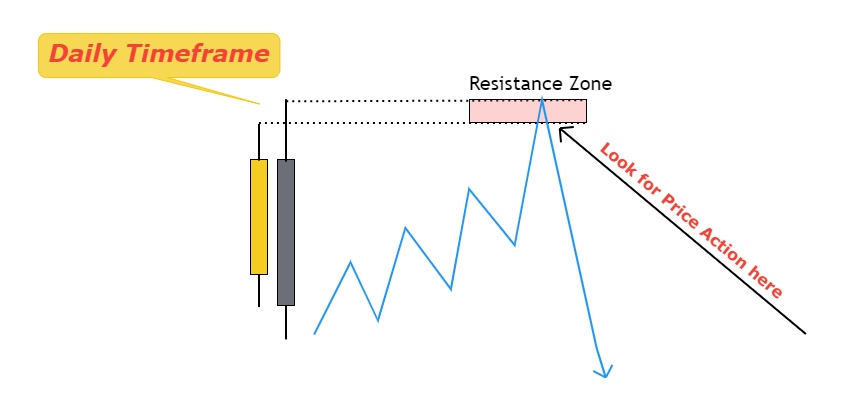

The daily timeframe is the best timeframe to identify strong levels in the forex market. Finding support and resistance levels on a daily timeframe and trading that levels on intraday is the best trading strategy,

How to find daily support and resistance levels?

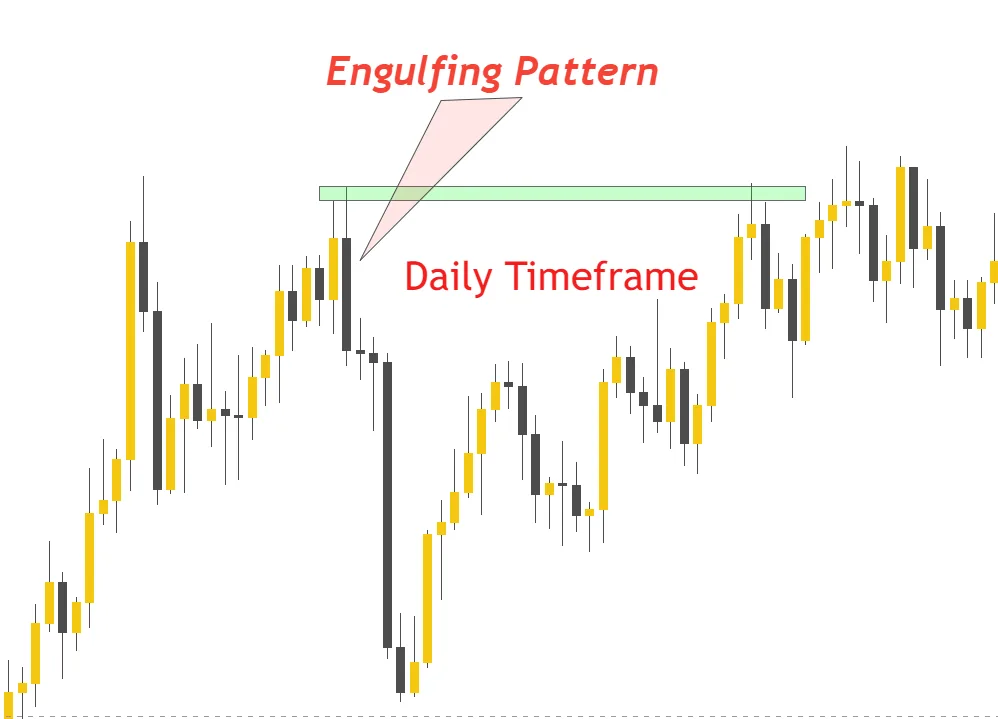

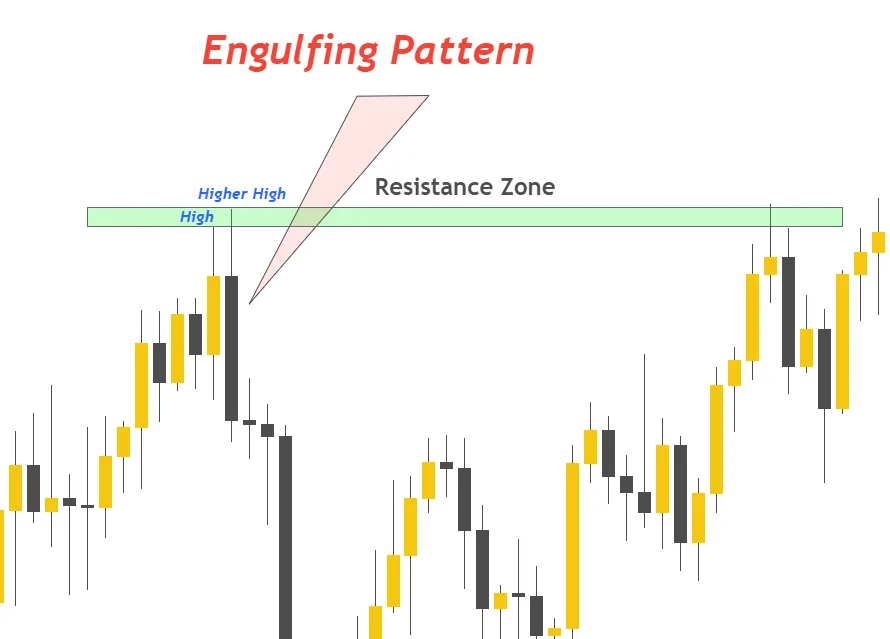

The high and Low of daily engulfing or pin bar candlestick act as strong support and resistance level in forex trading.

Find out daily engulfing or pin bar candlesticks in a daily timeframe. Low and High of daily engulfing or pin bar candlesticks act as a strong support and resistance level respectively. Our focus is to draw a strong level on the daily timeframe and trading in lower timeframes.

- The daily timeframe is the best timeframe and technical analysis works well on this timeframe

- Trading on lower timeframes gives a high risk-reward ratio.

- Daily timeframe S&R levels are strong

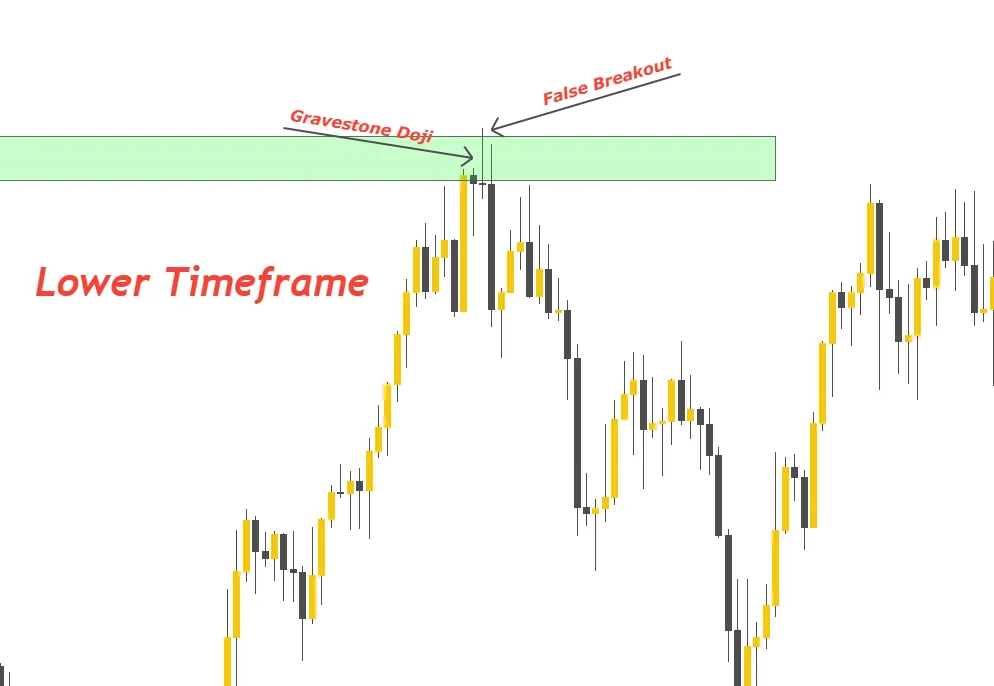

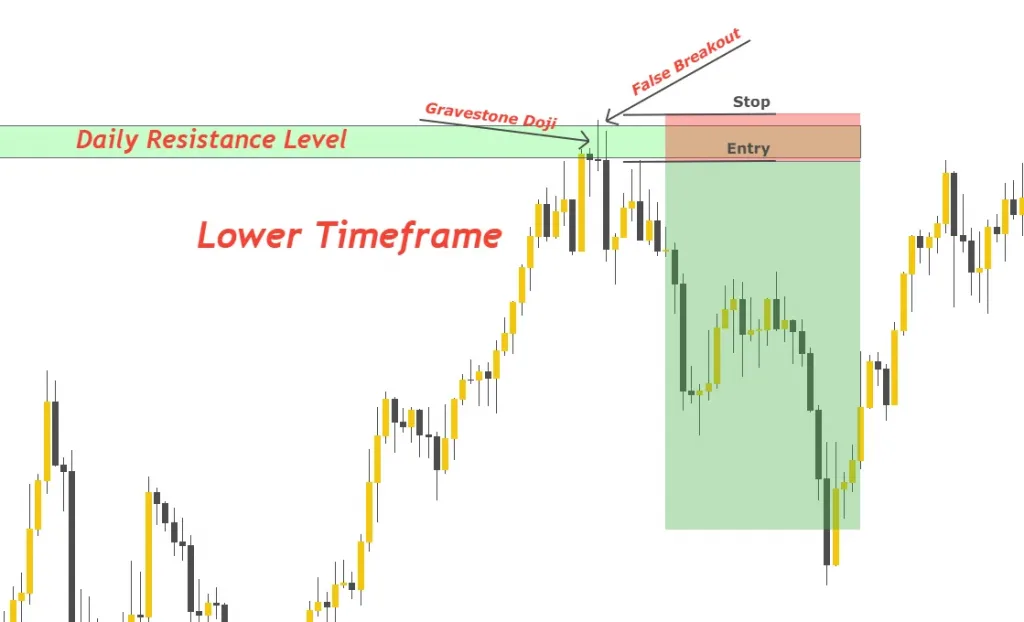

Look at the graphical image below for understanding the concept.

After identifying bearish engulfing candlestick on the daily timeframe, draw a zone meeting the high and higher high of engulfing candlestick and extend the zone to right. Upon backtesting, this method has proved a good way to draw support and resistance levels.

Support and Resistance Zones

To draw support and resistance zones, simply pick the high of engulfing candlestick and the previous candlestick and draw a zone. The engulfing candlestick pattern consists of two candlesticks. In the case of a resistance zone, draw a zone by picking highs of both candlesticks. Draw zone on the distance between lows of both candlesticks, in case of the support zone.

Three simple steps to find strong S&R levels

Simply follow three steps for strong support or resistance levels

- Open daily chart and look for a fresh engulfing candle

- Draw a zone from highs or lows of engulfing candle-like shown above

- On the intraday chart, wait for price action at the zone.

Support and Resistance levels Trading Strategy

Trading support and resistance in forex or stock trading is the most basic concept but to trade with a proper strategy is most important. Because in strategy just finding support and resistance levels will not make you a profitable trade until you will follow risk-reward and risk management.

That’s why we have made a strategy based on the following parameters.

- Finding strong support and resistance level on the daily timeframe

- Trading that level on a lower timeframe using price action to get high risk-reward

does it make sense to you?

On the lower timeframe, when the price will approach the resistance or support level then look for price action in this area. I mean a reversal chart pattern or reversal candlestick pattern like a gravestone Doji. Open order on the basis of price action pattern and also adjust stop loss on the basis of price action. I will recommend sticking to safe stop-loss always.

Conclusion

Identifying daily timeframe S&R levels and trading on a lower timeframe with price action is the best and proven strategy. Steve Nison, the founder of Japanese candlesticks, also recommends this method. I have explained the strategy of using engulfing candlestick but it is your homework to do all these steps for pin bar candlestick and do not forget to ask questions in comments.

Read more articles of price action from our blog to learn more about stop loss, take profit

Simple But Effective Technique

forexbee

Draw a zone by meeting the highs of both candlestick in daily engulfing candlestick pattern, and it will act as resistance level on intraday timeframe. To draw support level, simply draw zone by meeting lows of candlesticks in a daily engulfing pattern. Technical analysis works the same with crypto and forex.

Untouched levels in the market are called fresh support and resistance levels. They have a high probability of winning in the forex market. So prefer to trade fresh support and resistance levels.

SR in trading means support and resistance level in trading. In short form, S means to support level and R means Resistance level. It is a widely used term in trading. It is also named S/R levels.

SR flip represents flipping of resistance level into support level or support level into resistance level in forex trading.

Plz explain volume

Stay tuned. we will explain interesting facts of VSA.