How to Trade Inside Bar?

Trading inside bar pattern in forex with price action is the best and profitable strategy. In this article, the top 3 methods of trading inside bar pattern will be discussed.+

There are the following three inside bar trading strategies explained.

- Inside bar at Support and Resistance level

- Trading inside bar at trend line

- Inside bar formation after fakeout

I will recommend you go through the previous article on the inside bar patterns to learn these inside bar strategies effectively.

Qualities of a Good inside bar pattern

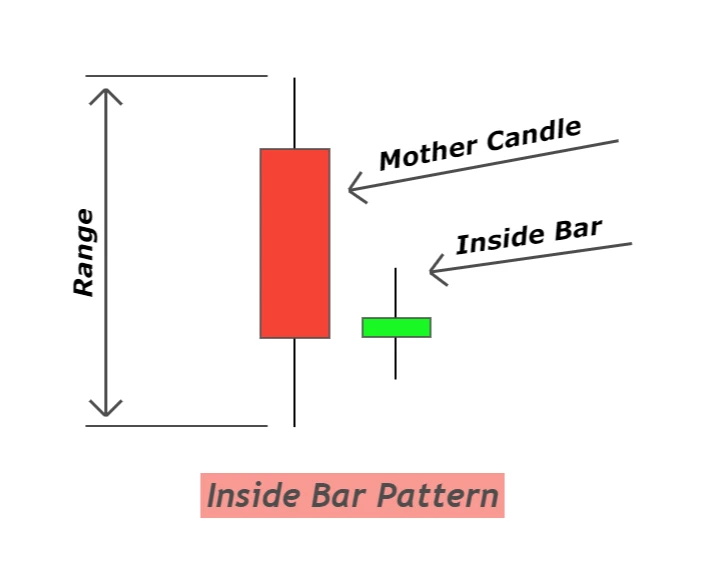

A good inside bar pattern has a large mother candlestick. A large mother candlestick means it has a large body to wick ratio.

There is a complete logic behind it. Big body and small wick represent high market momentum. The smaller body and larger wicks indicate low market momentum. That is why verify the following characteristics of the inside bar pattern before using it in trading strategies.

- Mother candlestick should have larger body and smaller wick size

- Inside bar candlestick should be relatively small to get higher risk reward (optional)

Now let’s move on to inside bar trading strategies.

How the inside bar strategy will work?

It is important to learn the structure of the inside bar pattern. What does it tell the forex traders! It tells the traders that the market is looking for direction. Big institutions and big traders are deciding either to upward or downward.

Remember that whenever the market is moving like a broadening pattern or inward pattern then it is always looking for direction.

Basis of IB strategy

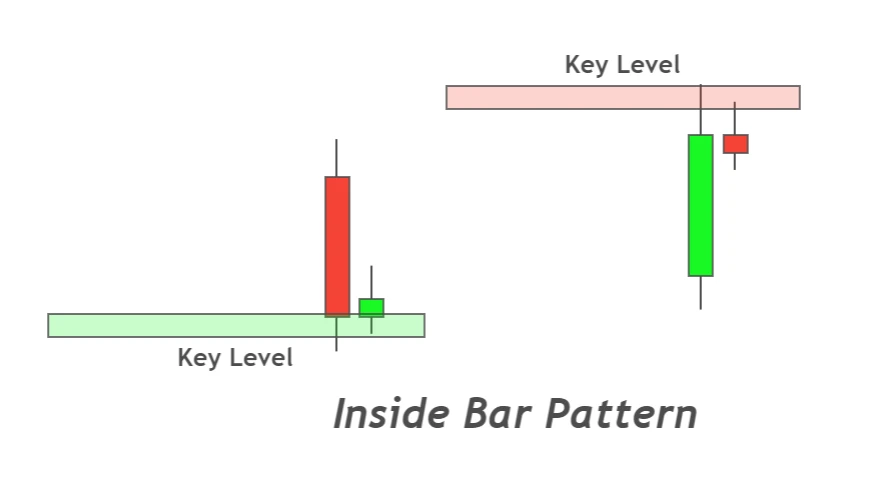

This inside bar strategy is based on the fact that price decides its direction from key levels. But if there is an inside bar at the key level then it will make it easy to forecast the direction of the market.

For example, the market will tend to reverse or continue its direction from a resistance level. When the market price reached a resistance level, there it will decide either to break this resistance level or to reverse from this level.

When the inside bar forms at that resistance level, it is a clear indication that the market is deciding its future direction. Breakout of the inside bar pattern confirms the direction of the market. If the price breaks high of the inside bar, then it will continue its trend (it will go up). Price will reverse its trend if it breaks the low of the inside bar.

The main benefit of the inside bar is that it shows a tight stop loss level

Inside Bar strategy guide 1

This inside bar strategy has been made by the combination of inside bar breakout and support/resistance breakout. This is a pure price action strategy, and it has a higher winning rate.

Components of inside bar strategy 1.

- Support and resistance

- Inside bar

- Fibonacci extension tool

Support and resistance zones represent strong key levels. when price breaks those key levels, it tends to move to the next key level. The Fibonacci tool is a powerful natural tool and I have used it to adjust take profit level.

Procedure to be followed

Follow the following steps of inside bar trading strategy 1.

- Draw a strong support/resistance zone (strong means at least three price bounces from zone)

- Identify an inside bar candlestick after support/resistance zone breakout. Keep in mind that the breakout candlestick must be a mother candlestick and it must have big body and small wicks.

- Place pending sell stop below the inside bar in case of support zone breakout. On the other hand, place pending buy stop above the inside bar candlestick in case of resistance zone breakout.

- Stop loss level will always be placed on the other side of inside bar. Like if order opens at the high of inside bar, then stop loss will be below of low of IB.

- Use the Fibonacci trend-based extension tool and highlight 1.618 and 1.272 Fibonacci extension levels. First take profit level will be at 1.272 and TP2 will be at 1.618 level.

This is the guide to inside bar and support/resistance trading strategy.

Inside bar strategy guide 2

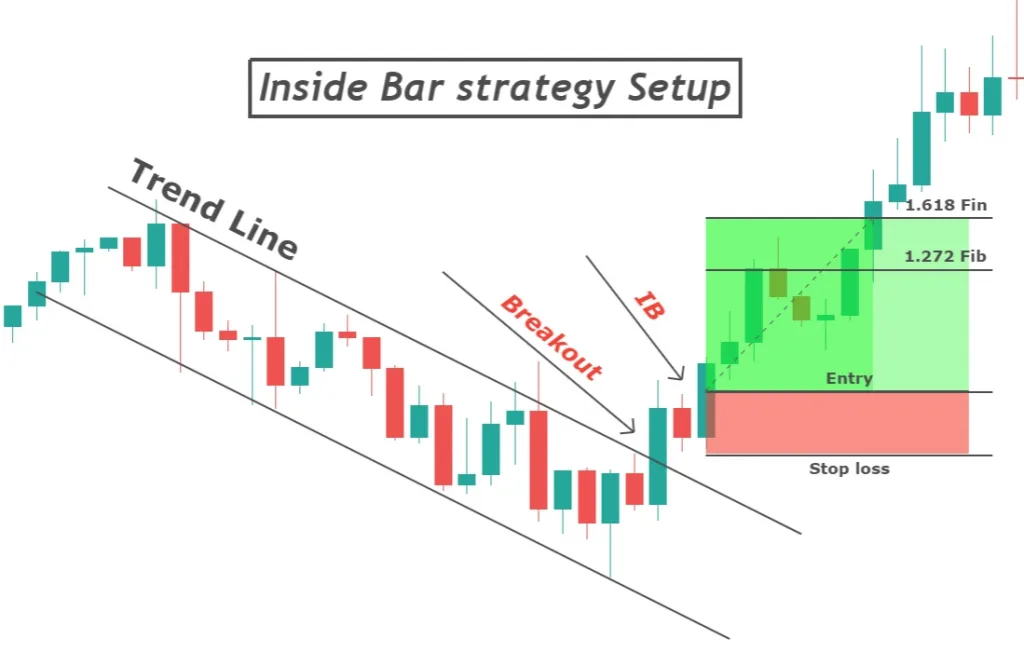

The inside bar strategy 2 is composed of a trendline breakout and an inside bar breakout. A trendline is made up of at least three consecutive bounces of the price that make it a key level. it is also known as inclined support or resistance level.

This strategy consists of the following parameters

- Trendline breakout

- inside bar pattern

- Fibonacci extension tool

Steps to follow

formation of inside bar pattern after the breakout of trendline works best and this breakout strategy gives profitable results.

follow the following steps

- Spot a valid trendline setup (trend line must have at least three bounces/touches)

- Check the trendline breakout with mother candlestick and inside bar formation after mother bar.

- Place a pending sell stop order in case of upward trendline breakout and pending buy stop order in case of downward trendline breakout.

- Stop loss and take profit levels will remain same as described in the above topic.

The trendline and inside bar strategy is easy to spot and it has a high winning probability as compared to support/resistance.

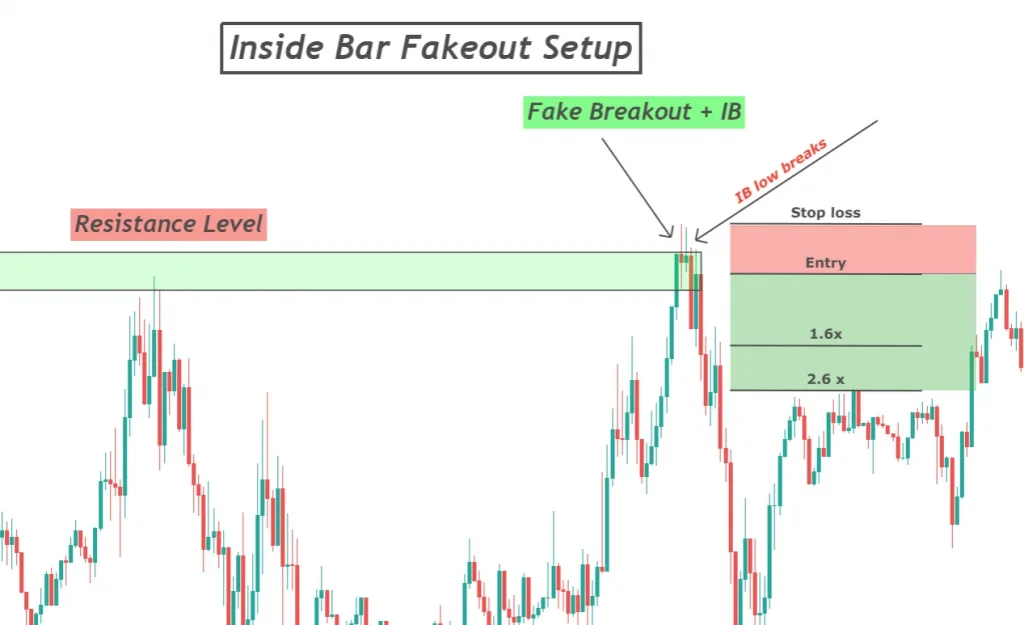

Inside bar strategy guide 3

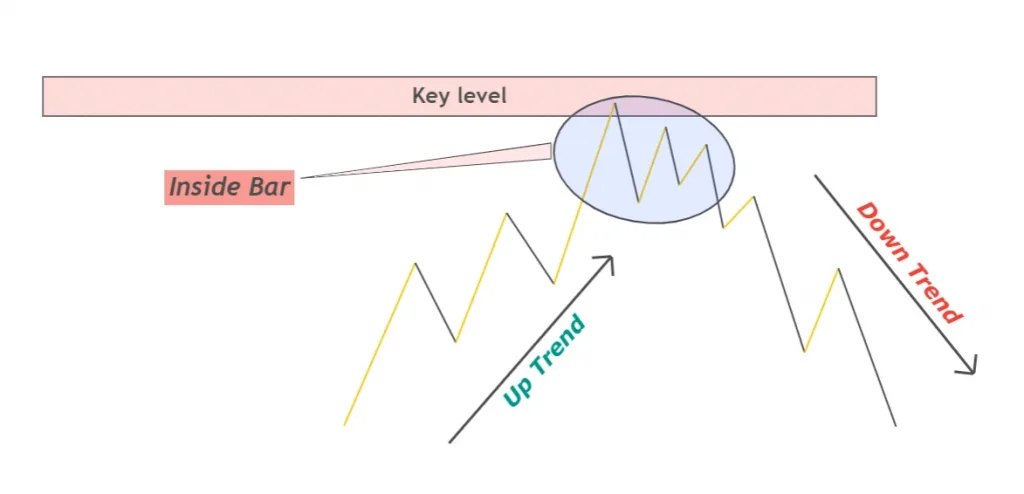

Sometimes, when support and resistance or trendline breaks with a big candlestick then price again come back inward the key level. It represents a fakeout.

This strategy is composed of a fakey setup, and it has a higher winning ratio if it is traded with the trend. For example, trendline and support/resistance breakout represents trend continuation. But sometimes, after the breakout, the price again closes inside the key level. It is a trend reversal setup.

Keep remembering that in this fakey setup you will buy or sell in opposite direction as compared to the two strategies discussed in the above topics.

There are a few steps to follow inside bar trading strategy 3.

- Spot a trendline or S&R breakout with mother candlestick

- Formation of inside bar after the mother candlestick

- Place a buy stop order above the high of inside bar in case of false support zone breakout. On the other hand, place a sell stop order below the low of inside bar in case of false resistance breakout.

- Stop loss will be placed on the other side of inside bar candlestick

- In this false breakout setup, take profit level 1 will be 1.6 times the size of inside bar and TP2 will be 2.6 times the size of inside bar. This is also Fibonacci ratio

Conclusion

A trading strategy consists of many confluences that make a strategy tradeable. Without confluences, you will not be able to make a profit obviously. The inside bar is the best candlestick pattern and I have used price action with the inside bar candlestick and made the best tradeable strategies.

You can modify these strategies too according to your temperament. But keep in mind that confluences are necessary to increase risk reward and winning ratio. These tactics will make you able to profit consistently.