Margin in forex trading refers to the amount of money that a broker sets aside to keep the position open. After closing position, this amount is added to the total balance.

To maintain a position, the margin is required. Every currency has its own margin percentage. it depends on the broker.

Used margin refers to the total amount of money that has been set aside by the broker as a margin to maintain more than one position.

For example, To open a position of $1000 in EURUSD (2% required margin depending on broker type) the required margin will be $20. The broker will set aside $20 from the account balance to maintain the position of $1000. This is simply the required margin.

if you have $1000 in your account, you can’t open a position of $1000 until you deposit $20 more in your account.

like if you opened three positions of $1000 size each. $60 will be the total margin used to maintain three positions. here $60 will be termed as used margin.

Account balance in forex?

To start forex trading, You need to open a forex account with a broker. after opening an account, you will deposit money into your account. This total amount will be called an account balance.

Don’t forget to approve your trading account with a broker before depositing money.

With this amount, you can open a position.

Floating P/L in forex

Floating P/L is referred to as floating profit or loss. it is the amount of profit or loss due to opened positions but it’s floating. This floating amount will be added to your account balance on the closing position and it is referred to as realized profit or loss.

The position will close automatically if floating loss equals the account balance.

For example, if the current price of the EURUSD pair is 1.11000 and you opened a position size of 1000. after some time, now the exchange rate of EURUSD is 1.12000.

Let’s calculate unrealized profit/loss

use the following formula to calculate floating P/L

Floating P/L = 1000 x (1.12000 - 1.11000)The position is 100pips in profit. multiply 100 pips into 0.1 (in the case of a micro lot). $10 is your floating profit.

if you close this position then $10 will be your realized profit.

Equity in forex

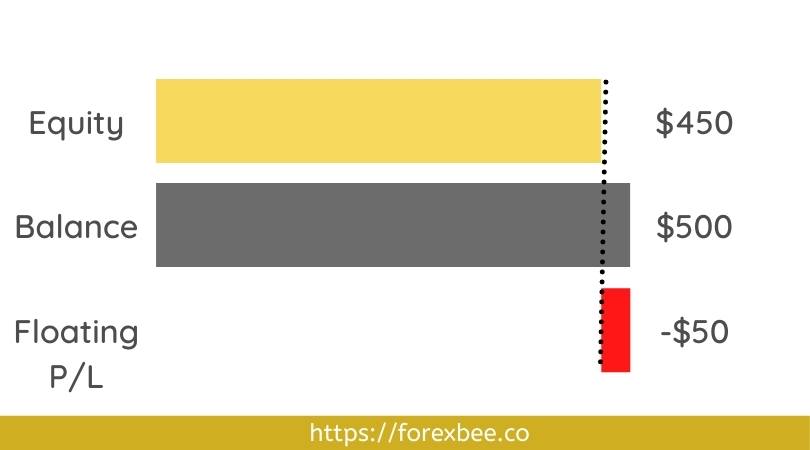

Equity refers to the sum of total floating P/L and the total balance of your trading account.

If you haven’t opened a trade then Equity will be equal to your account balance. Equity keeps on fluctuating on every tick due to floating P/L.

Difference between balance and equity in forex

the main difference between the equity and balance is that balance refers to the total amount in your trading account after closing all the opened positions whereas equity refers to the real-time calculation of P/L on opened positions. Look at the image below for a better understanding

Your diet is a good bank account. Good food choices are good investments

Bethenny frankel

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4.

Note: All the viewpoints here are according to the rules of technical analysis and for educational purposes only. we are not responsible for any type of loss in forex trading.