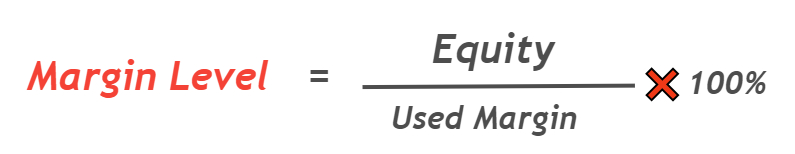

Margin level in forex refers to the ratio of equity available to the used margin in the mt4 trading account. Margin level is directly proportional to the health of your mt4 trading account. A higher margin level indicates a good trading account, and you have more margin to more open trades in the trading account. On the other hand, a lower margin indicates a weak trading account, and you have a low margin to open more trades in the trading account.

For example, you have equity of $10000 in a trading account and you have used $500 of margin then your account margin level will be 2000%. A margin level of 2k% is an indication of a good trading account in forex.

Like in the example, we are using the equity of the trading account in the numerator. If your trading account has no open position, then equity will be zero. Margin level is calculated only with equity, not account balance.

Safe margin level in forex

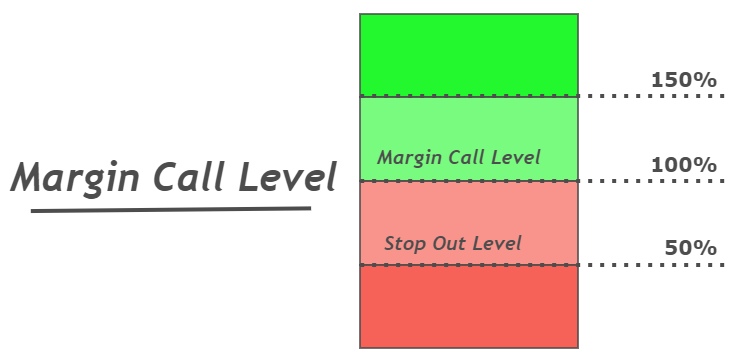

Most of the trading broker has set limitations like they will not allow you open a trade position when your trading account margin level will reach 100% or less. You will not be able to hedge a position once the account reached a margin level of 100%. Remember, a margin level close to 100% is not safe. It must be greater than 100%.

What is margin call in mt4?

Each broker has set a specific margin level percentage, when that margin level is reached then you will receive a margin call notification from the broker that you will be no longer able to open a new position.

So, to open a new position, you need to deposit more money to increase the margin level at least above the margin call level. This is a very important term, and every trader must know about margin and margin call.

What is stop out in forex?

Stop out in forex refers to a specific margin call level at which the broker will start closing your positions one by one according to the available margin. Most of the forex brokers usually close all the positions at a margin call level of 20%.

Most brokers provide negative balance protection in case of stop-out.

In order to succeed, you first have to be willing to experience failure

Yvan Byeajee

I hope you will like this Article. For any Questions Comment below, also share by below links.

Note: All the viewpoints here are according to the rules of technical analysis and for educational purposes only. we are not responsible for any type of loss in forex trading.