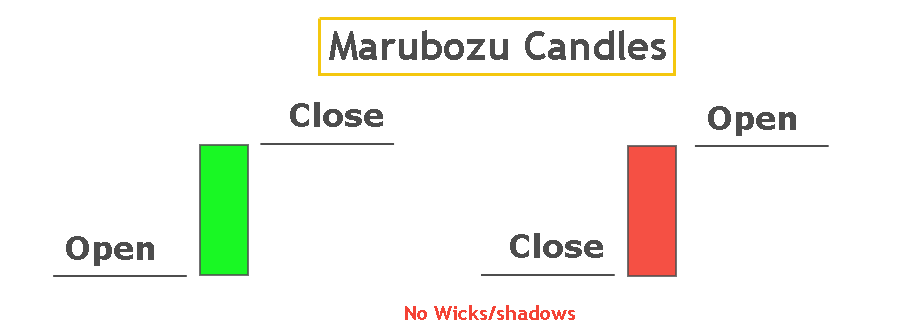

Marubozu candle refers to a single candlestick that has no wick or shadow in forex technical analysis. Marubozu candlestick does not have any high or low value but only open and close value.

It is a single candlestick pattern, and it predicts the future price. Marubozu candle indicates strength in the trend. There are two types of this pattern according to open and closing price.

- Bullish marubozu

- Bearish marubozu

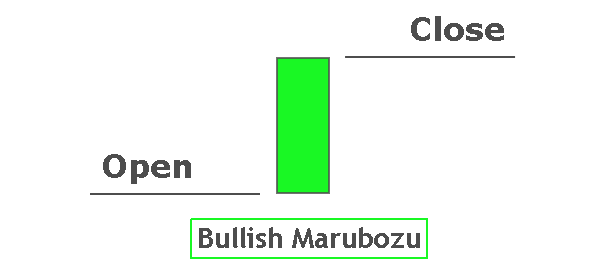

Bullish marubozu pattern

Bullish marubozu candlestick has a low opening price and high closing price. Candlestick bodies and wicks indicate the momentum of buyers or sellers. Full body with no wicks indicates strong momentum in price. Bullish marubozu candle indicates buyers are strong and momentum is bullish.

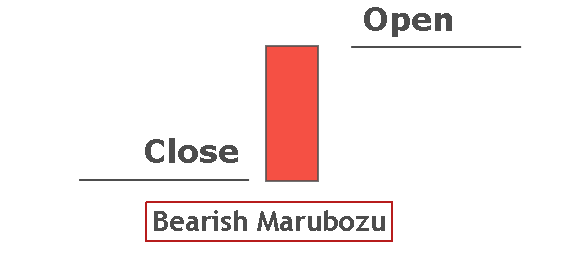

Bearish marubozu pattern

Bearish marubozu candlestick has high opening and low closing prices. A full bearish body with no wicks indicates that sellers are in full control and due to large momentum they will keep on pushing the price down. Look at the image below.

Marubozu candle strategy

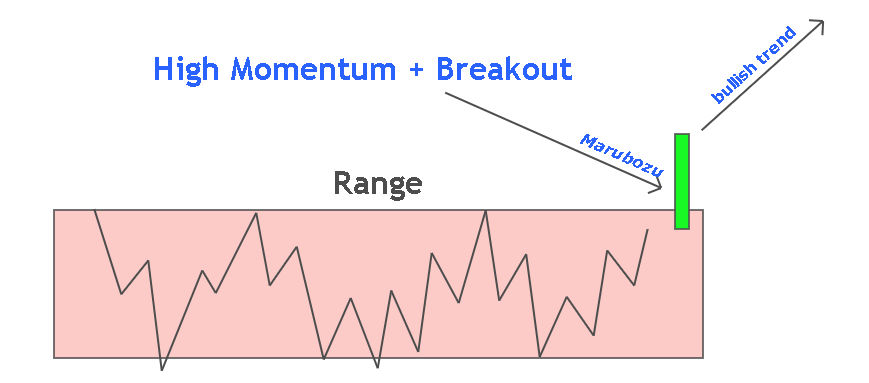

There are two parameters to identify the best marubozu candlestick pattern. Because these patterns form many times a day, but all patterns are not tradable. We will have to filter out the best patterns from the crowd.

- The first parameter is the length or size of marubozu pattern. It means the size of the pattern must be larger than at least the last 10 to 20 candlesticks.

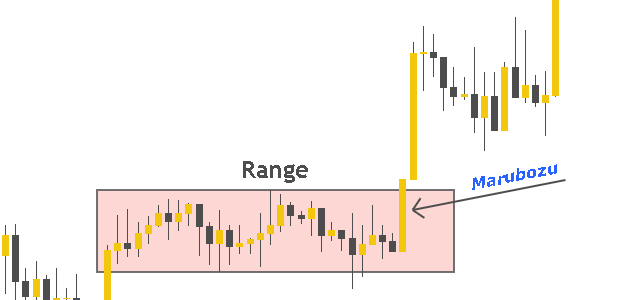

- The second parameter is the location of marubozu pattern. If a bullish candlestick pattern forms when price is over bought already, then it might be a fake out. But if a marubozu candlestick forms at the breakout point of a range of a trend line, then it indicates a valid breakout. Remember, breakout must be in the direction of trend to get better results.

Look at the image below. A marubozu candlestick broke the range in the direction of the previous trend. In the range, there are many small candlesticks. But after this range, a big candlestick (marubozu) formed, it broke the range. Simple candlestick, open inside the range and closed outside the range. It clearly indicates that price has taken a decision and buyers are in full control and now the price will go up.

This is the psychology behind this pattern.

This is not only the way. There are many ways to use this marubozu pattern like if you have opened a buy posit and after some time a bullish marubozu formed then you can hold your trade to get more profit. Because it indicates that there is still momentum in price.

Use this pattern with your strategy and increase the risk-reward and winning ratio to survive in the forex market. Visit Trading view to get marubozu candlestick indicator for free.

Read the Price

forexbee

I hope you will like this Article. For any Questions Comment below, also share by below links. Tradingview is the best chart tool

Note: All the viewpoints here are according to the rules of technical analysis and for educational purposes only. we are not responsible for any type of loss in forex trading.