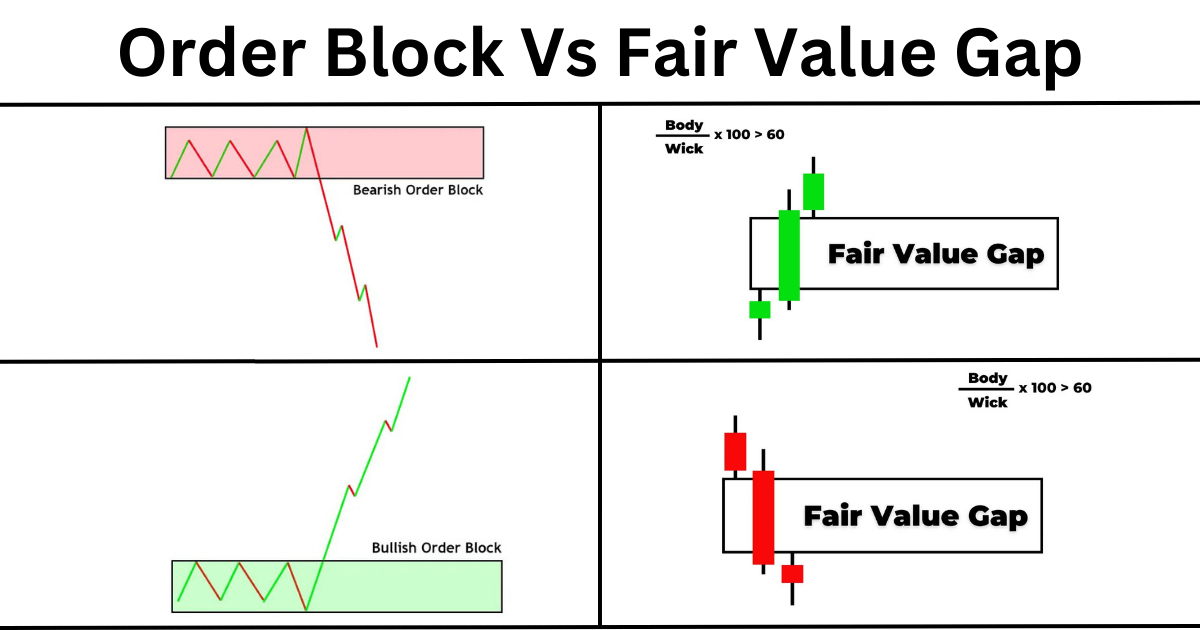

I will explain the difference between the order block and the fair value gap in this article. Both are the most important concepts of technical analysis. However, most traders need clarification on both concepts with each other because both patterns give a signal of imbalance and balance in the market.

Order block Vs. Fair Value Gap

| Order block | Fair value gap |

|---|---|

Order block is the presence of a chunk of market orders that results in a sudden rise or fall in the market. | The fair value gap shows the gap on the candlestick chart that creates an imbalance in the market. |

| The order block area shows the interest of market makers in a certain price level. That’s why we can trade that level when the price returns to the order block zone. | However, the market always balances the imbalance by filling the gap. That’s why it shows the potential trade opportunities in the direction of imbalance. |

| Price mostly bounces from the order block zone. | When price may or may not bounce from the fair value gap. Because the primary function of the fair value gap is to balance the imbalance only, it may bounce if the proper value gap forms in the direction of the trend. |

| The order block zone will form just after the break of the ranging market structure. Like in natural process, after range impulsive waveforms and after impulsive wave range forms. | However, the fair value gap forms in the trending market. And price always attracts the gap to fill the gap. This process keeps balance in the market. |

| Order block pattern is based on natural phenomena. | The fair value gap pattern is also based on natural phenomena. |

| Order block indicator draws the zones on the chart, which we can trade by the confluence of other technical tools. | The fair value gap indicator also draws zones on the chart, but it only shows us the direction, always toward the imbalance or gap. |

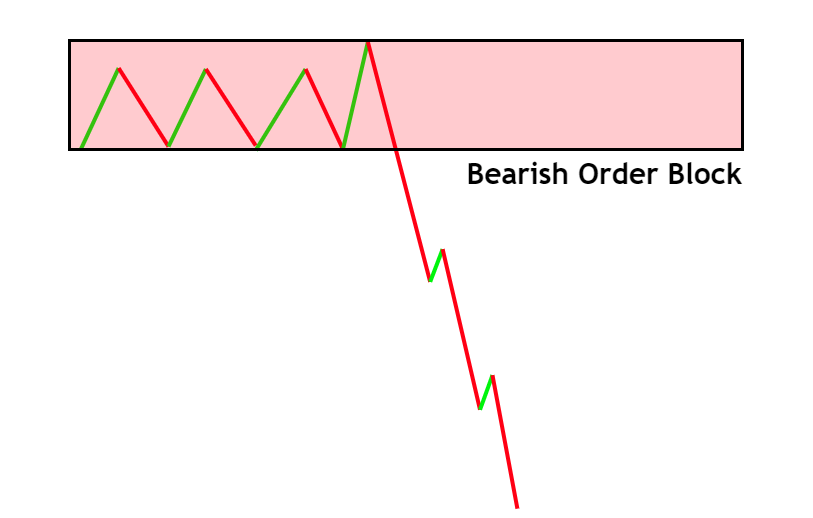

The psychology behind the order blocks

Order blocks are the area on the price chart that shows the chunk or market orders. Because big institutions cannot place their big orders just at once, they turn the big orders into several small ones. So when these chunks of orders trigger, a significant impulsive move forms on the price chart.

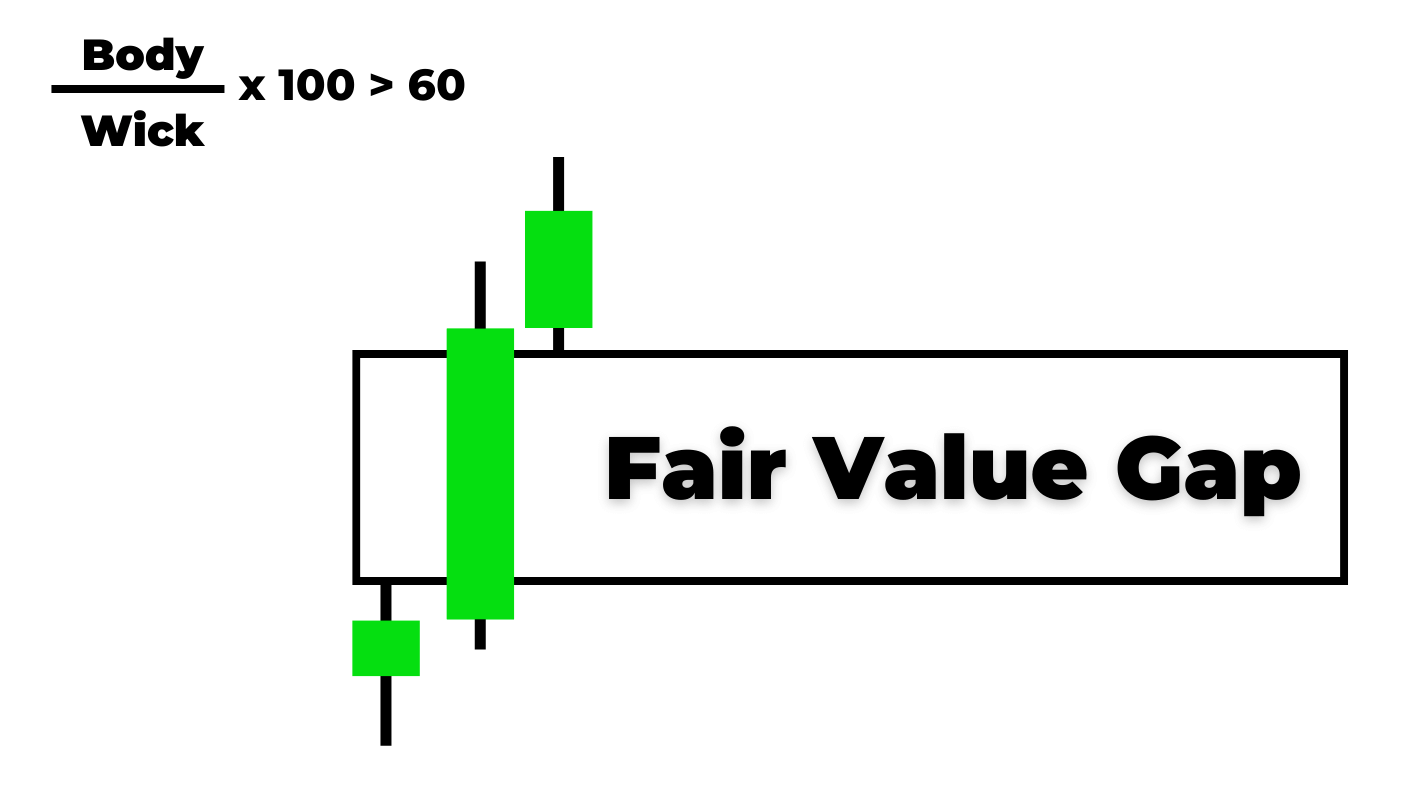

While the fair value gap shows the imbalance on the price chart, a gap is created on a candlestick chart when big orders trigger at once. This gap represents the imbalance, and prices always try to balance those imbalance zones.

Which technical tool should you use in trading?

If you compare the order block with the fair value gap, both concepts are different. It depends on your strategy.

According to my recommendations, you should use the fair value gap to determine the market’s future direction. In technical analysis, most traders need help determining the market’s direction, resulting in many losing trades.

However, if someone knows about the future, he can trade in the forecasted direction. It will give you high-probability trade setups because trading is all about probabilities. The confluence of technical tools can increase the probability of winning.

A trader should use the order blocks as high-probability zones. Because market makers had chosen a level, and it must be unique. That’s why it can be traded in the future.

To trade order block zones, we should add the confluence of reversal candlestick patterns like a pin bar or engulfing candlestick. For example, on a bearish order block zone, a bearish engulfing candlestick can increase the probability of trend reversal.

Recommended trading strategy

Choosing a trading strategy depends on many factors, like temperament, time availability, and expertise level. However, the most straightforward and profitable setup combines supply demand and fair value gap indicators.

Link to Supply and demand indicator

Link to Fair Value Gap indicator

In this trade setup, the supply and demand indicator will give you entry and stop loss price while the fair value gap indicator will give you a direction and take profit level.

When we combine these setups, high-probability, and high-risk reward trade setups will form.

Conclusion

Fair value gap and order blocks both are natural concepts in technical analysis. You can use these patterns in the trading strategy or analyze or forecast. If you want to use it in the strategy, I recommend using the order block and fair value gap indicators.