Introduction

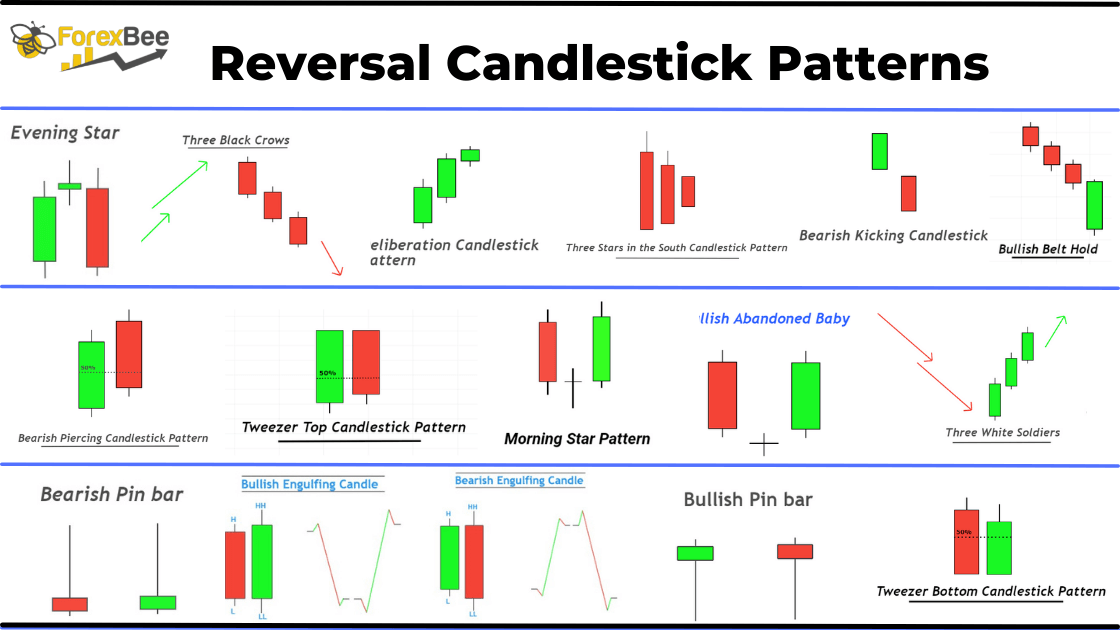

The candlestick patterns that turn the trend from bearish to bullish or bullish to bearish price trend are called trend reversal candlestick patterns in technical analysis.

Several patterns forecast trend reversal. Each pattern has unique characteristics. Some are used in forex trading, some are explicitly used in stocks or indices trading, and a few are universal candlestick patterns.

Steve Nison introduced the major candlestick patterns in his book “Japanese Candlestick Charting Techniques”. However, many other candlestick patterns were introduced later to the world.

List of trend reversal candlestick patterns

There are 12 reversal candlestick patterns cheat sheet so far that are used in technical analysis to predict a trend reversal.

- Engulfing candlestick

- Pin bar candlestick

- Piercing candlestick

- Tweezer top & Tweezer bottom candlestick

- Morning & Evening Doji Star candlestick

- Bullish & Bearish Abandoned Baby candlestick

- Three white soldiers candlestick

- Three black crows candlestick

- Three stars in south candlestick

- Deliberation candlestick

- Kicking candlestick

- Bullish & Bearish belt hold a candlestick

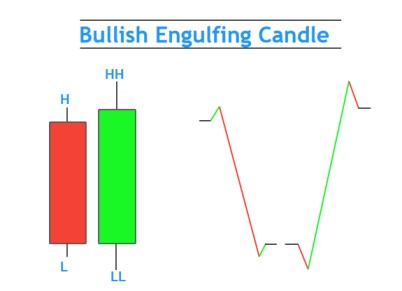

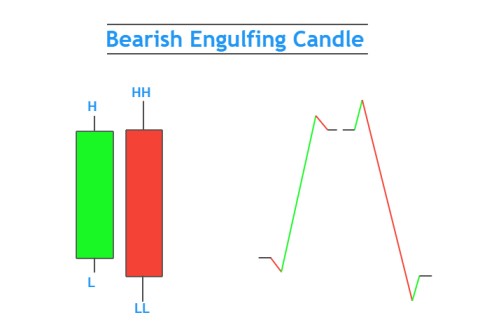

Engulfing candlestick pattern

It consists of two opposite colour candlesticks in which the second candlestick will completely engulf the first candlestick. In technical terms, a higher high and lower low will form.

It is further divided into two types based on the nature of the trend.

- Bullish engulfing candlestick

- Bearish engulfing candlestick

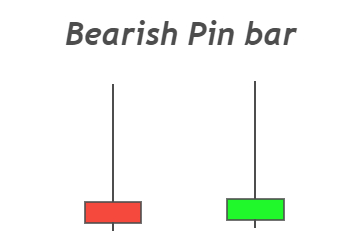

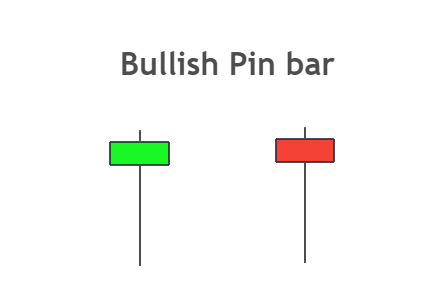

Pin bar candlestick pattern

It is a single candlestick pattern with a long tail on the upper or lower side with a small body. It is also categorized into bullish and bearish pin bars.

A bullish pin forms at the bottom of the chart, and it has a long tail on the lower side. In comparison, the bearish pin bar forms at the top of the chart and has a long tail on the upper side.

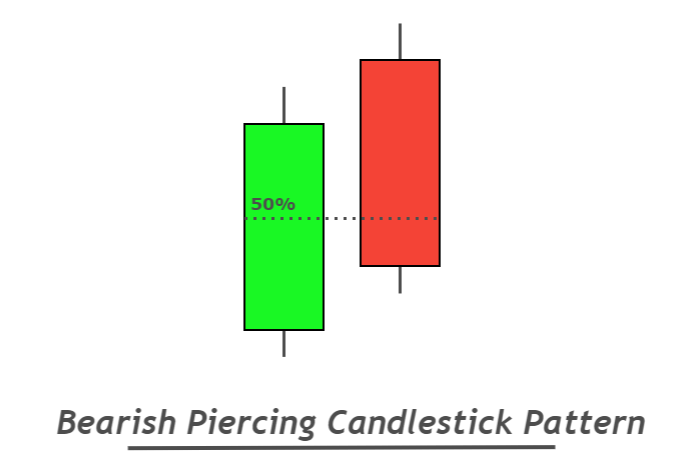

Piercing Candlestick pattern

The piercing candlestick pattern consists of two opposite colour candlesticks in which the second candlestick must cross the 50% Fibonacci level of the first candlestick.

This pattern is further categorized into bullish piercing and bearish piercing candlestick patterns.

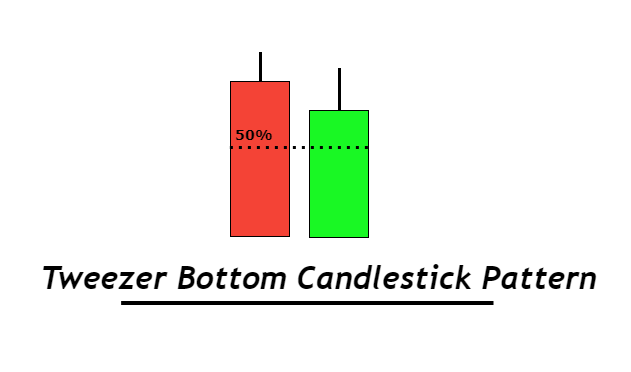

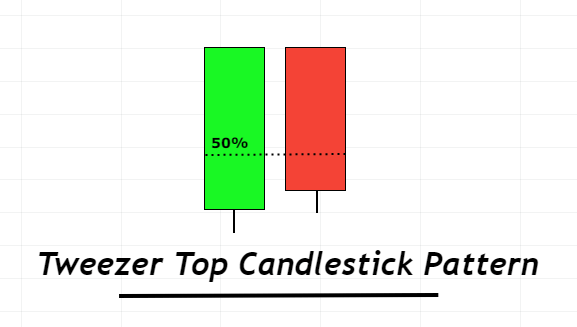

Tweezer top & Tweezer bottom candlestick pattern

Tweezer top and bottom are two opposite candlestick patterns. In tweezer bottom, both bullish and bearish candlesticks will not have wick/shadows at the bottom, and both candlesticks will close and open at the same price.

In tweezer top, both candlesticks will not have shadows on the upper side, and they will form at the top of the chart. The closing price of the first candlestick will be equal to the opening price of the second candlestick.

Find High Probability Trades with this ADVANCED Candlestick Patterns Course

The Ultimate Candlestick Patterns Course That Will Help You To Trade Better

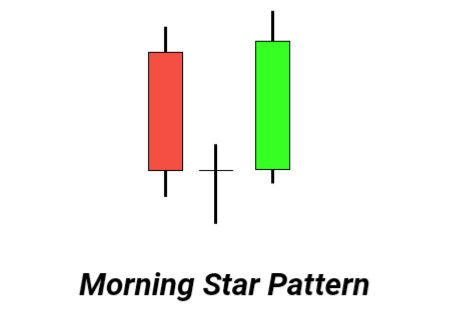

Morning & Evening Doji Star pattern

The morning doji star is a bullish trend reversal candlestick pattern consisting of two opposite candlesticks and a Doji star in between. Look at The structure of the morning doji star pattern in the image below.

The evening doji star is a bearish trend reversal candlestick pattern consisting of two opposite candlesticks and a Doji star at the top of the pattern.

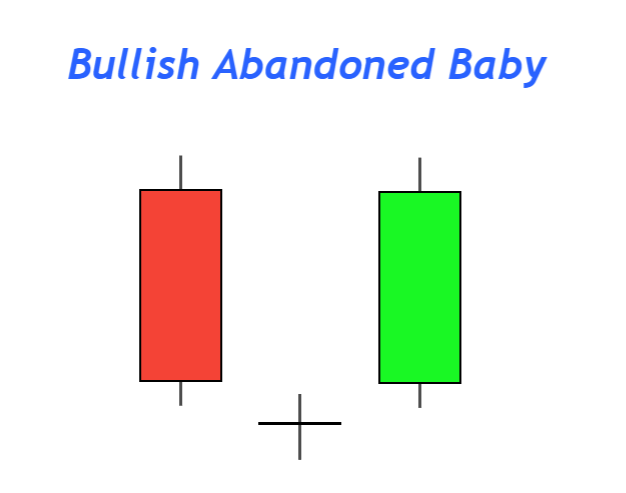

Abandoned baby candlestick pattern

The abandoned baby candlestick is similar to the morning/evening doji star candlestick. The difference is that the Doji candle will form in an abandoned baby pattern with a gap up or a gap down.

It is classified as a bullish abandoned baby candlestick and bearish baby candlestick.

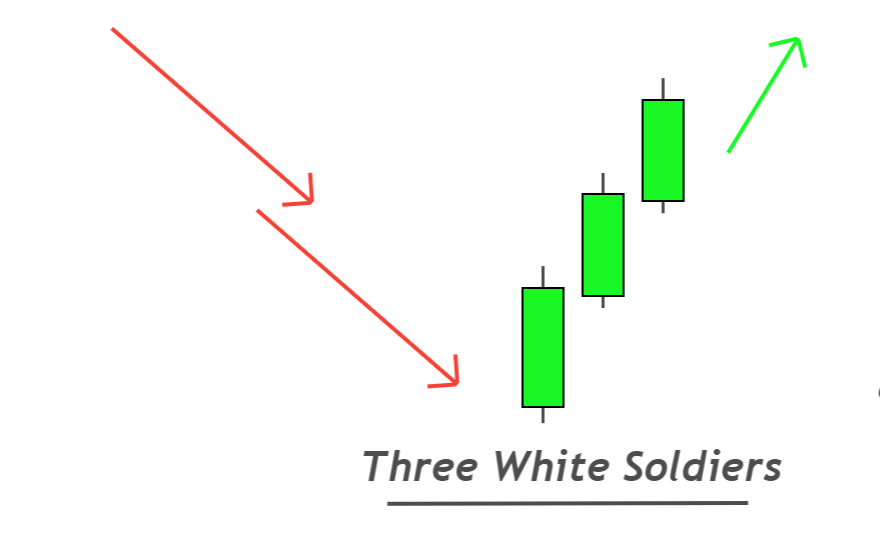

Three white soldiers candlestick pattern

It consists of three big bullish candlesticks at the bottom of the price chart. Three white soldiers candlestick is a bullish trend reversal pattern. The prior trend should be bearish.

This pattern should form at the support or demand zone to get a high probability trend reversal signal.

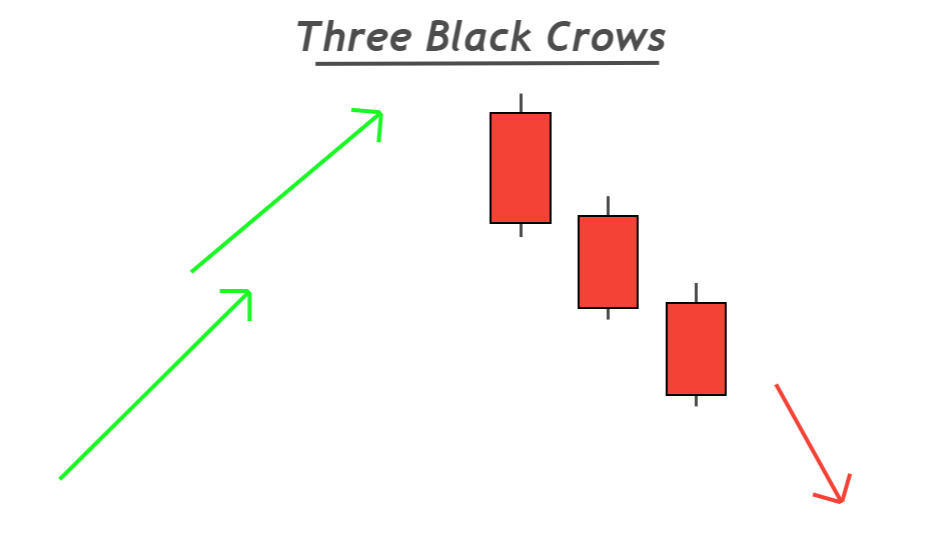

Three black crows candlestick pattern

It consists of three big bearish candlesticks at the top of the price chart. These three candlesticks should form in a row.

Three black crows candlestick is a bearish trend reversal pattern. The prior trend to this candlestick should be bullish.

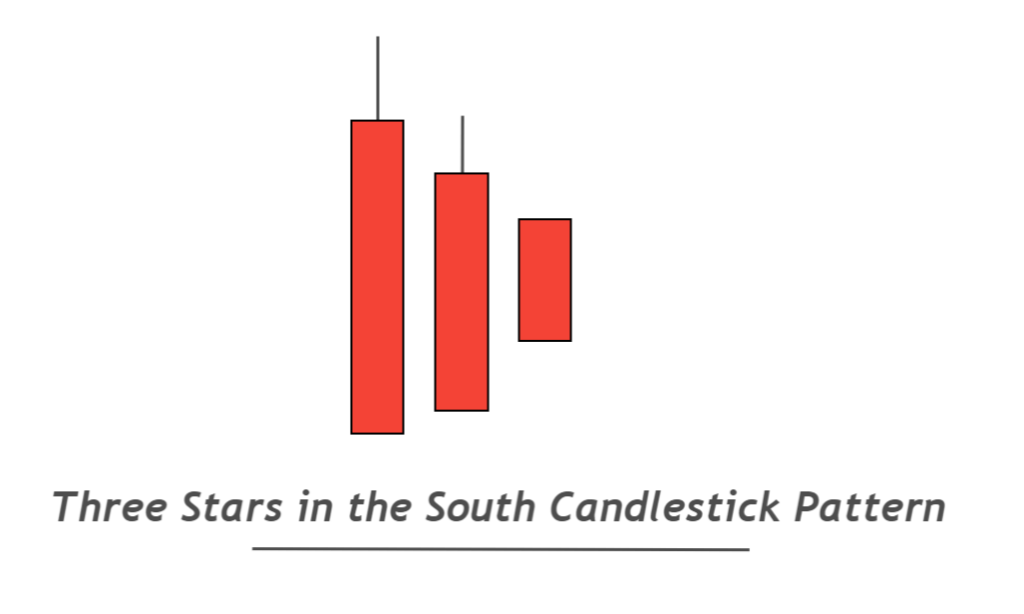

Three stars in south candlestick pattern

The three stars in the south candlestick also consist of three bearish candles, but each candlestick will form within the range of the previous candlestick like inside bar candle.

It will mostly form in stocks or indices. Read the complete article for a better understanding of this pattern

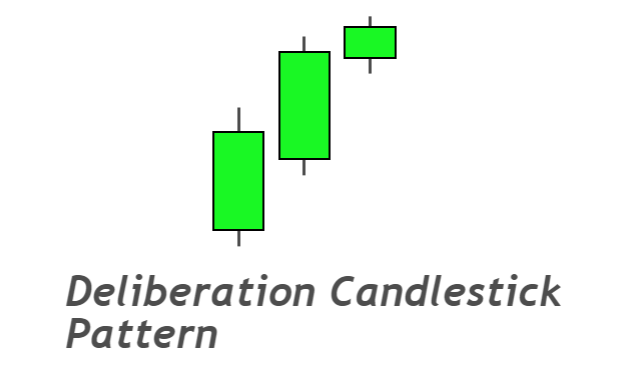

Deliberation candlestick pattern

The deliberation is also a bearish price trend reversal pattern that consists of three bullish candlesticks. Look at the image below to find the structure of this pattern.

It is mainly used to do technical analysis of stocks and indices. It is not used in forex trading.

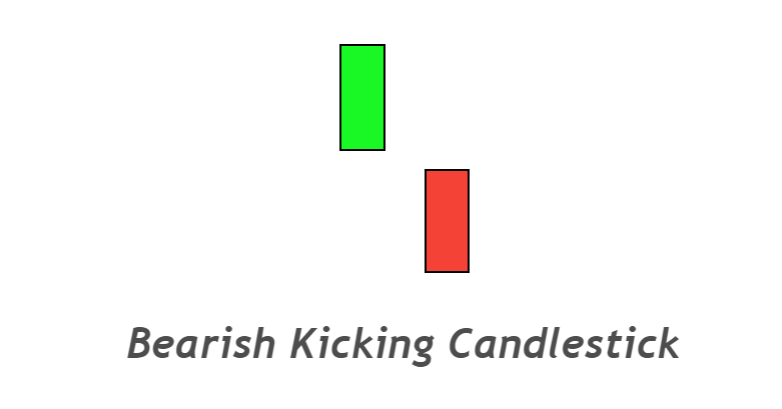

Kicking candlestick pattern

The kicking candlestick pattern consists of two opposite-colored marubozu candlesticks and a gap between them. It is also further classified into a bullish kicking pattern and a bearish kicking pattern.

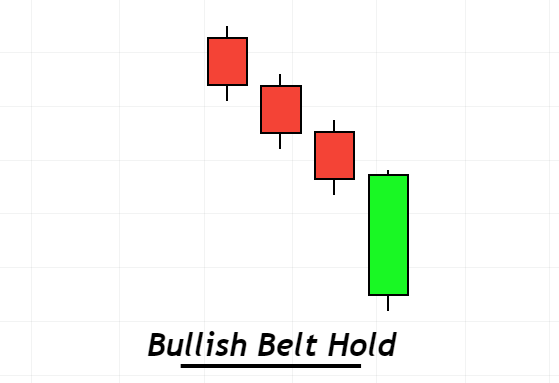

Bullish or bearish belt hold candlestick pattern

The belt hold pattern also consists of two opposite color candlesticks. In the bearish belt hold, after the bullish candlestick, the next bearish candle will open with a gap up, and it will close below the 50% level of the first bullish candlestick.

In the bullish belt hold, after the formation of the bearish candlestick, the next bullish candle will open with a gap down and close above the 50% level of the first bearish candlestick.

Conclusion

If your trading strategy is based on a trend reversal, you should always add a confluence of trend reversal candlestick patterns. This step will increase the performance of your trading strategy.

Make sure to backtest all the candlestick patterns properly.

Great Informative

Thank you for sharing.