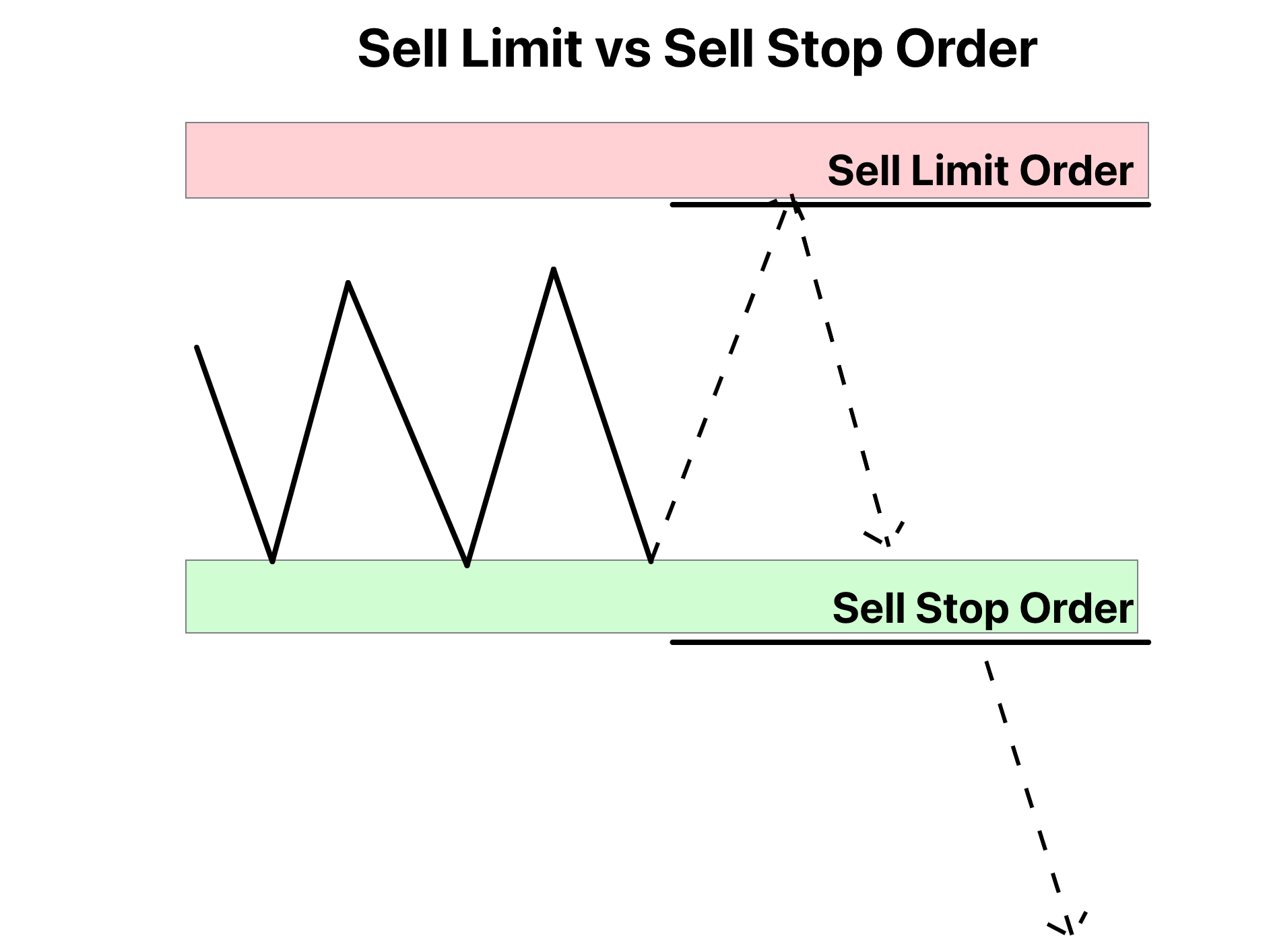

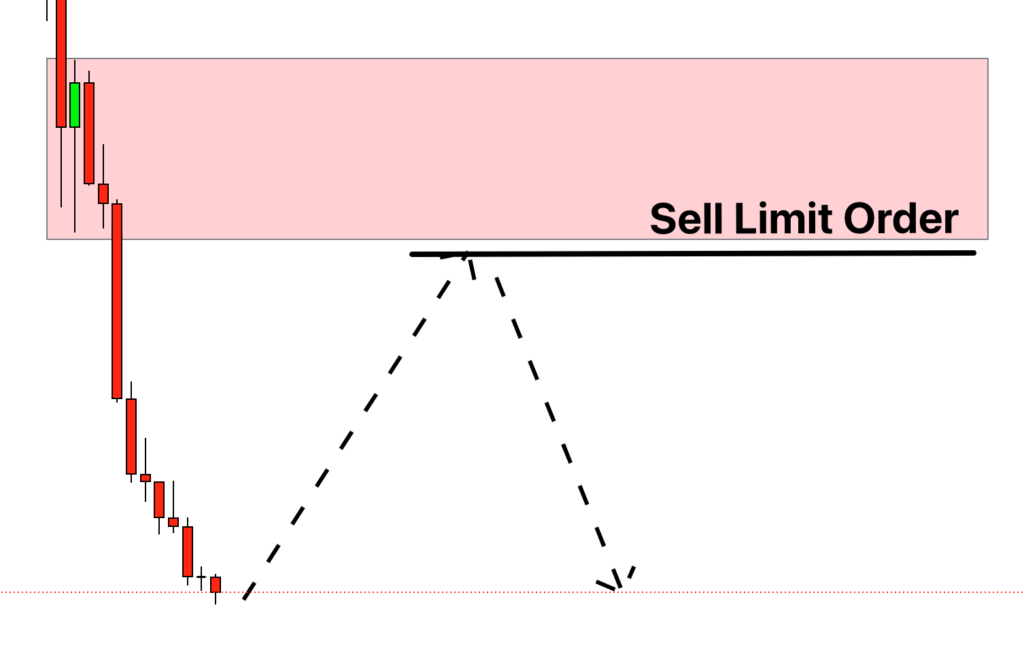

Sell limit order

It is the type of sell order in which a trader sells his asset at a specified higher price than his purchasing price.

Sell limit order resembles a local market where a shopkeeper sets the fixed price of his goods. Once a customer is willing to pay the said price, he will sell to get a profit.

If you buy a currency pair at $130 and you think it will be a good idea to sell it for $138. You will set your sell limit order at $138. Once the set price is achieved, your broker will execute the trade.

Sell limit order includes,

- Selling at a specific or higher price

- No guarantees for the execution of trade if the threshold price is not achieved

- A sell limit order can limit the losses by avoiding future risks, as the trading move will take place once the stop price is touched.

Sell limit order offers the following advantages and disadvantages

| Pros | Cons |

|---|---|

| Sell limit order helps you to capture a profit. | In a sell limit order method, a trader sells his assets at a higher price; a trade may stay unexecuted if the threshold of a trade is not achieved. |

| It can limit future losses in the case a market takes a dip. | A trade may miss market opportunities because the stop price is set at a higher value. |

| It is a useful tool for managing the risk. | A trade may not achieve the desired price. |

| A sell limit order offers you the luxury selling of your asset at any given time of the day in a trading session. | In a low-liquidity market, the execution of a trade is difficult. |

| Sell limit order is used to take advantage of reducing market impact. |

Sell stop order

It is the type of sell order in which a trader sells his asset at a specific or lower price.

You set a stop price to execute a trade. Once the stop price is hit, your broker will execute the trade for you.

Suppose the value of your asset is $300. You set a sell-stop order at $295. Suppose the market is experiencing a dip. To avoid future potential losses, once the set price of $295 is hit, the trade will be executed for you. This type of selling method opts to avoid future potential losses due to decreasing value of the asset in the trading market.

Sell stop order includes,

- Selling of an asset at a specific or lower price.

- Once the stop price is hit, the trade is executed.

- It is used as a risk management tool.

- Execution price can vary from the stop price.

There are the following limitations and advantages when you opt for a sell limit order method for the execution of your trade.

| Pros | Cons |

|---|---|

| In sell stop order method, an asset is sold at a specific or lower stop price which helps in avoiding the bigger losses. | In a sell-stop order, a trader sells at a lower price than the current market price, which may offer some losses. |

| It is used to anticipate bigger losses in the case a market exhibits further decrease. | A desired price is often not achieved. |

| It is used as a tool for risk management. | Executions at unfavorable prices can take place. |

| A sell-stop order provides you the opportunity to execute a trade at any given time in a trading session. | False activation can take place in a volatile market which can result in premature selling. |

| It is used as a breakout trading strategy in a volatile market. | There is a lack of control in the case of the sell-stop order method. |

Comparison of sell limit order with the sell stop order

Sell limit orders and sell stop orders can be compared based on the following factors.

- The objective of a trade

- Activation of an order

- Execution of a trade

- Risk management

- Relationship with current market price

Above mentioned factors are compared in the table below.

| Factors | Sell limit order | Sell stop order |

| The objective of a trade | To sell at a specified or a higher price | To sell at a specified or a lower price |

| Activation of a trade | When the market achieves or exceeds the stop price | When the market achieves or decreases the stop price |

| Execution of a trade | At a higher price | At a lower price |

| Risk management | Limits the future potential losses | Minimizes the current loses |

| Relationship with current market price | The current price is lower than the sell limit | The current price is higher than the sell stop |

Example 1 – sell limit order

Suppose you are trading a currency pair at $80, and you desire to sell it at a higher price. You set the stop price at $85; once the threshold price is hit, your broker will execute the trade for you.

Example 2 – sell stop order

Suppose you are trading a currency pair at $80, and the market shows a downtrend. To avoid future bigger losses, you will set the stop price at $76, which is lower than the current market price. Once the threshold price is achieved, the trade will be executed.

Uses of sell limit and sell stop order

Sell limit orders and sell stop orders are used in different situations for different trading strategies. The brief use of sell limit and sell stop order is given below.

Uses of sell limit order

- A trader can secure profit by using a sell limit order.

- Setting a sell limit order can help you to execute your trade in terms of resistance levels.

- You can avoid future losses by selling your asset before the market takes a dip.

- Sell limit order offers control over your trades in terms of the selling price.

Uses of sell-stop order

- In the sell-stop order method, a trader sells his assets at a price that is lower than the current market price.

- Sell stop order method can help to limit the losses.

- Sell stop method is used to protect the profits by selling the asset when the market starts to take a dip.

Conclusion

Selling an asset is a crucial step as the potential losses and profits depend on it. The choice of a trading method depends on the personal choices and trading goals of a trader. If you are attempting to avoid bigger losses, you can use the sell-stop order. While if your goal is to make a significant profit and move out of the trade, then the sell limit order is a perfect method.