Definition

Synthetic indices are the simulated markets that work like real markets. But the price numbers are generated randomly by a fully secured computer program. This program is handled by fully independent third-party companies.

These indices are programmed in such a way that natural disasters do not affect the working of indices. There are many advantages of these indices over the other forex currency pairs. That’s why retail traders like to trade such types of indices.

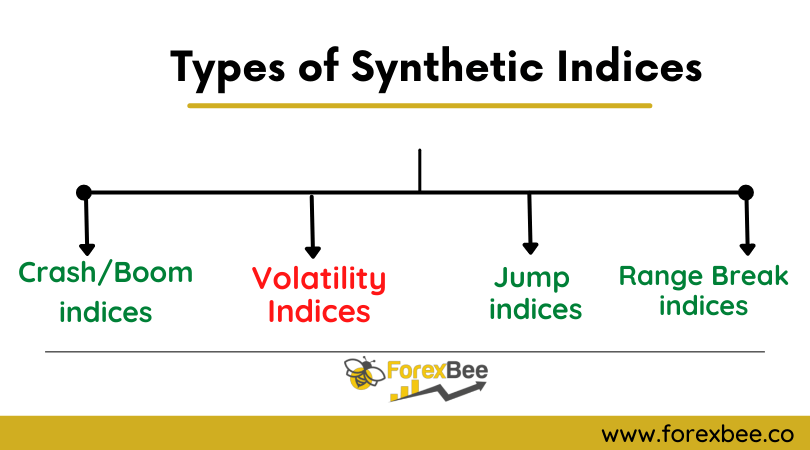

List of synthetic indices

There are five major categories of synthetic indices and they are further classified into different types depending on their characteristics.

- Volatility indices

- Crash/Boom indices

- Jump indices

- Range Break indices

Advantages of synthetic indices

Trading indices are easy to some extent as compared to forex or stocks. Because of few characteristics, synthetic indices have captured the attention of many retail traders.

No effect of fundamentals

In trading a currency pair or stocks, fundamentals have large control. Fundamental news can turn the market up or down. It also creates an environment of fear among retail traders. Also, it increases the spread and it becomes difficult to trade during that time. But these indices are free from any fundamental news. Any news has zero impact on synthetic indices

Spread and Leverage

The most important factor that influences the trading strategy is the spread. Sometimes spread causes loss in a winning trade. You can’t trade some currency pairs on lower timeframes because of the large spread. But the spread is too much low in synthetic indices. This is also a plus point.

24/7 Live Trading

In forex, you cannot trade over the weekend because the forex market remains close. So forex is a 24/5 market. But Synthetic indices work all the time. You can trade any time or at any big event. This is a 24/7 market.

These are few major characteristics that make difference between synthetic indices and the forex market.

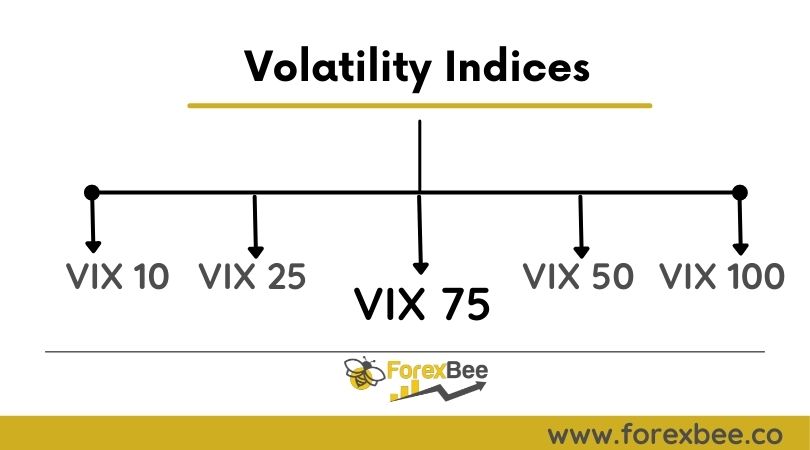

Volatility indices

There are five types of Volatility indices. It depends on the characteristics of a particular index.

Here is the list of all volatility indices

- Volatility 10 index

- Volatility 25 index

- Volatility 50 index

- Volatility 75 index

- Volatility 100 index

The numbers 10, 25, 50… represent the real market volatility. 10 means it includes 10% market volatility. 75 means 75% market volatility. The volatility 75 index is a popular index among retail traders.

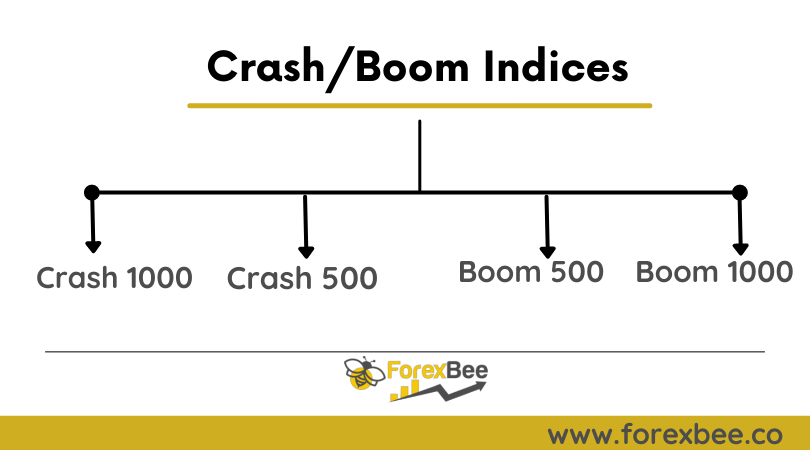

Crash/Boom indices

These types of indices are programmed in such a way that a crash or Boom occurs in the index after a specific interval of time.

There are four main types of crash/boom indices

- Crash 1000 index

- Crash 500 index

- Boom 1000 index

- Boom 500 index

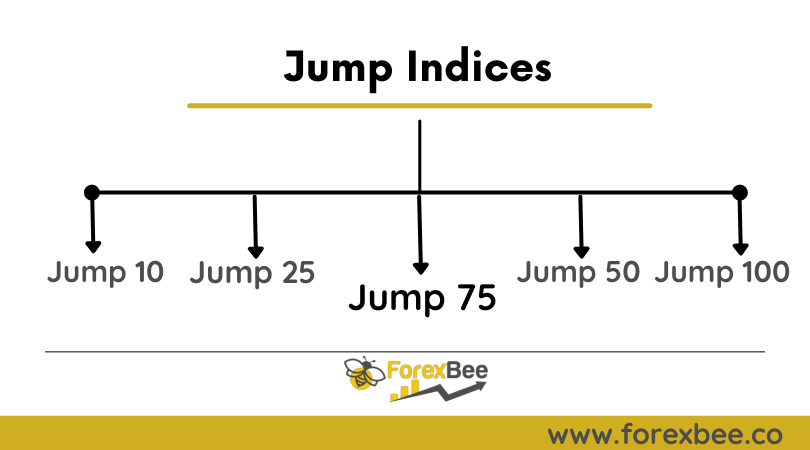

Jump indices

Like Volatility indices, jump indices also include a fixed percentage of Volatility. According to the deriv market, a jump in this index occurs after every 20 minutes. There are five major types of jump indices

- Jump 10 index

- Jump 25 index

- Jump 50 index

- Jump 75 index

- Jump 100 index

Range break indices

The range Break index shows a similar market pattern. For example, it forms a range for a specific time and then breaks the range to form an impulsive move. After an impulsive move, it again forms the ranging market pattern.

Broker that supports synthetic indices trading

They are only offered by DERIV brokers. Because these are indices that are programmed by computer software. That’s why most brokers do not support such types of indices. Deriv is the broker that supports all types of synthetic indices.

If you want to trade indices specially Volatility indices then you can create a demo account by clicking here.

Are synthetic indices manipulated?

Yes, it can be manipulated. Because, unlike forex or stock market, synthetic indices are not natural. They are controlled by computer software that generates numbers randomly. But the deriv broker believed that they are secured cryptographically. So there is less chance of manipulation.

According to our recommendation, you should avoid trading these indices if you have a big account size. Less than $50k can trade without any worry of manipulation.

Are synthetic indices available in MT4 or MT5?

No, synthetic indices are not available in MetaTrader 4 or MetaTrader 5.

Conclusion

These indices are good to trade. If you have a strategy that’s failing because of spread. Then, you should try to trade these indices.

Great Article, if you are into Synthetic Indices, take a look at this Free Ebook written by Trader Vince Stanzione for Deriv. https://static.deriv.com/marketing/how-trade-syntheticindices-fa.pdf