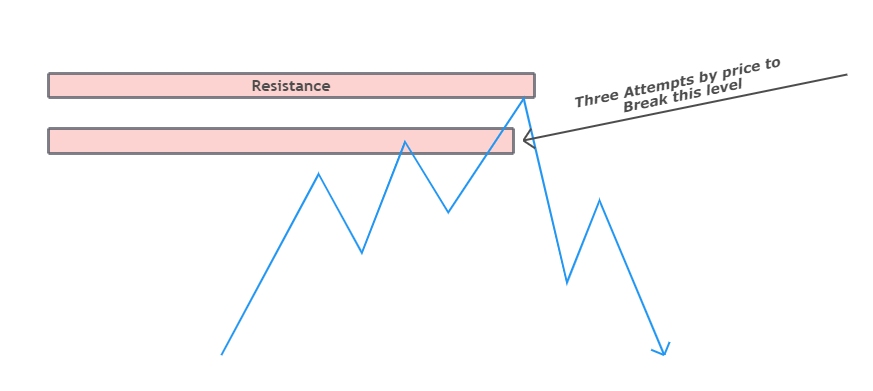

A reversal pattern indicates three consecutive and symmetrical attempts by the price to achieve a target price and then reversal is called a three drives pattern.

In this article, I will explain the three drives pattern, the psychology behind this pattern, and a complete guide to using 3-drives pattern in a strategy to increase the winning ratio and probability of a trading setup.

What is three drive pattern in forex?

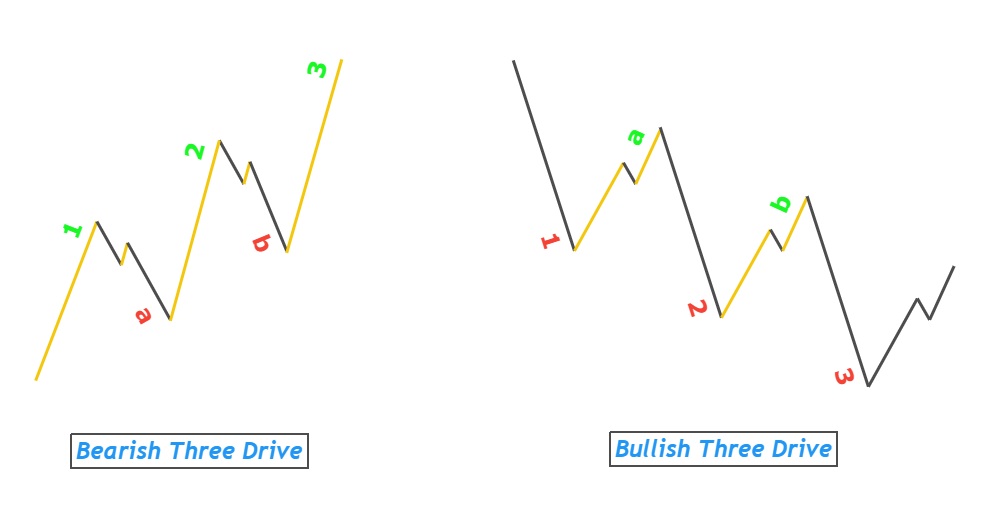

The 3-Drive pattern consists of three approximately symmetrical waves making higher highs consecutively in case of the bullish trend. On the other hand, it consists of three waves making lower lows in case of a bearish trend.

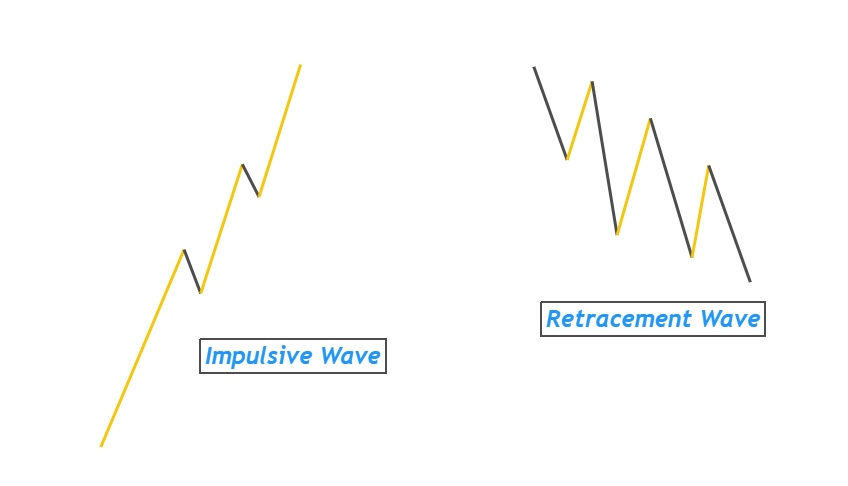

Keep in mind a wave further consists of two sections.

- Impulsive wave

- Retracement wave

Impulsive wave shows big movements in price due to institutional traders and then retracement wave shows traders taking profit and trapping retail traders.

So in a 3-drive pattern, there will be three impulsive waves and two retracement waves. Impulsive waves are indicated by 1-2-3 and retracement waves are indicated by a-b. Look at the image of three drive pattern below

Rules of 3 drive pattern

There are some rules to follow to filter the 3-drive pattern from noise which are described below

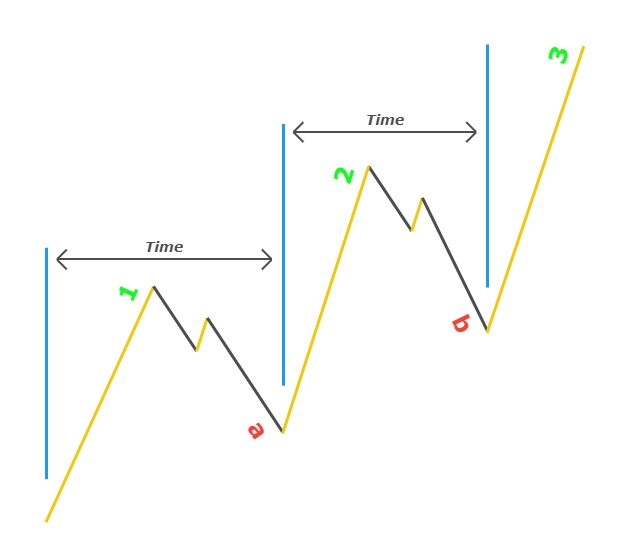

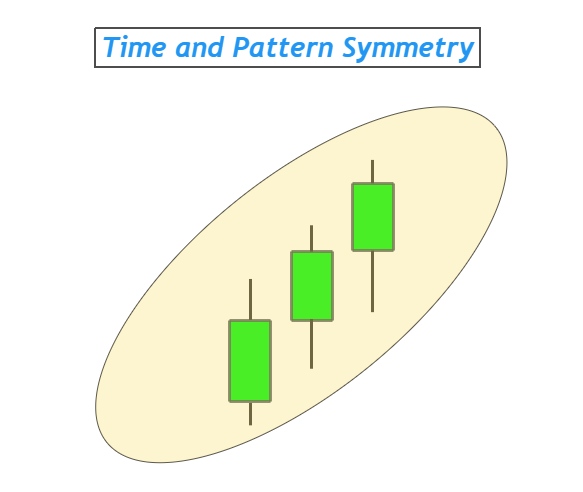

- Time period of progression of all the three waves must be approximately same. I’m not saying to exactly match the time here you will have to use common sense. You will know everything when you will back test three drive pattern.

- Price must form symmetrical waves. Price pattern must be same.

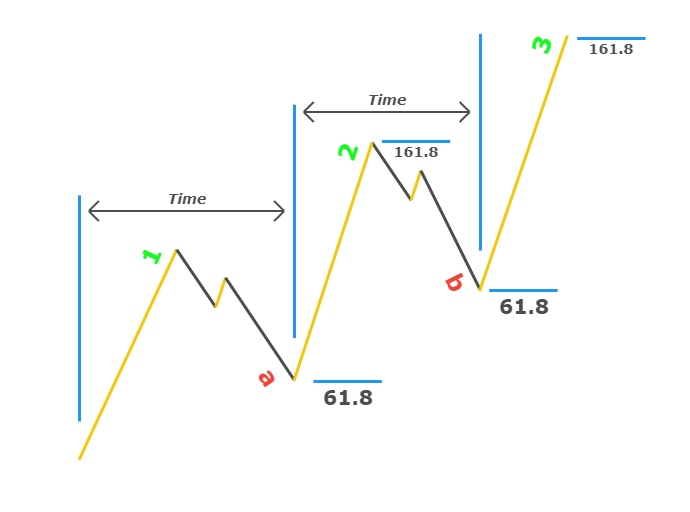

That’s all. Only two rules to follow. There are other rules like using the Fibonacci tool but I will not recommend it. Because the main purpose of this pattern is to look for symmetry in patterns in time. Fibonacci is not a necessary tool for this pattern. However, if you are a beginner, I will recommend you to use Fibonacci for your convenience. Let me explain Fibonacci rules to be used to identify 3-drives patterns (optional).

- Both retracement waves must retrace to Fibonacci 50 to 61.8 level.

- Wave 2 and 3 must extend to Fibonacci extension 127.2 to 161.8 level.

Psychology of three drives pattern

Psychology is very simple. Like if the price wants to go down but as there is a level above which is under the attention of many retail traders. There is a stop-loss level for a lot of traders. So institutions will be interested to hike the price to capture SL’s. Also because of a lot of selling pressure institutions will try three consecutive attempts to break that level. After breaking that level price will come down like a falling arrow. This is a psychological pattern and it works.

Three drive pattern can also be identified using simple three candlesticks if three consecutive candles have symmetrical price and time patterns. Look at the image below.

Three drives pattern trading strategy

I will use two confluences to make a valid and high probability three-drive setup. One will be the use of support & resistance or Supply & Demand to protect stop loss. Another one will be the use of upper described rules to filter out a good three drive pattern forex setup. At the end of the third wave, a pin bar or engulfing candle is necessary to trigger an order.

- A valid three drive setup

- Look at the left of the chart by zooming out to get an S&R or SnD level

- Look for a pin bar or engulfing and then enter in that trade.

Stoploss level will be above the resistance level or below the support level.

First take profit level will be at 61.8 Fibonacci level of total three waves and 2nd tp will be at the origin of the three drive pattern. That’s all

The Art of Time is NOT Wasting It!

LaSean R Shelton

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4.

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.