Introduction

A lot refers to “a large number” or “a large amount.” You might have heard the word “lot” while dealing in the market or in a movie showing an auction scene. A lot is also called a set, bunch, or bundle.

The word lot is used in every walk of life, especially related to business. For example, a plot may be considered a lot in a real estate business. While in a simple scenario, a layperson buying a dozen bananas from a local shop might need to learn that 12 bananas are a lot for dealing in bananas.

As mentioned above, a lot is essential for a business like real estate and a simple shopping of fruits. The financial world of forex is similar as it also deals in a specific lot size.

Definition

In the forex world, a lot is termed as a unit of measurement to trade an amount of currency.

In simple words, forex is all about buying or selling currency. To buy and sell currency, one requires a basic unit or a number of a specific currency. This basic unit is defined as a lot in forex.

e.g., if the EURUSD rate is 1.10, one requires 110,000 currency units to open the position of 1 lot.

Importance of Lot Size in Trading

If you consider forex a “body,” a “lot” could be termed as its “backbone” as it is an essential aspect of trading.

Determination of a lot can impact your trading in the following ways

- Risk factor

- Longevity and Survival in a Trade

- Determination of margin requirement

- Determination of potential profits and losses

- Execution of a trade

Risk factor:

A risk factor is one of the top barriers in a human brain while stepping into the forex world. It is a significant factor that might keep some people from trading for a lifetime while some overcome it and start forex, yet no one can overcome it completely. Some might follow the approach of a safe game, while others take the “greater the risk, greater the reward” approach. In both cases, one must determine the risk factor directly proportional to the lot size one trades in. Smaller lot sizes usually offer low risk, while greater lot size increases the potential risk of losses. So, determining a lot size will provide you with important information about what you put at stake if things go wrong.

Longevity and survival in our trade:

A lot size also determines your capacity for lasting in a trade. The distance you go in a trade can affect your profit and loss. Sometimes a more excellent lot is difficult to hold in the market when things are not Rosy. So one must be very clear about his resources while offering a trade to survive in the long run; it is only possible by determining a lot size while trading.

Determination of margin requirement:

Margin is the amount of cash a trader should have in his account to open and maintain a position. Smaller lot size requires less margin, while the more fantastic the Lot is, the more significant the requirement of margins to cover a trading position. Thus, a lot size provides you with the necessary information about margin determination while trading.

Determination of potential profits and losses:

A lot size provides you with information on future potential profits and losses. A lot size lets traders control the size of their positions in the forex market. These positions can directly affect future profits and losses.

Execution of a trade:

Large lot sizes could be problematic while executing a trade, especially within a market with lower liquidity. This factor determines the speed and expense of trade execution. Thus, lot size is a critical factor in the execution of a trade regarding the speed and cost of a trade.

How to Determine Lot Size for Your Trades

To determine a lot size for trading, one needs to remember the following steps.

Step-1: risk capital

It is termed the calculation of the risk or the amount of money a person will lose if things go harshly.

Step-2: calculation of stop loss

To perform the necessary stop loss calculations, one must determine the distance between the entry and stop loss level in pips.

Step-3: determine the position size

A standard formula for determining the position size is,

Position size= (risk capital/stop loss distance)/ pip value per standard lot

Step-3: adjustment of lot size

A trader may adjust the lot sizes according to his capacities of account and risk limits.

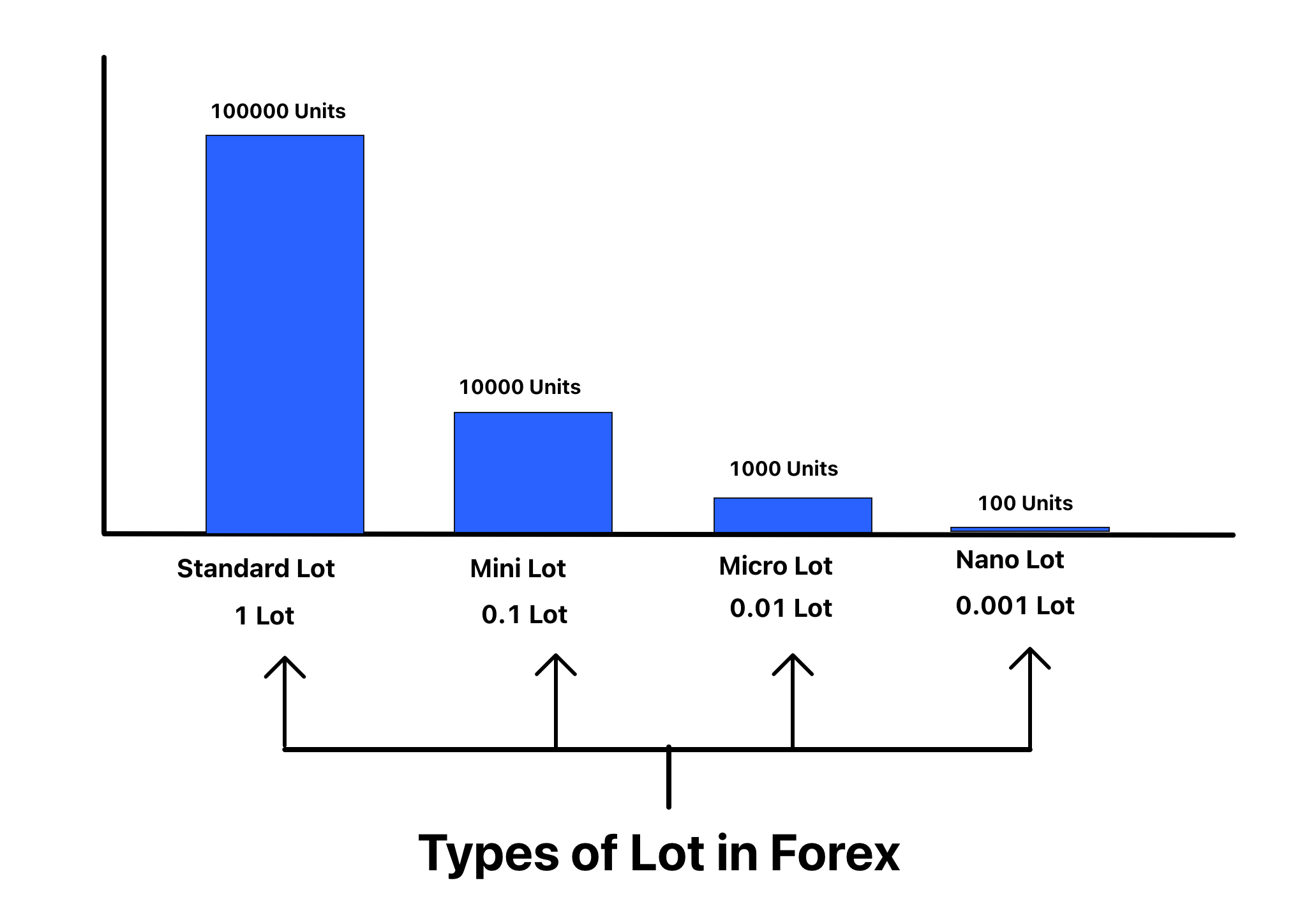

Types of lots

There are four types of lots while dealing in a forex market.

- Standard lot

- Mini lot

- Micro lot

- Nano lot

| Standard lot | Mini lot | Micro lot | Nano lot |

|---|---|---|---|

| It is 100,000 units of currency. In the case of the Euro, One standard lot of Euro= 100,000€. It is referred to as one lot. | A mini lot is 1/10th of a standard lot. It is 10,000 units of currency. In the case of pounds, One mini lot of pounds = 10,000£. It is 0.1 lot. | It is 1,000 units of the base currency. In the case of Yen, One micro lot of Yen = 1000¥. Micro lot is also said to be 0.01 lot. | It is 100 units of currency. In the case of a dollar, One nano unit of a dollar = 100$. It is termed as a 0.001 lot. |

How much is 1 Lot?

It is a standard lot that is equal to 100,000 currency units.

It is also called one lot as,

100,000/100,000 = 1

How much is 0.1 lot?

It’s called a mini lot, and its value is 0.1 as a mini lot is equal to 10,000 currency units, so,

10,000/100,000 = 0.1

How much is 0.01 lot?

Micro lot is equivalent to 1,000 currency units, so it is also called 0.01 lot, as,

1,000/100,000 = 0.01

How much is 0.001 lot

A nano lot is also the smallest and is said to be a beginner’s lot; it is also known as a 0.001 lot.

A nano lot is equal to 100 currency units, so,

100/100,000 = 0.001

Which lot size should I choose in trading?

Choosing a lot size in trading is more of a personal choice than a technical one.

so choosing a lot size depends on,

- Risk factor

- Investment balance

- Style of trading

- Trading strategy

Calculate the lot size using the lot size calculator

A typical forex lot size calculator calculates the,

- Amount at risk

- Position size

- Lot sizes

Based on the information regarding,

- Type of currency

- Available balance

- Risk factor

- Stop loss

- Currency pairs

To use a lot size calculator, click below,

Conclusion

The lot size is not only crucial for opening a trade, but it also impacts your potential profits and loss. One wrong decision in determining lot size can doom your trading experience, and one fine calculation might make you fall in love with the forex world.