What is trading style?

It is a set of methods and preferences a trader employs to open and execute a trade. A trading style depends on many factors,

- Size of account

- Trading frequency

- Time frame

- Risk factor

- The personality of a trader

Size of account

The size of your account or the available amount you are willing to trade is a crucial factor in determining your trading style. If you are willing to spend less, you will choose a trade that will be executed or closed in a shorter period. A small account size will not be able to hold for a long time in a volatile market; thus, a trader will opt for a quick trade. If the available balance is sufficient, a trader will take his chances and tend to prolong the trading spread.

So, your account size is a key factor in choosing a trading style.

Trading frequency

Trading frequency is the no. of trades you place in a given time. In simple words, it is how often a trader executes trades. If you are willing to execute more trades, you will tend to choose a trading style that is short-term and quick. In the other case, a trader will choose a long-term trading style.

Time frame

The time frame is the time you are willing to devote to your trading life. Most traders choose trading as a secondary source of income; thus, they cannot spend hours looking for selling and buying patterns. Instead, they tend to choose a quick trade. On the contrary seasoned and full-time traders can devote a significant time to the trading world. So, the time frame is a significant factor that affects the choice of a particular trading style.

Risk factor

The risk factor is how much you are willing to put on the stake while executing a trade. Low risk means a quick execution of a trade, while a greater risk indicates a long-term trading execution. So the choice of a specific trading style is directly proportional to the risk you are willing to take in a trade.

The personality of a trader

It is the ultimate and decisive factor in determining a trading style.

The personality of a trader involves,

- Emotional state

- Tolerance

- Discipline

- Persistence

- Mindset

- Fear management

- Risk management

- Experience

- Self-awareness

There are key factors to determine the trading style.

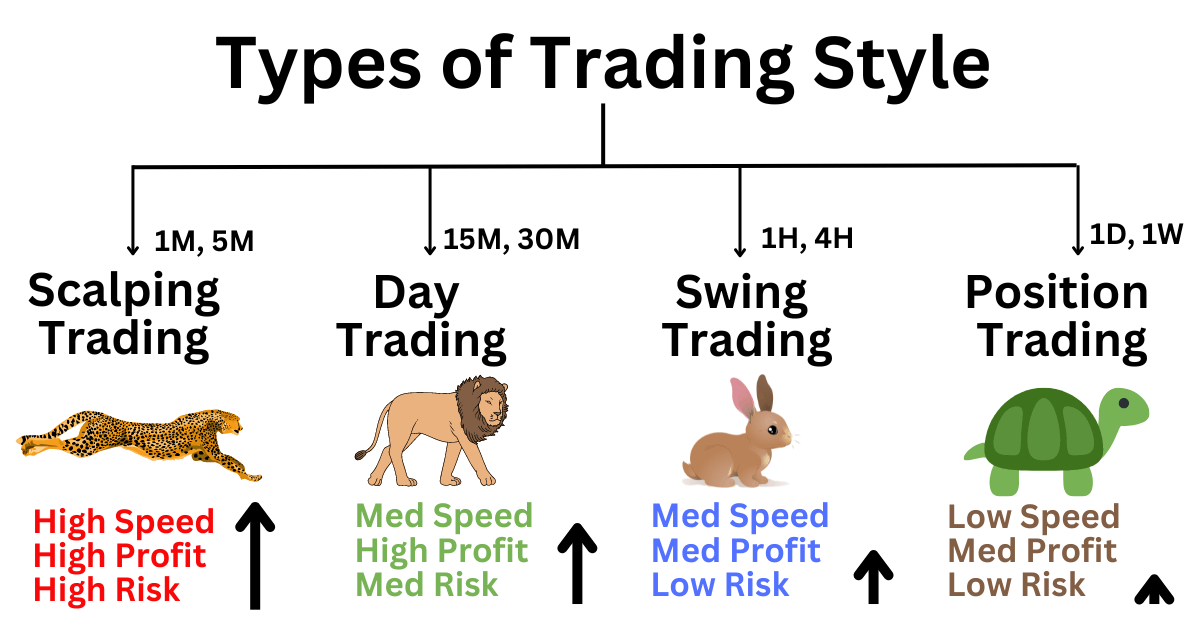

Types of Trading Styles

Traders employ four basic trading styles.

1. Scalping

Have you ever seen a great migration of wildebeests in the wilderness of Africa on national geographic? Of course, you have. To cross a river, these beasts are often hunted by crocodiles hiding in the water. They submerge themselves in the water and make a move as soon as an opportunity presents itself.

Scalping trading is no different. A scalping trader makes a move just like a Croc when he sees an opportunity in his favor.

In scalping, a trader holds a position for a very short time and makes a move as the market moves in his favor.

Scalping involves,

- Fast trading, which involves a few seconds to minutes

- A more intense form of trading

- Involves high risk

- It involves a highly liquid market

- Scalping trading style demands more focus, stamina, and emotional stability

- It involves tight spreads

- high commissions are charged in the scalping style of trading

- This type of trading style heavily relies on strong technical analysis and indicators.

2. Day Trading

As the name suggests, day trading is the type of trading in which a trader performs all his trades on the same day before evening.

It involves the opening and closing of trade on the same day; thus, it is also known as intraday trading. In the day trading style, a trader may perform multiple trades in a single day at different times of the day, but he closes his trades before evening. Closing the trade before evening lessens the commissions and risk factors involved overnight.

Day trading involves,

- Low commissions as compared to scalping as the trade don’t involve night durations

- A strong technical analysis is required

- Day traders employ strategies involving short terms

- High liquidity of the market is targeted in the day trading style

- Close monitoring of trading is essential as it involves quick and intense moves from a trader

- A day trader must be emotionally very strong and stable

Day trading also involves other trading styles like scalping, which are short-term and quick.

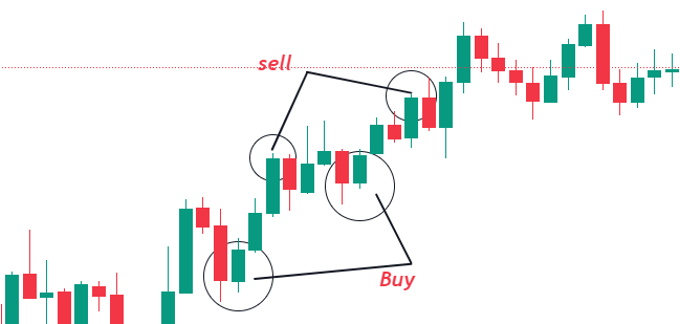

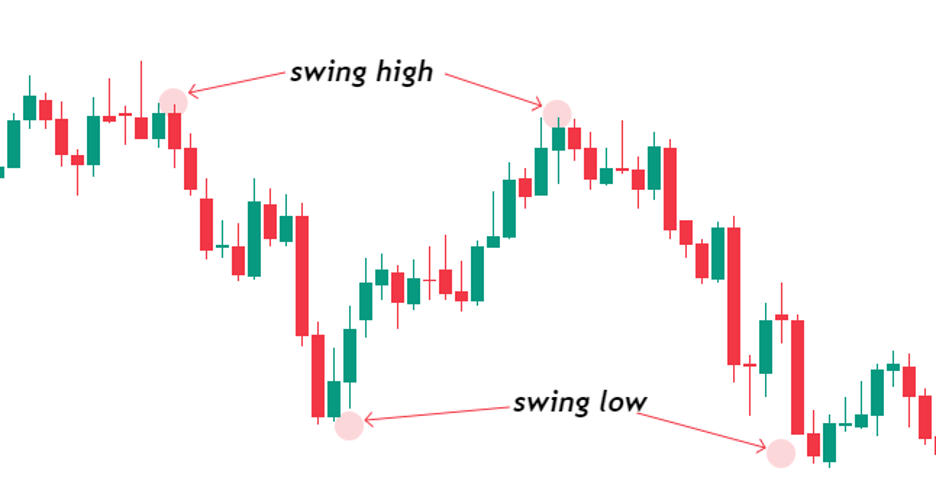

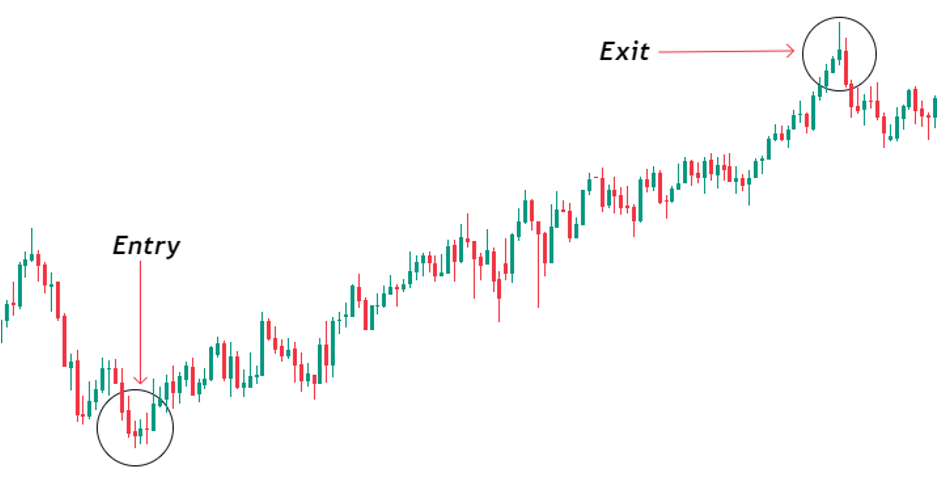

3. Swing Trading

As kids, we all have experienced a swing. In a swing, there are two positions, one is a high swing position, and the other is a low swing position.

Swing trading is like a swing in a park where a trader takes positions in a larger trend. A swing trader opts for short or medium-term price swings in a trading trend.

Swing trading involves,

- A few days to weeks for the execution of a trade

- Swing trader needs to hold or manage their positions In a trade actively

- High-risk management is involved as a swing trader needs to protect against potential losses.

- A very strong technical analysis is required for such trades

- It doesn’t require active monitoring of a trade like a day trading

- Less intense trading style as it is a bit more relaxed trading style as compared to day trading

- Long-term positions can help you to avoid risks

4. Position Trading

Position trading is like a sniper sitting in the bushes long enough to wait for his target and strike when an opportunity is presented. The wait can be longer for weeks and months.

In position trading, a trader holds a trade for long terms, such as weeks or months. In some cases, a trade may last for years.

The key features of position trading are,

- A trader holds his trade for a long time in the swing trading style.

- Position trading involves a strong identification of market trends

- A trader places a low frequency of trades because a long period is required to execute a trade

- The commission and transaction cost is at the lower end due to the low frequency of trades

- A trader must have strong discipline and patience in his personality to opt for the position trading style

Which trading style should you choose?

One must consider the different factors mentioned in this blog to choose a trading style. For ease, let’s compare key factors involved in four basic trading styles.

| Type of trading style | Time frame | Risk factor | Commission fee/transaction cost | The intensity of a trade |

| Scalping | Seconds to minutes | Very high risk | high | highly intense |

| Day trading | Short term | Intermediate to high | Medium to high | very intense |

| Swing trading | Short to medium | Intermediate | Low to medium | relaxed |

| Position trading | Long-term up to years | Low | Low | Very relaxed |

So, choosing a specific trading style depends on different factors. If a trader prefers a quick profit, he can opt for a scalping or day trading style, while if you want to have a simple and long-term approach, you can opt for either the swing or the positions style of trading.

As mentioned above, it depends on the availability of time to trade, your mental psychology, and other technical factors. So, choosing a specific trading style is one’s personal choice.

Swing trading is the best trading style for a trader

Because you will have enough time to open and close the trade without any psychological issues that traders face in the day trading and scalping. However, psychological factors in position trading are also low, but a low portfolio trader can’t wait months to open and close a trade.

That’s why swing trading is the best regarding time and psychology.

The bottom line

A trader relies on a trading style to achieve short- or long-term goals in their trading career. A specific trading style can directly impact your future potential profits and losses.

The choice of a trading style heavily relies on One’s personal choice, personality, and trading goals.