Volatility 75 index refers to a synthetic index that is a simulation-based index and has 75% of real market volatility. This simulation is run by randomly generated numbers by a computer program. It is similar to the real market.

The range of the Volatility index is from 0 to 100.

- Value of 100 means maximum market Volatility in the index

- Value of 0 means minimum market volatility in the index

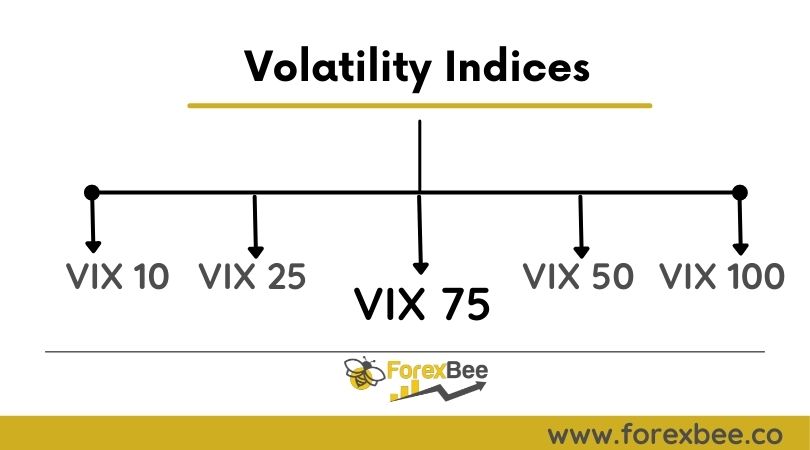

Volatility indices are further classified into five types based on the percentage of real market volatility. For example, 10 means 10% of real market volatility, 25 means 25% of market volatility, and so on.

- Volatility index 10

- Volatility index 25

- Volatility index 50

- Volatility index 75

- Volatility index 100

The number with the volatility index indicates the Volatility of that trading instrument. VIX 75 is the most popular index among traders.

Why Volatility index is important?

Volatility indices are important because of a few characteristics. These characteristics are the following

- Fundamentals or news has minimum or no effect on Volatility indices because of computer generated numbers. So it makes it safe for retail traders to trade Volatility indices without any worry of important news releases.

- VIX 75 has low spread and high leverage that make it easy to trade it in lower timeframes, even for scalping.

- Unlike forex, you can trade Volatility index any time 24/7 without any worry of weekend gap.

- The most important characteristics of Volatility index 75 is that price action technical analysis works same like in forex trading.

- The beauty of VIX 75 is that you can even trade a micro lot 0.001 lot size. Even with a small account, you can practice on a real account to handle emotions. That’s why, traders prefer to trade VIX 75.

Trading strategy

Breakout of the trend line and Quasimodo pattern strategies work best in the volatility 75 indexes. There are many ways to trade VIX 75 like the use of supply and demand in technical analysis. Supply and demand are the best and historically proven ways of trading. There are only two forces in the market. Supply and demand. Supply and demand create balance and imbalance in the price of an asset.

Trend line breakout with supply & demand and Quasimodo pattern strategy have been explained already on our blog. Complete strategy cannot be explained here. Learn these strategies from our blog for free and apply them on VIX 75. Remember to back-test a strategy before trading on the real account.

Volatility 75 index signals

To get VIX 75 signals, join our free Telegram channel. Price action signals and educational posts are shared on the free Telegram channel daily. Learning before trading is important.

Broker that has Volatility 75 index

Deriv.com is the best and a leading broker that is providing services to trade the Volatility index. Most of the brokers don’t have volatility 75 index trading instruments because they will be inferior quality brokers. Only Big brokers have a wide range of trading instruments. Deriv.com is the best one to trade VIX 75 or other Volatility indices.

Read the Price

forexbee

I hope you will like this Article. For any Questions Comment below, also share by below links. Tradingview is the best chart tool

Note: All the viewpoints here are according to the rules of technical analysis and for educational purposes only. we are not responsible for any type of loss in forex trading.

How do I get in touch with you

Do you know another broker (instead of Deriv) that has V75, V100, etc.? Thank you!

H! do you offer account management for deriv?