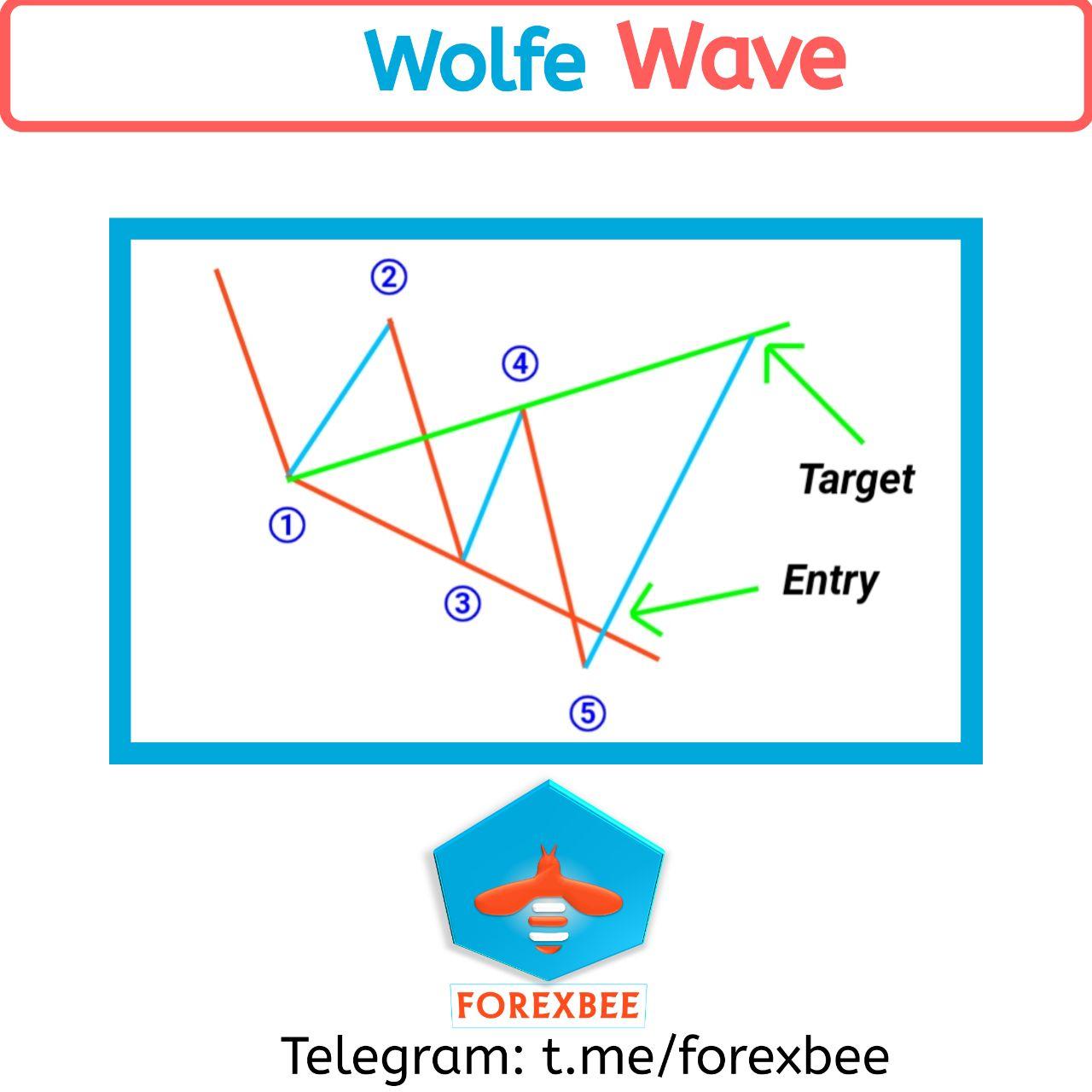

The types of Wolfe wave pattern were discovered by Brian and Bill Wolfe and introduced by a veteran trader and market wizard Linda Raschke. The trading strategy that gives a high profit to loss ratio comes under the Wolfe Wave strategy. Wolf Wave strategy enables us to make predictions regarding the price and the time can also be estimated to attain or reach that price. So Wolfe Wave trading can also be named as a market-timing tool. Value changes suddenly that is experienced by the security, keeping it view specific pattern are plotted. When the four waves are plotted, a new “Breakout” will be expected by the trader. The profit target line is created by a line between the first and fourth points and the line is further projected to the breakout point. This gives us the future expected price and time of that price to occur.

Rules for Wolfe Wave Trading

These rules will help us with the chart pattern that shows some symmetry. Following are the Wolfe Wave’s characteristics

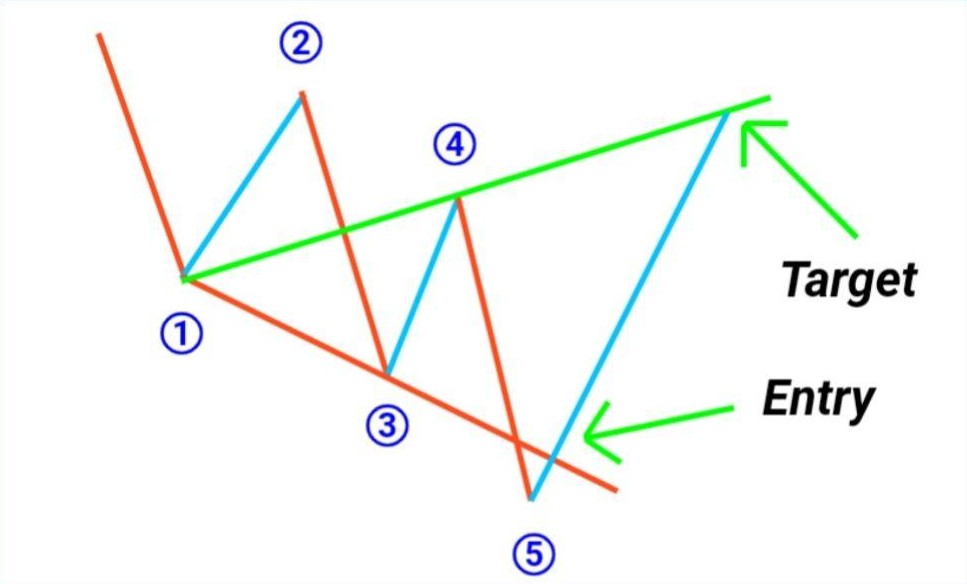

- Wave 1 and Wave 2 create a channel that must contain Wave 3 and Wave 4.

- To highlight perfect symmetry Wave 1 and 2 should be equal to Wave 3 and 4.

- Our entry is triggered with the help of Wave 5 that breaks above the trend line plotted by Wave 1 and 3.

- The time between all the waves has the same interval which means that between 1-3-5 wave cycles are equally timed.

Entry, Exit, Take profit

Wolfe Wave is a Reversal Pattern.

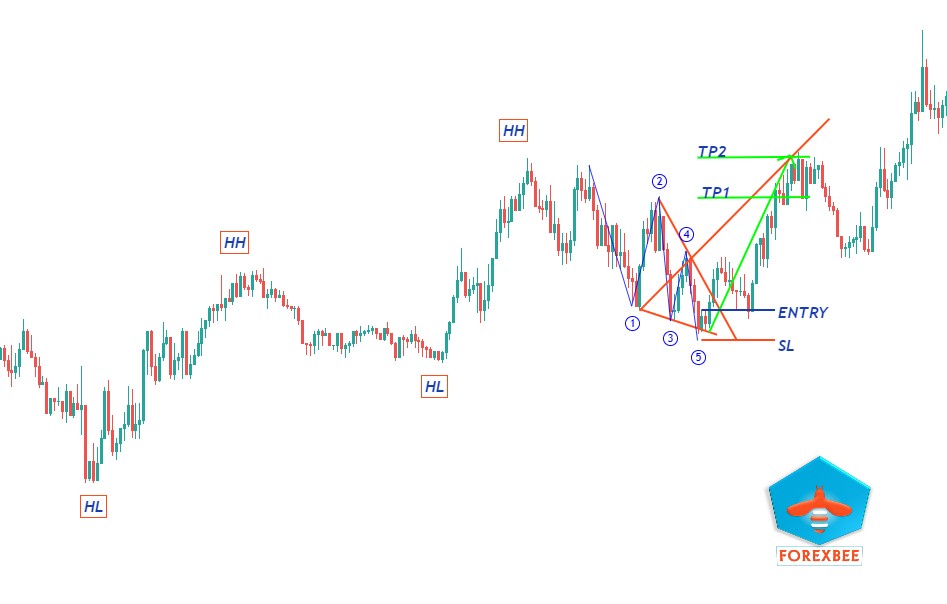

- The entry point will be after wave 5 formation and closing inside the trendline.

- The stop loss level will be 3 pips below the last Low made by the price.

- We will use two take profit levels.

Confluences

Now it comes to the most important point of forex technical analysis. Without confluences, nothing will work. Only with confluence, we can increase the probability of winning trade. I will explain with points for a better understanding of the Wolfe wave pattern.

- When Price will break the Trend line during the 5th wave and after breakout will come inside the trendline again then we will look for a Pinbar / Engulfing/ inside bar candlestick pattern there. This will confirm our Entry Point. We will enter on Pinbar or engulfing candle formation or inside bar breakout.

- Trend analysis is the second confluence. We will look for at least two higher highs or two Lower Lows. We will trade this pattern only in the direction of higher high or lower low.

- Higher timeframe Analysis is the 3rd confluence. I have already cleared this topic. Watch the video in this link to learn a higher timeframe analysis.

Practice Makes a Man Perfect.

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4. Join Telegram to get trade ideas free.

Thanks

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.