Definition

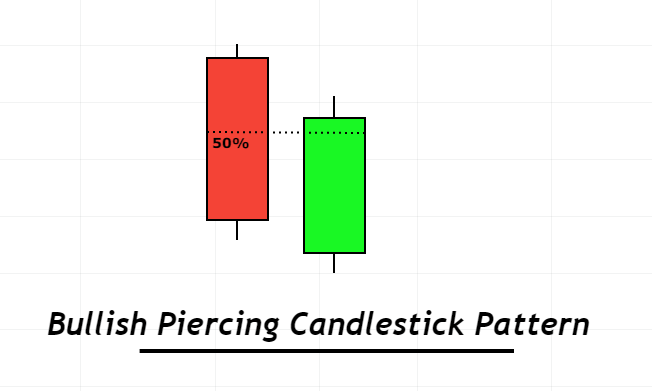

The bullish piercing pattern is a bullish trend reversal candlestick pattern that consists of two candlesticks and the recent candlestick closes above the 50% level of the previous candlestick. It causes price trend reversal from bearish into bullish.

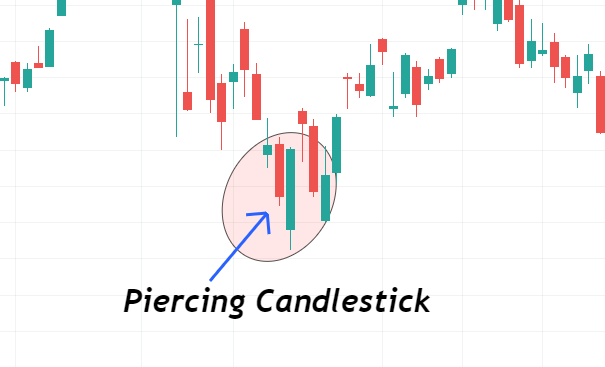

A piercing pattern is a simple candlestick pattern that also resembles a bullish pin bar on a higher timeframe. It gives profitable results in trading if traded with a perfect strategy.

How to identify a piercing candlestick pattern?

The piercing pattern consists of two opposite-color candlesticks. The most recent candlestick will be bullish and the previous one will be a bearish candlestick.

There are a few criterions you need to follow to find out an ideal piercing pattern on the price chart.

- The body to wick ratio of bearish candlestick should be greater than 60%. Because it should represent strong selling pressure.

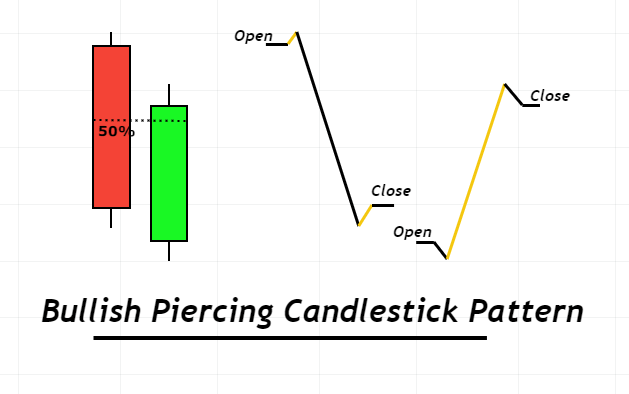

- Bullish candlestick should open below the low of bearish candlestick with a gap.

- Draw a horizontal line at 50% level of bearish candlestick. Then the bullish candlestick should close above this 50% level and below the close of bearish candlestick. This is a mandatory step to follow.

Find High Probability Trades with this ADVANCED Candlestick Patterns Course

The Ultimate Candlestick Patterns Course That Will Help You To Trade Better

Location of candlestick pattern

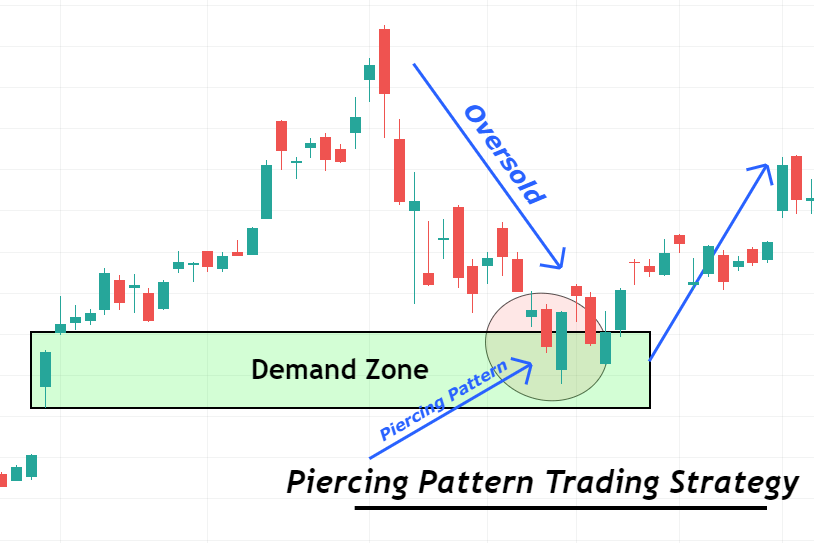

To get a higher winning rate in a trading strategy, the location of the candlestick pattern matters a lot. For example, if a candlestick will form within a ranging market condition or choppy market then the candlestick pattern will not work. That’s why we have filtered a few locations at which piercing candlestick patterns will work.

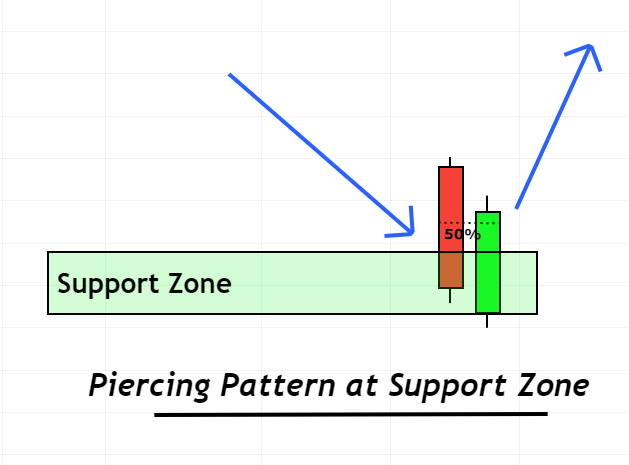

- Support zone

- Demand zone

- Oversold level

Bullish Piercing Pattern: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 2 |

| Prediction | Bullish trend reversal |

| Prior Trend | Bearish trend |

| Counter Pattern | Bearish Piercing Candlestick |

What does a piercing pattern tell traders?

The bullish piercing pattern indicates that buyers are becoming stronger than sellers. The 50% level in the bearish candlestick acts as a strong resistance level. And the gap in the price chart indicates imbalance and high volatility.

A gap after a big bearish candlestick means that a huge number of sellers sold out the currency resulting in oversold conditions. Then a big candlestick engulfing the gap and closing above the 50% level of bearish candlestick means that now buyers are controlling the market and they have overcome the barrier created by sellers.

This is the logic behind the piercing candlestick pattern.

Pro Tip: Before choosing a trading system, a trader should understand the logic behind the trading system. You should be able to read the market on the price chart.

How to trade Piercing pattern?

Bullish piercing candlestick pattern is very easy to find on candlestick chart because of its simple structure. But it is not easy to trade a single candlestick pattern without the confluence of any other technical tool. That’s why it is recommended to trade the Piercing pattern with chart patterns or technical indicators.

Piercing candlestick pattern trading strategy

Here I will explain a simple strategy based on piercing pattern and a confluence of the support zone.

Open a buy order

The first step is to look for a strong support zone. After identification of the support zone, find a piercing candlestick pattern at the support zone. As there is always a probability of trend reversal from a strong support zone but the addition of confluence of candlestick pattern increases the probability of trend reversal.

Open a buy trade just after the formation of the piercing pattern at the support zone.

Stop-loss level

Place stop-loss below the support zone. You can also adjust SL below the candlestick pattern but the safe side is placing it below the support zone.

Take profit level

Close 75% of the trade at a 1:1 risk-reward ratio. Then break even the rest of the trade and let it run until the trade setup achieves a 1:2 risk-reward ratio.

Risk management

For piercing pattern trading strategy, you should not risk more than 2%/trade of your tot account balance. Risk management also depends on account size and type of trading strategy. Because for scalping, a trader should not risk more than 1% per trade. And for swing trading, you can risk more than 1%.

Conclusion

Piercing candlestick pattern is a high probability candlestick pattern because it represents a bullish pin bar pattern on the higher timeframe.

It works mostly in stocks. Because in forex, there is little chance of gap within candlesticks because of the large trading volume.