Introduction

Supply and demand trading works on all timeframes. However, the best timeframe for you will depend on how much time you have and your trading style.

In this article, I’ll explain the best timeframes in trading. By the end, you’ll have a clearer idea of which one suits your supply and demand trading best.

Understanding Timeframes in Trading

Forex trading has a wide range of timeframes, not just the ones everyone talks about like the 15M, 30M, or 1D. Beyond these, there are options like 16M, 17M, or 18M. From seconds to months, the range is vast and offers something for every type of trader.

While many traders stick to popular timeframes, it’s worth exploring others. The forex market doesn’t stop; it’s always active. This means every timeframe, even the unusual ones, has its own story to tell.

Remember, no matter the timeframe you choose, the rules of the game remain the same. Supply and demand trading fits all timeframes, allowing flexibility in how and when you trade.

Choosing the Best Timeframe for Supply and Demand Trading

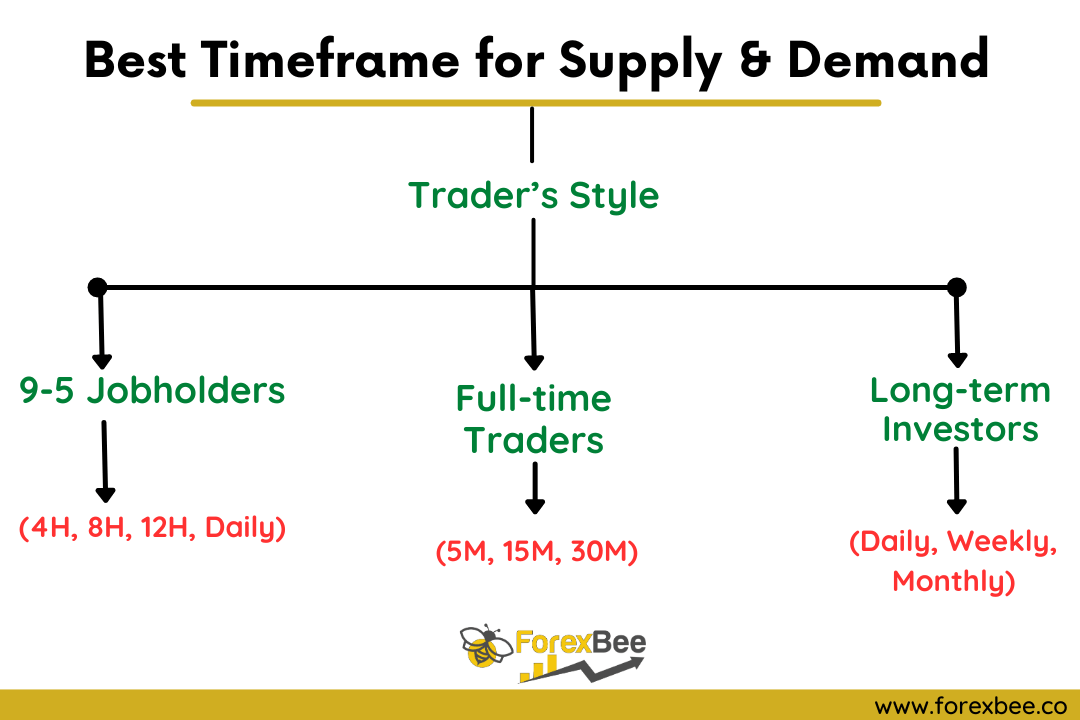

Understanding that supply and demand zones work across all timeframes is the first step. You’re not just bound to the common, default timeframes; the market offers a plethora of options. So, how do you pick the right one? The answer lies in syncing your trading with your daily life and routine.

- 9 to 5 Jobholders:

If you’re someone who is occupied with a regular 9 to 5 job, shorter timeframes might be a challenge. Trading on a 15M timeframe while juggling job responsibilities can be stressful. Psychological pressures can come into play, potentially leading to losses. Instead, a longer timeframe like 4H, 6H, or 8H provides the breathing room you need. It allows for more thoughtful decision-making, alleviating the urgency and potential for hasty, emotion-driven choices. - Full-time Traders:

If trading is your primary occupation, and you’re consistently in front of the screen, then shorter timeframes might be the best fit. Timeframes like 15M or even shorter can be suitable because you have the ability to react quickly, capitalizing on market movements as they happen. - Long-term Investors:

Those who are looking to invest and hold for more extended periods, with a focus on long-term market trends, would find daily, weekly, and monthly timeframes most fitting. These charts provide a broader perspective, making them ideal for long-term decision-making.

Best Timeframes for Different Trading Styles:

| Trader’s Style | Best Timeframes for Supply & Demand Trading |

| 9-5 Jobholders | 4H, 8H, 12H, Daily |

| Full-time Traders | 5M, 15M, 30M |

| Long-term Investors | Daily, Weekly, Monthly |

Profitability Across Timeframes in Supply and Demand Trading:

When you’re new to trading, you might want to make fast money. But rushing can lead to losses. Experienced traders don’t rush. They trade safely, stay steady, and are patient. By doing this and using smart methods, they grow their money bit by bit.

Here’s a look at the profits you might see on different timeframes:

1. Short Timeframes:

This is about quick trades, hoping to get some quick bucks.

Good Stuff:

- You don’t need much money to begin. Even a small amount can get you started.

- The risk is small too, because you’re not putting in a lot.

Tricky Parts:

- It can get stressful. The market moves fast, and decisions need to be quicker.

- You’d need to keep an eye on the charts a lot, almost all the time.

2. Medium Timeframes (Like Swing Trading):

This is for those who have a regular job but want to trade on the side.

Good Stuff:

- It fits well if you’re working 9 to 5. Trade in the morning or evening, whenever you’re free.

- You get enough time to think over your trades.

- No need to constantly stare at the screen.

Tricky Parts:

- You might need a bit more money to begin, maybe around $10,000. But think about it: with 12% profit each month, you’d be adding $1,200 to your account.

3. Long Timeframes:

For those who believe in the “wait-and-watch” strategy.

Good Stuff:

- It’s chill. You’re not rushing anywhere.

- You can spot big market changes easily.

Tricky Parts:

- You’ll need a big starting amount. But this means you’re also aiming for bigger returns.

- This might not be everyone’s cup of tea, especially if you don’t have a big amount to start with.

The Path to Consistent Profits in Supply and Demand Trading

Supply and demand trading offers traders clear guidelines on where to enter and exit trades. This clarity makes it simpler to determine entry points, stop-loss points, and take-profit levels. Furthermore, with this approach, trades often come with attractive risk-reward ratios, making it crucial for traders to hone their risk management skills.

Let’s break this down with an example:

Imagine you risk only 0.5% of your trading account on a single trade. If a particular trade offers a 1:10 risk-reward ratio, you stand to increase your account by 5% if that trade is successful. Now, even if you were to face losses on 9 subsequent trades (losing 0.5% each time), you’d still end up profitable.

Here’s a simple table illustrating this:

| Trade Number | Risk % | Risk-Reward Ratio | Profit/Loss % | Cumulative Account Change |

| 1 | 0.5% | 1:10 | +5% | +5% |

| 2 | 0.5% | N/A | -0.5% | +4.5% |

| 3 | 0.5% | N/A | -0.5% | +4% |

| 4 | 0.5% | N/A | -0.5% | +3.5% |

| 5 | 0.5% | N/A | -0.5% | +3% |

| 6 | 0.5% | N/A | -0.5% | +2.5% |

| 7 | 0.5% | N/A | -0.5% | +2% |

| 8 | 0.5% | N/A | -0.5% | +1.5% |

| 9 | 0.5% | N/A | -0.5% | +1% |

| 10 | 0.5% | N/A | -0.5% | +0.5% |

| Net Profit | +0.5% |

The above table showcases how even with nine consecutive losses after one winning trade, the trader remains in a net positive position due to the strong risk-reward ratio.

The key takeaway? The secret to consistent profits doesn’t solely lie in the trading method. It’s a combination of a solid strategy like supply and demand trading, good risk management, and mastering trading psychology. When you balance these elements, consistent profits become achievable.

Conclusion

In conclusion, the ideal timeframe largely hinges on your personal circumstances, goals, and risk appetite. While shorter timeframes can offer quicker returns, they come with their set of challenges. On the other hand, longer timeframes might be slower but provide stability. Assess your situation and choose the timeframe for supply and demand trading that aligns best with your objectives.