In this article, I will discuss Flag limit, flag and pole pattern, FTR (fail to return). By understanding these terms, one will be able to read the market. How does the price move? Hidden Orders? Path of IT’s (Institutional Traders)? I will cover all these above terms in this article.

Flag Limit

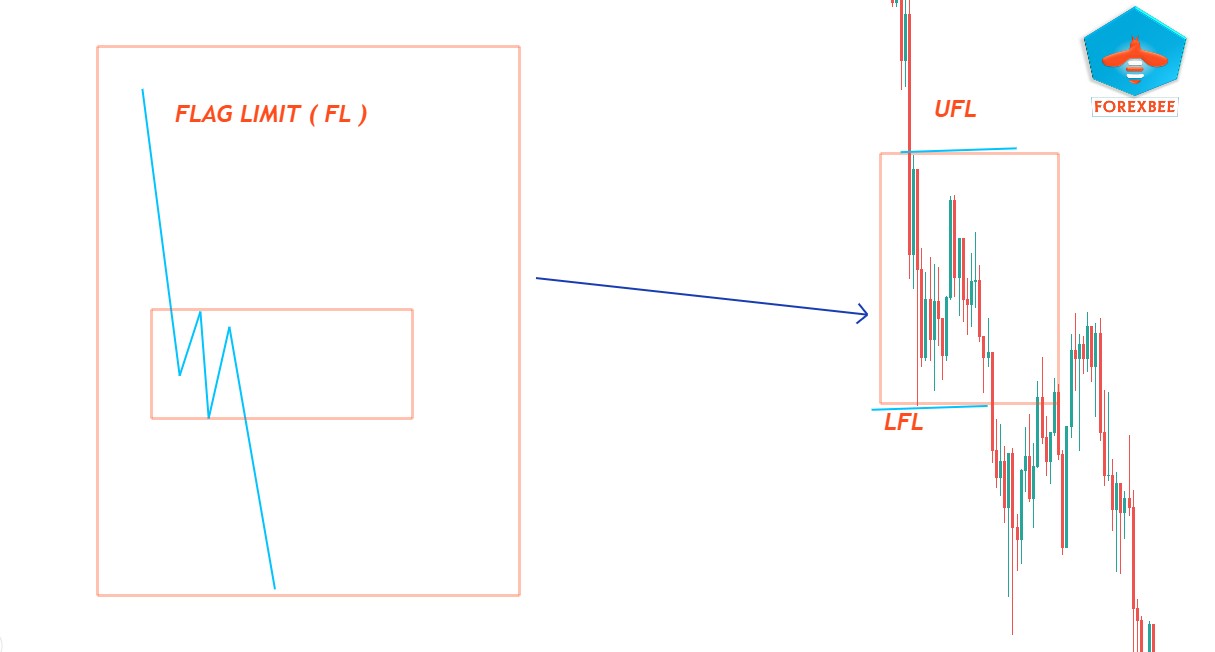

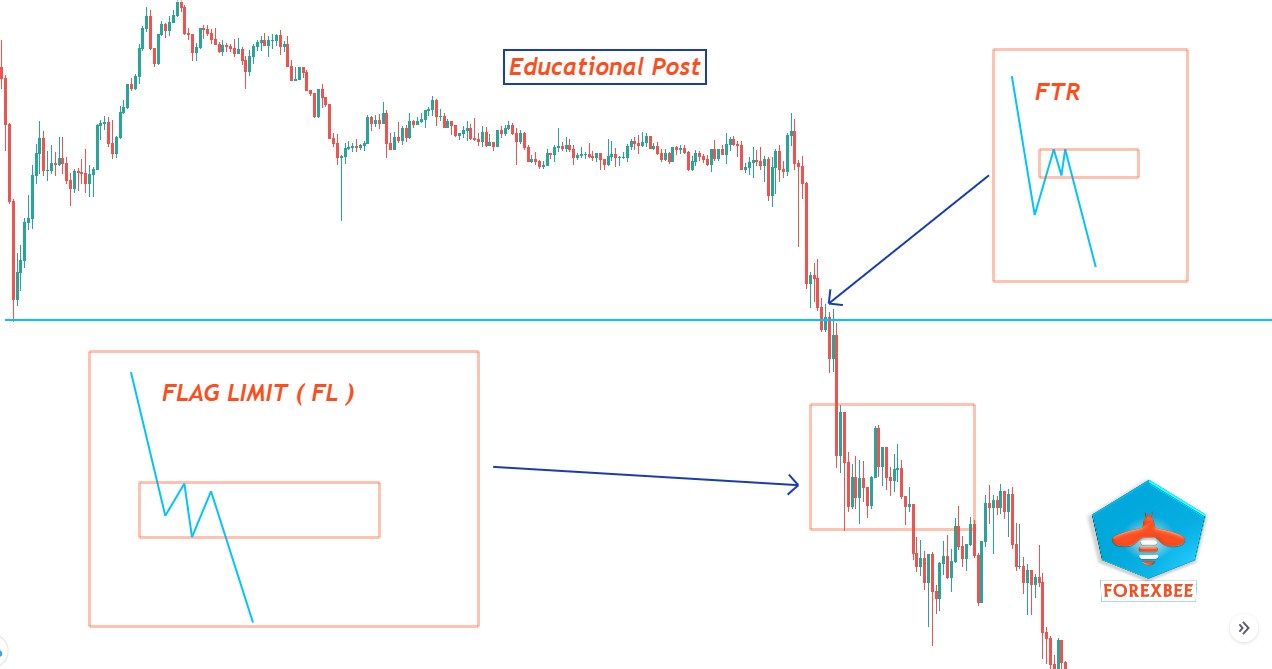

Most of the traders are not able to understand the difference between the flag limit and ftr. I will also clarify this concept. First, we will discuss the flag limit. So what’s Flag Limit (FL)? The flag limit is the Base or Area where the market will decide its direction either to go up or down. By seeing the chart below, you will be able to understand the concept behind it like price looking for a direction. Simply RBR and DBD form flag limit.

Price moves from one flag limit to the next flag limit. Engulf of flag limit indicates that price will move to the next flag limit to fulfill hidden orders. Flag limits are drawn by horizontal Zone. The highest Price of this base zone is called the upper flag limit and the lowest price of the base zone is called the Lower Flag limit. I have drawn a flag limit in the chart below where it will be easy to understand the concept behind the flag limit.

- Upper Flag Limit (UFL)

- Lower Flag Limit (LFL)

FTR (Failure to Return)

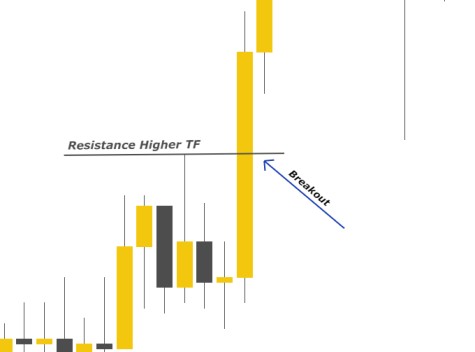

FTR is a very simple but effective concept in forex technical analysis. FTR represents a key level in the market. It has the ability to reverse the market and the beginning of a new trend. I have drawn the FTR pattern in the chart below. In the FTR pattern, Price will break the major SR Level, and then the price will retrace back. Price will fail to return back from major SR Level. Instead, it will again continue with the trend. This will form FTR. FTR can be traded by confluence with other price action patterns to increase the probability of winning in a trade. I will discuss in the next article how to trade FTR and Flag Limit. In this article, I have just cleared basic concepts of flag limit and ftr.

What is FTB in forex?

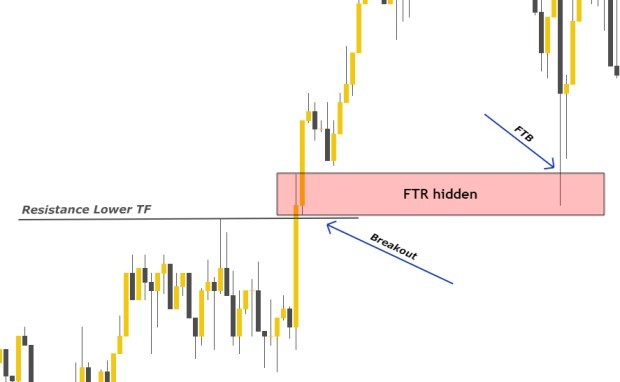

The first-time return of price to the previously formed ftr is called FTB or the first time back. Price returns to the ftr to pick unfilled orders and then continue its trend.

How to trade FTR and FTB?

After the break of a strong resistance or support level, price forms an FTR pattern in price. Now whole FTR pattern will act as a fresh and tradeable zone until touched by price. When the price returns back to FTR zone basically price wants to pick unfilled orders from this zone. So FTR gives us the opportunity to trade with institutions using FTB strategy. Stoploss will be placed always few pips above or below this zone. watch the images below for a better understanding of FTB

What is hidden FTR?

The most vital part of this article is a hidden FTR which is always under consideration of many big players. Hidden FTR is not visible on higher timeframe but visible in lower timeframe. That’s why it is important. Observe the images below for a clear view of hidden FTR

I hope everything will have been cleared now.

Difference between FTR and Flag Limit

I will not write a lengthy paragraph about the difference between flag limit and failure to return. Instead of clearing the concept, they will confuse you more. I have drawn FTR and Flag limit in the chart below just to simplify it and for clear understanding. FTR is just a break of a strong level and short retracement and then price will continue with the trend. On the Otherhand, the Flag limit is the base zone where the market will decide its direction. Pole in flag limit is from the origin of the move to the end of the base zone.

Watch the video below to get more detailed information and a better understanding of FTR and Flag limit.

In the Next Article, I will reveal the Power of FL & FTR and will also explain how to trade these patterns with proper confluence.

Passion, Patience, Persistence, Profit

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4. Join Telegram to get trade ideas free.

Thanks

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.

Hi. Have you published the subsequent title on flag limit?

thankyou

Very informative article

Thank you for the specialized article

Regarding the characteristics of FLs, do you believe that there must be a moving pole

do you consider the condition for the price to reach the target before the formation of FL?

A failure to return tested by FTB can be considered FL. That is why it is said that every FL is FTR but not all FTRs are FL.