Kill zones are times in the trading day when there’s a lot of action in the market. Not every hour is good for trading. Sometimes the market doesn’t move much, and other times it moves a lot. Kill zones are those busy times when you’re more likely to find good chances to make trades.

In this article, I’m going to talk all about kill zones in forex. I’ll show you how to spot them and use them to trade better. Plus, I’ll share a trading strategy and a real example to help you understand better. Make sure to read the whole article to get the full picture.

Understanding Market Sessions

Before understanding the kill zones, it’s important to have a clear understanding of the forex market sessions and the times when trading activity is typically higher.

The forex market operates 24 hours a day but is divided into several major sessions, each with its own characteristics and levels of activity. These sessions are the Asian, London, and New York sessions. Here’s a breakdown of these sessions and the best times for trading:

| Market Session | Best Trading Times (New York Time) | Characteristics |

|---|---|---|

| Asian Session | 6 PM to Midnight | Known for lower volatility. Good for steady trends. |

| London Open | 2 AM to 5 AM | Very active. High liquidity and volatility. Best for big moves. |

| New York Open | 7 AM to 10 AM | Also very active. Overlaps with London for high activity. |

These times represent the best periods for trading within each session, where you’re likely to see the most action and opportunities in the market. Remember, these are based on New York time. you can determine the forex live session times here.

Identifying Kill Zones

To spot a kill zone, what you need to do is pretty straightforward. During each trading session – whether it’s the Asian, London, or New York session – draw a rectangle on your chart. This rectangle should cover the range from the lowest to the highest price during that session. This boxed area is your kill zone.

Why do this? These kill zones are important because they help you catch the big market moves. A lot of day trading decisions are made when the market is really active, which is during these kill zones. By focusing on these areas, you can see what the big traders are doing. If there’s a lot of action in a kill zone, it might be a good time to make your move and open a trade.

The Role of Market Makers and Stop Loss Hunting

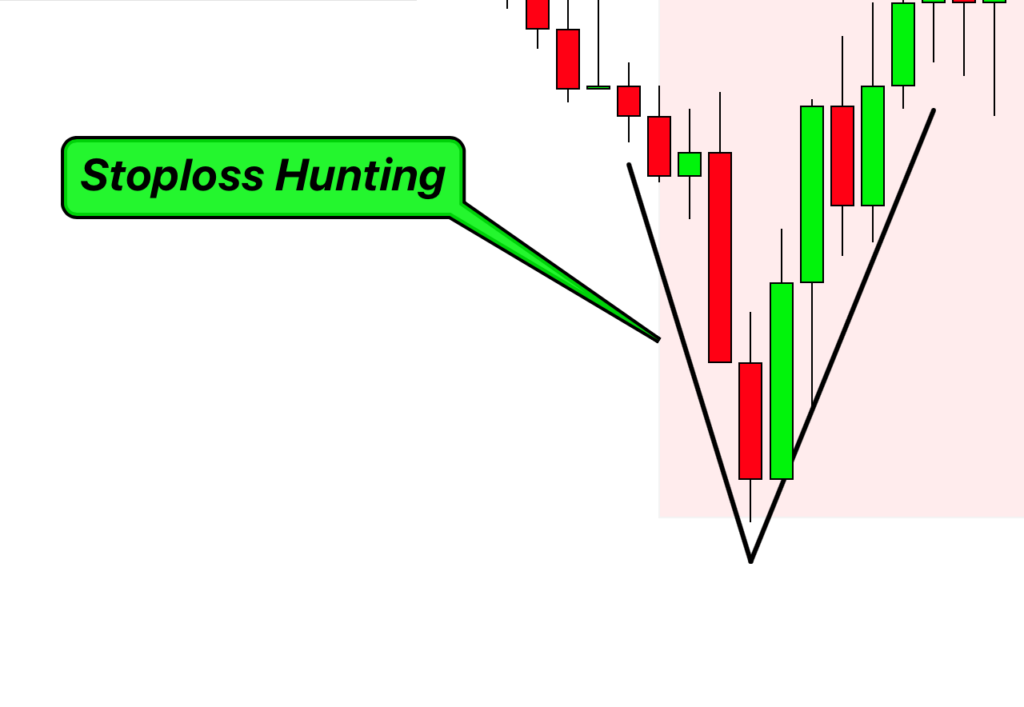

Market makers play a big role in the forex market. They are the ones who provide a lot of the liquidity, which means they make it easier for traders to buy and sell. But market makers also have their own strategies, and one of these is called stop loss hunting.

Stop loss hunting happens when market makers try to move the market price to levels where many traders have set their stop losses. Why do they do this? It’s because before making a big move in the market, market makers often aim to trigger these stop losses.

When a lot of stop losses are triggered, it creates more movement in the market. This movement can benefit market makers, as they can then enter trades at better prices before they push the market in the direction they want.

So, as a trader, it’s important to be aware of this. By understanding stop loss hunting and the role of market makers, you can make smarter decisions about where to set your stop losses, especially around kill zones where this activity is more common.

Case Study: Trading with Kill Zones and Smart Money Analysis

Scenario:

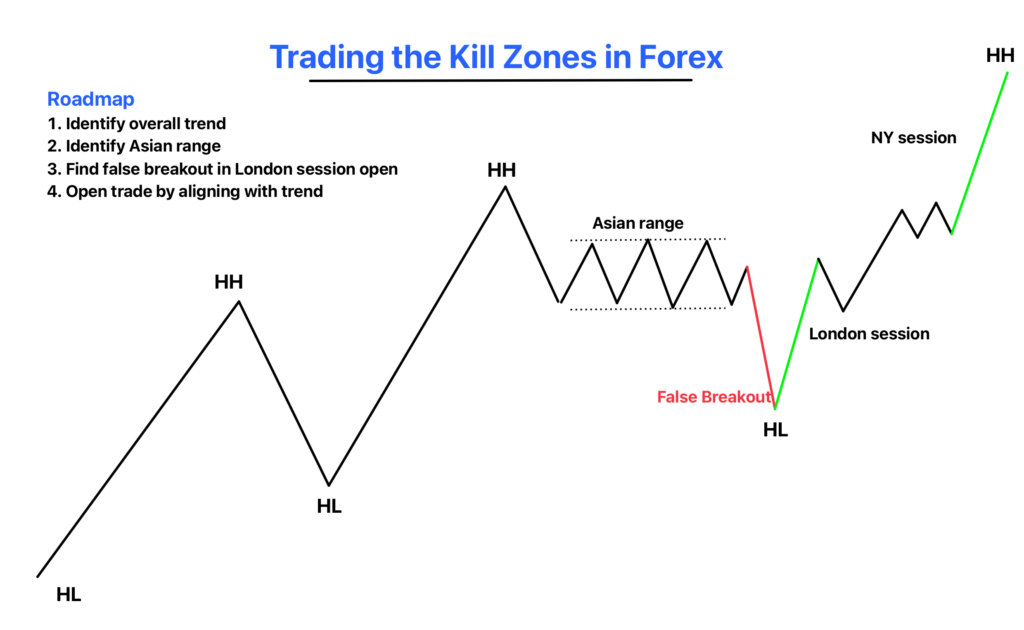

In this case study, we’re focusing on how smart money operates during kill zones and uses liquidity pools to drive market moves. Our example involves a day when the market showed a bullish bias for a particular instrument, identified through higher timeframe analysis, which indicated a higher high was forming.

Observations and Actions:

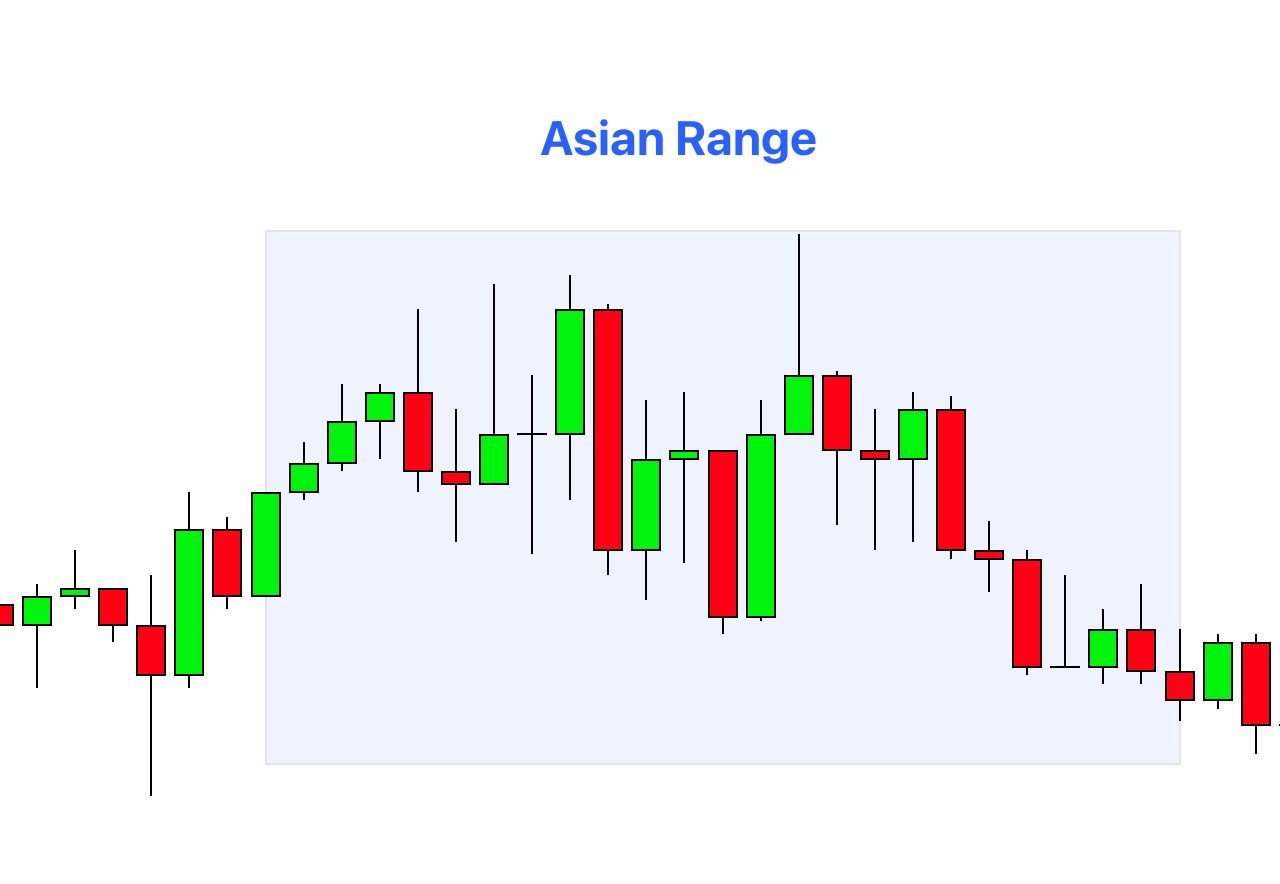

- Asian Session Activity:

- During the Asian session, the price formed a ranging market structure. This means the price moved back and forth within a defined range, without a clear direction.

- This set up a liquidity pool, consisting of stop losses from bullish traders and breakout orders from bearish traders.

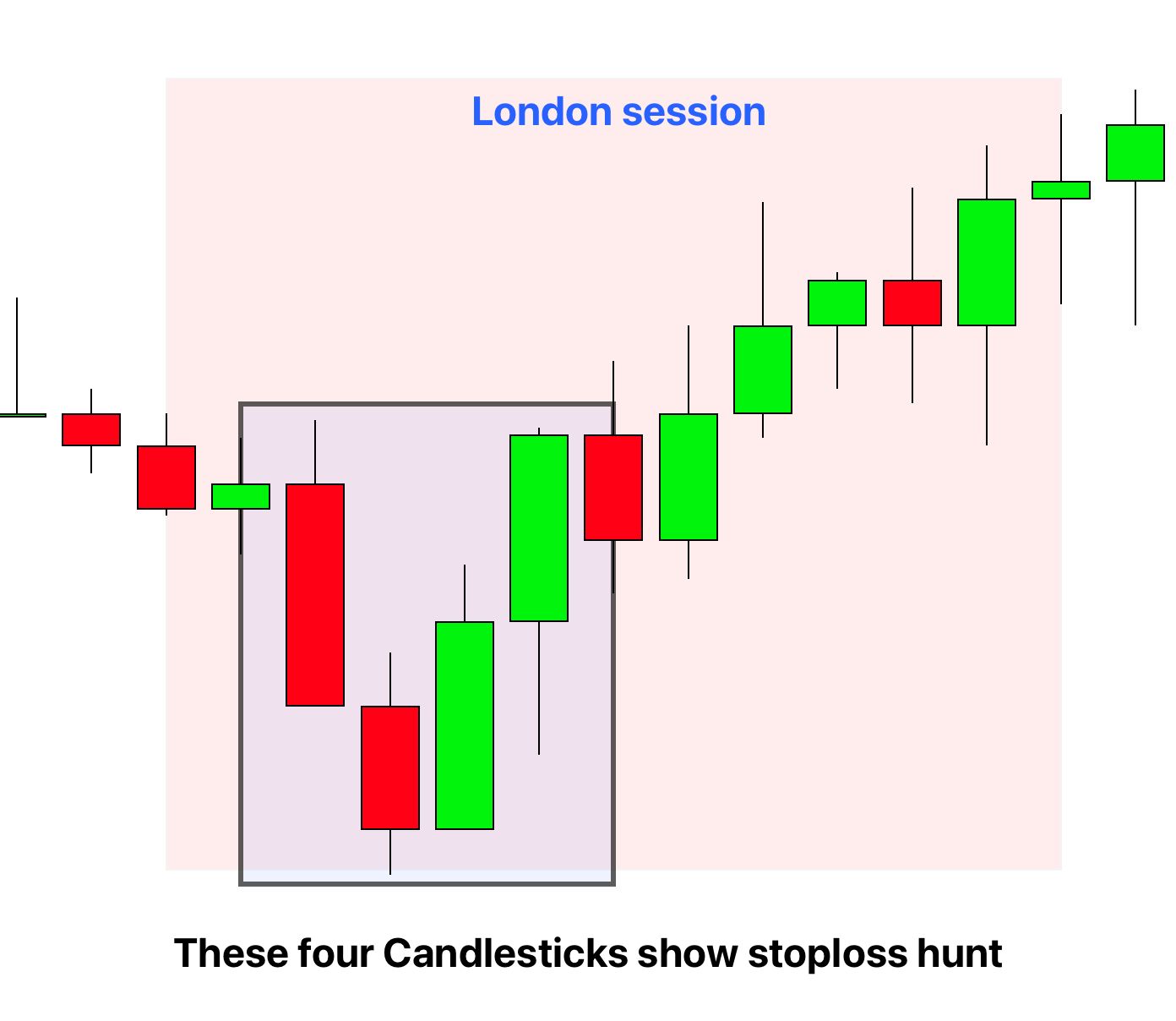

- London Open – Bearish Stop Hunt:

- In the London open session, we observed a bearish stop hunt.

- After making a significant bearish move, the price returned and closed above the low line of the Asian session range. This pattern indicated a false breakout, typically a stop loss hunt by smart money.

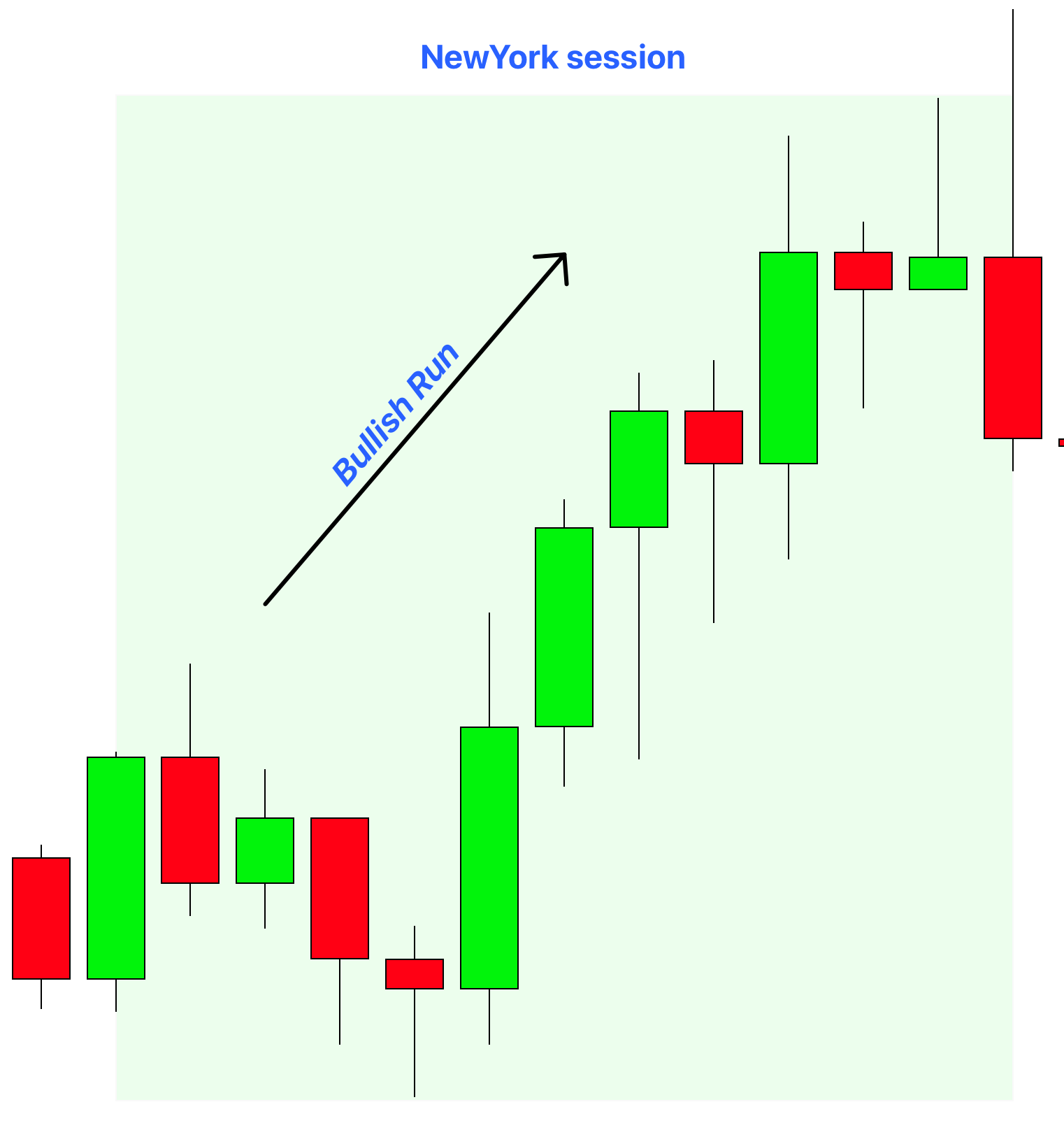

- New York Session – Bullish Run:

- Market Reaction: In the New York session, following the earlier stop hunt, the price made a substantial bullish run for the rest of the day.

- Trading Strategy:

- London Session Reaction: A trader observing the bearish false breakout in the London session would recognize it as a potential stop hunt. The key signal here was the price returning above the Asian session’s low range.

- New York Session Entry: The bullish run in the New York session would confirm the earlier analysis, providing an opportunity for a long position, aligning with the market’s overall bullish sentiment.

This case study demonstrates the importance of understanding kill zones and how smart money uses them to execute trading strategies. By recognizing the patterns of stop hunts and liquidity raids in these zones, traders can align their actions with smart money moves. It’s important to note that these setups do not occur every day, but by having kill zones highlighted on your M15 (15-minute) chart, you can spot these opportune setups when they do arise

How to Trade Kill Zones

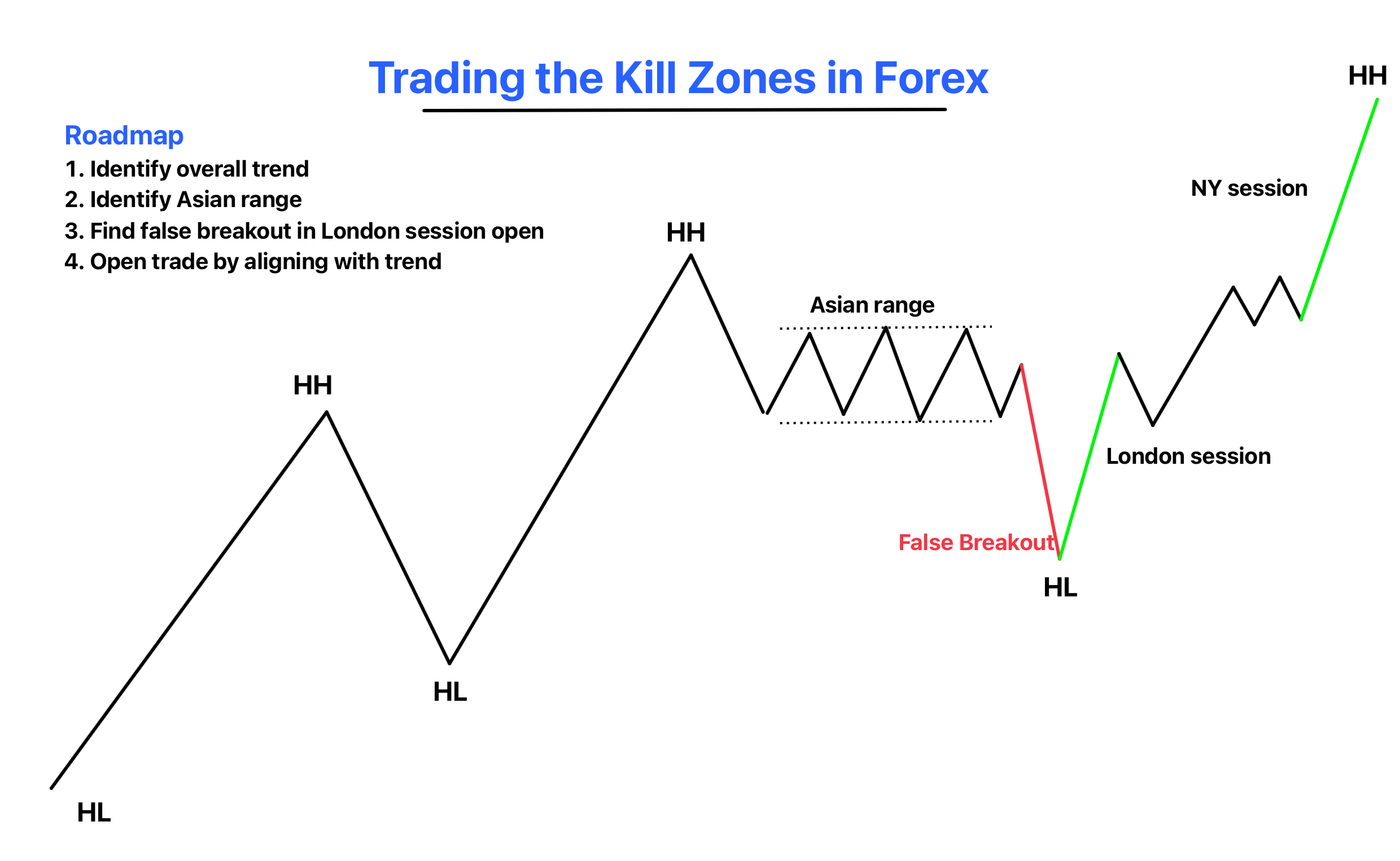

Trading kill zones effectively can vary depending on your trading strategy. The real advantage of identifying kill zones is that they reveal when market makers are likely making significant decisions. Here’s a strategy I recommend, focusing on stop loss hunting through false breakouts or takeouts:

1. Identify the Overall Trend:

- Start by zooming out on your chart to get the ‘big picture’ of the market.

- Determine the overall trend direction – is it generally moving up (bullish) or down (bearish)?

2. Identify the Asian Session Range:

- Look at the price movement during the Asian session.

- Notice if the price has formed a range, characterized by the price moving between clear high and low points.

3. Look for False Breakouts Against the Trend:

- In the London or New York sessions, watch for price movements that seem to break out of the Asian session’s range, but against the overall trend.

- These false breakouts are crucial. They often appear to signal a trend change, but in reality, they might be traps for unsuspecting traders.

4. Enter the Market During Major Market Sessions:

- After spotting a false breakout, plan your entry during the London or New York session.

- Align your trade with the overall trend direction that you identified in the first step.

- This approach uses the momentum and volatility of major market sessions to your advantage.

Tips for Successful Trading: Use additional indicators or technical analysis tools to confirm the false breakout and the continuation of the overall trend.

Protective Stop Loss

When setting a protective stop loss in kill zones, especially during stop hunting, it’s essential to approach it with care due to the tricky nature of these zones. Here are some technical tools you can use to help determine the best placement for your stop loss:

Conclusion

To wrap up, kill zones in Forex are key times when there’s a lot of action in the market. Remember, these are times like the London or New York sessions when things really get moving. To make the most of them, keep an eye on the overall trend, watch for false breakouts, and plan your trades during these busy times.

And don’t forget, setting a smart stop loss is super important to protect your trades. Just be careful, as these zones can be tricky. Happy trading!