The buzz around the bearish and bullish order blocks is everywhere. Many people are chiming in on what order blocks are and how you can trade with them.

We did cover order flow in our previous article; here, we’ll talk about bullish and bearish order blocks and how you can apply the OB indicator in your forex strategies.

So make sure to stick to the end!

What is an order block?

The chunk of market orders placed by big traders and institutions that are shown in the form of zones on the candlestick chart are known as order blocks.

Just a quick recap! Order blocks are technical analysis technique that tells you about the accumulation or distribution of orders from big market players.

These players, like central banks or financial institutions, don’t place their orders at once because of the massive volume, and they are the ones that carry the market.

So, the order block strategy is to jump on the big players’ bus and trade with them.

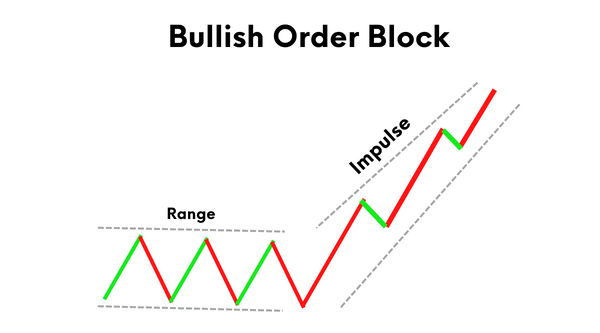

What is a Bullish order block?

Bullish order blocks represent the zones that signify the presence of chunk of buy orders of institutional traders and banks.

Bullish order blocks are areas that appear in a downtrend and signify a trend reversal.

The price stayed in a downtrend for a while, and now the big players are making their moves to increase the price.

The bullish order block is also known as the accumulation of orders.

We’ll talk about how you can locate order blocks in a while.

What is a Bearish order block?

Bearish order blocks represent the zones that indicates the presence of chunk of sell orders of institutional traders and banks.

Bearish order blocks emerge in an uptrend and signify a trend reversal. Price stayed in an uptrend for a while, and now it is reversing because of the orders from the big players. So, we can take our short positions.

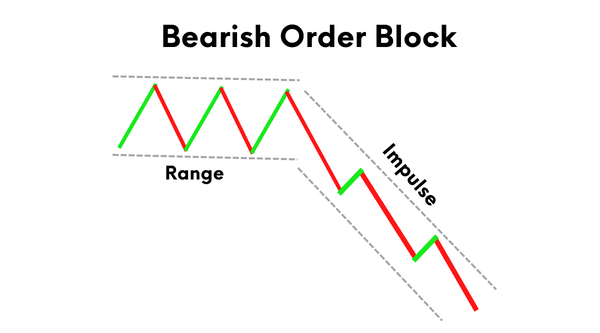

How to find order blocks in trading?

It is the most important aspect of order block trading; how you can find order blocks.

Order blocks appear after a strong uptrend or downtrend. The price breaks the order block and indicates a reversal. This reversal is marked by a chart pattern like a head and shoulders or a candlestick pattern like a pin bar.

When the price breaks from the order block, the price tends to retrace back into the order block range to pick up more market orders.

It’s important to remember that the price can’t stay in the order block for too long. If it does, it is just a period of consolidation for enough orders from big players to be made before any price change.

The price must be in uptrend to draw a bullish order block. Then you have to locate the low of the last candle and the recent high, draw a rectangle and extend it to the right side.

Conversely, for a bearish order bloc, so the price must be in a downtrend. Then you can locate the high of the last candle and the recent swing low, and then draw a triangle around it.

Order blocks and liquidity

Liquidity and order blocks go hand in hand. When the price leaves the order block area, it signifies central banks are moving the prices to opposite areas of liquidity, which we call liquidity pools.

These pools allow financial institutions who buy or sell at the previous order block to exit their trades or give orders to those willing to take them.

We know this must be confusing. So let’s explain this with an example.

Let’s say a bank wants to place a buy order of $100 million in EUR/USD. They placed the trade only $30 million is filled. Why? Because of liquidity.

For every buy order, there is a sell order, and vice versa. So, the bank can’t place the full order of $100 million in one trade, as there isn’t enough liquidity in the market.

So, what will the bank do then?

It’ll place the order at the next order blocks and execute them at different prices till no portion of $100 million is left.

Unlike us, big players deal with monstrous sizes, so it’s common for them to run into liquidity issues.

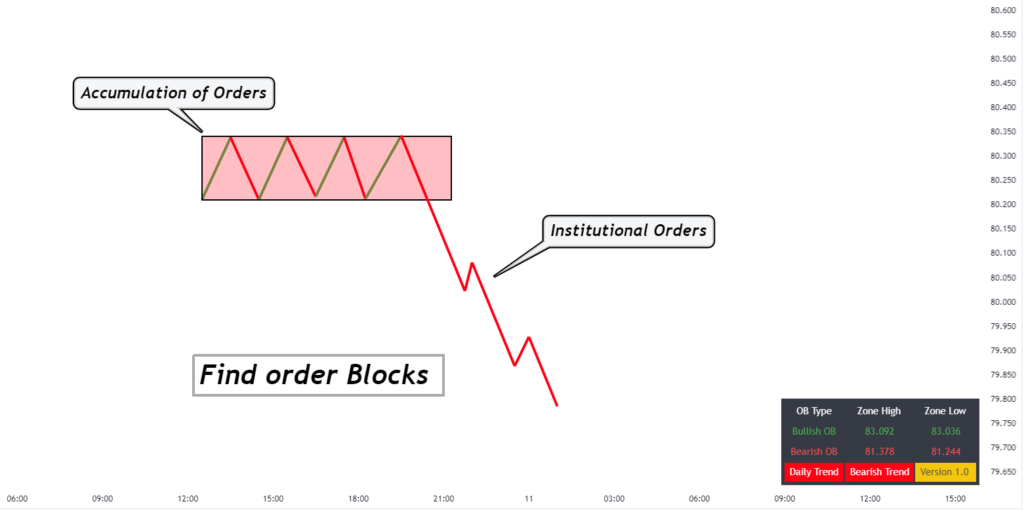

Order block forex strategy using OB indicator

Wouldn’t it be helpful if there was a tool that could take the hassle out of order block trading?

I guess it’s your lucky day!

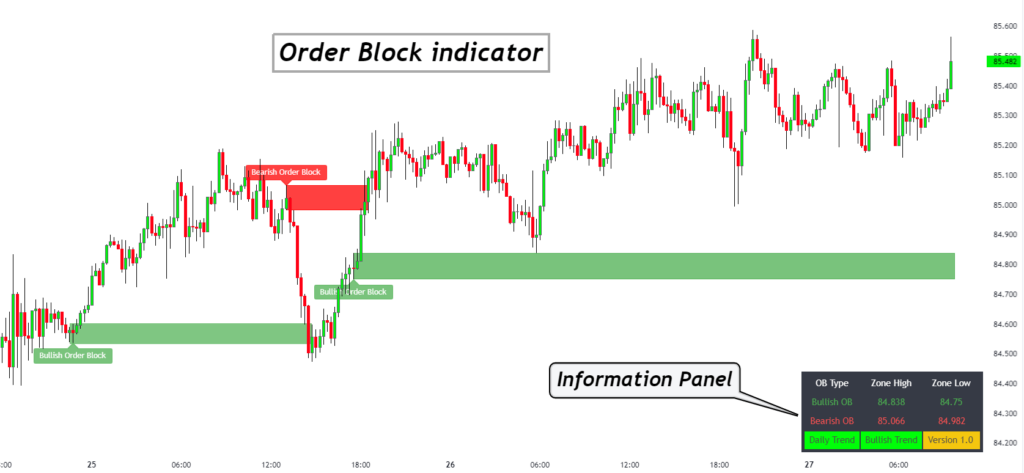

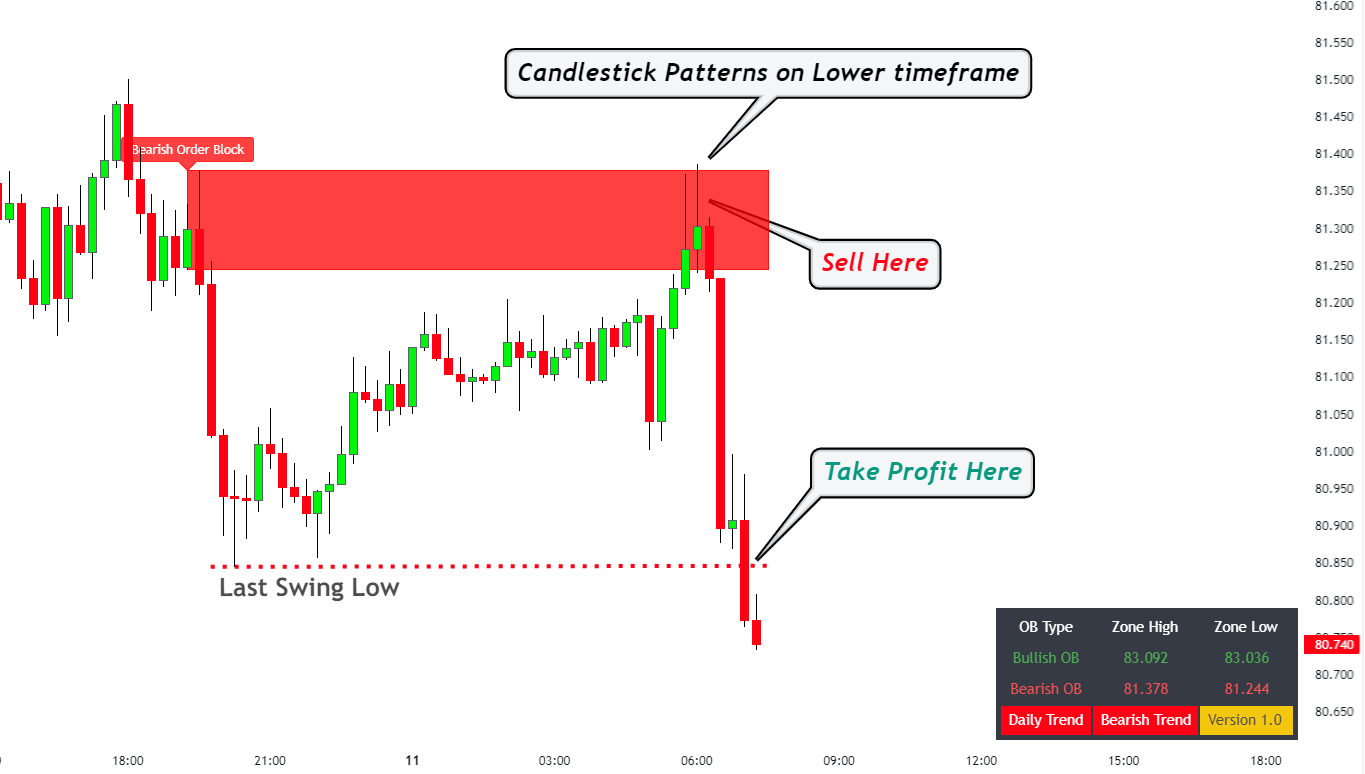

The OB indicator plots the bullish and bearish order blocks; from there, you can enter and exit the trades. It tells what’s happening behind the scenes and plots order blocks on the chart.

The good thing about the indicator is it has an information panel. It tells about the order block type, the high and low zones, and the overall trend.

Let’s see how you can buy and sell with the indicator.

Open a sell trade

- The indicator must plot the bearish order block.

- Locate the reversal chart or candlestick pattern.

- Wait for the price to break through the bearish order block and enter the trade.

- Place a stop-loss at the high of the bearish order block.

- Set take-profit at the last swing low from the bearish order block.

Open a buy trade

- The indicator must plot the bullish order block.

- Locate the reversal chart or candlestick pattern.

- Wait for the price to break through the bullish order block and enter the trade.

- Place a stop-loss at the low of the bearish order block.

- Set take-profit at the last swing high from the bullish order block.

The bottom line

So, there you have it. Order block trading can be difficult to master or apply. However, with the OB indicator, you can do that hassle-free. Just add the indicator, and with its help, you can pinpoint the entry and exit points.

So, don’t get stopped out frequently when you can trade along with the big players through order blocks.

Frequently Asked Questions

Does order block work in the stock market?

Yeah, it does. Order blocks work in every market, and you can apply them to stock trading strategies. However, locating order blocks in the stock market can be difficult. So, you can apply the OB indicator to find these levels.

Why are order blocks important?

Order blocks are important because they tell you where the market will head next. As the big players start placing their trades, you can ride along with them and not take the opposite position.

Your information is so educational

Would like to purchase a order block indicator

Very educative..kindly,assist me with order block indicator.

Sir with due respect. I have a question

I found some mistake in your article.

you say that

The price must be in a downtrend to draw a bullish order block. Then you have to locate the low of the last candle and the recent high, draw a rectangle and extend it to the right side.

Conversely, for a bearish order bloc, so the price must be in a downtrend. Then you can locate the high of the last candle and the recent swing low, and then draw a triangle around it.

For both order blocks we need a down trend?

and my second question is that if the price going in downtrend how we can find a bullish order block in down trend. we can find only bearish order block in down trend correct me if i am wrong