Introduction

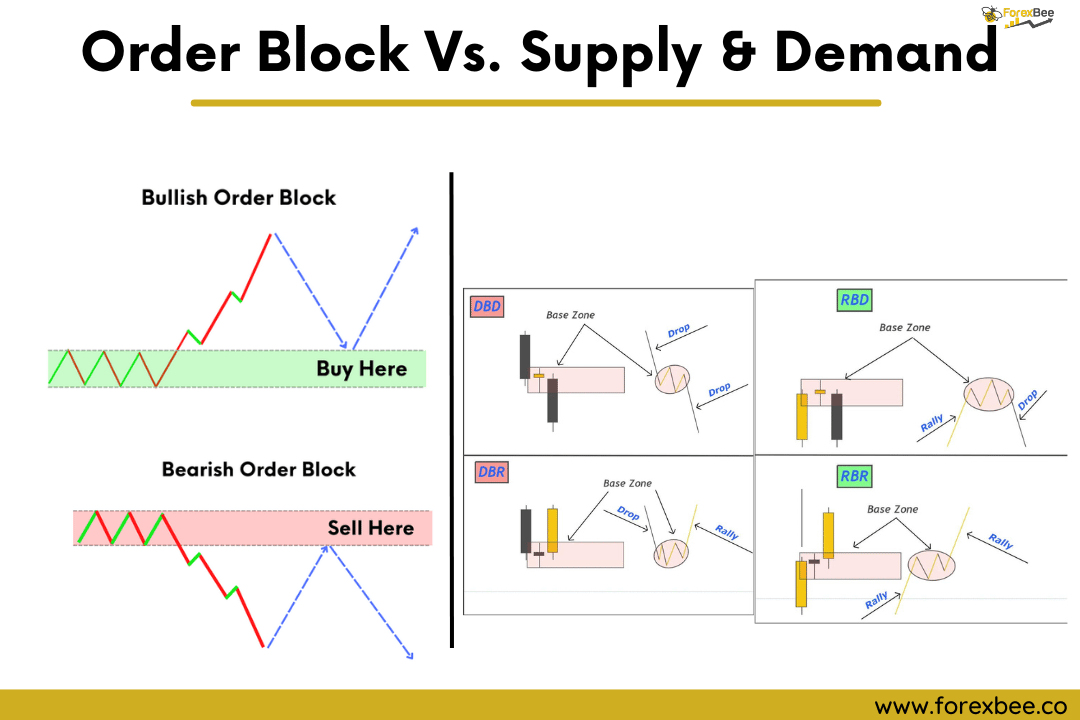

Order blocks in forex work on the principle of balance and imbalance, while the supply and demand is based on the concept of rally base rally, drop base drop, drop base rally, and rally base drop.

The order block is not the same as the supply demand. Both are different concepts based on pure price action trading.

I will explain the differences between order block and supply demand trading. So in this article, you can find an accurate tool for trading. At the end of the post, I will also suggest some tools that can help you a lot in trading. So make sure to read the full article without missing any steps.

Difference between the order block and supply demand

| Order Block | Supply and Demand |

|---|---|

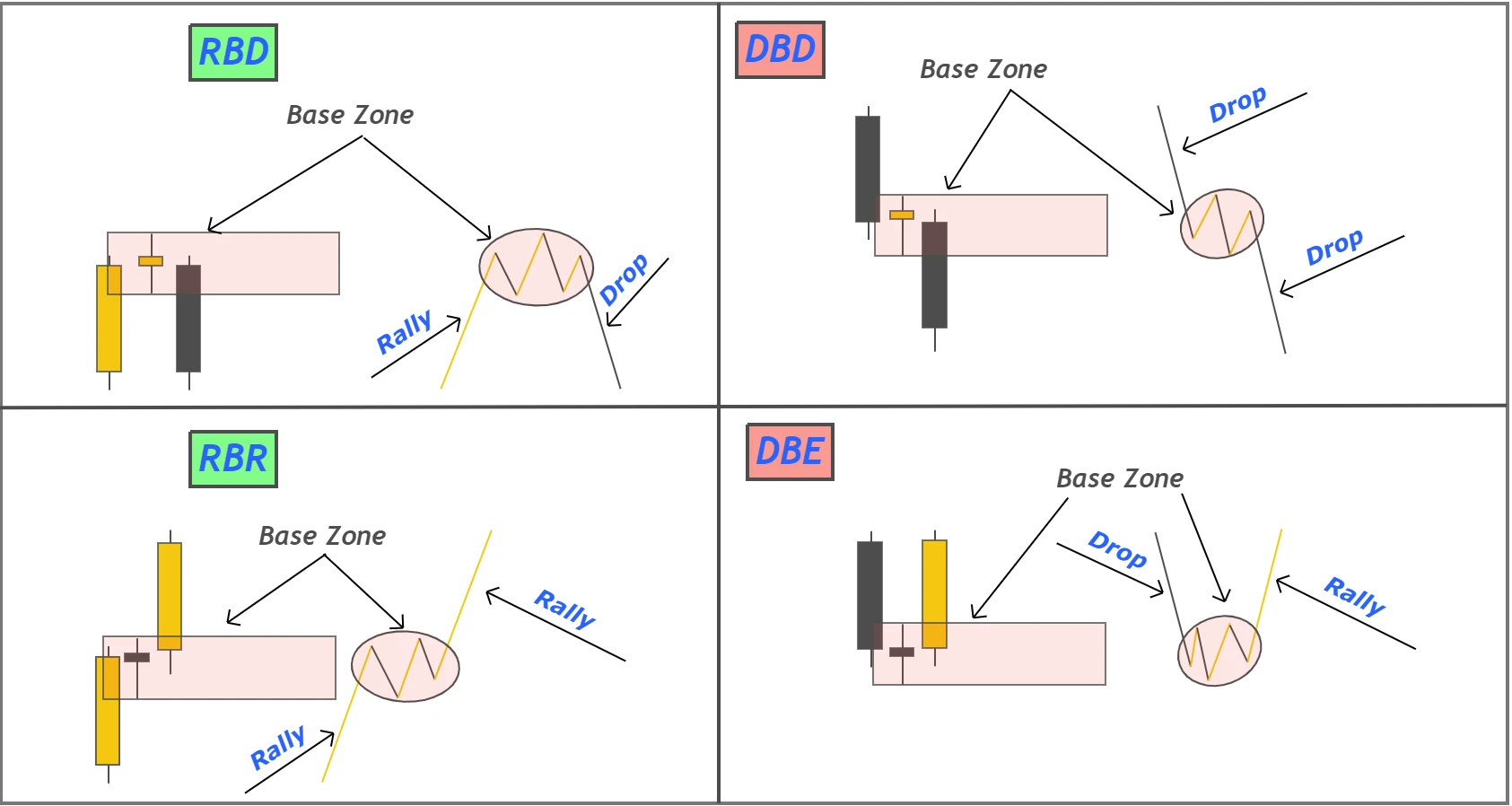

Order block pattern shows the filling of the chunk of market orders at the break of the ranging structure. After orders filling, the price will increase or decrease in the form of a big impulsive wave in a very short time interval.  | The supply and demand pattern is based on the RBR, DBD, DBR, and RBD concepts.  |

| In the order block pattern, a sideways wave will first form, then a big bullish or bearish impulsive wave will form. | The supply and demand pattern consists of three waves, impulsive, sideways, and again impulsive wave. These three waves give rise to the formation of a supply and demand zone. |

| The order block zone shows the presence of a chunk of remaining orders on the chart because most orders got filled when impulse waveforms. | Supply and demand zone predict the presence of all the institutional orders within the limits of the base zone. Price will return to the zone to fill the unfilled institutional orders. |

| Order block is based on the natural phenomenon of balance and imbalance. | Supply and demand pattern is also price action pattern based on natural phenomena. |

| To increase the probability of winning, we can also use the candlestick patterns with order block zones. | While in supply and demand trading, a trader focuses on picking the pinpoint entry. That’s why the confluence of candlestick patterns is not necessary. All you need to do is find the excellent supply-demand zones on the chart. |

| Order block zones offer moderate risk-reward ratio trades. | While the supply-demand zones offer ultra-high-risk reward trades.  |

| Order block strategy is suitable of for higher timeframes. | Supply and demand trading strategy is suitable for intraday or lower timeframes. |

| In the Order block trading strategy, we will first check a valid order block zone on the chart. Then we will open a buy/sell trade when the price returns to the zone after confirmation of a trend reversal candlestick pattern like a pin bar or engulfing candlesticks. | We will first find the supply or demand zone in the supply-demand trading strategy. Then we will open buy trade at the high of demand zone with a stop loss below the zone’s low. On the other hand, we will open sell trade at the low of the supply zone with stop loss above the zone. No confirmation is required in supply-demand trading for entry and stop loss. |

Recommendations for the Order block and the Supply demand trading

From the above points, you will be able to distinguish between the order block and supply-demand pattern. Now if you want to choose them as a trading strategy, then you must know the psychology behind these patterns. And how to use them in trading.

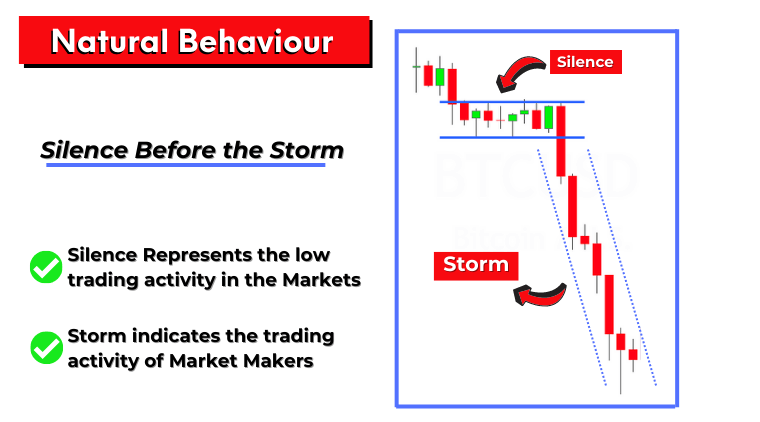

As the order block zone is based on sideways and impulsive waves. So when an impulsive waveforms, then a large number of institutional orders get filled. However, this also shows an area of interest for market makers. So when the price returns to the zone, then there are many chances that the price will bounce from this zone. And we can increase the probability of price bounce by the confluence of candlestick patterns.

That’s why it’s not straight forward method to trade. You need to make two to three decisions before opening a trade.

So I will recommend order block zones trading to intermediate and advanced traders.

As the supply and Demand trading method consists of fixed rules. Mainly you don’t need to make decisions. Just follow the rules of the rally base rally and the other three patterns. Then open a trade at the base region and place a stop-loss on the other side of the zone.

Supply and demand trading has become easy after introducing RBR, DBD, RBD, and DBR concepts.

That’s why I recommend that new, intermediate, and advanced traders use supply and demand trading in the strategy.

Order block and supply-demand indicator

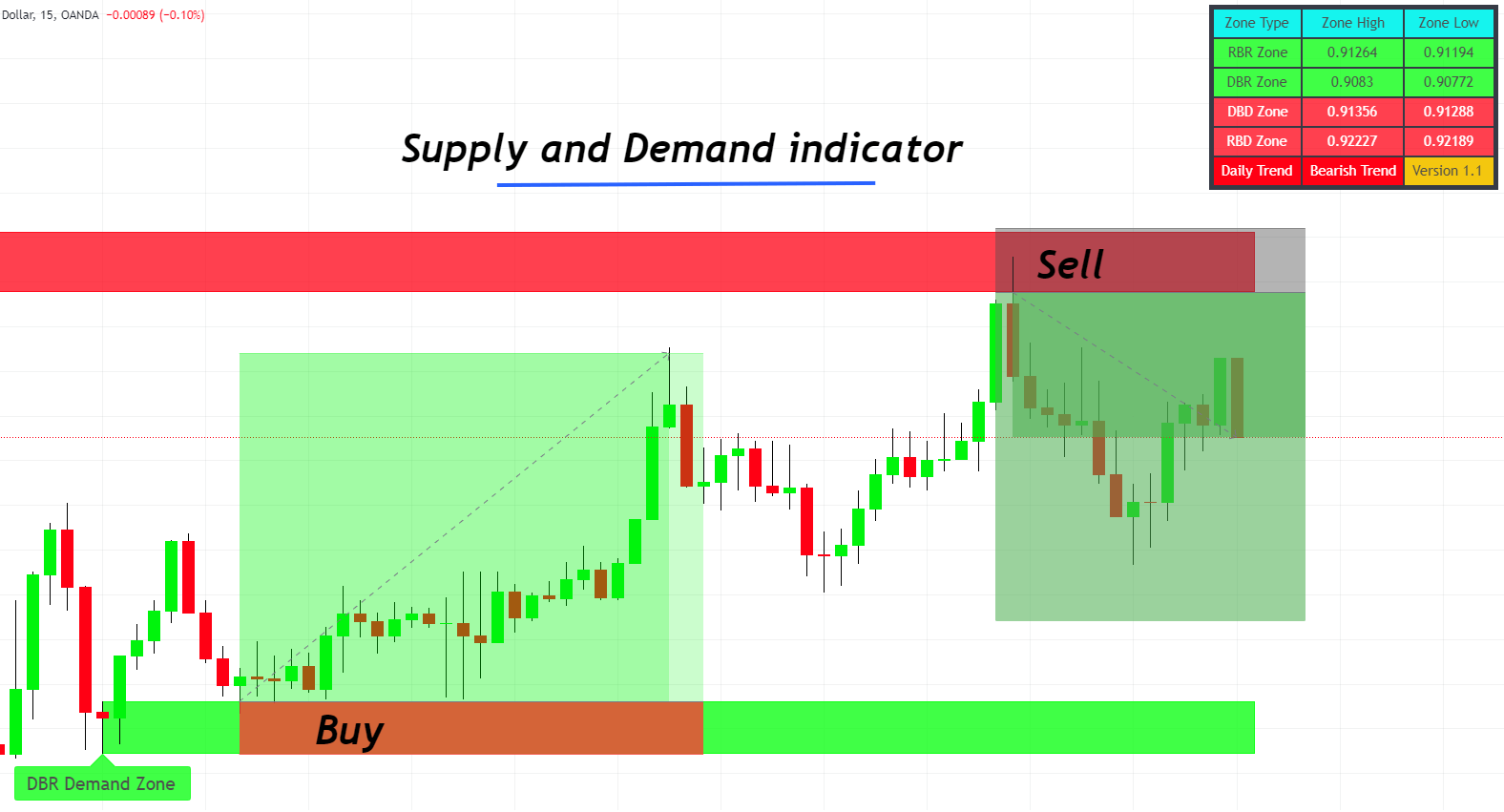

For traders, those who cannot do trading full time and want to make it a part-time job. Forexbee has also developed indicators or tools based on price action. These tools help traders to find the high-probability zones in the form of trade alerts.

The tool does most of the work, like finding the high-probability zone and sending users an alert to open the trade.

While choosing the indicator, you should read the above points first and then choose accordingly. To most of the traders, I will recommend supply and demand indicator.

Link to supply and demand indicator

Conclusion

Forexbee discourages using indicators for analysis or live trading but suggests using only price action based indicators. Order block and supply demand are pure price action indicators.

Due to advanced technology, mathematical indicators do not work nowadays. You can’t use them to do profitable trading.

However, the natural concepts( Balance & imbalance) are evergreen and will continue to work even in the future.