What does one pip mean in cryptocurrency?

A pip is the minimal change of value in cryptocurrency trading. It is the smallest incremental change you can observe while dealing in Crypto.

A crypto trader must understand the importance of one pip change to understand,

- Future profits and losses

- To evaluate the commission fee

- To understand the total cost of the trade

- To understand the market trend

- To compare different brokers and platforms

Now, you know the importance of understanding a pip in cryptocurrency. The next step is understanding the concept of pip in the cryptocurrency world, as it significantly differs from traditional forex trading. In a traditional forex trading system, a pip is usually calculated up to four decimal places, i.e., 0.0001, or in rare cases; a pip’s size is up to two decimal places, e.g., in a USD JPY currency pair, a pip size is 0.01.

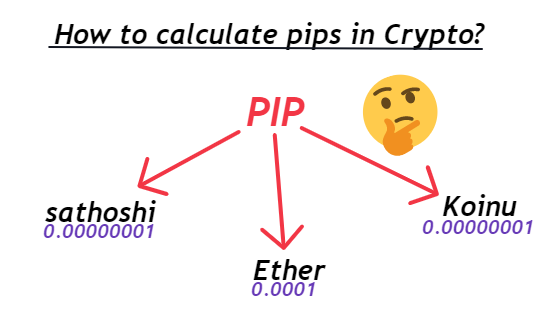

In cryptocurrency, one will experience substitute words for pip, usually cents, satoshi, wei, litoshi, etc.

The following table will guide you to understand the substitute words for pip in the case of different cryptocurrency coins and their minimal incremental change value.

| Cryptocurrency coin | Abbreviation of coin | Substitute word for pip | Pip value |

| Bitcoin | BTC | Satoshi | 0.00000001 |

| Ethereum | ETH | Ether | 0.0001 |

| Binance coin | BNB | Gwei | 0.00000001 |

| Dogecoin | DOGE | Koinu | 0.00000001 |

| Litecoin | LTC | Litoshi | 0.00000001 |

As the table suggests, a vast variety in name and value exists for a specific pip value. There are over 12,000 crypto coins, with the regular addition of new ones daily. A specific cryptocurrency’s pip size might vary from platform to platform.

Calculate pip value in BTCUSD.

Bitcoin is one of the most famous cryptocurrency coins. It was created in 2009 with a limited supply of 21 million Bitcoin that can ever be mined. It is the most traded and widely accepted crypto coin. It is also widely accepted as a form of payment.

To calculate pip value in BTCUSD, one needs to know the,

- Exchange rate of BTC to USD

- Size of trade position

Pip value = trade position x 1 Satoshi

If we are trading BTC and the exchange rate of BTCUSD is $20,000, and our trading position is 0.1BTC, then,

| Exchange rate = 20,000 Trading position = 0.1 BTC 1 satoshi = 0.00000001 Pip value = trade position x 1 satoshi = 0.1 x 0.00000001 = 0.000000001 BTC We will multiply the pip value with the current BTC to the USD exchange rate to convert this value into USD. Pip value in USD = 0.000000001 x 20,000 = $0.00002 |

How much is one pip in BTCUSD?

The smallest unit in a bitcoin is a satoshi, equivalent to 0.00000001 BTC.

To calculate one pip in BTC USD, one needs to know the,

- Exchange rate

- Value of 1 pip

| If the exchange rate is $21,000 and one satoshis is equal to 0.00000001 BTC, then, One pip = exchange rate x pip value = 21,000 x 0.00000001 BTC = 0.00021$ |

How much is one pip in ETHUSD?

Ethereum was launched in 2015 based on open-source Blockchain technology. It is the second largest cryptocurrency coin after Bitcoin. Ethereum is a decentralized coin that operates in contrast to the traditional currency printed on paper.

One pip in an ETHUSD can be calculated from the following formula,

One pip = 10,000 ETH

1 pip = 0.0001 x exchange rate

Example 1

If the exchange rate for ETHUSD is $2,000, we can calculate the value of one pip by following the formula,

One pip = 0.0001 x exchange rate

= 0.0001 x 2,000

= 0.2 $

Conclusion

The term pip is different in the case of cryptocurrency as compared to traditional forex trading. There are multiple terms for pip employed in cryptocurrency trading. There are more than 12,000 crypto coins, with the addition of new ones regularly. Thus, there is a vast variety in pip value for cryptocurrency coins.

One may observe the change in the calculation of pip value for a particular crypto coin, but one can’t ignore the value of pip calculation as it directly impacts,

- Future profits and losses

- Estimation of trade cost

- Comparison of broker platforms