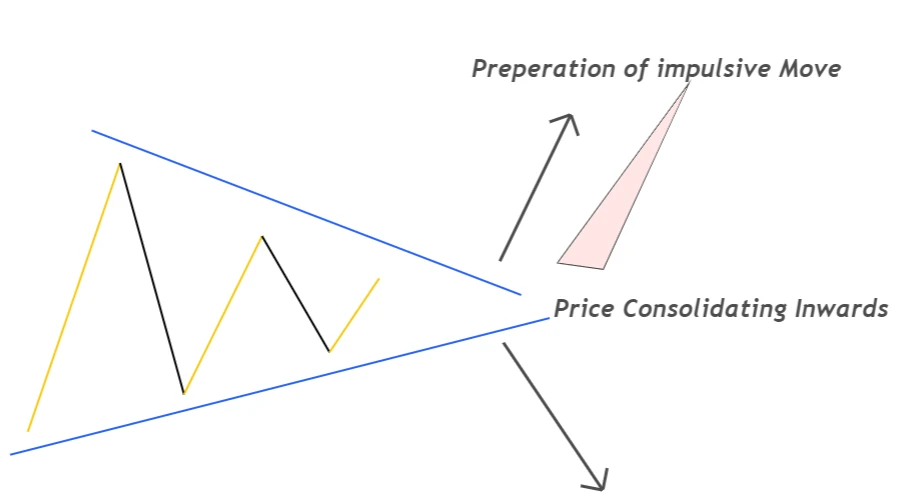

Whenever price moves inwards to a point and waves become shorter in size gradually with time then there will be an inside bar formation

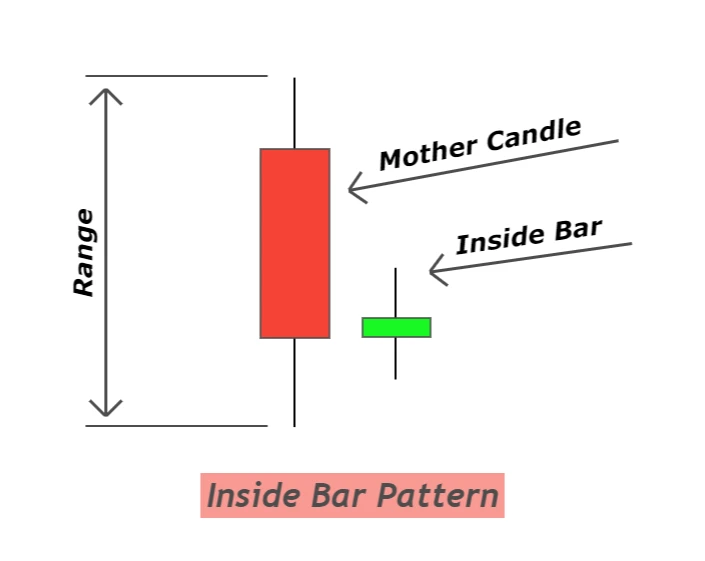

The Inside bar pattern is a price action pattern that is made up of two candlesticks in which the first one is called mother candlestick and the second candlestick is called inside bar that forms within the range of the previous mother candlestick. Mother candle should not have larger shadows up and down.

Meaning of Inside Bar

The Inside bar candlestick indicates that the market is looking for a direction. Think like this, After a bigger move ( Breakout of a level ) Market will be looking for a direction either to continue its direction or to take a reversal by a false breakout to capture the retailer’s stop-losses.

Thinking like this will make you able to forecast the upcoming big moves of market makers and big banks.

The inside bars represents a time of consolidation. A big timeframe candlestick pattern can look like a ‘ symmetrical triangle’ on a smaller chart time frame. They also form after a successful push in the market, as they ‘stop’ to stabilize the market until the market makers decide their next move. However, they may also form at market turning points and act as reversal signals from main support or resistance levels.

Key Points of Inside Bar Pattern

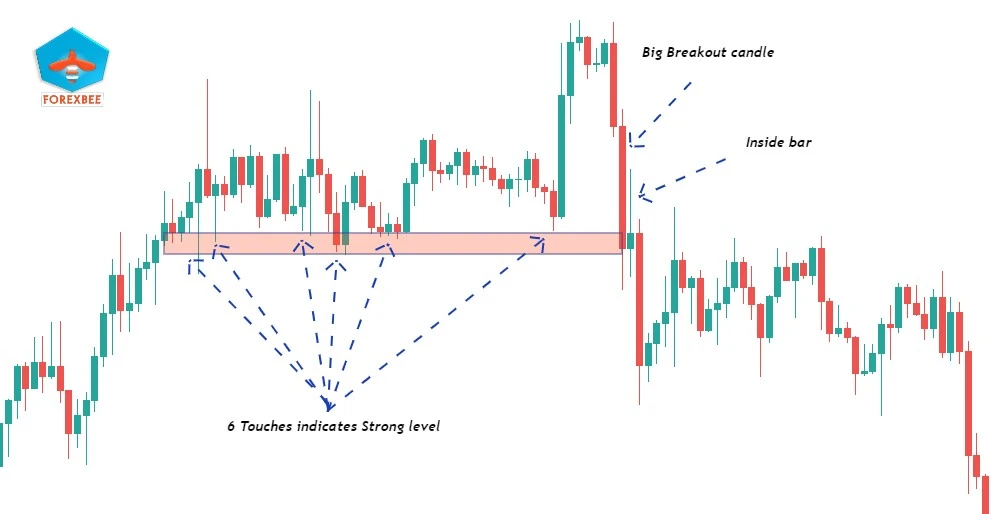

Now let’s come to the main point. All we have to do is to find out these three points. As discussed above, it works best when it forms at a key level.

- Support or Resistance Level

- S&R breakout with big Candlestick (Mother candlestick)

- Inside bar after mother candlestick

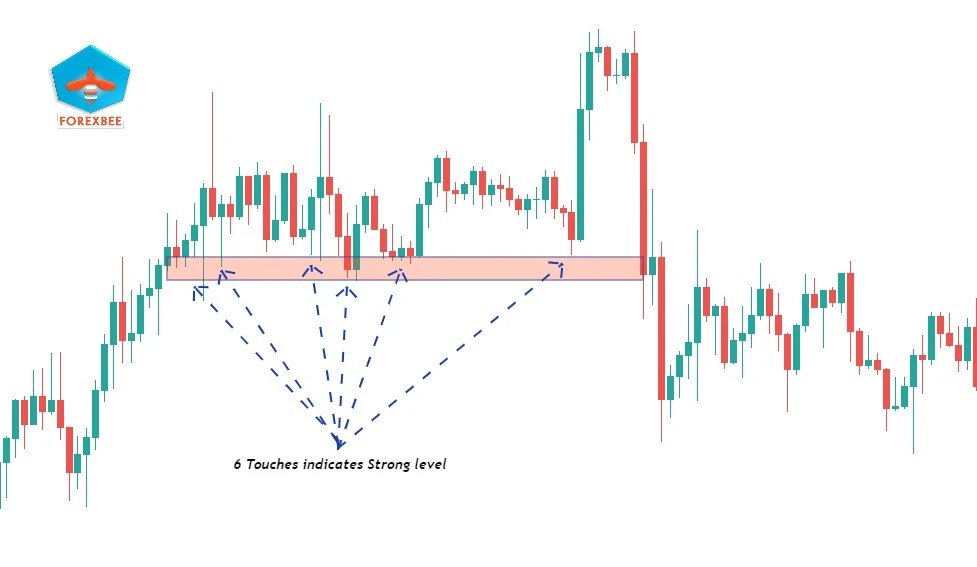

Support or Resistance level should be a fresh level at least more than three touches of that level. The number of touches indicates the strength of a zone. More price bounces from zones mean a strong zone and fewer price bounces mean a weak zone.

Look at the image below.

How to trade inside bar?

When inside bar candlestick forms after support zone breakout, it shows two conditions here.

- Price will go down obviously after the breakout of the support level

- The market is deciding its future direction by consolidating inward on the chart

Breakout of this candlestick will also indicate a bearish momentum of the market. So the common thing in both cases is that market will start a downtrend after the breakout of support and the candlestick pattern. We will use this method to make a strategy.

The final trading strategy consists of the following four parameters

- Identify a strong support or resistance zone

- Look for the formation of inside bar candlestick after support/resistance breakout\

- Open order in the direction of breakout

Pending Sell Order setup

Place a pending stop sell order on the low of inside bar pattern so it will automatically trigger during IB breakout. The Stop-loss level will be always above the high of the inside bar (in case of sell setup).

In the sell setup, There are two main elements

- Support zone and Breakout

- Inside Bar and Down Breakout

Pending Buy Order setup

Buy stop order is placed on the high of inside bar candlestick and stop loss level is below the low of IB (in case of buy trade setup).

In the buy setup, Always remember two elements

- Resistance zone and Breakout

- Inside bar and up breakout

very simple setup!!!.

Entry of the order will be 1 to 2 pips below the inside bar Low in the direction of the big candle and stop loss is one to two pips above the high. Take profit level is measured using Fibonacci extension levels 1.21 and 1.618. You can get 1:4 and 1:5 Risk rewards easily with this setup.

key takeaways

You will not get this set up daily so what we will do is that we will use all types of support and resistance

- Dynamic S&R level ( MA )

- Diagonal S&R ( Trendline )

- Horizontal S&R

Before you invest in something, invest in time to understand it.

In Summary

Always try to read the price action to understand the decisions of market makers and become a pro technical analyst. The price reading will help you to make logical decisions in trading that helps a lot in trading and improve your psychology.

I have tried to make you able to read the price by explaining inside bar candlestick trading strategy. This is the most widely used candlestick pattern in forex trading.

Now it’s your time. Try to backtest this strategy at least 100 times to master it. DIY.

I hope you will like this Article. For any Questions Comment below, also share by below links.

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.