This article is about reading a candlestick chart or how to read candlesticks in forex? Or how to master multi-timeframe analysis using candlestick patterns? Everything will be covered from beginning to advanced level. At the end of this article, you will be able to identify candlestick patterns of multi-timeframe charts from a single lower timeframe chart. forexbee will make you able to predict the future in the forex market only using candlestick patterns. Learn advanced price action techniques from forexbee only. Let’s start from the beginning.

What is candlestick in forex?

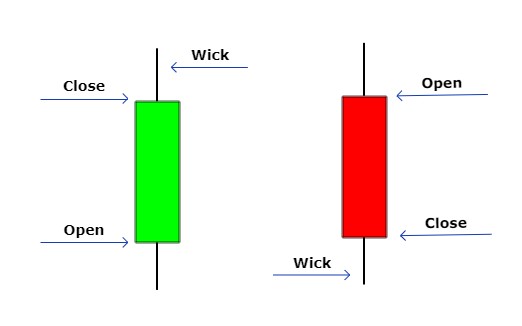

A candlestick consist of three main points a closing price, opening price, and wicks. Candlestick indicates the direction of price either bullish or bearish and how the price is moving forward. Various candlestick patterns predict the future direction of price in the forex market. Identification of candlestick patterns from multi- timeframes is the main goal of this article.

Open price: opening price indicates the first traded price of a specific pair exchanged during that time

Close price: closing price indicates the last traded price of a specific pair exchanged during that time.

Wick: wick indicates the variation in price relative to the opening and closing price of a specific pair.

For more clarification see in the image below.

Best Candlestick patterns

There are various types of candlestick patterns. You can also learn from many forums and websites on the internet but forexbee is here so you will learn only important and valuable content. Only three candlestick patterns you should follow only instead of complicating things a lot.

- Pinbar candlestick

- Engulfing candlestick

- Inside Bar candlestick

Why only three candlestick patterns?

Pinbar, engulfing, and inside bar candlesticks make a lot of sense to me. I will also show you how you can convert every candlestick into an engulfing candlestick.

In short, every candlestick pattern is an Engulfing candlestick in a higher timeframe

The above important line will be explained in the multi-timeframe topic.

Multi-Timeframe Analysis

This is the most important topic of technical analysis in forex trading called as multi-timeframe analysis. After reading this paragraph, you will not be restricted to only 9 timeframes or waiting for a pin bar or engulfing candlestick in a specific timeframe. A-Pro trader can analyze multi timeframes from a single timeframe.

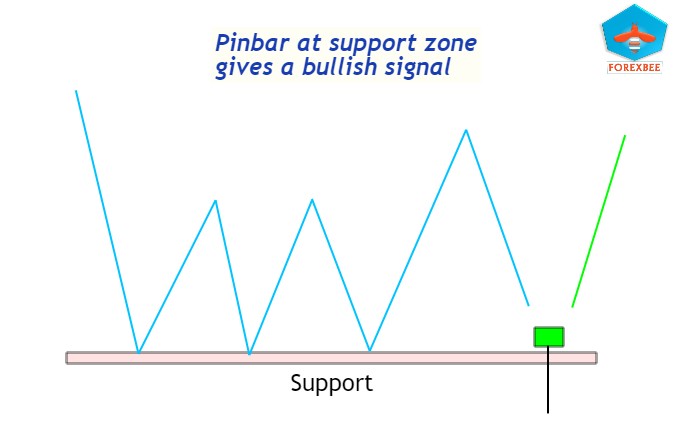

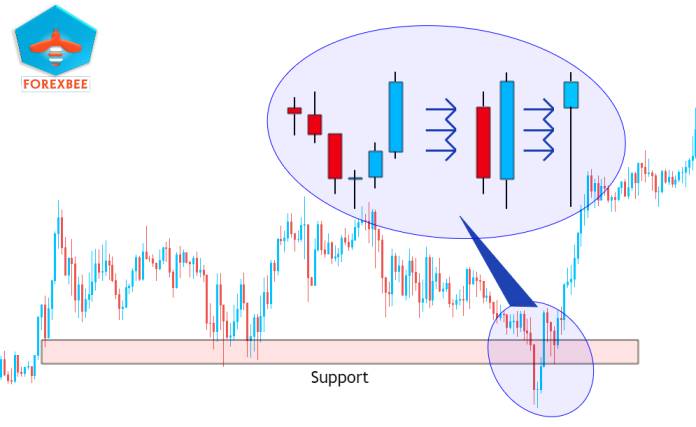

A bullish pin bar pattern at the support zone will give a buy signal. Remember the way to do multi-timeframe analysis. No need to look for the exact pin bar in 1min, 5min, 15min… And so on. Read the price action.

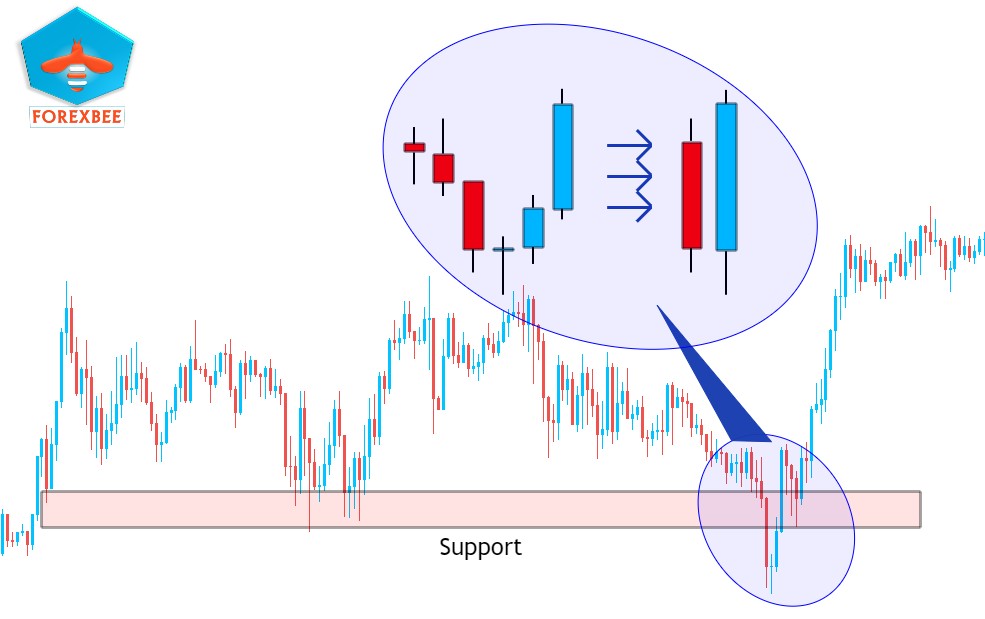

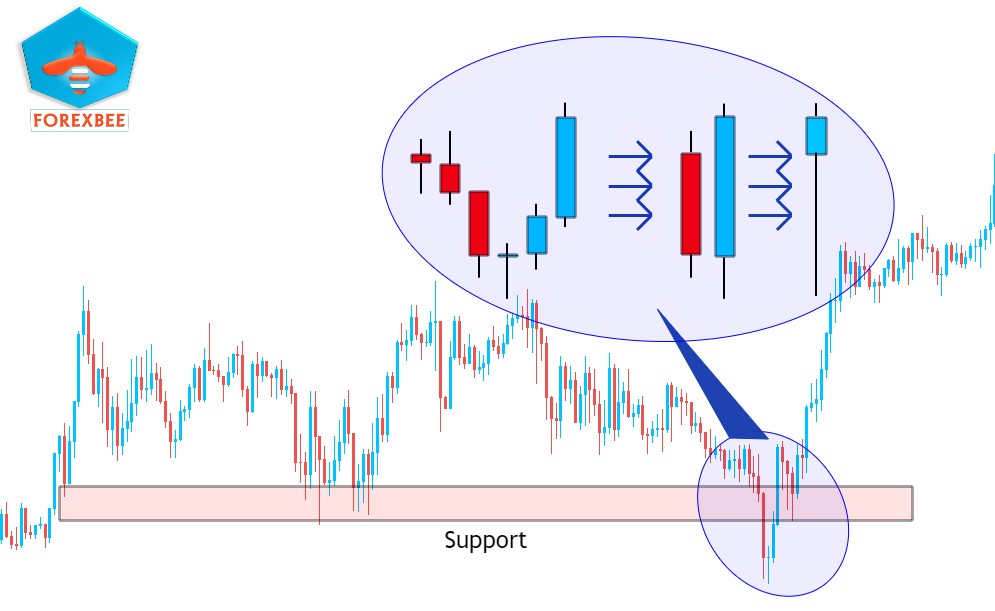

Look in the image above there are six candlesticks. Now convert these six candlesticks into two candlesticks by using the opening price and first candle and closing price of the last candlestick. Very Easy! It looks like an engulfing candlestick.

Again convert two candlesticks into a single candlestick. Awesome! It looks like a pin bar. And pin bar is the best candlestick to enter in a trade. A pin bar is a confirmation of an order to be triggered.

That’s All just try to read the price instead of following the flow. Learn more in detail about eliminating timeframe restriction by viewing the youtube video

I fear not the man who has practiced 10,000 kicks once but I fear the man who has practiced One kick 10,000 times

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4. Join Telegram to get trade ideas free.

Thanks

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.

Good

Thank you

for the lower timeframes or recent tf …where should I start to choose a candle to become engulfing or pinbar?

is it at A B C formation? or what?

Recent TF. Timeframe that is fulfilling your strategy.