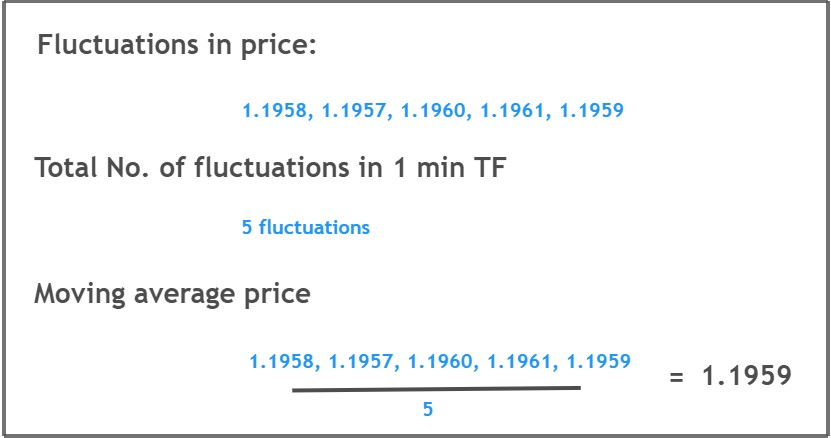

Moving average is an indicator that is used to determine trend direction. Add all the data points of a specific currency pair over a specified time interval and then divide a total number of data points. This is a simple formula to calculate the moving average. I will make it easy for you with a simple example

Let’s look at the EURUSD currency pair and a 1min timeframe. Assume the current EURUSD price is 1.1958. During the 1min timeframe, there are 5 fluctuations in price. So simply moving average is the sum of all the data points during 1 min interval and then dividing by a total number of data points that occurred. This is called Moving Average in forex trading.

Types of Moving Average

Two types of MA are mostly used in forex trading technical analysis for trend analysis.

- Simple moving average (SMA)

- Exponential Moving average (EMA)

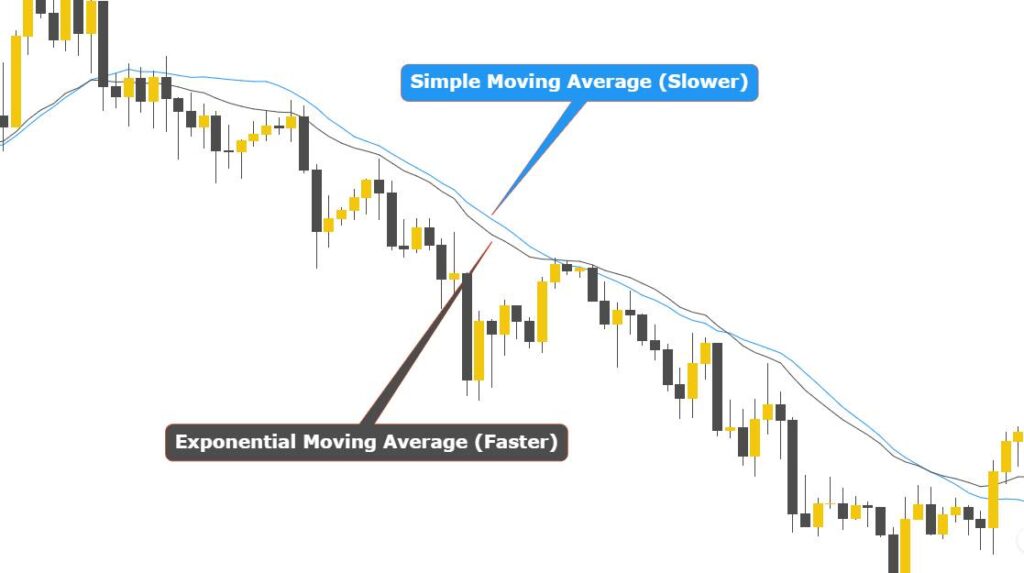

EMA vs SMA

I will not explain in detail types that are not relevant to technical analysis. Just keep in mind that a simple moving average contains average prices. Whereas the exponential moving average is more advanced and gives more value to recent prices. The simple moving average is lagging and slower one but EMA is a faster one and it reacts to price faster while breakout. So it can give many false signals. It depends on the purpose only. I use EMA to extend take profit level.

Moving average period

The period represents the time interval. In terms of forex, the period is the number of previous candles used for calculating the moving average. For example, a period of 21 means MA is calculated by adding up the closing prices of the previous 21 candles and then dividing the total by 21. It depends on your strategy like how far in the history you want to look for. 21 period MA and 1 min timeframe mean you are calculating the average of the previous 21 candles.

How to use moving average

Moving average is the same as a trend line but a dynamic trend line that changes with time. There are many ways to use a moving average. For a swing trader, MA is used to extend take profit level as well as to adjust the stop-loss level. Moving average also acts as a dynamic support and resistance level. The main purpose of MA is to use it as a trend analyzer and as a support and resistance.

Does MA Crossover still work?

Moving average crossover does not make any sense to me. I will recommend you to not use these crossover methods. They are useless. First of all MA crossover is a lagging indicator. Second thing is that there will be a lot of crossovers during the price retracement or accumulation. Indicators only show you results of previous data. They don’t forecast the price. So my advice is to use the MA as a support and resistance and to filter trends to boost your profits.

MA as a Trend Filter

The most common and widely used method of MA is as a trend filter. If the MA is respecting high highs then it will act as a bullish trend filter. Until a big candle breakout and lowers low formation. If the MA is respecting lower lows then it will act as a bearish trend filter. Until a big candle breakout. Look at the image below for an overview.

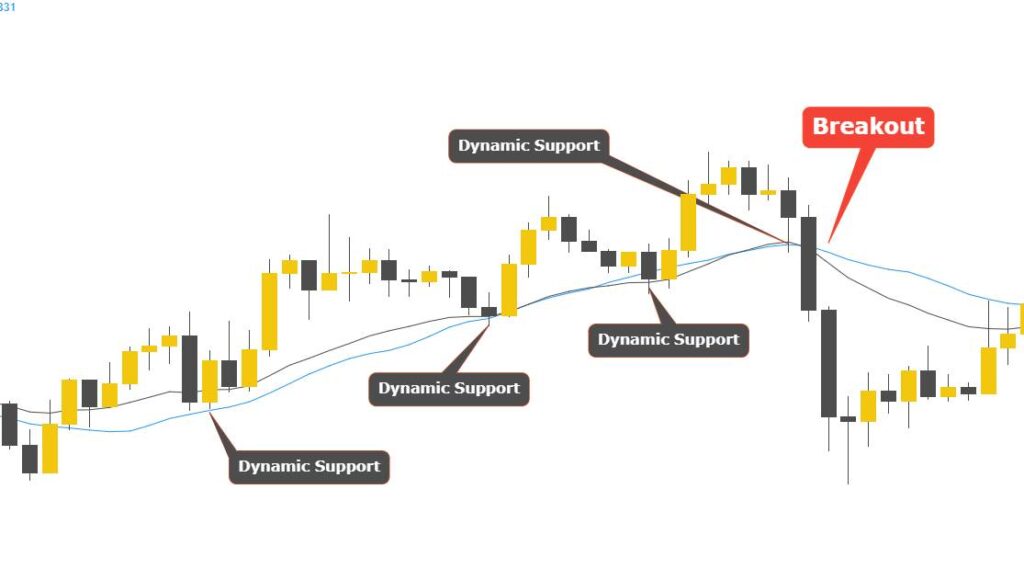

Dynamic Support and Resistance

This is one of the best use of moving average as dynamic support and resistance. Like trend lines also act as inclined support and resistance. To determine a valid MA, there must be at least two retests. After two retests, the MA will act as a barrier to the price. Any pin bar or engulfing pattern on the retest and also the combination of Fibonacci levels will make the best trade setup. Look in the image below how dynamic support and resistance works.

Now let’s discuss MA configuration for day trading and swing trading.

Best moving averages for day trading

9 and 21 period MA work best for day trading and is also preferred most of the time.

Best moving averages for swing trading

21, 50, and 100 periods MAs work best for swing trading. 100 period is used for filter retracement.

Best moving average for daily chart

200 MA is used for daily charts.

The market can stay irrational longer than you can stay solvent

John Maynard Keynes

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4.

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.