What is Drop base drop in trading?

Drop base drop is a price pattern that indicates the creation of a supply zone on the chart. More sellers are willing to sell from the supply zone created by the drop base drop pattern.

It is the most basic type of supply and demand in technical analysis. You need to learn the basics of supply and demand to become a supply and demand trader.

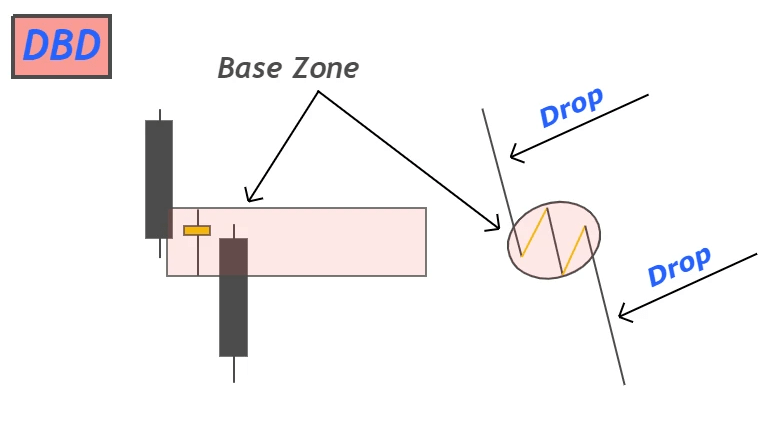

In short, drop base drop is also called DBD.

How to identify drop base drop?

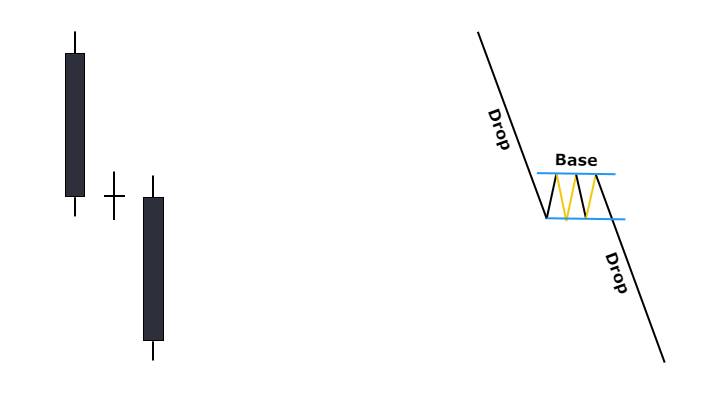

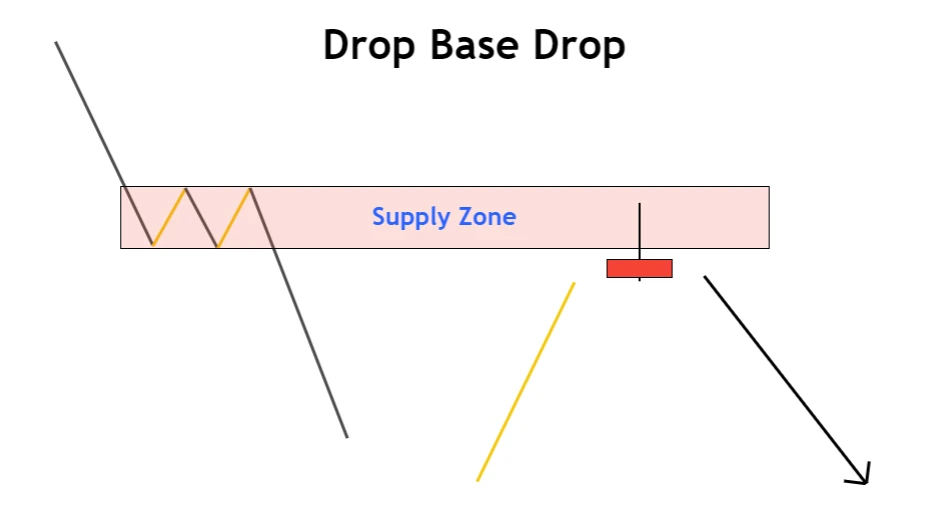

It consists of two bearish impulsive waves and one retracement wave. The retracement wave is sandwiched between the two bearish impulsive waves.

After going deeper in technical analysis, a bearish impulsive wave can be seen in a single big bearish candlestick. A Doji candlestick represents the sideways movement of price or price retracement.

So, to identify a drop base drop pattern on the candlestick chart, look for two big candlesticks with a Doji candlestick sandwiched between two big bearish candlesticks. Like in the image below.

Follow the following simple formula for DBD

DBD = Big bearish candlestick + Doji candlestick + Big bearish candlestick

Body to wick ratio of candlesticks

The body-to-wick ratio of big bearish candlesticks must be greater than 70%. It is necessary because the big body of the candlestick indicates the huge momentum of sellers.

Doji candlestick must-have body to wick ratio below 25%. The same opening and closing of the candlestick indicate the sideways movement o price on the chart. It also represents indecision in the market.

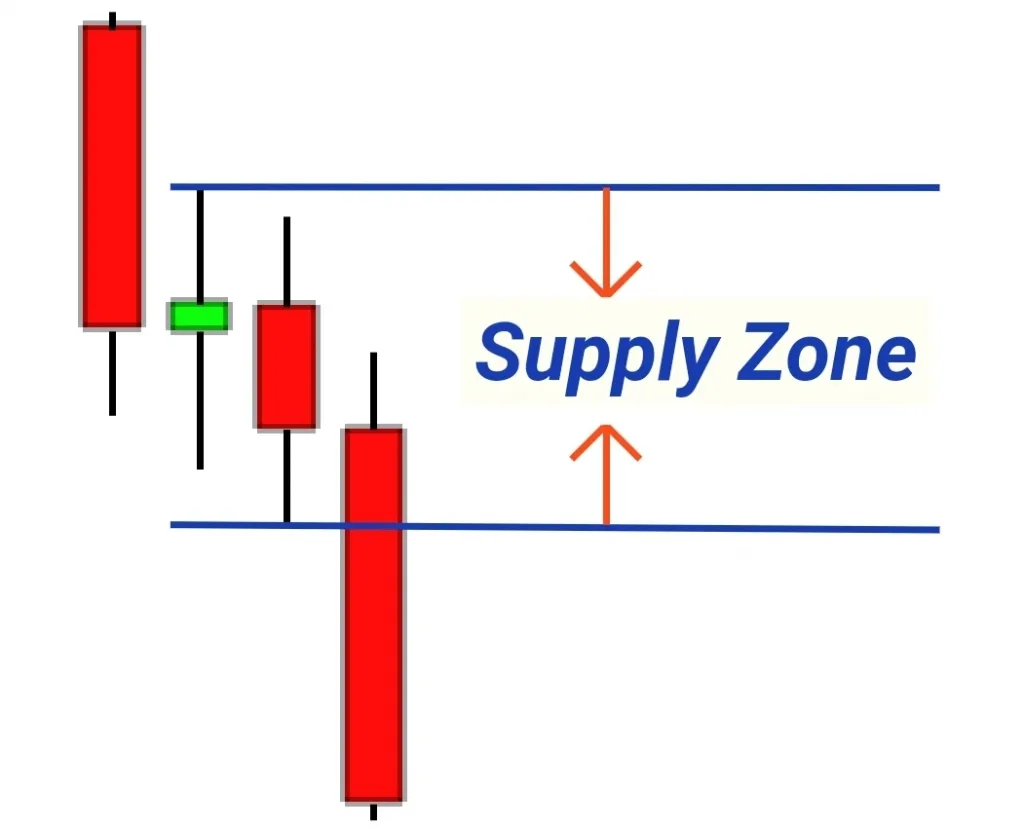

How to draw a supply zone?

To draw a supply zone, simply highlight the high and low of the base candlestick. Now draw a rectangle meeting the high and the low of the base candlestick and extend the rectangle to the right to the appropriate length.

A base zone is basically a supply zone in technical analysis. The base zone can consist of more than one candlestick. But you should always take the high and low of the total base zone to draw a supply zone.

What does DBD pattern tell traders?

The psychology behind this pattern is based on a natural pattern. Like in nature, real life is full of ups and downs. In the same way, the market is full of impulsive and retracement waves. Price travels from one zone to another zone in the form of impulsive waves.

This is nature and the DBD pattern is a purely natural pattern. When the DBD pattern forms, it creates a supply zone naturally. The supply zone is always under the attention of big traders and big institutions that are willing to sell from that zone.

The supply zone in the DBD pattern is the footprint of market makers in technical analysis. If you want to sell a currency pair, you should sell with market makers from supply zones.

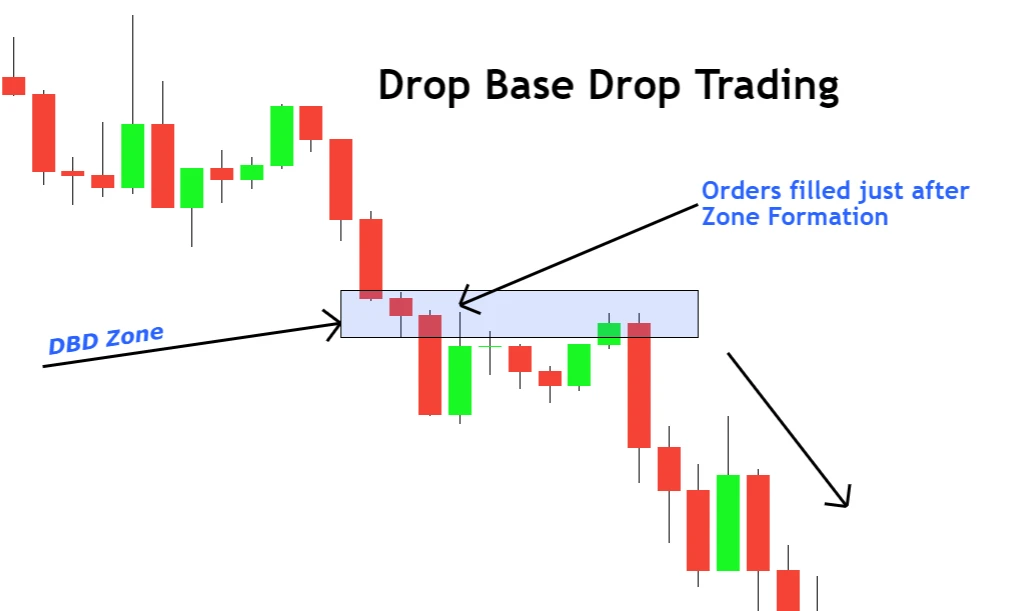

How to trade Drop base drop pattern?

There are two methods to trade DBD pattern

- First method is to sell a security when price come back to touch the supply one just after the formation of supply zone

- Second method is to sell a security when price come back to touch supply zone after a full swing

After backtesting, we have come to a result that the supply zone becomes weak if the price takes more time to return to the supply zone to pick sell orders. So, we have made a strategy for the later method.

Trading plan for second method

After drawing the supply zone, when the price will return to the zone after a full swing/some time then wait for the formation of a bearish pin bar or any other bearish candlestick pattern

Open a sell order on the formation of a bearish pin bar at the supply zone and place the stop loss above the supply zone. The base zone will protect your stop loss from fake-outs.

In the drop base drop pattern, the supply zone does not tell us about the take profit level. So, to fix this issue, you should trade the supply zone with another chart pattern or any other trading pattern.

Conclusion

DBD is the basic concept in technical analysis. Using this pattern as a confluence to trade other chart patterns or key levels will increase the probability of winning.

It also helps to fix a proper stop loss above the supply zone, and it increases the risk-reward ratio.

I will suggest you to backtest this Drop base drop pattern at least 100 times before trading on a live account.