Definition

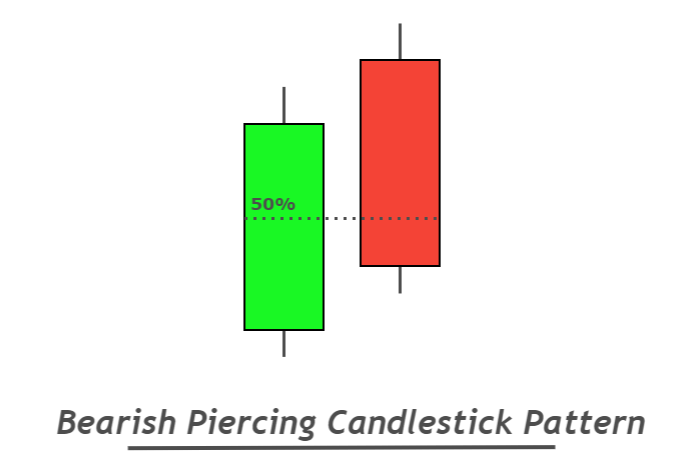

The bearish piercing pattern is a bearish trend reversal candlestick pattern that consists of two opposite color candlesticks with a price gap in between them. In this pattern, the bearish candlestick will close below the 50% level of the previous bullish candlestick.

The bullish piercing pattern is the opposite pattern. It is mainly formed in stocks and indices. It is always traded at the top of the price chart to get profitable results.

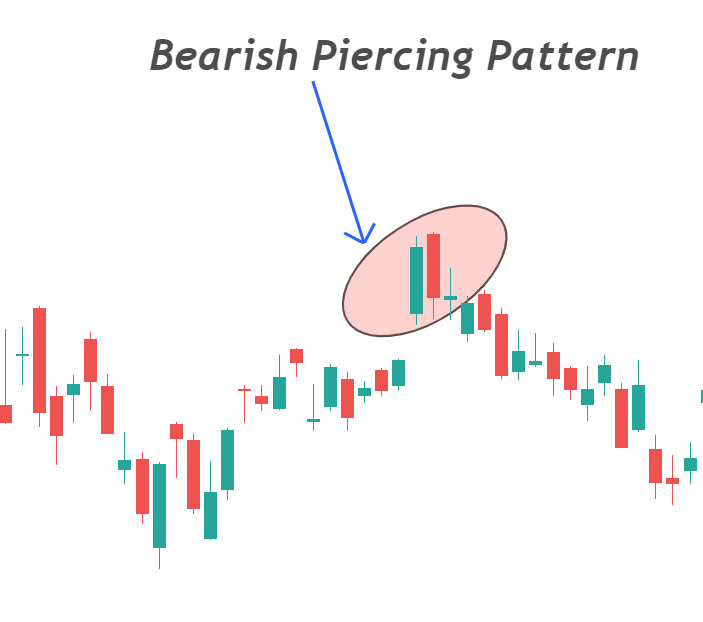

How to identify a bearish piercing pattern?

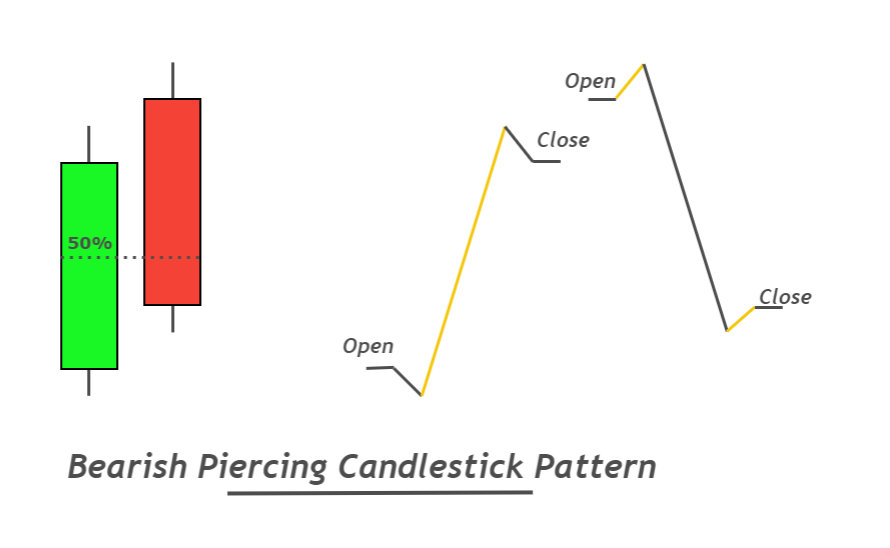

A bullish and a bearish candlestick combine in a proper sequence to make a piercing pattern.

Here are a few rules you need to follow to find a good pattern on the price chart.

- Body to wick ratio of both bullish and bearish candlesticks should be greater than 60%. The body of the candlestick indicates the momentum of buyers and sellers.

- After the formation of the bullish candlestick, a bearish candlestick should open with a gap up and then close below the 50% level of bearish candlestick.

- This candlestick pattern should form at the end of the uptrend

Find High Probability Trades with this ADVANCED Candlestick Patterns Course

The Ultimate Candlestick Patterns Course That Will Help You To Trade Better

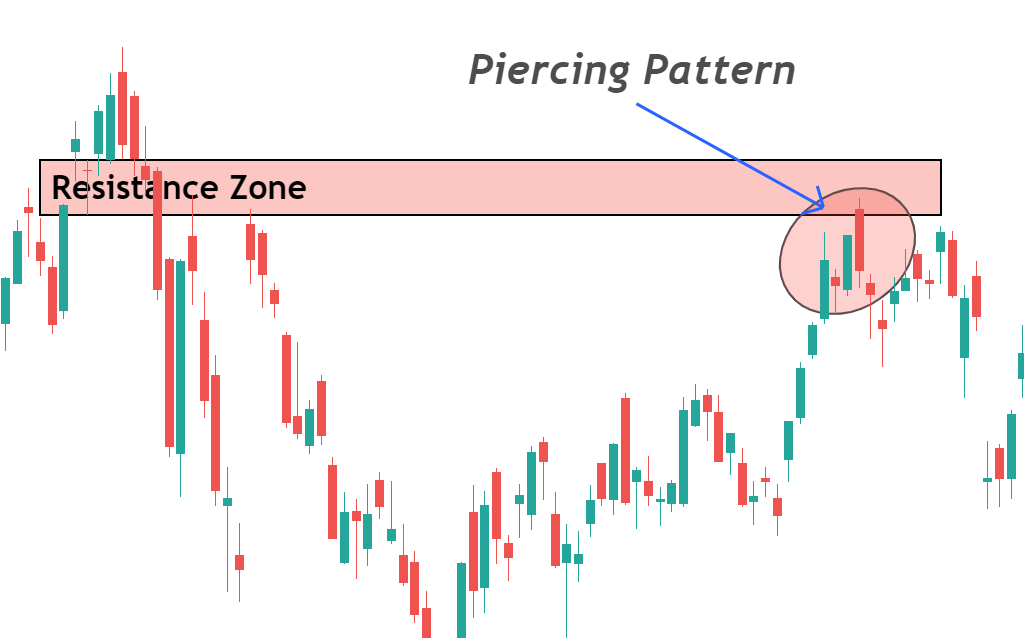

The best location for piercing candlestick pattern on the price chart

The location of a candlestick pattern on the chart matters a lot. Because some candlestick patterns will work in the trending market conditions while some will work during sideways market conditions. So, it would help if you refined a trading setup from the crowd by adding confluences.

Here are the three most popular price action confluences to get a high probability candlestick pattern on the chart.

- Supply zone

- Resistance zone

- Overbought level

Bearish Piercing: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 2 |

| Prediction | Bearish trend reversal |

| Prior Trend | Bullish trend |

| Counter Pattern | bullish piercing pattern |

The psychology behind the bearish piercing pattern

The bearish piercing pattern represents that sellers have become more potent after a long uptrend than buyers, and now the price will decrease.

Let’s read the price…

The bullish trend before forming the candlestick pattern shows that buyers are weakening with time. Because after overbought conditions, the price will have to come down. Because buyers will not be able to hold the price up for a long time.

At some key level, institutional traders will try to capture the retail traders before price trend reversal because they don’t want retail traders to profit. So they will make a false breakout of key levels in the form of a gap. Because at resistance breakout, retail traders will buy thinking of a breakout, but market makers have thought something else.

After the gap at the key level, a significant bearish candlestick will form that will close inside the key level and below the 50% level of the previous bullish candlestick. This indicates a false breakout because prices have closed below the resistance after the breakout.

So now the price will go down because sellers are ready to decrease the price.

Pro Tip: False breakout is an excellent signal of a price trend reversal. A bearish piercing pattern formation at the breakout level will generate a high probability signal.

How to Trade Bearish piercing pattern?

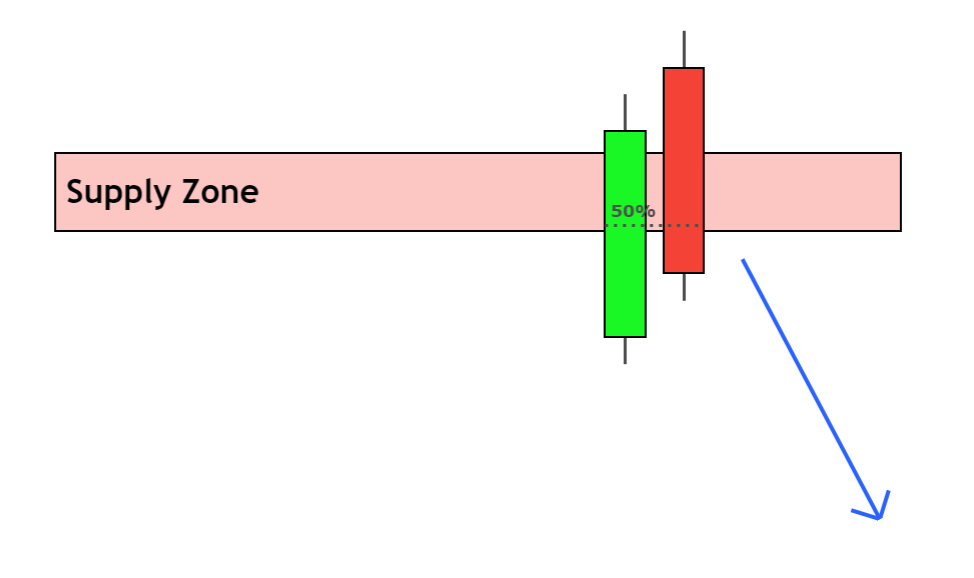

Here I have explained a trading strategy based on supply zone and bearish piercing pattern.

Open a sell order

The first step is to find a strong supply zone on the chart. After identifying the supply zone, look for the formation of piercing candlestick at the supply zone. The power of trend reversal of both technical tools candlestick pattern and supply zone will combine, and a solid bearish trend reversal signal will form.

Open a sell order just after piercing candlestick closing.

Stop-loss level

Place stop-loss above the high candlestick pattern or the supply zone. Choose the highest point always.

Take-profit level

Close 75% of the trade at a 1:1 RR ratio and keep holding the trade until the trade setup achieves a 1:2 risk-reward ratio.

The Bottom Line

Due to the gap, only a few patterns form in the currencies chart. It usually forms in the chart of stocks and indices.

It is recommended to backtest this candlestick pattern at least 100 times before trading on a real account.