Introduction

Everyone has been to the ice cream stall. We all know the smallest amount of ice cream we can buy from a stall is “one scoop.” Have you ever gone to a market and bought a half egg or half candy? The answer is “No.” To buy/sell, a minimum amount or unit is defined, and there is no exception in trading. In the case of forex trading, the smallest value, size, or amount you can find is a “pip.”

It is the smallest change in a currency pair value that can be noticed or observed.

If you are trading in EURUSD and the currency value moves from 1.3001 to 1.3002, then the change in the value is said to be one pip.

Definition of pip

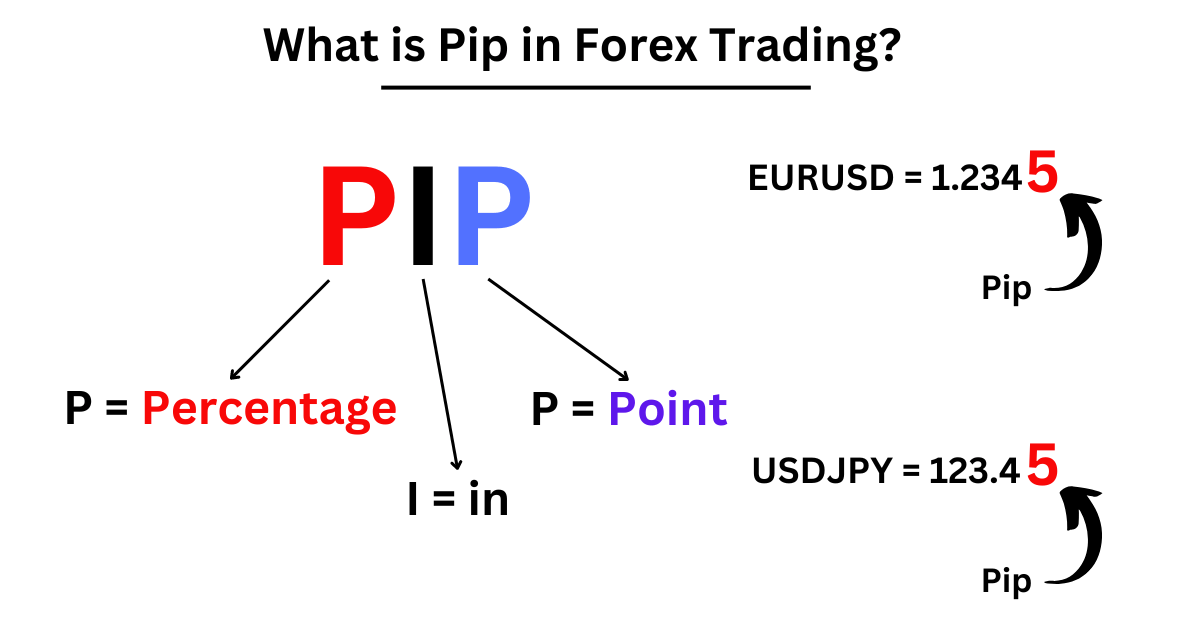

The word pip is an abbreviation, and its full form is,

P = percentage

I = in

P = point

A pip is defined as “ The smallest change in a currency pair value which can be observed.”

A pip is,

- Smallest increase a currency pair can exhibit

- It is usually the fourth place in a decimal figure except in the case of Yen, where there are only two decimal places.

- Pip value can vary depending on the trade volume or size

- It is one-hundredth of one percent

How to calculate a pip?

In order to calculate a pip value, one requires,

- One pip (0.0001 in most cases)

- Exchange rate of currency pairs

- Trade volume or size

By using the above-mentioned points, we can formulate a formula in order to calculate a pip.

Value of the pip = (0.0001/ exchange rate) x trade volume

Examples

In the case of EURUSD

If we are trading a currency pair of USD and EUR for a trade size of one standard lot, which is 100,000 where the exchange rate is 0.92, then according to the above formula,

| One pip = 0.0001 Exchange rate = 0.92 Trade volume = 100,000 Value of the pip = (0.0001/0.92) x 100,000 =10.86 |

In the case of GBP/USD

If we are trading a currency pair of GBP and USD for a trade size of 10,000 where the conversion rate is 1.24, the value of the pip can be calculated as,

| One pip = 0.0001 Exchange rate = 1.24 Trade volume = 10,000 Value of the pip = (0.0001/1.24) x 10,000 = 0.80 |

In the case of USD/JPY

There are only two positions prior to the decimal while dealing in JPY, so one pip in the case of a Yen in a currency pair will be 0.01. So, in order to calculate the pip value for the currency pair of USD/JPY for a standard lot size can be calculated below, keeping in mind the conversion rate of 135.

| One pip = 0.01 Exchange rate = 135 Trade volume = 100,000 Value of the pip = (0.01/135) x 100,000 =7.40 |

Significance and usage of pip unit in trading

A pip can be considered the heart and soul of the forex world, as no trade execution is possible without the value of a pip. The significance of the pip can be estimated from the following postulates,

Risk management: Pip value is helpful in risk management as it is vital in determining the position size and setting the stop loss, which is a key factor in reducing risk by avoiding the maximum position in a trade.

Estimation of trade value: A pip in forex is the slightest incremental change in a trade while dealing with the currency pairs. To calculate the total cost of trade, one needs to be aware of the pip value.

Execution of a trade: As we trade through brokers, a broker fee is always involved whether you are using a fixed forex spread or a variable one. So to execute a trade, one needs to pay the broker’s commissions or fee, which is always measured in pips.

How to calculate position size using Pips

Pips can play a vital role in calculating a position size while executing a trade. In order to determine a position size, one needs to know,

- His/her account size

- The gap in pips (entry and stop loss)

- Value of the pip for currency pairs

Position size can be determined by the following formula,

Position size = risk factor/(gap in pips x pip value)

Example:

Suppose you are willing to risk $100 in a trade where the gap between entry and stop loss is 40 pips, and the pip value is $10; we can calculate your position size by the above-mentioned formula as,

Risk factor = $100

Gap in pips = 40

Pip value = $10

Position size = 100/(40 x 10)

Position size = 100/ 400 =0.4

So you can take the position size of 0.4 lots for your currency pairs in order to stay in the trade regarding your risk factor strategy.

Pip value in Gold

As mentioned above, in the case of forex currency pairs, the value of a pip is usually 0.0001, but in the case of Gold, most brokers use a pip of 0.01. As Gold is dealt in ounces, and one standard lot is 100 ounces. Suppose an ounce of Gold is worth $2017, and a change of $2018 is exhibited. It will be a change of 100 dollars as the pip size is $0.01.

Pip value in crypto

Dealing with crypto is slightly different from the usual and traditional forex trading. In the crypto world, a pip is not usually used for determining the slightest change or incremental value in a trade. Instead, in a crypto market, cent and satoshis are usually the common terms.

Some markets might use $0.01 as a minimum unit, while others deal in 0.0001 cents depending on the cryptocurrency.

In the case of Bitcoins, a satoshi is the smallest change that a crypto trader can observe.

One satoshi = 0.00000001 BTC

Pip value in US oil

The size of a pip while dealing in crude oil is $0.01, as it is the smallest change or fluctuation which can be observed or noticed while dealing in oil trading. US oil has a standard lot of 1,000 barrels, so a change in pip will be $100 dollars for a change of 1 dollar/ barrel unit price.

The bottom line

A pip has a core value while executing a trade in forex, as,

- It helps in the determination of an incremental change in a currency pair

- It helps to calculate the risk factor

- It helps in determining a position size while trading

- It helps in the calculation of the total cost of a trade

At the end of the day, the proper understanding of a pip size and its involvement in the execution of a trade can play a vital role in determining your future potential profits and losses.