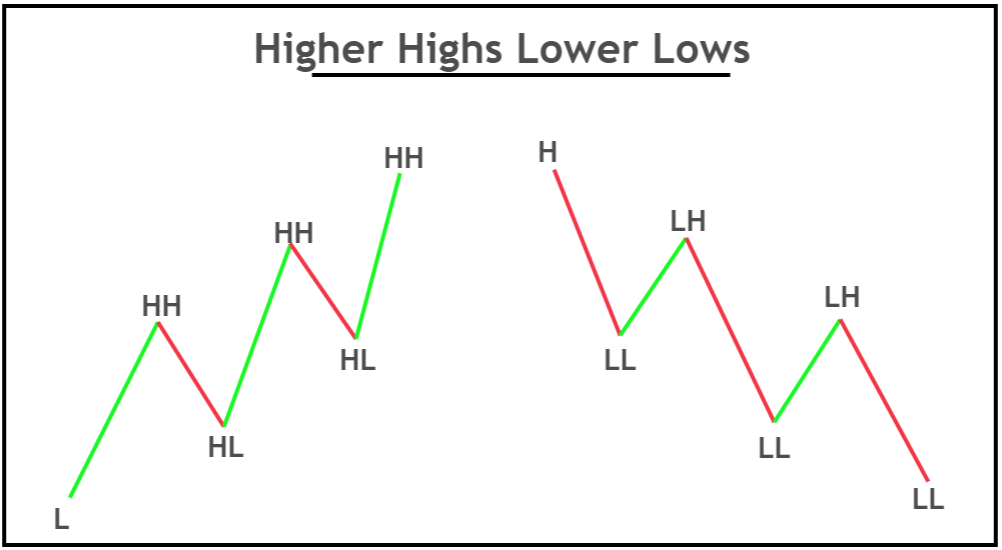

The formation of Higher highs lower lows in the forex represents the direction of the forex market either bullish or bearish. Identification of trends in the forex is the first step of technical analysis in trading.

We are talking about the most important topic in forex trading technical analysis. Every Trader should know about trends in forex and how to identify trend reversal in forex.

ABC of technical analysis is “Always trade with Trend”. It means we have to apply our strategy in the direction of the trend and we should avoid moves against the trend.

Types of trends in forex

The trend in forex represents the control or power of buyers or sellers in the market. if buyers are stronger than sellers then the market will move upward. The equal force of both buyers and sellers indicates the sideways movement of the market. If sellers are more powerful than buyers then the market will move downward.

There are only two types of trends in the market

- Higher highs and higher lows / bullish trend

- Lower highs and lower lows / bearish trend

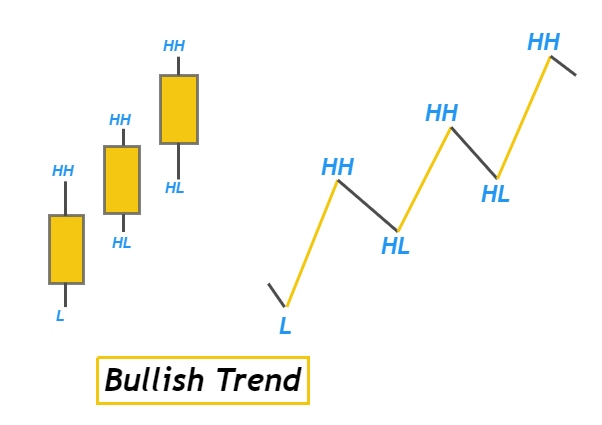

Higher highs and Higher lows

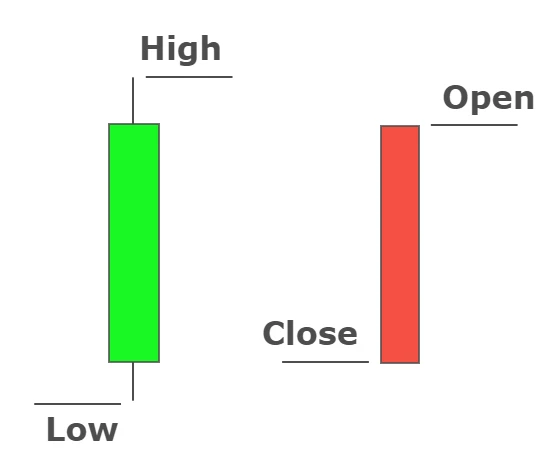

Higher highs and higher lows in forex mean the high and low of the recent candlestick is higher than the high and low of the previous candlestick consecutively. It represents that market is in a bullish trend and buyers are controlling the market.

There is strong buying pressure. A lot of traders are buying the currency and buyers have dominated the sellers. This results in the upward movement of price with time.

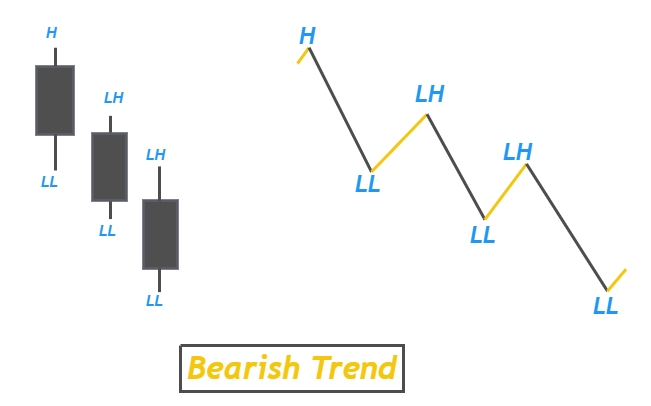

Lower highs and lower lows

Lower highs and lower lows mean the low and high of the recent candlestick is lower than the lower and high of the previous candlestick. The formation of consecutive lower lows and lower highs in the price of a currency during a specific timeframe is referred a bearish trend in forex trading.

It indicates strong selling pressure and the number of sellers is greater than the number of buyers. A lot of traders are selling the currency which results in a downward movement of price with time.

Lower highs mean the high of the recent candlestick is lower than the high of the previous candlestick.

how to identify trend reversal in forex?

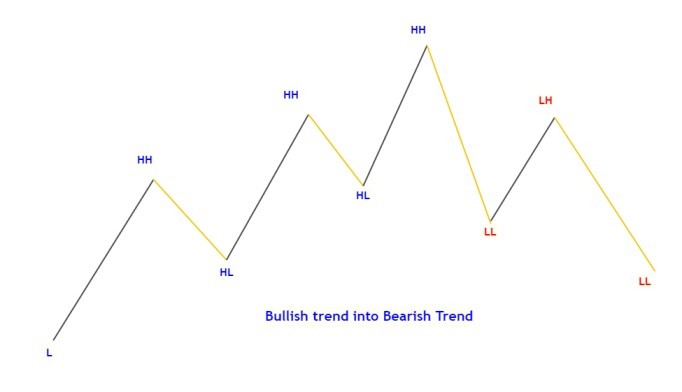

The formation of lower low and lower high after three consecutive higher highs and higher lows in the market indicates a bullish trend reversal.

if the market is in a bullish trend and it forms a pattern like explained below in the image, then it is a sign of the change of trend.

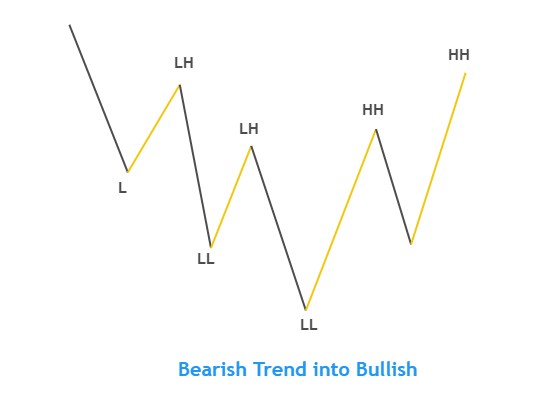

A bearish trend reversal means the formation of higher high and higher low after three consecutive lower lows and lower highs in the market structure.

Trend reversal trading strategy

I will show you a live example of a bearish trend reversal in the EURJPY currency pair on a weekly timeframe.

Price is forming Lower lows and lower highs consecutively in the EURJPY currency pair. The last high was in the month of March. Price has made four lower lows and three lower highs. In June 2019, the price has broken the last lower high. It means the price is going to reverse its bearish trend into bullish. The downtrend is about to end.

Trendline breakout with a big bullish candlestick also indicates a trend reversal. After trend reversal, we will look for buy opportunities on the chart and will open a buy trade according to a specific trading strategy.

This is the best strategy to predict the trend and trade the trend.

Now you will be able to do trend analysis in every setup or analysis before placing an order. Don’t forget to do trend analysis every time before placing a trade.

Conclusion

Trading with trends is a vital part of technical analysis. because we have to trade with the banks or trends created by banks/institutional traders. if you will trade against the trend then you will lose in most trades. In technical analysis, the first step to analyze a currency pair is to do higher high and lower highs analysis. I will recommend you to do trend analysis on daily timeframe candlesticks and then trade in the direction of the trend on lower timeframes.

Always Trade With Trend

forexbee

THANKS A LOT FOR THE BEST EXPLANATION

Bro help me to download the higher and lower low pdf.

Or send the PDF to me directly in my Gmail

Thank you so much for all of best informations shared here, sir.

Thanks

Thanks. Very grateful.

Thanks so much. That really go a long way.