Definition

The 5th wave in trading is the final and longest wave in a trend that typically emerges at the end of a price trend and forecasts a trend reversal. It is characterized by the formation of higher highs and lower lows, often resulting in a stop loss hunting pattern. This wave signifies the potential end of the current trend and the beginning of a new direction in the market.

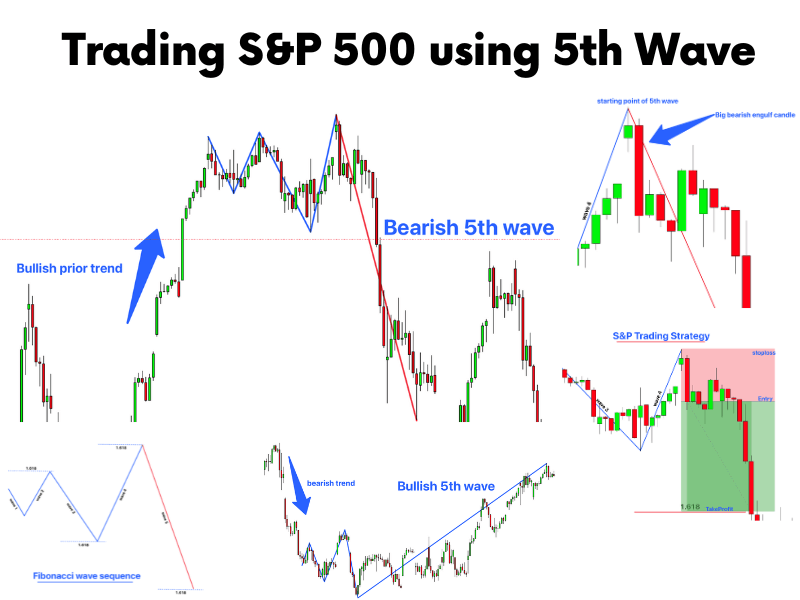

In this article, I’m going to break down the natural sequence of waves in trading, with a special focus on the importance of the 5th wave. I’ll show you how this pattern can help you make money in the market, especially with the S&P 500. But remember, this pattern works in other markets too. So, be sure to read the whole article to understand how to use the 5th wave in your trading.

Understanding the Fibonacci Sequence and Waves in Trading

In the world of trading, just like in nature, things often follow a certain sequence. This idea comes from the Fibonacci sequence, a pattern that appears in many natural elements, including the human body. This same concept applies to the markets.

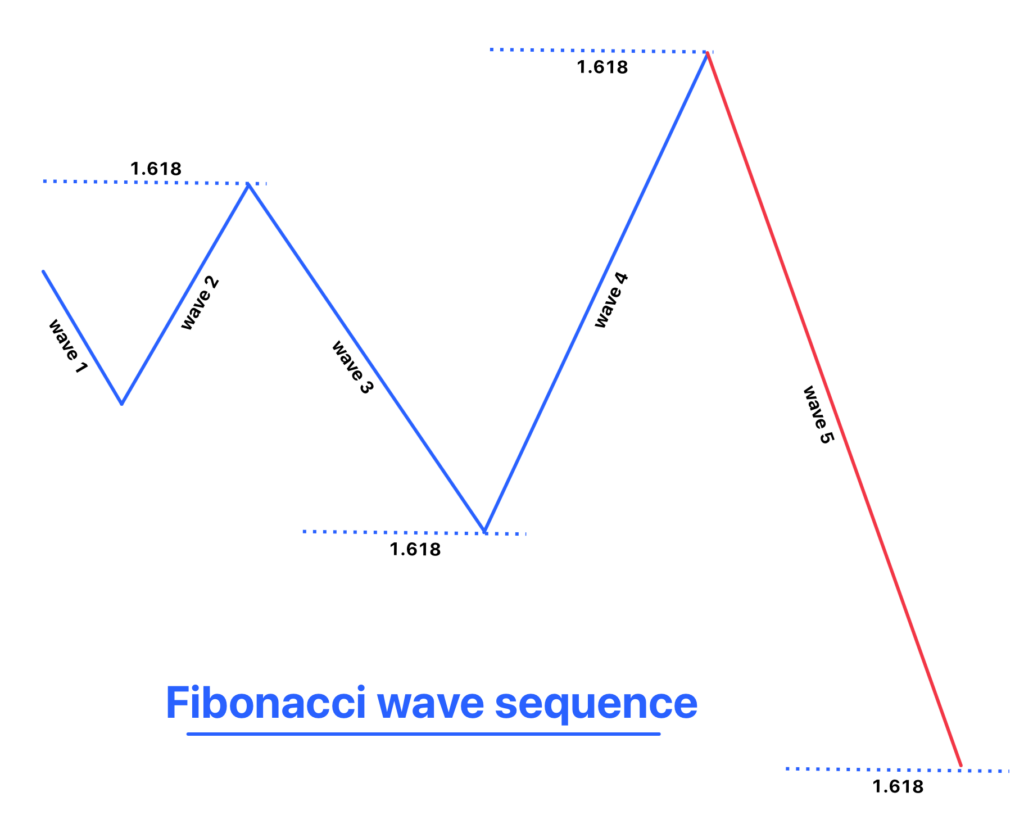

In the market, the movement of prices often follows the Fibonacci sequence, especially in broadening patterns. Here, each wave in the price pattern is related to the Fibonacci sequence and tends to be bigger than the previous one. For example, if one wave in the market is of a certain length, the next wave is likely to be 1.618 times longer, following the Fibonacci ratio.

Markets usually turn or change direction by forming these waves, which are often based on Fibonacci numbers like 3, 5, and 8. Out of these, the number 5 is particularly significant because markets tend to respect this number more often. That’s the reason behind the creation of the 5th wave trading strategy.

Importance of the 5th Wave in Trading

In trading, understanding the strategies of market makers is crucial for success. Market makers are the big players who drive the market, and as traders, our best chance of success is to follow their lead. Going against them usually leads to losses.

The 5th wave pattern is one such strategy used by market makers, often for stop loss hunting. At the end of a trend, you’ll notice the price making higher highs and lower lows. This is not random; it’s a deliberate move to create more liquidity in the market. Market makers need a lot of buying and selling activity (liquidity) for larger price movements.

Here’s how it works:

- When the price hits higher highs, it attracts more buyers.

- Then, as the price drops to lower lows, it brings in more sellers and shakes out some of the buyers.

- As the price goes up again, creating another higher high, it pulls in more buyers and pushes out previous sellers.

This cycle of creating higher highs and lower lows without a clear trend is a method of stop loss hunting. It effectively brings more traders into the market, building up the liquidity that market makers need for their significant moves. Most often, this happens on the 5th wave of the price, in line with the Fibonacci sequence, making this wave particularly important for traders to watch and understand.

Types of 5th Wave in Trading

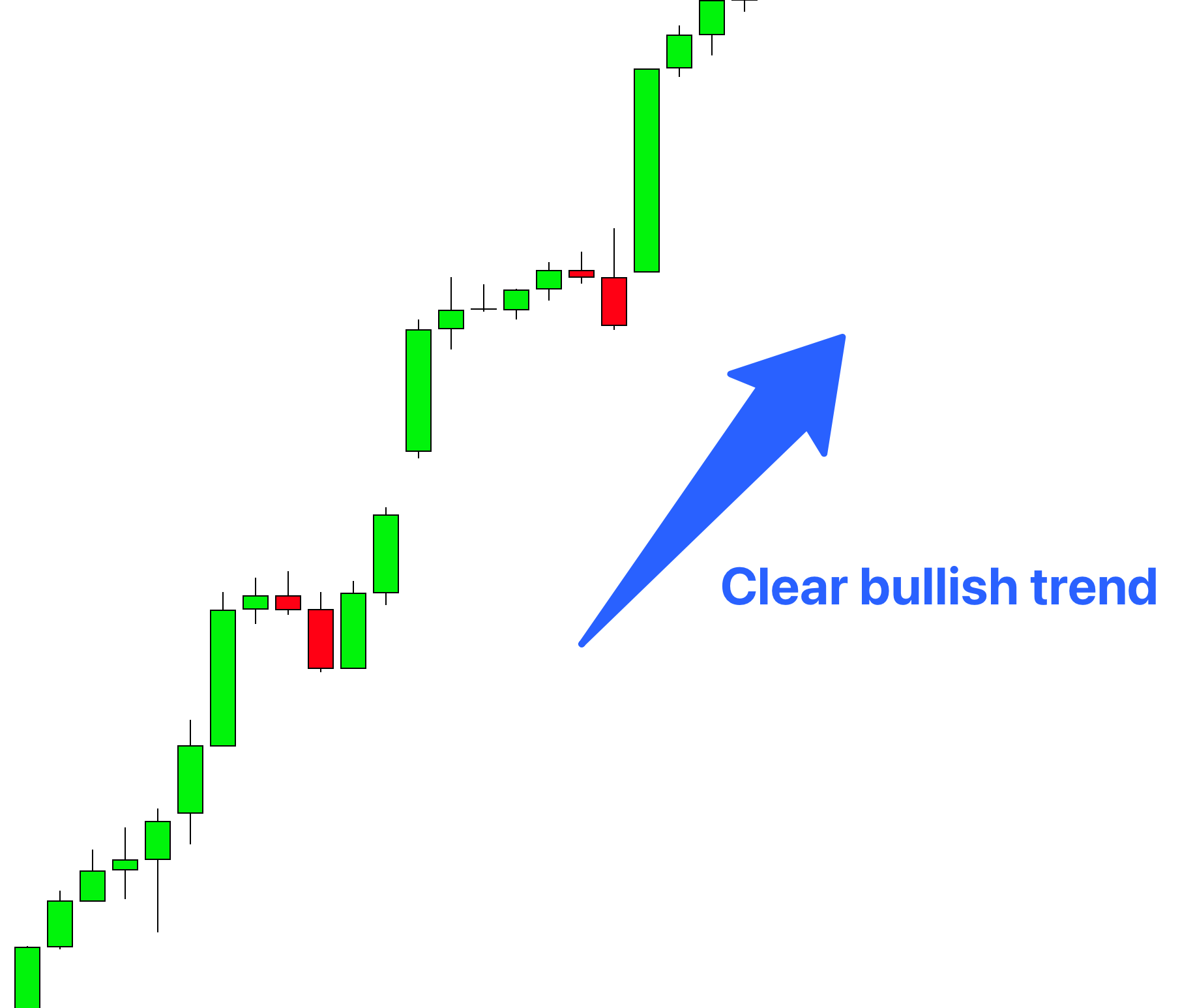

In trading, the 5th wave can manifest in two main types, depending on the prevailing market trend. These are the bullish 5th wave and the bearish 5th wave:

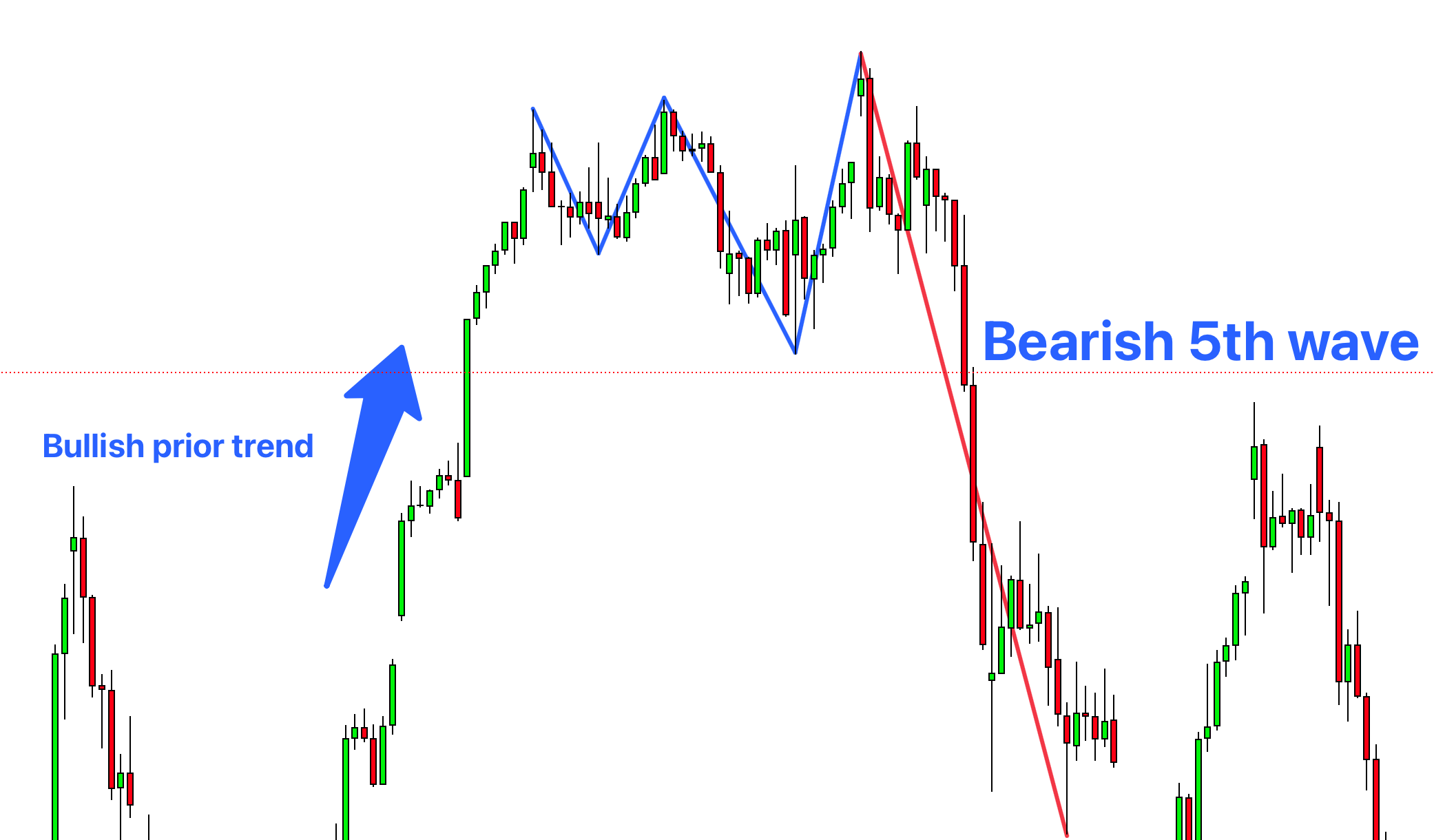

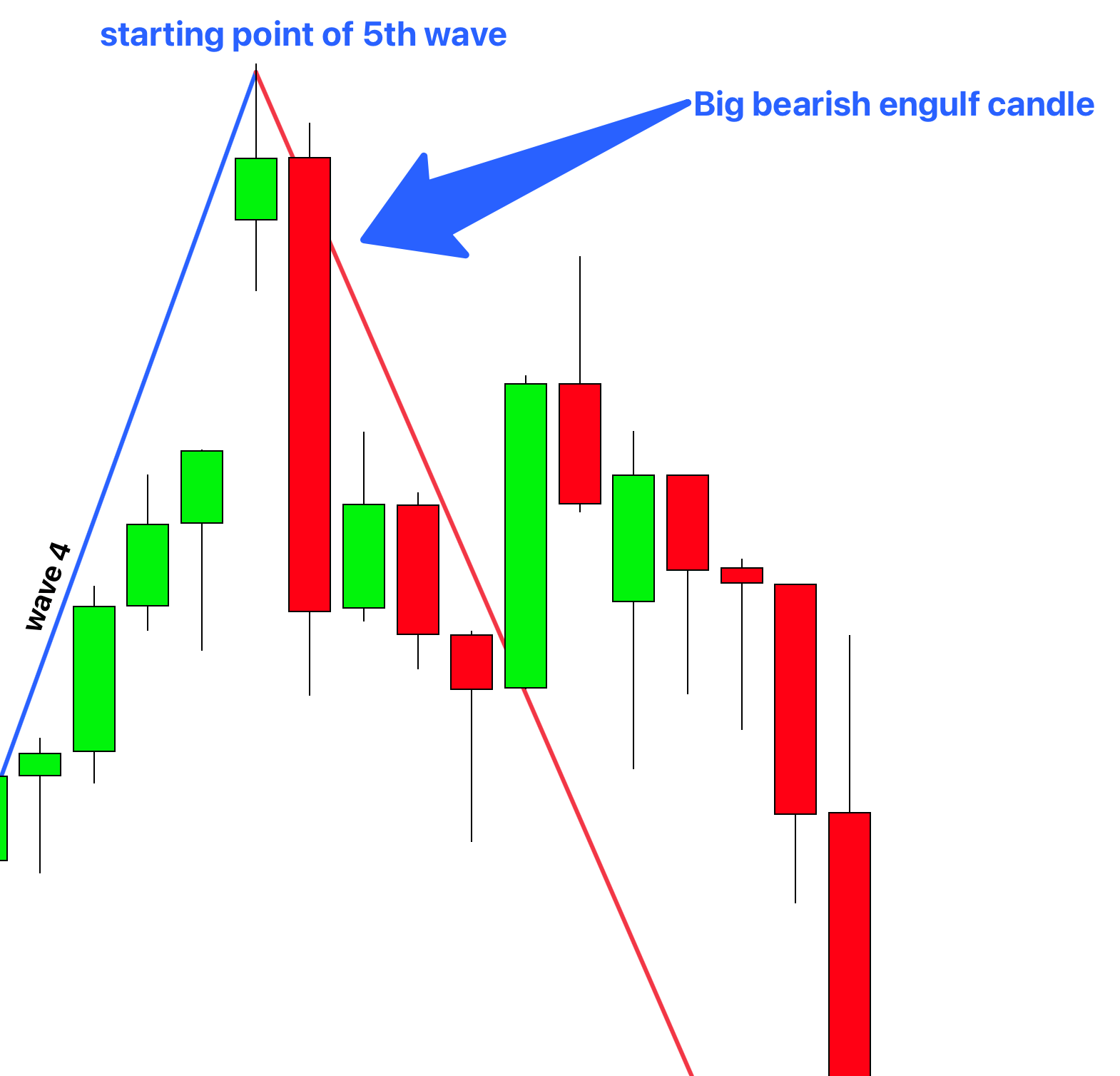

- Bearish 5th Wave:

- This type of 5th wave occurs at the end of a bullish trend.

- When you see a broadening pattern forming after a period of upward trend, the 5th wave that follows is typically bearish.

- It indicates a potential reversal from the bullish trend to a bearish trend.

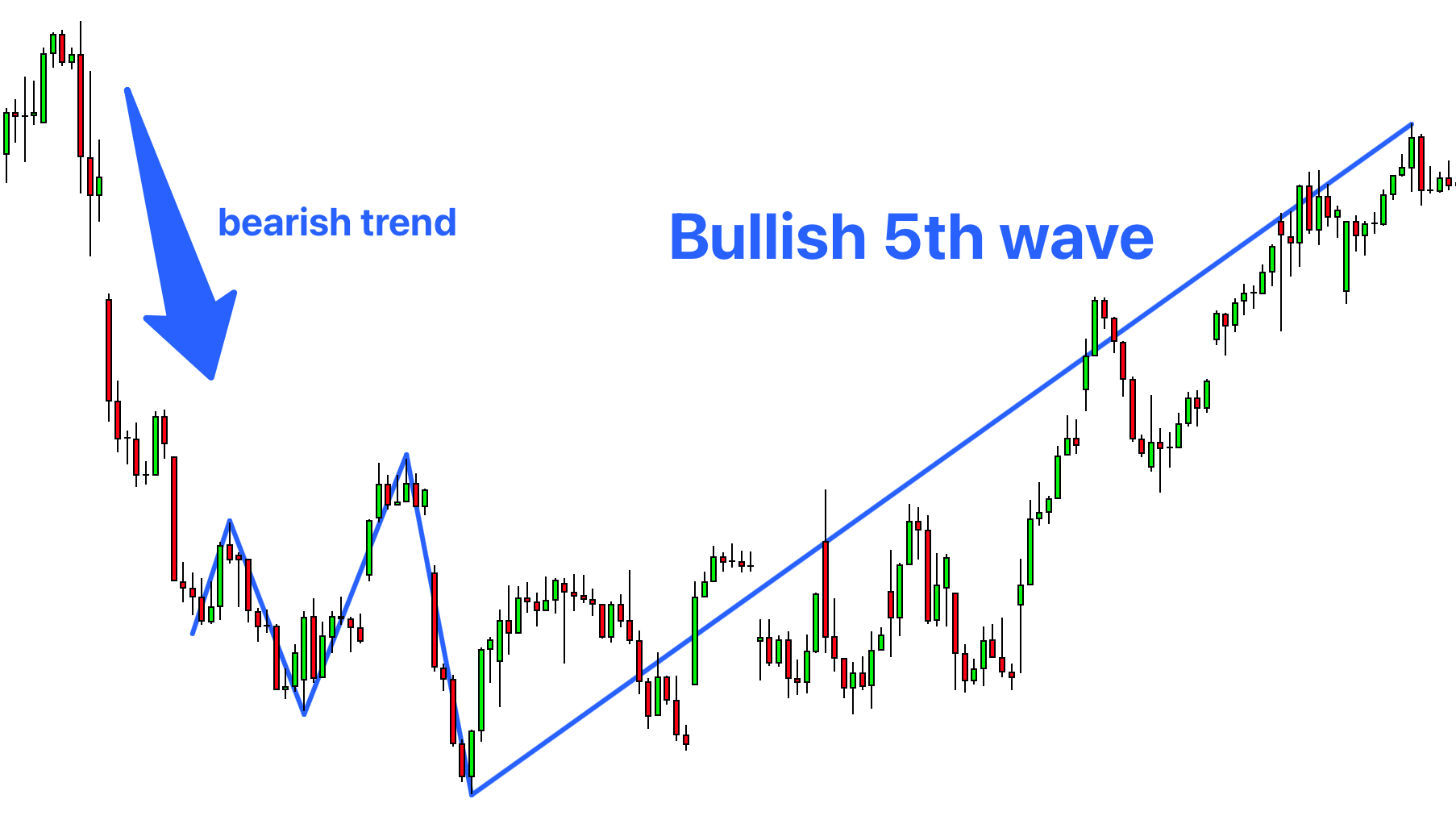

- Bullish 5th Wave:

- Conversely, a bullish 5th wave takes place at the end of a bearish trend.

- Here, if a broadening pattern develops following a downward trend, the 5th wave is likely to be bullish.

- This signals a shift from the bearish trend to a bullish trend.

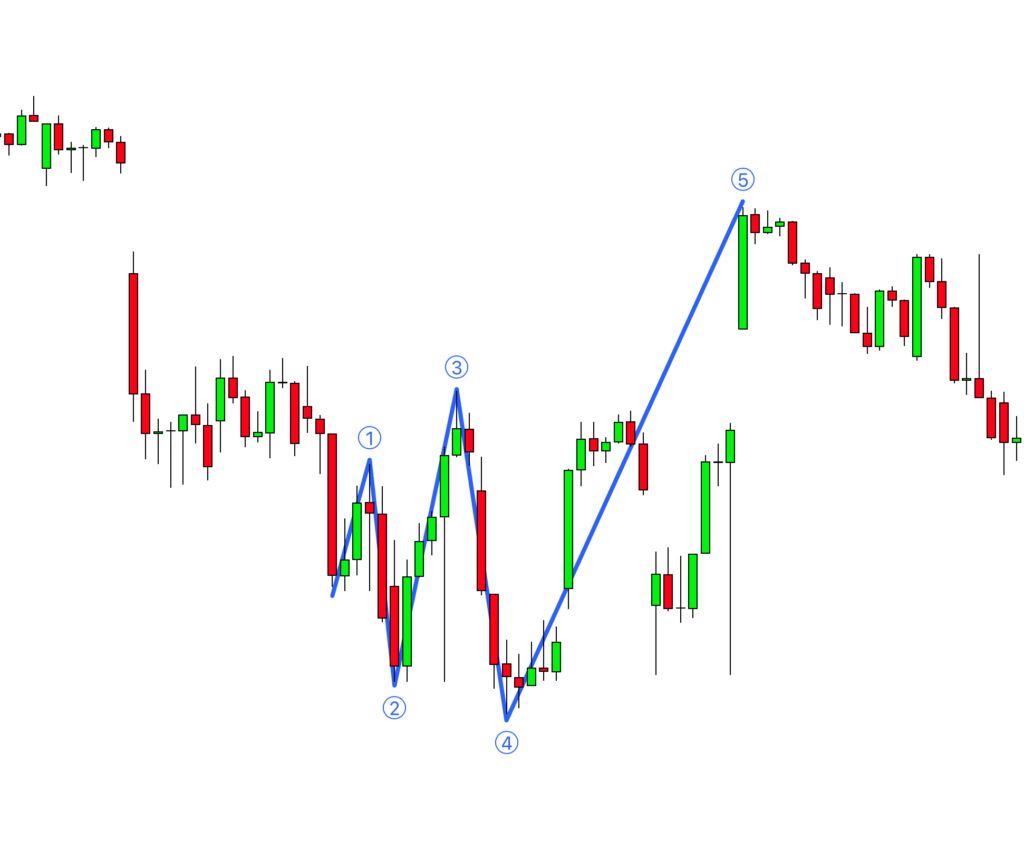

How to start wave counting?

Counting the waves in a broadening pattern, especially for identifying the 5th wave, can indeed be challenging initially but becomes more intuitive with practice. Here’s how to count the waves based on the prior trend direction:

If the Prior Trend is Bullish:

- Wave 1: Identify a small bearish wave as wave 1.

- Wave 2: Look for a bullish wave larger than wave 1, making a higher high.

- Wave 3: This is a bearish wave, bigger than wave 2, and makes a lower low.

- Wave 4: A bullish wave that creates a new higher high, larger than wave 3. The end of this wave can be determined by applying Fibonacci retracement to wave 3 and identifying reversal patterns.

- Wave 5: The final wave, which is larger than all previous waves, completing the pattern.

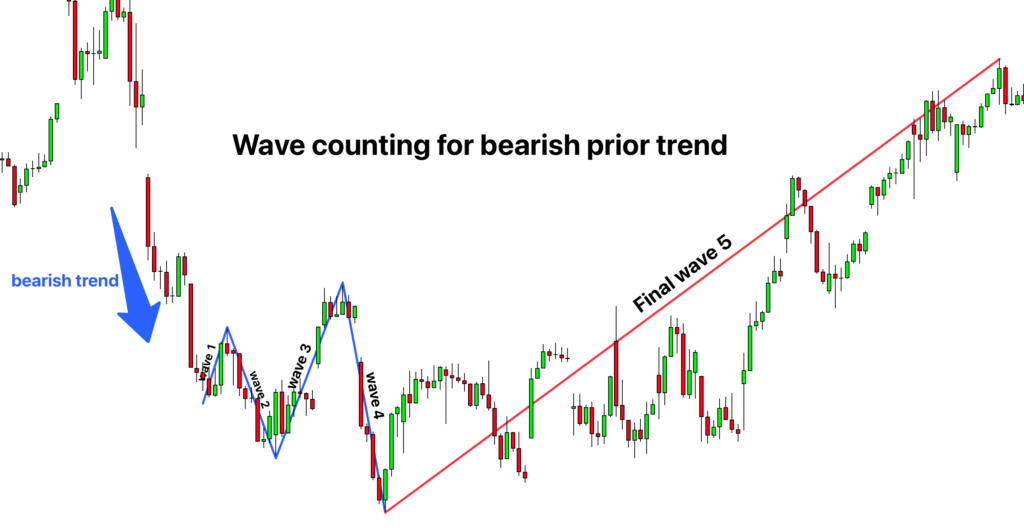

If the Prior Trend is Bearish:

- Wave 1: Start with a small bullish wave.

- Wave 2: Followed by a bearish wave that’s larger than wave 1, making a lower low.

- Wave 3: A bullish wave, bigger than wave 2, creating a higher high.

- Wave 4: A bearish wave that goes lower than wave 3, but is larger in size. Similar to the bullish trend, use Fibonacci retracement on wave 3 and look for reversal patterns to determine the end of wave 4.

- Wave 5: The last wave, exceeding the size of all previous waves, signals the completion of the pattern.

In both cases, the key is to observe the size and direction of each wave relative to the preceding one, ensuring each successive wave is larger and continues the broadening pattern.

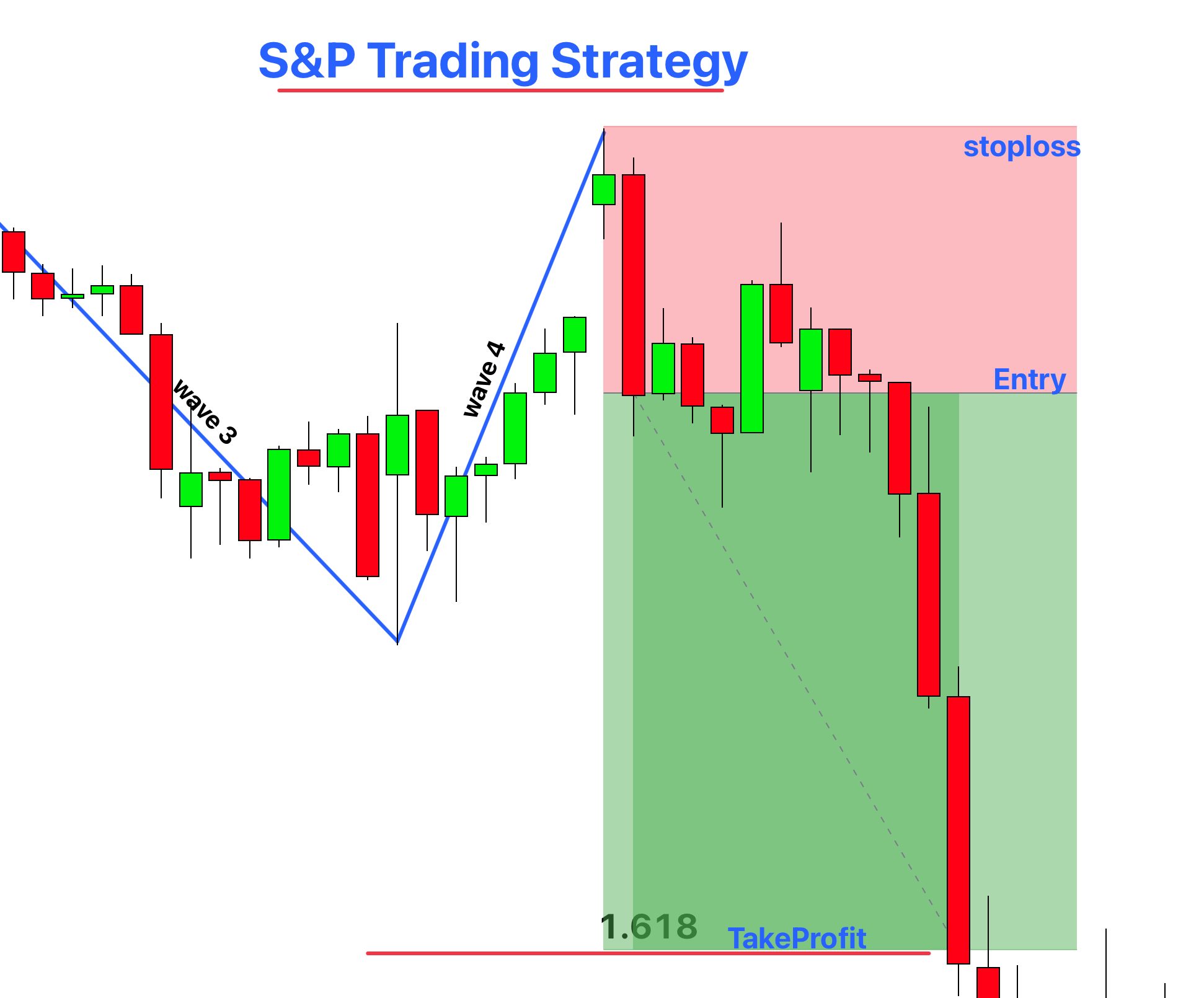

How to Trade the 5th Wave Pattern in S&P 500

Trading the 5th wave pattern in the S&P 500 isn’t just about spotting the pattern itself. It involves looking for multiple factors or ‘confluences’ that come together to create high-probability trade setups. Here’s what to look for:

- Check the Prior Trend of the Broadening Pattern:

- The trend leading up to the broadening pattern should be clear and impulsive, not just a retracement or a choppy market.

- This impulsive wave is important because it shows the exhaustion of buyers or sellers in the market, setting the stage for the potential reversal that the 5th wave indicates.

- Examine the Starting Point of the 5th Wave:

- The beginning of the 5th wave should show signs of a trend reversal. This could be in the form of reversal candlestick patterns or recognizable chart patterns.

- These signs are critical as they provide the initial confirmation that the market might be changing direction.

- Ensure Clear Wave Count:

- The wave count should be clear and unmistakable. If you’re finding it difficult to count the waves or if the pattern seems ambiguous, it’s better to avoid trading that setup.

- With practice, ideally after analyzing this pattern at least 100 times, you’ll become more proficient at identifying and trading the 5th wave pattern accurately.

- Opening the Order:

- Place your order at the confirmation of a reversal. This confirmation could come from a reversal candlestick or a chart pattern that indicates the start of the trend reversal.

- The confirmation is crucial as it signifies the potential start of the new trend predicted by the 5th wave pattern.

- Setting the Stop Loss:

- Your stop loss should be placed strategically to minimize potential losses. A good rule of thumb is to set it just below the low of a previous key level or below the identified chart pattern.

- This placement helps protect your trade from normal market fluctuations while still allowing for the anticipated movement.

- Measuring the Take Profit Level:

- Use the Fibonacci tool to measure your take profit levels. Draw the Fibonacci retracement levels on the 4th wave.

- Split your trade into two parts. Close the first part of your trade at the previous high/low of the 4th wave. This ensures you secure some profits from the initial market movement.

- For the second part of your trade, aim to close it at the 1.618 Fibonacci extension level. This allows you to maximize profits by capitalizing on the full potential movement of the market.

By following these steps, you can trade the 5th wave pattern in the S&P 500 more effectively. This structured approach helps in maximizing potential gains while minimizing risks, ensuring a balanced trading strategy.

Risk management table

When trading the 5th wave pattern, especially in the context of the S&P 500, having a solid risk management plan is essential. Here are some key points to consider:

| Risk Management Aspect | Recommendation |

|---|---|

| Risk Per Trade (Small Account) | For accounts below $10,000: Risk 2-3% of account balance per trade |

| Risk Per Trade (Large Account) | For accounts above $10,000: Risk 1-2% of account balance per trade |

| Optimal Timeframes | 1H, 4H, and D1 |

| Use of Compounding | Apply compounding to reinvest profits and grow account balance |

Backtest results

Here are some backtest results showing that how 5th wave can be a game changer strategy for S&P 500.

Conclusion

Forecasting the future in trading is no easy task; the markets are unpredictable and no one truly knows what will happen tomorrow. However, there’s a rhythm and sequence in nature that, when applied to trading, can offer us valuable insights.

By using these natural patterns, like the 5th wave strategy, we can significantly improve our chances of success. These patterns often lead to a high success rate in predicting market movements. You too can find success in trading, not just with the S&P 500 index but in other financial assets as well, by applying the 5th wave strategy and understanding its natural sequence.

A super vote of thanks to Ali Muhamad! I found more content here than anywhere else I looked, including books on Amazon. There are very good YouTube videos but it is very helpful to have a book to thumb through! Would you recommend a good book. Or do you have a pdf available?

Once again, many thanks for excellent work and instruction!