Key levels are the most important part of technical analysis in forex. In this article, we will learn about the psychology behind the key levels in forex as well as to identify perfect key levels and a few confluences before deciding about a key level. I will not make it complex for you. I want to keep it simple and you will learn a simple technique using the Doji candle to draw key levels instead of scrolling left in the history of the chart.

What are key levels in forex?

Key levels are psychological levels which are under the attention of a lot of traders. There is a lot of buying or selling pressure at these levels. At these key levels, price decides its direction either to go bearish or bullish. As most institutional orders are placed before time so most often they place their orders at key levels. Because a good key level can turn the price. By using more technical analysis techniques, we can refine good key levels and the probability to win will increase. Trade with the flow only instead of fighting with them.

How to draw Key levels in forex

There are two types of key levels in technical analysis. I’m not going to tell you about support and resistance zones here.

- Key resistance level

- Key support level

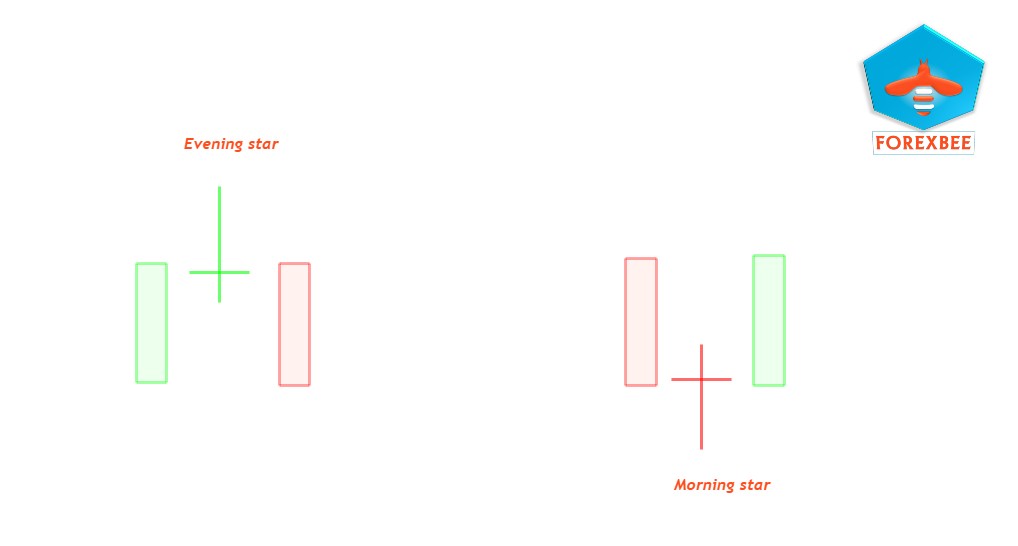

There are many ways to draw a key level. On many forums, you will learn to scroll left in the history of a currency pair and find out a key level by just guessing a level that has more rejections. But this is not a method. Complexity is the reason for most traders to fail in trading forex. Without any proper rules, you will not be able to identify a key level. Instead of identifying the best key level, many psychological thoughts will come into mind. So I have found out a technique using the evening star and morning star candlestick pattern. The evening star candlestick pattern consists of three candles

- Big Bullish candle

- Small body candle

- Big bearish candle

Price action key levels in trading

Let me tell you about the rules of the perfect evening star or morning star pattern. Morning star is its opposite pattern. You can relate this to Drop base rally or Rally base Drop as supply and demand concepts. Now the rules here are as follows

- The first big candle should have a body-to-wick ratio greater than 70%. Simply it must have a larger body than its wicks

- The second candle must be a Doji candle and the Doji candle should close within the first candle. Doji candle should not be within the range of the first candle. Like it should not be inside bar candle. This is the most important rule.

- The third candle also should have a larger body.

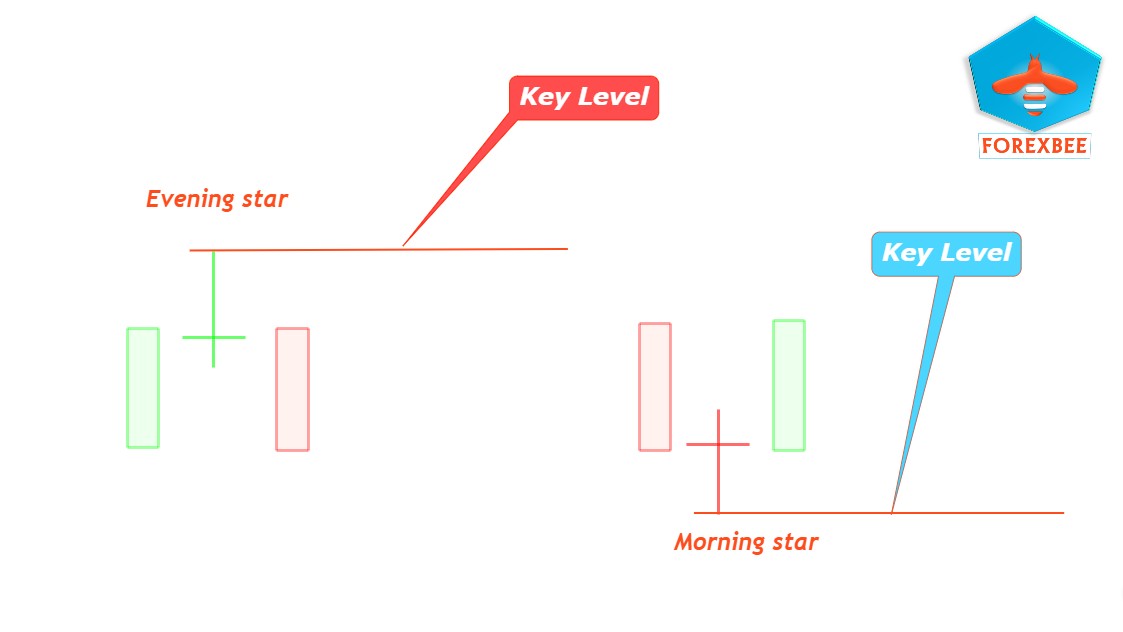

Key resistance level

High of the Doji candle will act as Key resistance Level In the case of an evening star pattern.

Key support level

Low of the Doji candle will be called a key support level in the case of a morning star.

Let me clear a confusion that key levels are just lines not zones. We will draw an exact price level in case of key levels. These are not zones. Every trader has his own perspective but according to my experience key level is the exact price where market reaction decides its direction. Let’s see in the live chart.

How to trade price action Key Levels?

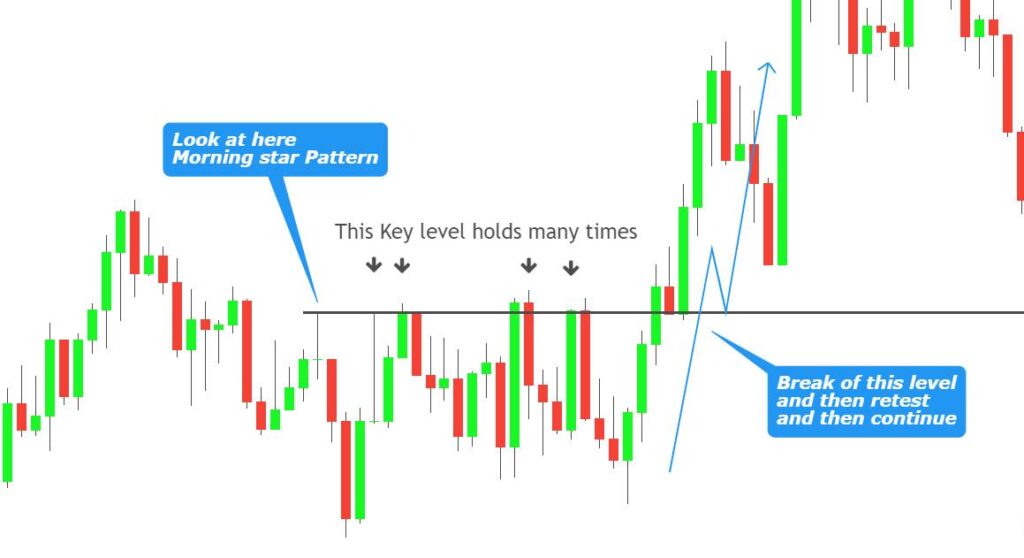

This was a simple strategy to draw a key level. Now, let’s discuss the confluences we should watch before trading a key level. Forex is a business of probabilities that’s why confluence with any trade setup is necessary.

- Trade the key level only with the trend

- Sell at this key level when the price is overbought and Buy from the key level when the price is oversold.

- Try to catch recently made key levels

- Stay in the same timeframe

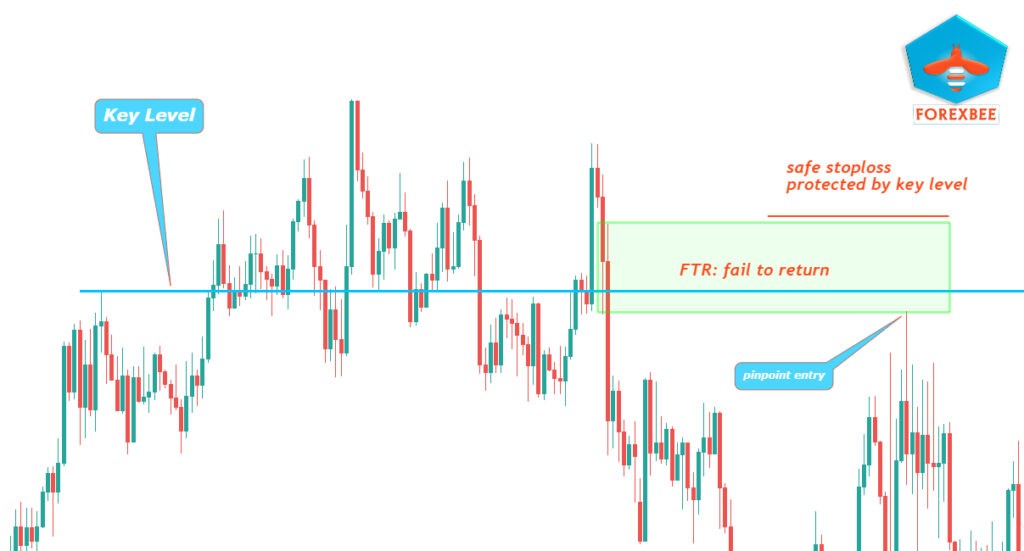

Key Levels can only be traded with a strategy. For example, if you are trading supply and demand strategies then you should use key levels for a trade entry point. For example, a demand zone at a key level has a much high probability of winning. In the chart above FTR (fail to return) hold well which was a key level. Stoploss was also safe because it was above a strong key level. These are advantages of key levels. it is a necessary tool for technical analysis in forex trading.

In Forex Success Comes Overnight But After Several Years of Hard Work.

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4. Join Telegram to get trade ideas free.

Thanks

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.

I read this paragraph completely regarding the

difference of newest and earlier technologies, It’s amazing article.

Thanks a million

In the first two actual charts that you’ve shown (just before the section titled “How to trade price action Key Levels?”), I believe what you’ve labeled as “Morning Star” is actually be labeled an Evening Star.

Thanks for a great article.

Thank boos I just come across your website today

Hello sir, what is this key levels ,I it an area of support and resistance? If yes do we enter the trade after the market has reached key level?