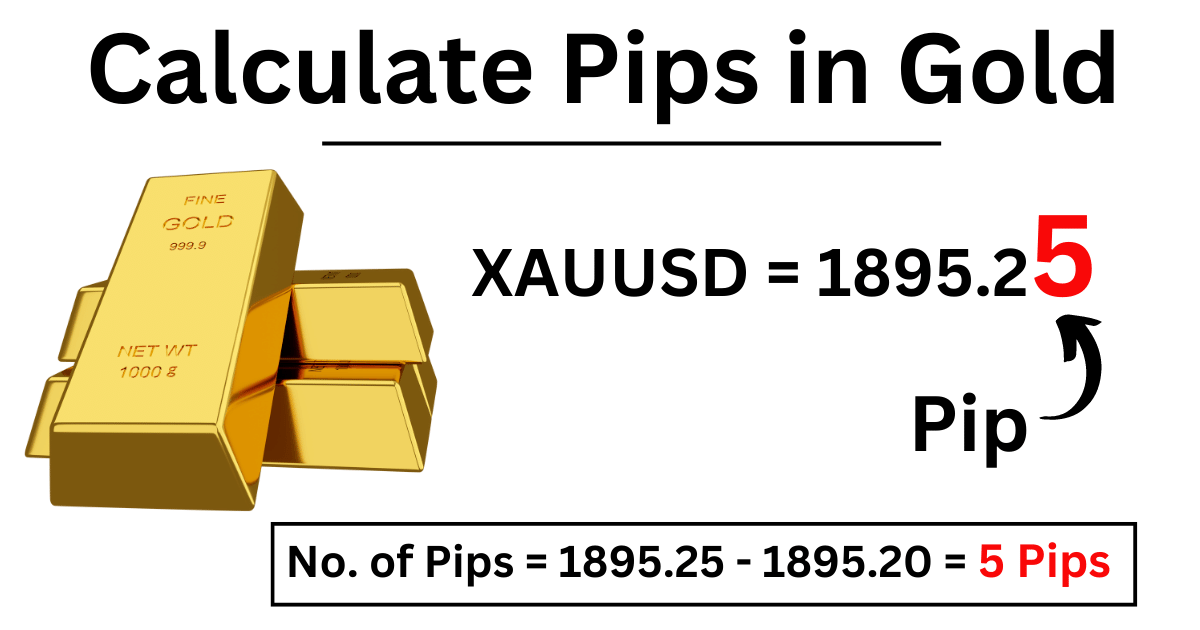

What does 1 pip mean in Gold?

A pip is the smallest incremental value one can observe while trading. In gold trading, the smallest change while trading in Gold is $0.01.

Gold is a valuable metal present on the planet Earth, and its trade volume is huge across the globe.

As it is a metal, an incremental change in gold trading can be calculated on the basis of its weight, which is usually measured in ounces and grams.

Most brokers across the globe offer a two-position decimal system instead of the four-decimal system traditionally employed in forex trading.

In the case of Gold,

One pip = $0.01

100 pip = 1 $

Calculate pip value in XAUUSD.

To calculate pips value in Gold, one needs to know the following three things,

- Contract size

- Pip

- Current gold price

To put above -mentioned things in a formula, one needs to understand the following questions.

What is a contract size?

“A contract size is the asset volume or the amount a trader is willing to trade in a single trade.”

For example, one standard contract size will contain 100,000 base currency units if you are trading in forex.

As mentioned above, we use the weight as a measuring factor in the case of Gold. Thus, a contract size will be the proposed weight of the Gold in ounces. Typically a standard gold contract size contains 100 ounces. One ounce is equal to 28.349 grams. Thus, a standard gold contract size in grams will be 2834.95g.

What is a pip?

A pip is the smallest incremental value in trading. In the case of Gold, one pip is equal to $0.01.

What is the current gold price?

Gold trading occupies a major place in world trading, and its price rigorously fluctuates with the passage of time. The current gold price will be calculated at the time of execution of the trade.

Now we are in a position to calculate the pip value in XAUUSD. To calculate the pip value, we use the following formula.

Pip value = (size of contract x one pip) / current price How much is 1 pip in Gold?

A pip in Gold is different from currencies like forex trading. Brokers offer a two-decimal position size for a typical gold pip. The minimum or smallest change in the gold value can be observed in an amount in the case of XAUUSD, which is $0.01.

So,

One pip in gold trading = $0.01

100 pips in gold trading = 0.01/ 100

= $1

*1 dollar contains 100 cents

Example 1

If you are trading a standard contract size of Gold which is 100 ounces, and the current gold price is $2020 per ounce. The change of one dollar in the gold price will result in a 100 pip increase or decrease.

In order to calculate the pip value for the above-mentioned case,

| Size of contract = 100 ounces Pip = $0.01 Current price = $2020 So, Pip value = (100 x 0.01) / 2020 = 0.0004950 per ounce |

Example 2

If you are trading, a contract size of 50 ounces and the current gold price is $1850. We can calculate pip value as,

| Size of contract = 50 ounces Pip = $0.01 Current price = $1850 Pip value = (50 x 0.01) / 1850 = 0.000270 per ounce |

Gold Position size calculator

A gold position size calculator is a tool that a XAUUSD trader can use to calculate his/her position size while executing a trade.

A typical gold position size calculator uses the following information to calculate the position size.

- XAUUSD instrument

- Deposited currency

- Current open price

- Stop loss price

- Account size

- Risk percentage

By providing the above-mentioned data, one can calculate the position size.

One may use the following formula to calculate the position size for Gold manually.

Position size in Gold = (account size x risk %) / (pip value x stop loss)Conclusion

Gold occupies a huge trading volume, as nearly 27 million ounces of Gold is traded daily. One pip in gold trading equals $0.01, as it is the smallest change in an XAU trading world. Understanding the pips in gold can remarkably affect your future profits and losses.