In this portion, we will be studying what lot size is and how we can use it in Forex.

What is Lot Size?

Definition: The amount or quantity of a particular product requested to be manufactured on a specific date for delivery is called lot size.

For example, when you buy bananas, you tell the shopkeeper to give you one dozen bananas. He gives you 12 bananas. So one lot (dozen) of bananas contains 12 bananas.

What is Forex lot size?

A Forex trader usually buys or sells currency in the form of a specific unit called a lot. So we can say that ‘Lot’ is the unit of trade in Forex.

As a Forex trader, when you place an order on a Forex platform, that order is placed in the size quoted in lots.

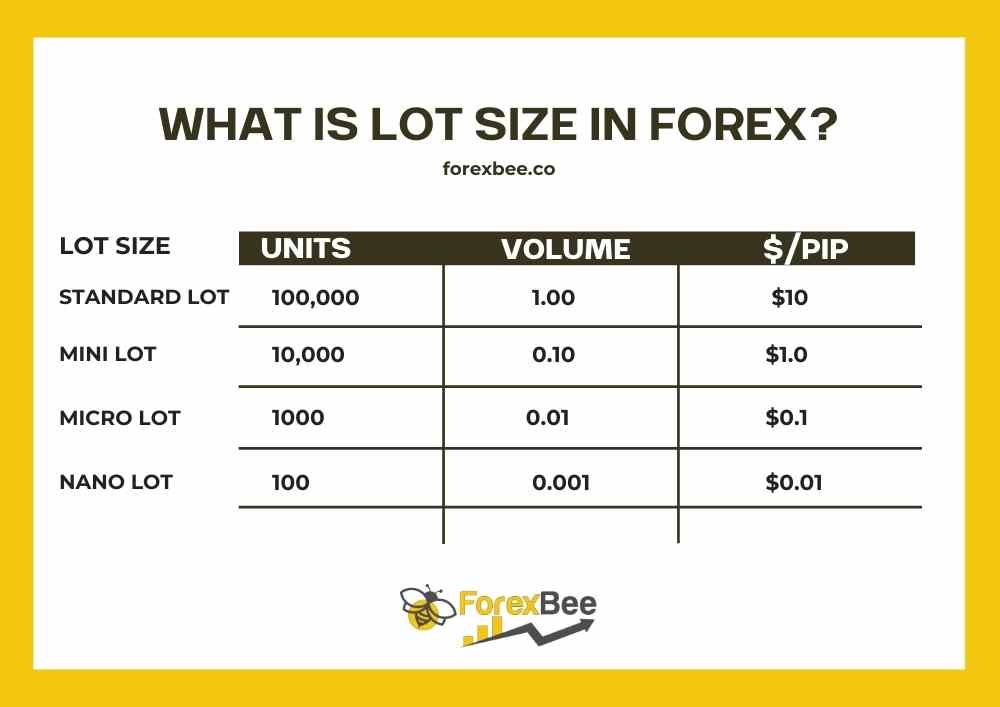

There are four types of lots in Forex. The standard lot contains 100,00 units of currency.

There are other types of lots as well named mini, micro, and Nano lots.

What is a mini lot in Forex?

A mini lot is equal to 10,000 units of the base currency in currency pair and is one-tenth in quantity compared to standard lot size.

When an investor trades a mini lot, he will buy or sell 10,000 units of the currency pair’s respective base currency. For example, in GBP/USD currency pair, when an investor trades a mini lot, he buys or sells 10,000 GBP.

What is a micro lot in Forex?

In a forex trade, 1,000 units of the base currency are equal to one micro lot. The base currency indicates the first currency in a currency pair, and this is the currency which a trader buys or sells in the Forex market. Micro-lots are very useful as they allow traders to trade in small increments reducing the risk.

Let’s understand a micro lot through an example.

When a trader executes an order for a micro lot, it means he will buy or sell 1,000 units of the currency pair’s base currency. For example, in USD/GBP pair, a micro lot order will either buy or sell 1,000 USD.

What is a nano lot in Forex?

A nano lot is one-tenth of a micro lot and comprises 100 units of the currency pair’s base currency.

For example, if a trader executes an order for a micro lot, he will buy or sell 100 units of that currency pair’s base currency.

It is handy for beginners. Because it minimizes the risk of capital and beginners can trade in micro-lots and improve their strategies and portfolio with time.

Now that you understand about lot sizes and what is their difference. Let’s answer some of the questions that we get asked the most.

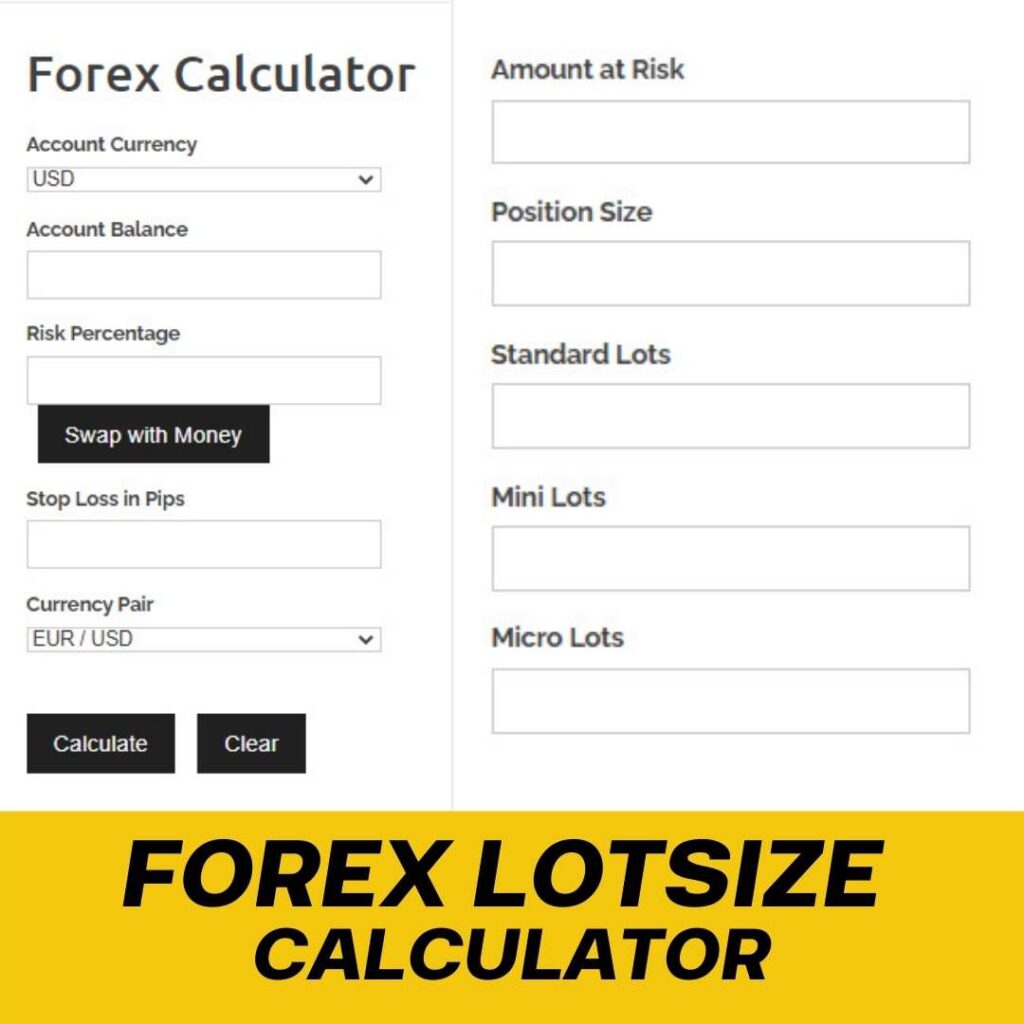

Forex Lot size Calculator:

We have added a lot size calculator. It’s very easy to use and the best thing about it is that it will calculate all types of lot sizes.

What lot size is good for $100 Forex?

To trade $100 in Forex, a 0.01 lot size is recommended. A $100 lot is also called a micro lot. Even though $100 is a small amount of capital, it is still enough to get you started trading. It would be best if you always traded by managing your risk, and for beginners, we recommend you risk no more than 2% of your investment amount.

What lot size is good for a $1000 forex account?

For a $1000 forex account, we highly recommend you to set up a stop loss of 50 pips with 1% risk so that you will be taking trade for two micro-lots. It is beneficial for you in case if your prediction goes wrong. And if your calculations were correct, you’ll be able to make some profit as well.

There is no Success without Taking Risks

I hope you will like this Article. For any Questions Comment below, also share by below links. Use Tradingview for technical analysis instead of mt4.

Thanks

Note: All the viewpoints here are according to the rules of technical analysis. we are not responsible for any type of loss in forex trading.

Healthy helpful tips in trading. Thank you so much.