The fair value gap in cryptocurrency represents the presence of imbalance zones on the candlestick chart. Price always fills those imbalance zones to keep a balance in the market. The fair value gap is also known as FVG in crypto trading.

The technical analysis of cryptocurrency is almost similar to the forex. Gaps form on the candlestick chart in crypto trading, and prices always fill those gaps. So if we identify a gap, we can also analyze the future direction of the crypto market.

In this article, I will explain the fair value gap for crypto trading, like Bitcoin, Litecoin, etc.

How to identify the fair value gap in crypto?

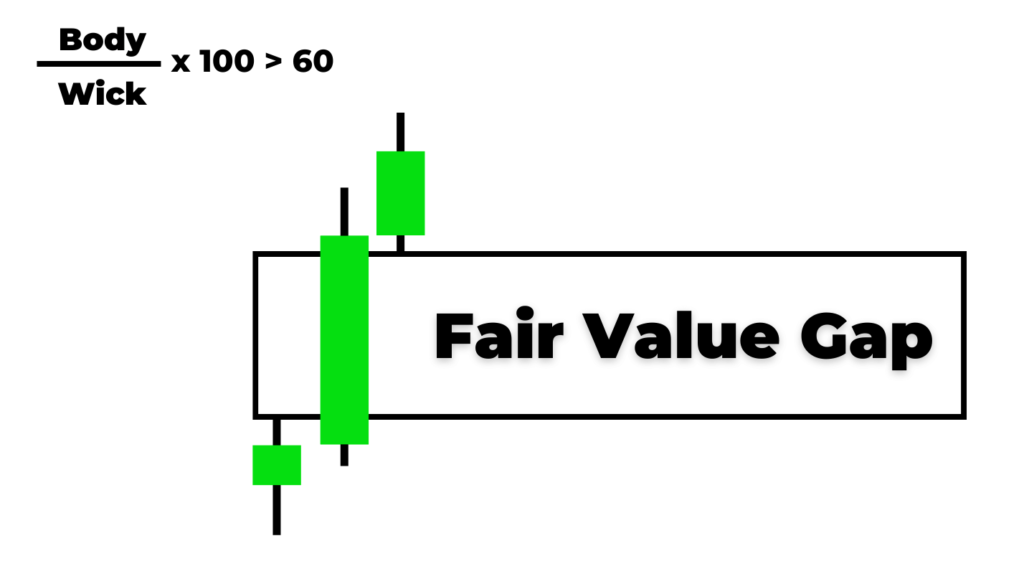

To find the fair value gap on the chart, you need to identify a big marubuzu-type candlestick. It should not be a marubuzu candlestick, but it must be a big-body candlestick.

Now follow the following steps:

- The body-to-wick ratio of big body candlesticks should be greater than 0.7, or 70% of the candlestick should be the body, and the rest of 30% should be wick.

- Now analyze the forward and backward candlesticks. The previous and forward candlesticks must not overlap the big middle candlestick.

- The wick of the previous and forward candlesticks should not overlap more than 23% from the top and bottom of the middle candlestick.

Look at the image below for a better understanding of this pattern

Type of fair value gap in crypto

Like in forex, crypto trading has two types of fair value gaps.

- Overvalued FVG

- Undervalued FVG

Overrated fair value gap

In the overrated fair value gap, the actual price of the cryptocurrency is higher than the fair value. It means that cryptocurrency is overvalued, but it should be lower in value in the backend. So to balance this, the price of cryptocurrency will decrease. This is called an overrated fair value gap.

Example 1: Overrated fair value gap in Bitcoin

This is the chart of Bitcoin, and you can see an overrated FVG. The formation of this pattern gives us a clue that there’s an imbalance in the market. And in the future, the price of Bitcoin will decrease because it’s already overrated. At some time, the market has to balance this gap.

So over time, the price of Bitcoin decreased, and the fair value gap was filled. Now bitcoin is in a balanced state.

Undervalued fair value gap

In the undervalued FVG, the actual price of cryptocurrency is lower than its fair value. It means the crypto price is lower, but it should be higher. So this creates an imbalance, and prices will increase to balance the market. It is called undervalued FVG.

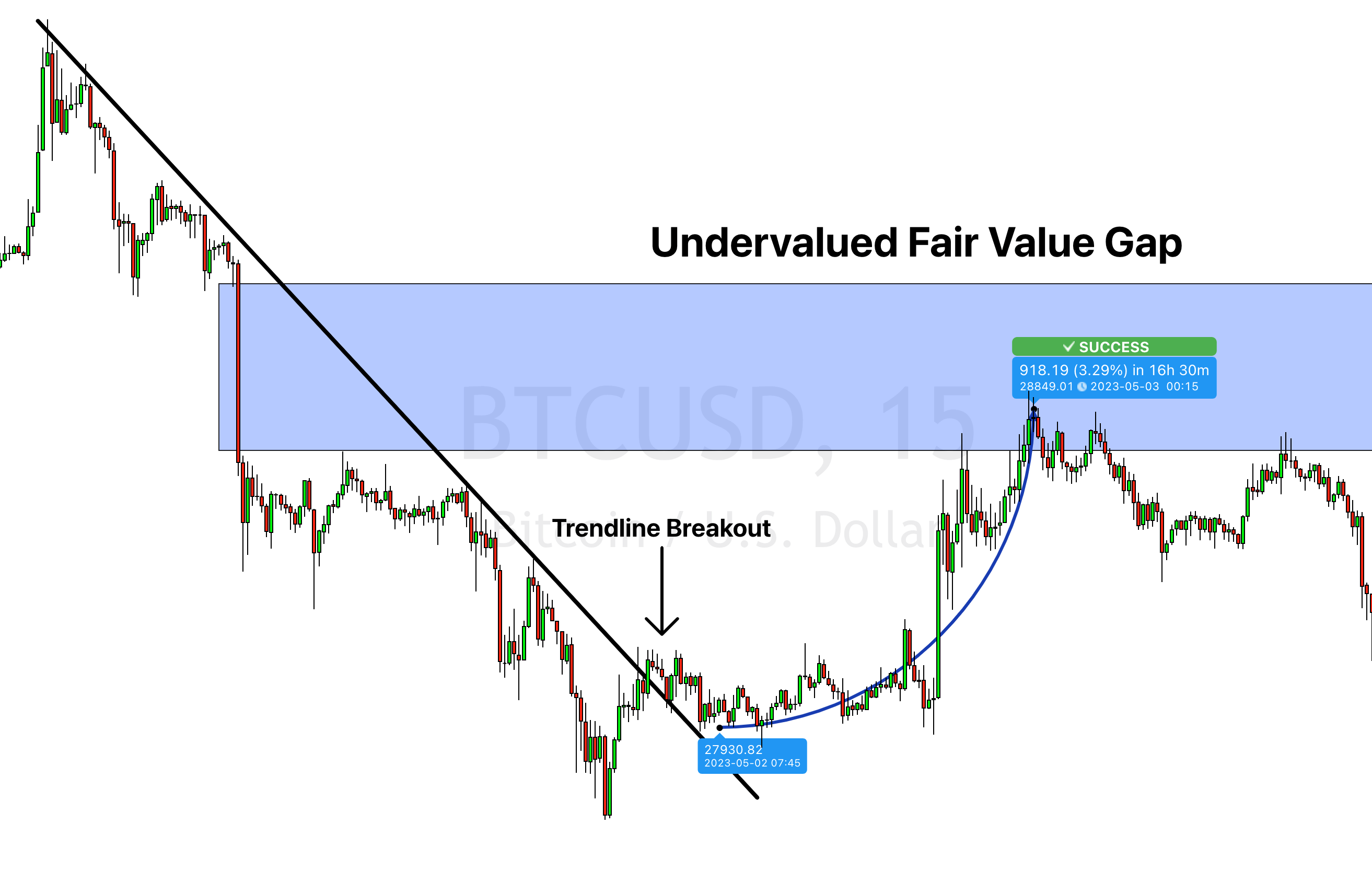

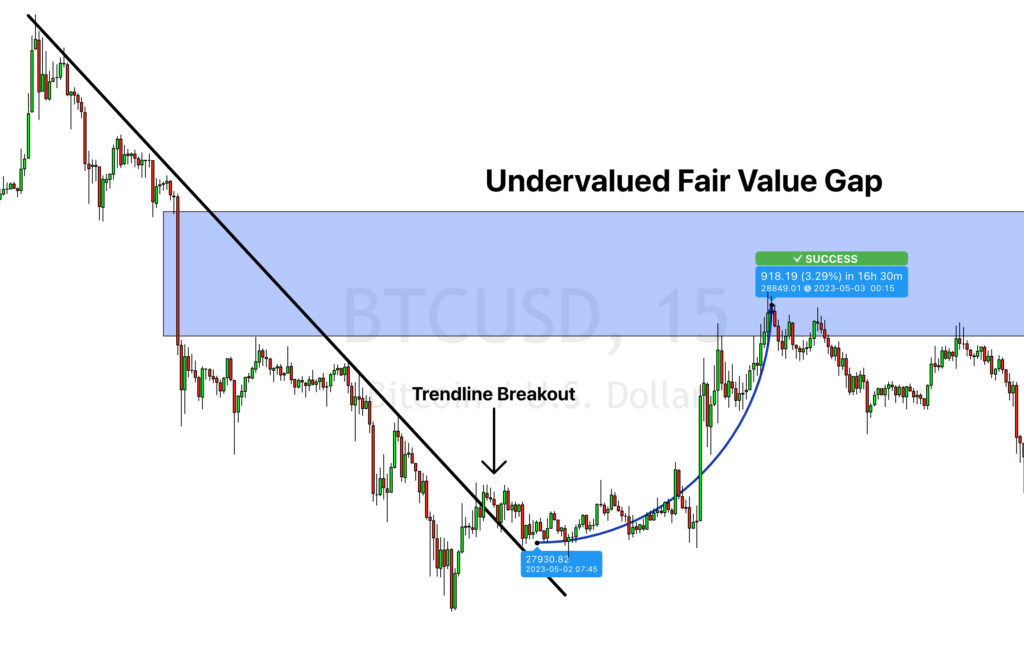

Example: undervalued fair value gap in BTCUSD

An undervalued FVG was created on the price chart in the above chart. This caused the market to return to that gap to balance the market. So after some time, the price will always reverse to fill that gap.

You can see that price reversed and returned to the undervalued fair value gap in the Bitcoin.

How far does the price go before returning to the fair value gap?

It is the most critical question that will come into the mind of most of the traders. So I will also answer in this article.

It depends. Because there are a lot of fair value gaps on different timeframes, we cannot find all the fair value gaps on different timeframes. So the price will sometimes fill the gap immediately or make a full wave or swing to fill it.

We’ll not trade the gap in price fills immediately. We’ll trade that fair value gap in which the price takes a full swing or wave to return to the zone.

The simple and straightforward method to determine when the price will return to the zone is by adding other tools like trendline breakout, support resistance breakout, or any other chart pattern that forms towards the direction of the fair value gap.

Look at the image below for a better understanding of this method.

Best timeframe to trade the fair value gap in trading

It is also the most critical question, depending on your strategy. There needs to be a more straightforward answer to this.

According to my suggestions, if you are a day trader, you should use a fair value gap on a 5M and 15M timeframe. Or, if you’re a swing trader, you should use the H1 and 4H timeframe.

I will recommend the 15M timeframe, and it’s the best for trading. You can also choose any timeframe between 5M and 15M, like 10M or 12M. This will add some uniqueness to your strategy.

To get the custom timeframes, you can use the tradingview platform.

Fair value gap indicator for crypto trading

The Forexbee team has also developed an automated fair value gap indicator to find the FVG zones on the chart and give real-time alerts. So you don’t need to sit in front of a screen waiting for the formation of FVGs, and you can also start with zero experience.

Click here to get access to the fair value gap indicator.

Conclusion

The fair value gap is the most valuable and accurate concept of technical analysis that is very helpful for a crypto trader. It can help you identify the take profit levels and find the direction of major trends.

So to get high-risk reward trades fair value gap is beneficial. On the other hand, if you’re facing a problem holding a trade longer, you should also use the concept of FVG in crypto trading.