Introduction

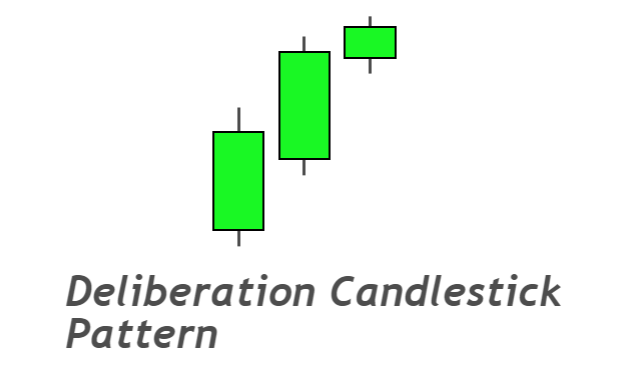

Deliberation Candlestick pattern is a trend reversal candlestick pattern made of three consecutive bullish candlesticks in a proper sequence. This candlestick pattern is also known as stalled candlestick pattern.

The deliberation pattern is like the three white soldiers to some extent, but there is a difference in the structure of candlesticks.

How to identify deliberation candlestick patterns?

Three bullish candlesticks should form in a specific sequence and structure to confirm a deliberation pattern.

Here’s the guide

- The first candlestick will be a significant bullish candlestick.

- The second candlestick must open above the opening price of the previous candlestick, and it should close above the high of the last candlestick.

- The last candlestick should have a small body and the same opening price. It can close either above the high of a previous candlestick or below the high. But it should be a bullish candlestick.

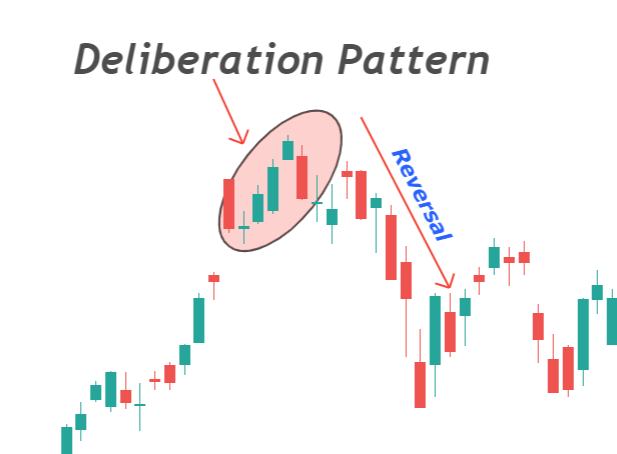

The deliberation candlestick should form at the top of the candlestick chart for better performance.

What does the deliberation pattern tell traders?

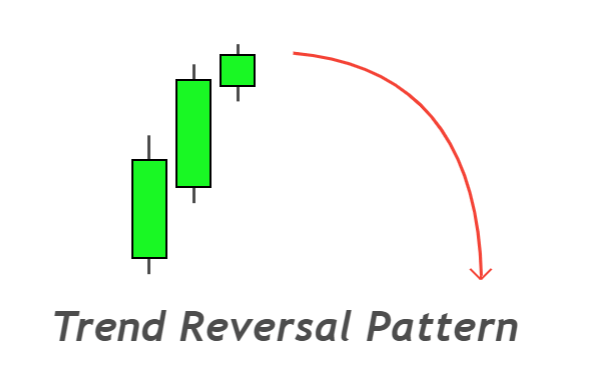

The three bullish candlesticks within the deliberation candlestick pattern indicate the momentum of buyers.

The first bullish candlestick represents the high momentum of buyers. In the next session, the momentum of buyers will decrease. In the third/last session, buyers’ momentum will significantly reduce due to the formation of a small candlestick.

This indicates that with time, the force of buyers is decreasing, and the power of sellers is increasing. In the third attempt, buyers will lose bullish momentum, and sellers will dominate the market. As a result, the price will decrease.

Deliberation pattern: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 3 |

| Prediction | Bearish trend reversal |

| Prior Trend | Bullish trend |

| Relevant Pattern | Advance block candlestick |

Best working conditions for the deliberation pattern

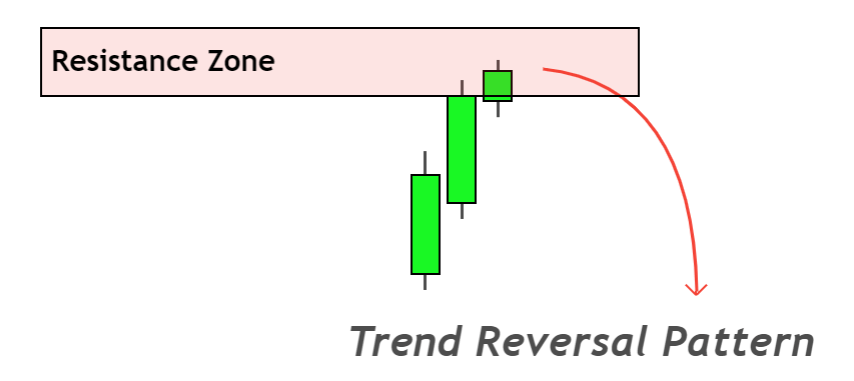

To increase the winning ratio of this candlestick pattern, you will always have to add confluences. Because every pattern is not worth trading. If you are going to sell on each candlestick pattern on a chart, you will not profit.

Here are the two confluences you can add to a trading strategy

- Resistance Zone: Forming a deliberation pattern at the support zone will turn bullish into a bearish trend. Because the confluence of both technical tools has been combined.

- Overbought region: If the deliberation pattern forms in the overbought area (RSI > 70), then the probability of bearish trend reversal will increase.

The Bottom Line

By analyzing the deliberate pattern, big traders and investors predict the future market on a higher timeframe. For example, a long-term analysis can be predicted on a weekly timeframe.

Make sure to backtest this pattern properly before trading on a live account.