Introduction

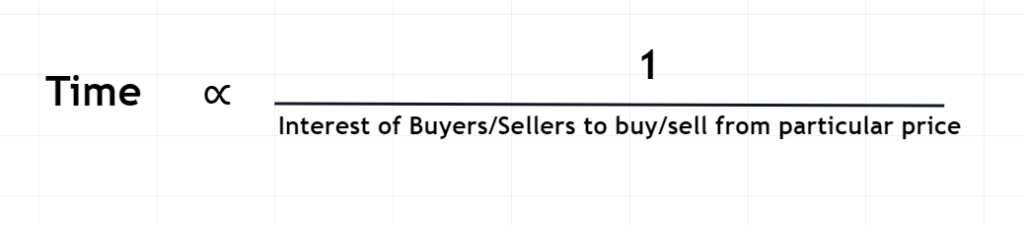

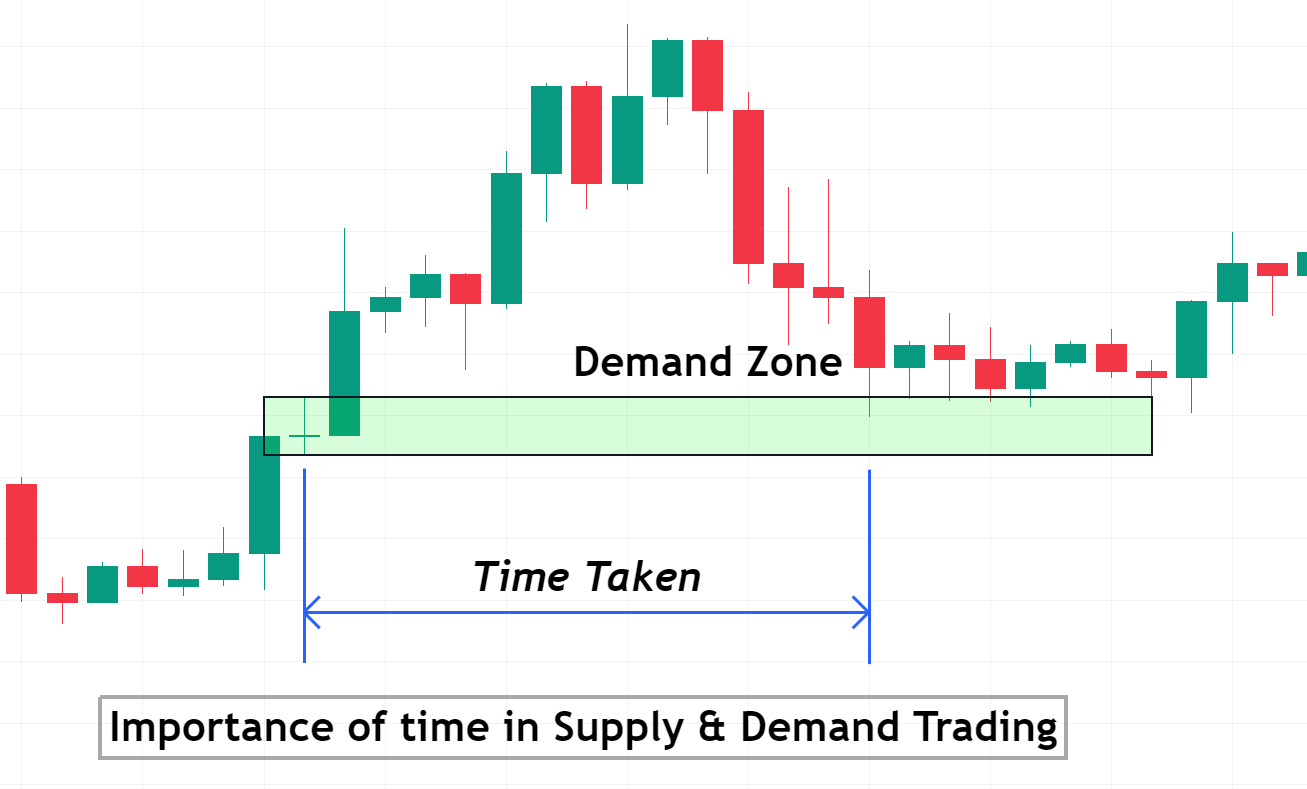

Time is the most important parameter in supply and demand trading. It shows the intensity of interest of buyers and sellers in the market.

The market is purely natural and works on the principles and laws of nature. Human psychology is a significant factor in the trading market. So, if you’re going to become a better trader, then I will recommend you understand the concepts and basics of the market before applying the technical analysis blindly.

Like most retail traders, learn to use the RSI indicator or candlestick patterns and start trading on a live account. You shouldn’t expect profit from trading until you become a pro trader. And also, you must keep your expectations low in terms of profitability; your focus should be on becoming a better trader.

Why the time matter in trading?

It’s a natural process that humans lose interest in different surrounding objects over time. For example, in childhood, one likes to watch cartoons or play games, while over time, the interest changes from cartoons to movies and other money-making activities.

In the same way, with time, traders also lose/change interest in different price levels. If a key level was working in 2021, then this is not necessary that it will also continue to work in 2022.

That’s why we should give importance to time in trading.

Important: Here, the interest of traders means the willingness of buyers/ sellers to buy/sell from a certain price level in trading.

Relation of time and interest of traders

There is an inverse relationship between the time and interest of traders in buying and selling from a particular price level.

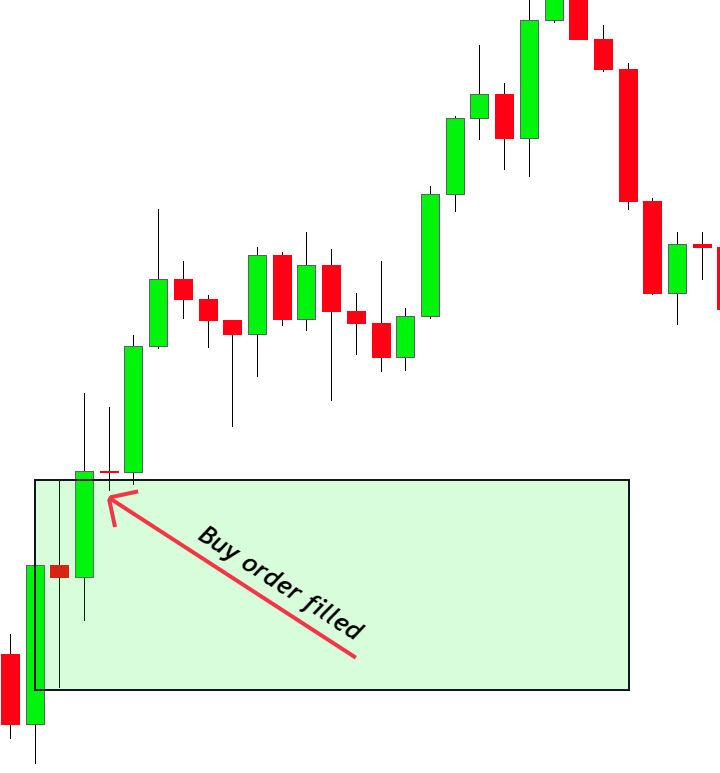

When a demand zone forms, traders’ interest in buying from that zone will be higher. Over time, the interest of buyers in this demand zone will decrease.

Demand zone

I will explain with an example.

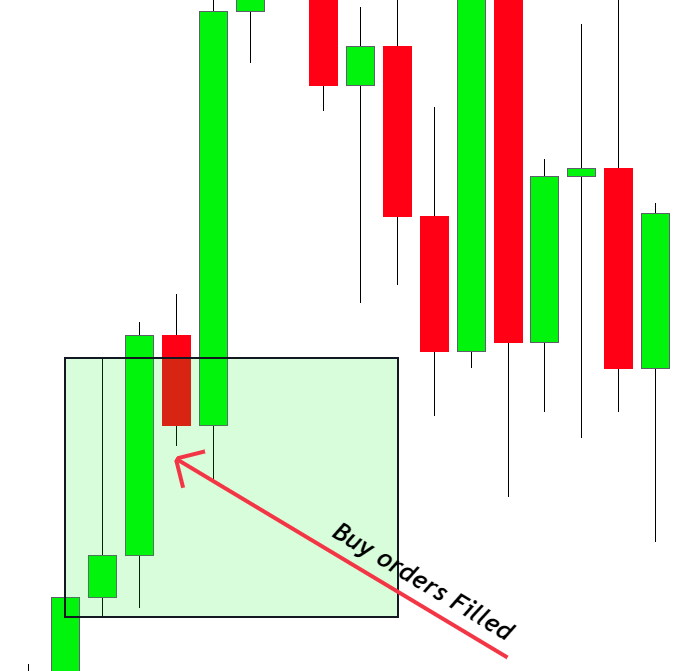

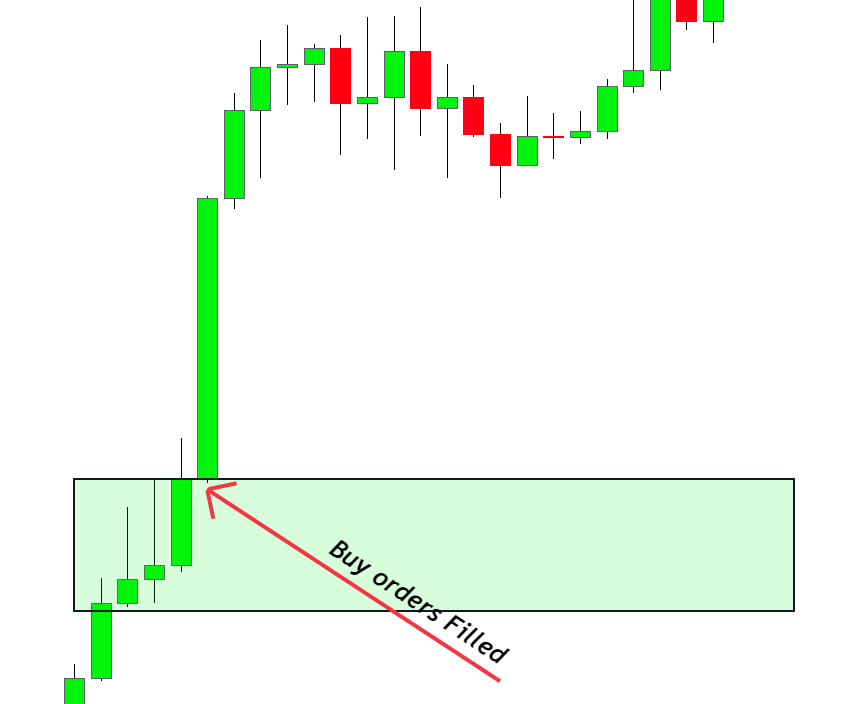

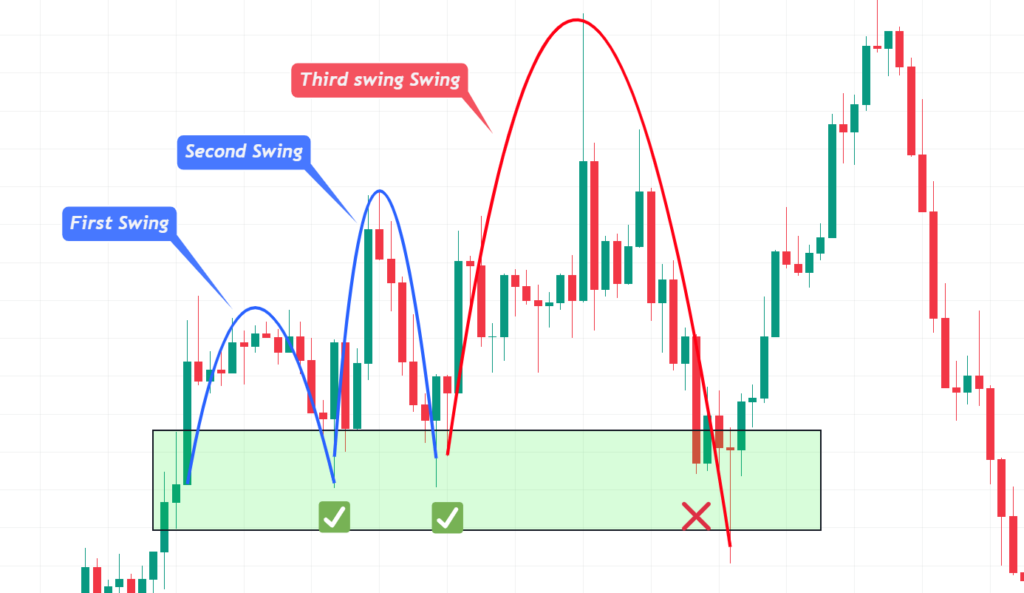

There are two demand zones on the candlestick chart of a particular currency pair.

- In the first example, the price bounced from the demand zone. It was a winning trade.

- On the other hand, the price broke the demand zone and was a losing trade.

These examples prove that the more time price will take to return to the demand zone, the weaker that demand zone will be. And there will be few chances of a price trend reversal from that zone.

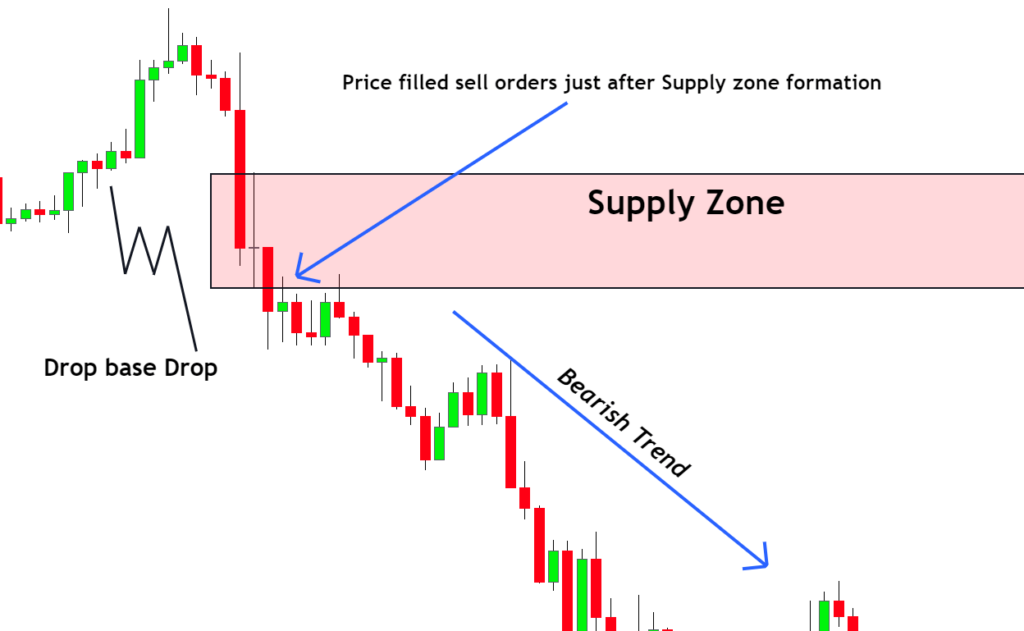

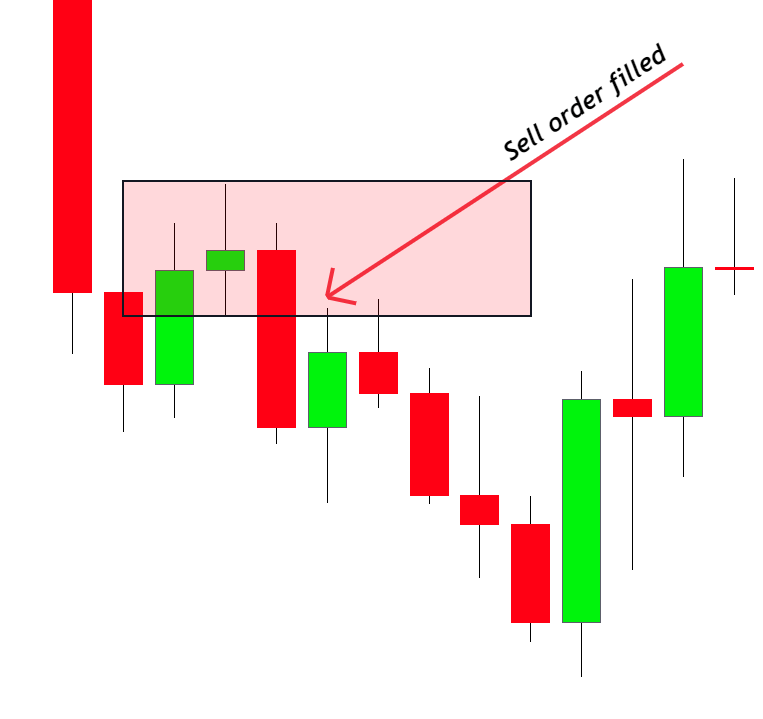

Supply zone

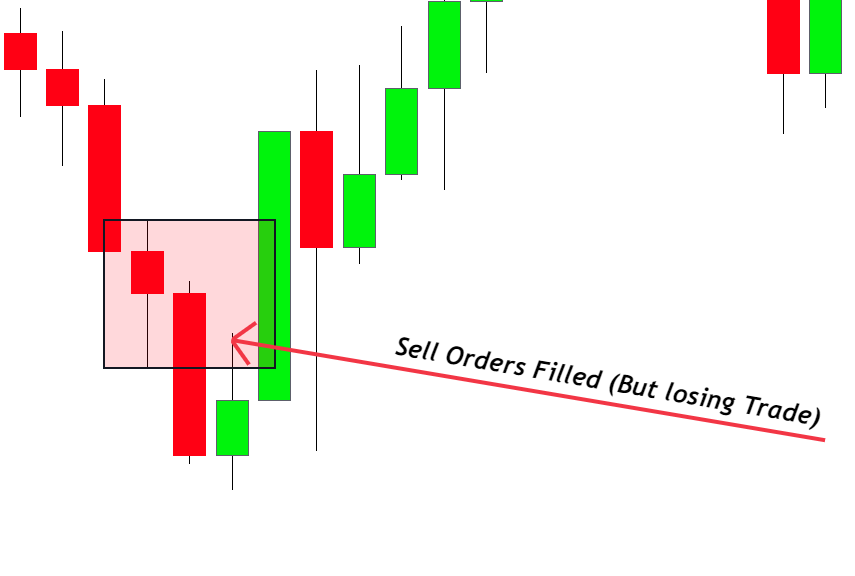

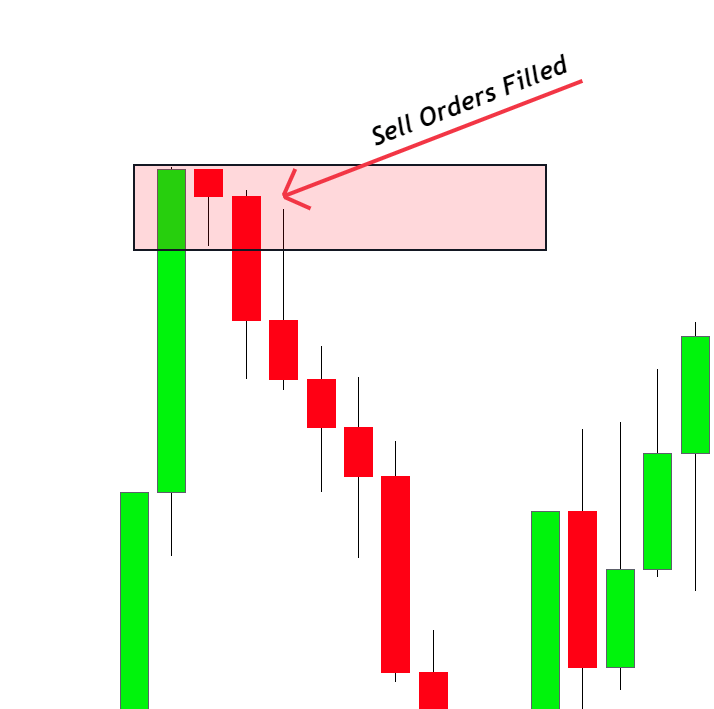

Now I will explain with an example of a supply zone.

In the first example, the price hit the supply zone and continued moving down. It was a winning trade, and the price took the least time to touch the supply zone.

In the second example, the price breaks the supply zone because it takes a lot of time to return to the supply zone.

So, the significant factor here is the time in supply and demand trading that a trader must understand.

Case study of high probability supply and demand zones

After studying the supply and demand zones deeply, it has been concluded that the less time price will take to hit the supply or demand zone, the stronger zone it will be.

I have shared examples of high-probability zones and weak supply-demand zones. Make sure to analyze each example correctly.

Identification of a strong zone

From the above case study, you will learn the importance of time in finding a good zone or price level. But what are the best settings or suggestions to find a high-probability zone?

Well! I will suggest you follow these two cases

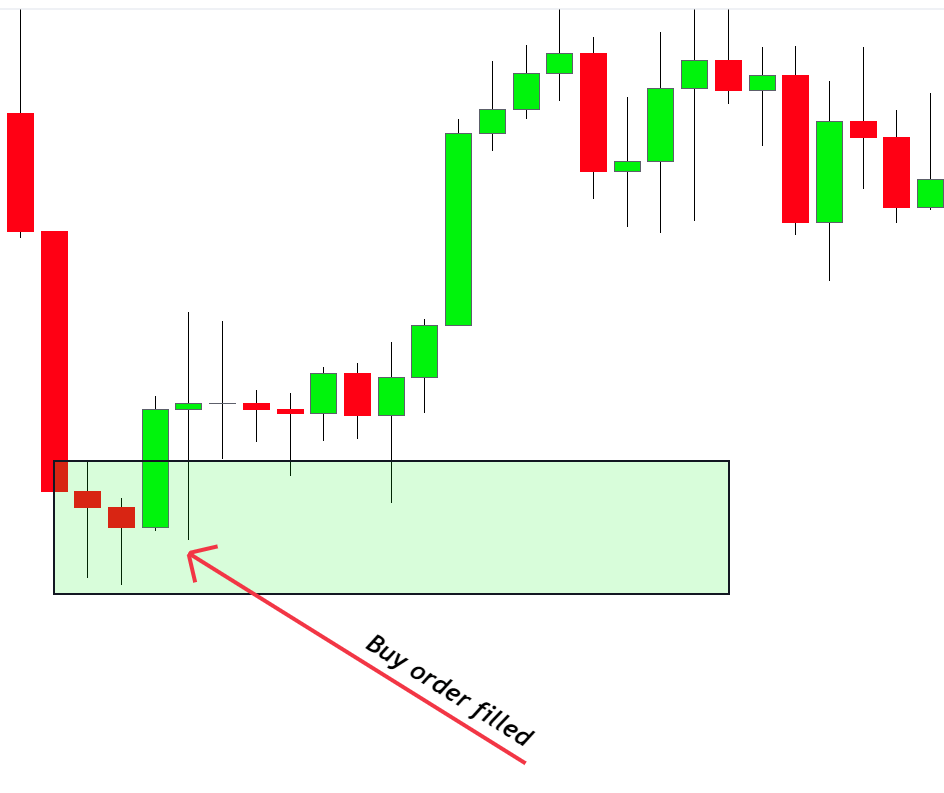

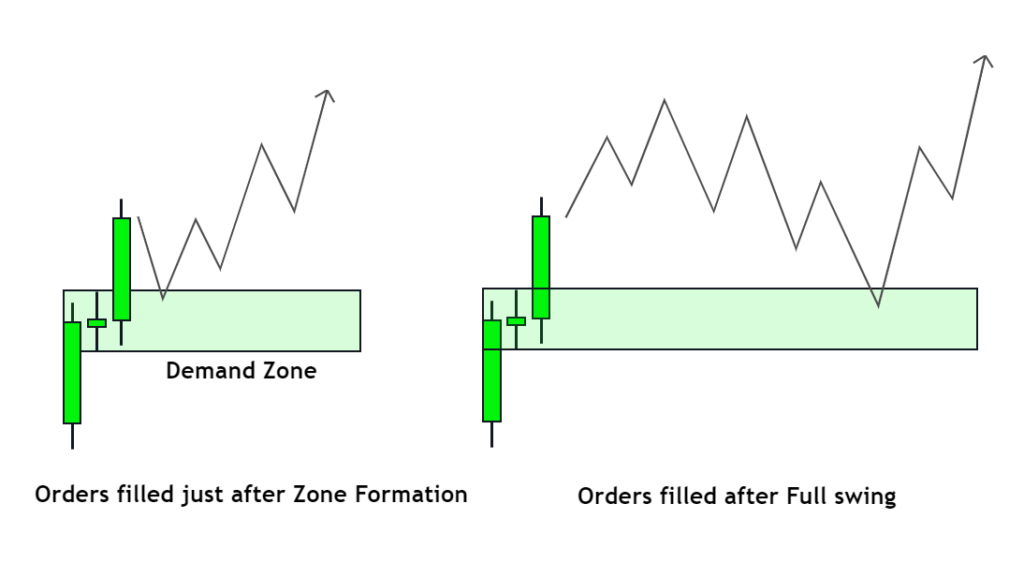

- In the first case, the price will hit the supply and demand zone just after its formation like in the image below

- In the second case, the price will hit the supply and demand zone after a full swing.

You should follow these two cases only. I have found high-probability patterns by following these two rules. That’s why I am also suggesting you. This is what I have learned from my experience. However, prices sometimes will also respect the zones after a long time, which is rare.

So our focus should always be to find the high probability market patterns.

The bottom line

Supply and demand trading is the advanced concept of technical analysis. It is the method of winning traders. So if you want to become a successful supply and demand trader, you should deeply understand small concepts to improve your trading.

It will be best to backtest this concept of strong and weak supply-demand zones at least 100 times. You’ll unlock many things behind supply and demand trading when you backtest yourself.

Very usefull