Definition

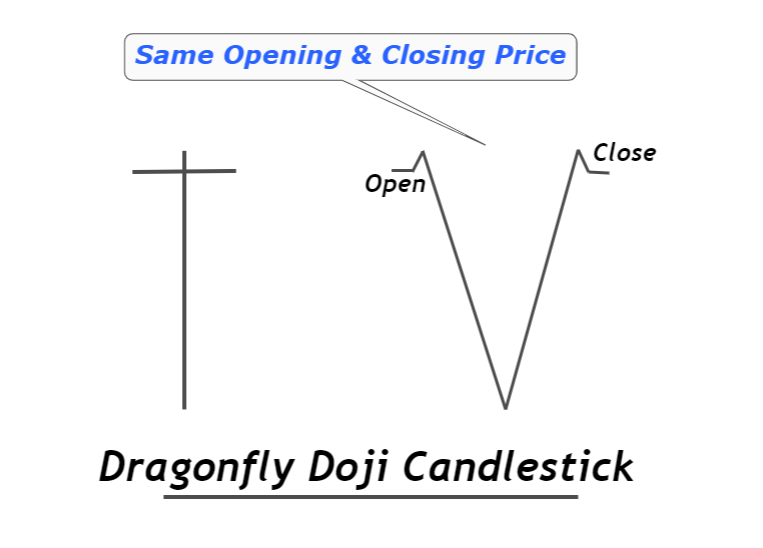

Dragonfly Doji is a type of Doji candlestick that represents indecision in the market, and it turns the bearish price trend into a bullish trend.

The unique feature of this candlestick is that it has the same opening and closing price. it has a large wick/shadow on the lower side. The large wick size indicates the false breakout that results in a trend reversal.

How to identify a Dragonfly Doji candlestick?

To find out perfect candlestick pattern on the price chart, follow the following procedure

- Step 1: Find out a candlestick that has the same opening and closing price.

- Step 2: Analyze the wicks of candlestick above and below the opening/closing price. 70% of the total wick of the candlestick should be below the opening/closing price. it will make a “T” shape pattern on the chart.

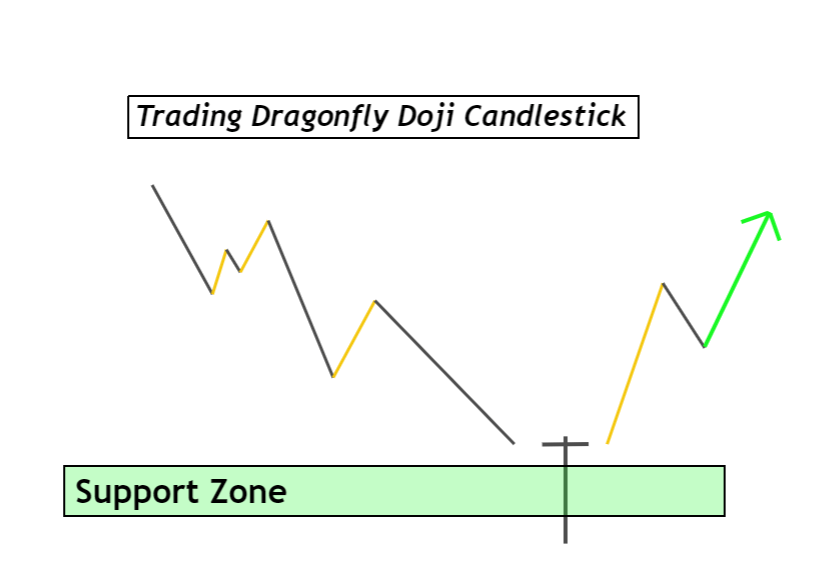

- Step 3: Identify the dragonfly Doji at the bottom of the chart or support zone.

It is a trend reversal candlestick pattern, but the trend will not be confirmed until the price breaks the high of the Doji candlestick. So that’s why it is a type of Doji candlestick. Price trend reversal also depends on the location of the candlestick on the price chart.

If it forms at the bottom of the chart, then it will act as a bullish trend reversal. On the other hand, the formation of a dragonfly Doji candle in the ranging market will make not give a trend reversal signal.

Dragonfly Doji: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 1 |

| Prediction | Bullish trend reversal |

| Prior Trend | Bearish trend |

| Counter Pattern | Gravestone Doji |

What does the Dragonfly Doji tell traders?

A Doji candlestick is an indication of equal forces of buyers and sellers in the market.

Let me explain to you the whole scenario…

When the price will open then it will move up then it will again return to the opening price. Now price will break that level and will move down. It will break an important level due to the huge momentum of sellers. Due to the presence of large pending buy orders at the support zone, the price will return and rise to the opening price. Then the price will close at the opening price making it a Doji candlestick.

Price rejection from the support zone indicates that buyers are stronger than sellers and they will turn the bearish trend into bullish. But the same opening and closing price of candlestick shows that there is indecision in the market. The only thing that confirms the trend reversal confirmation is the break of high of the candlestick.

Find High Probability Trades with this ADVANCED Candlestick Patterns Course

The Ultimate Candlestick Patterns Course That Will Help You To Trade Better

Best working conditions for Dragonfly Doji

I have explained the conditions for an ideal dragonfly Doji but now I will explain the strategy to get a high probability trend reversal signal. Because every dragonfly Doji candlestick will not reverse the bearish trend. You will have to add confluences to increase the winning probability of a trade setup.

These are two confluences that will enhance the power of trend reversal in this candle.

- Dragonfly Doji candle should form at the support zone or during oversold conditions

- You should confirm the trend reversal by checking either the price has broken the high of dragonfly Doji or not.

- It should not form during the sideways price movement on the chart.

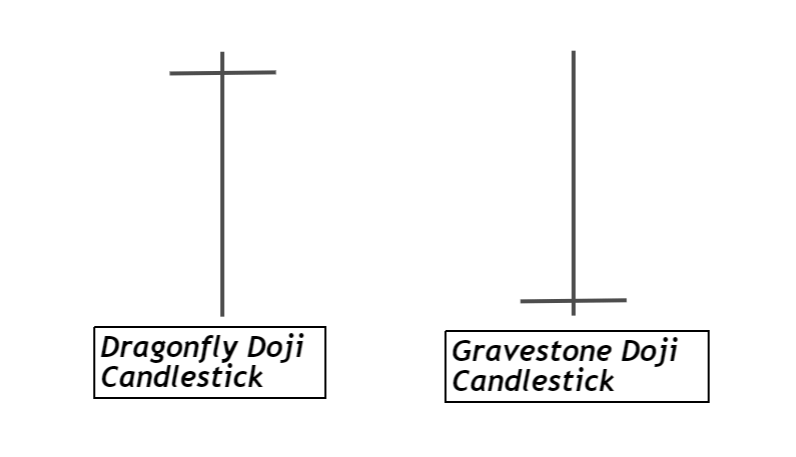

Difference between Dragonfly Doji and Gravestone Doji

There are two major differences between both candlesticks.

- Difference 1: The main difference between both candlestick patterns is that gravestone Doji will forecast a bearish trend reversal whereas dragonfly Doji will forecast a bullish trend reversal.

- Difference 2: The technical difference is that gravestone Doji has a large wick above the closing price of candlestick while Dragonfly Doji has a large wick below the closing price of the candlestick.

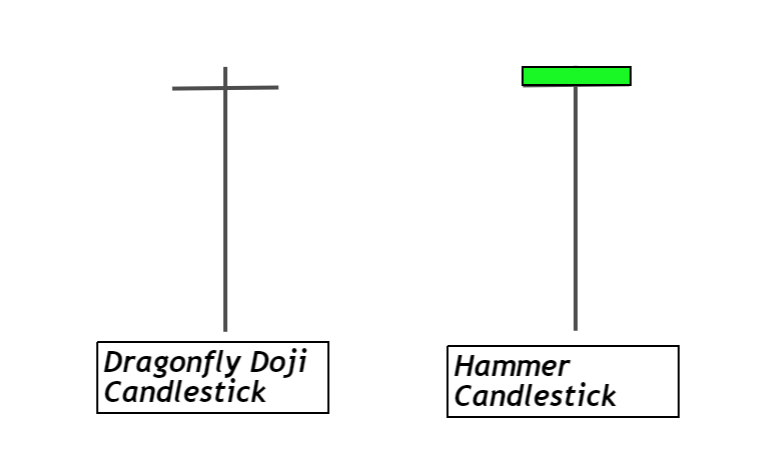

Does Hammer and Dragonfly Doji Candlesticks are same?

The working of both candlesticks is the same. Both indicate a bullish trend reversal.

But there is a difference between the shape of both candlesticks. Dragonfly Doji candlestick has the same opening and closing price while Hammer candlestick has the closing price slightly below/above the opening price of the candlestick.

The Bottom Line

Candlestick patterns add power to a trading system. A single candlestick will not make you a profitable trader ever, but a complete trading system will make you a good and profitable trader.

That’s why try to focus on making a perfect trading system by using candlesticks for entry or trend confirmation.

Make sure to backtest the Dragonfly Doji candlestick properly before using it within a trading system.