Definition

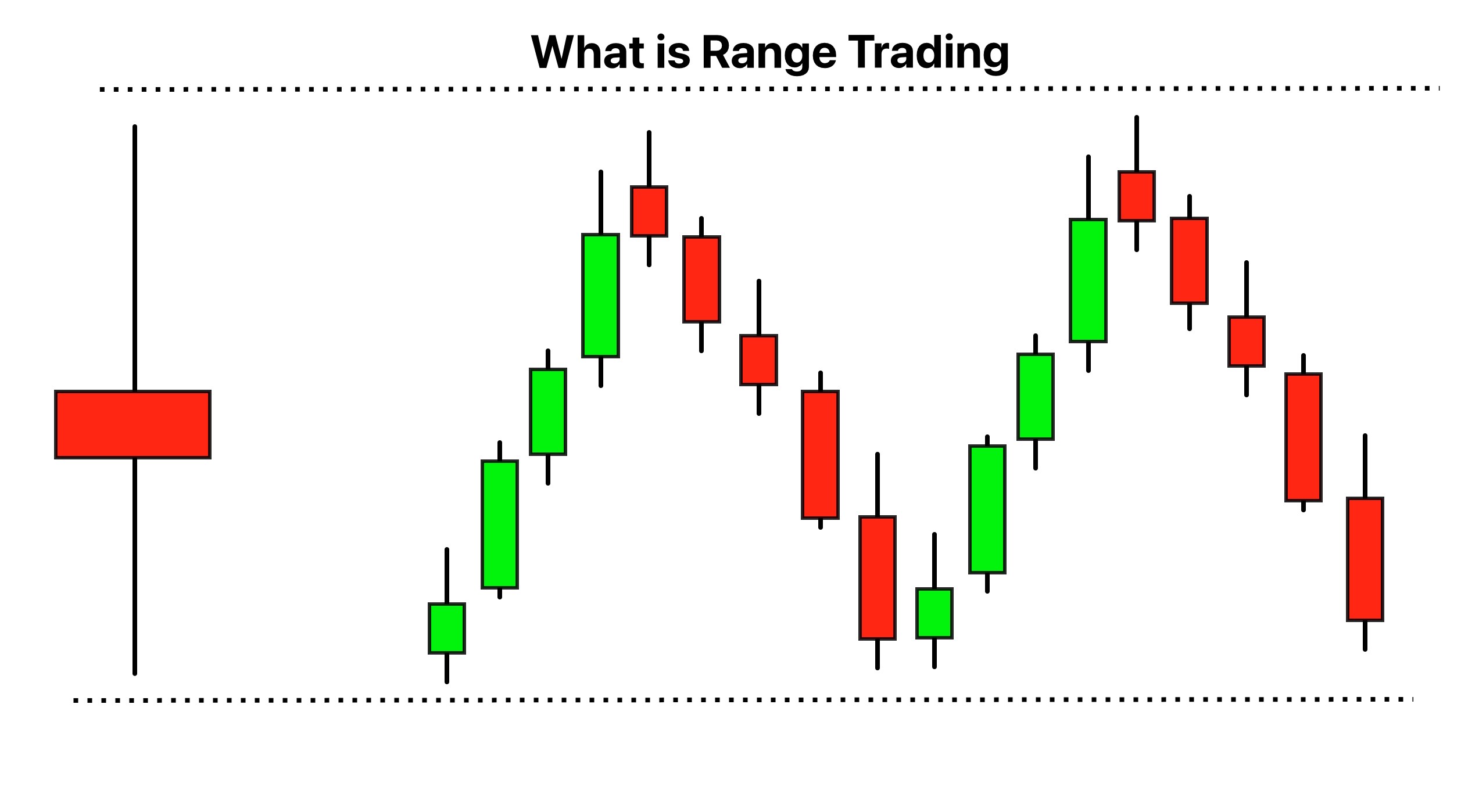

Range trading means trading the sideways market where buyers buy from the support zone and sell from the resistance zone within the price range. Prices always move within this range, and it is called range trading.

Most retail traders prefer trend trading, but it depends on the trader’s temperament. You should pick the trading strategy according to your daily routine and other life factors.

I suggest range trading to those who can’t hold the trade longer. It is easy to trade within the range.

I will explain the price range, range trading strategy, and tips to follow in this article, so read the complete article.

What is the range?

There are two types of market movements on the candlestick chart. First is the trend, and second is the range.

In the range, prices always move within fixed support and resistance levels in the form of Sin waves. That’s why it becomes easy to open a buy or sell order.

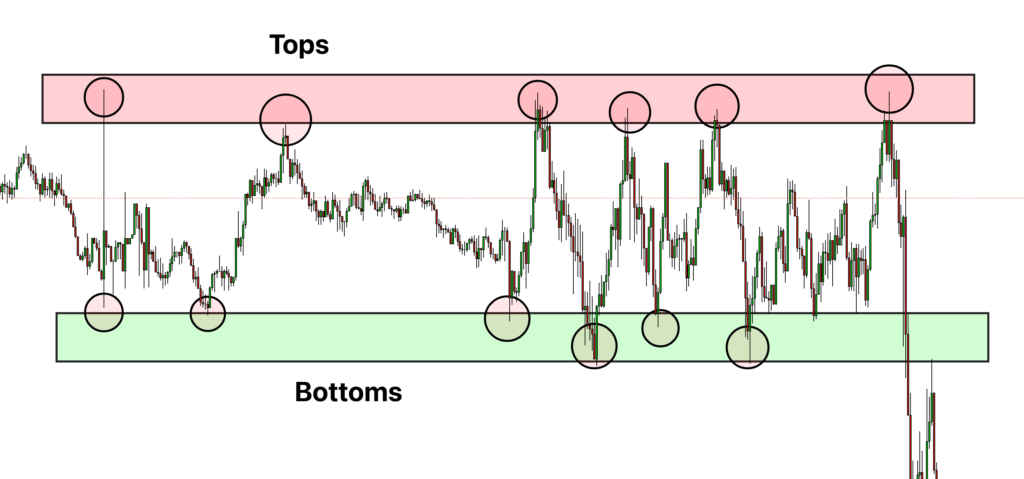

First, to identify the range on the chart, mark the upper resistance and lower support zone.

- Draw the support zone by checking the two bottoms of the price on the candlestick chart.

- Now draw the resistance zone by checking the two price tops on the candlestick chart.

How to draw the upper and lower zone in ranges?

Drawing these levels is essential in range trading because it will give you the entry and target levels.

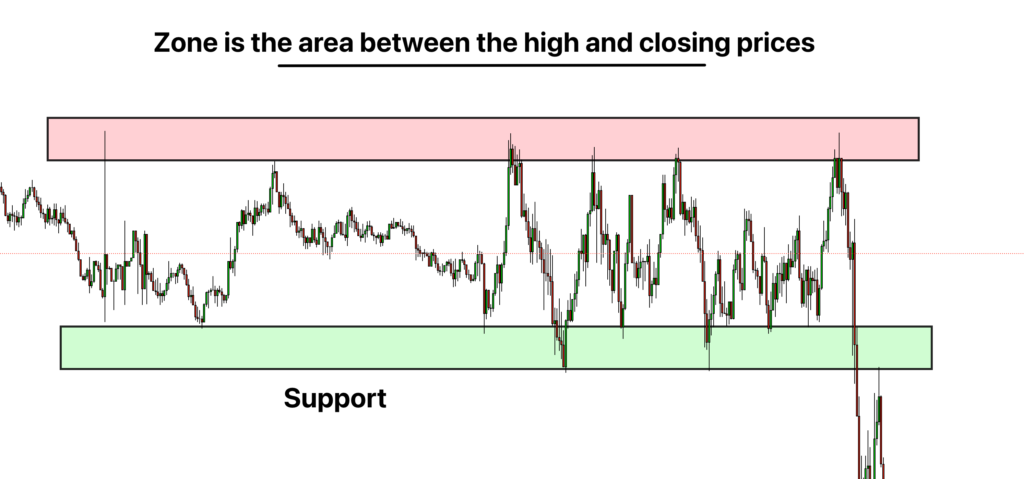

To draw the support or resistance zones, you should use the high/low of shadows and the closing price of candlesticks. There are no fixed rules to draw the zone. That’s why you should adjust the zone accordingly. My method is that use the wicks and closing prices of candlesticks to draw the zone.

Look at the image below for a better understanding.

Use of technical indicators to find the range

Instead of price action, we can also use some technical indicators to determine the ranging market. For new traders, I will also recommend using technical indicators to find the range, but with time, you must switch to price action because that’s the best way of technical analysis.

Here are a few indicators for finding the range:

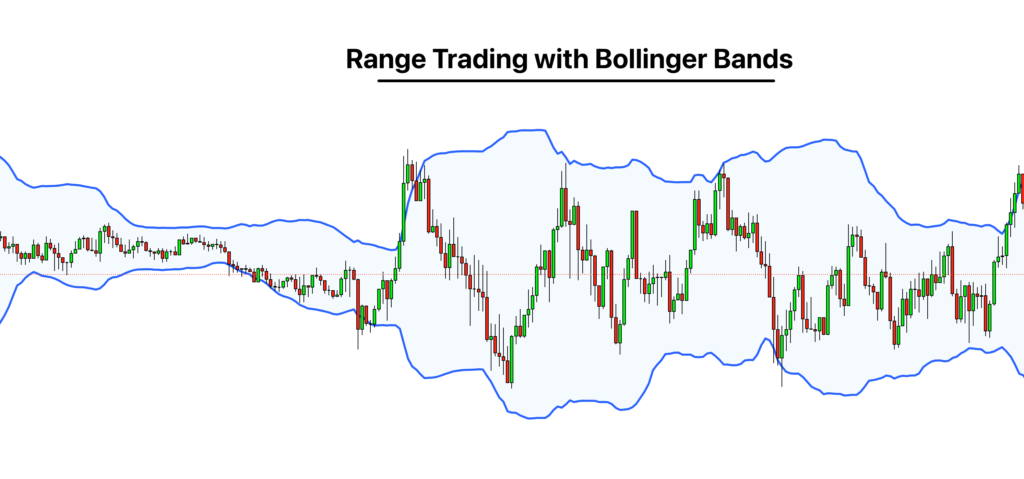

Bollinger bands

The Bollinger bands indicator consists of upper and lower bands. The angle or steepness of these bands shows us the nature of the market, either ranging or trending. So if the upper and lower bands are almost horizontal, the market is in ranging conditions. And it is time to apply the range trading strategy.

Horizontal bands are approximately horizontal. It will not become a straight horizontal line. Kindly take a look at the image below.

Moving averages

The moving average line is the second best and most user-friendly indicator to determine the ranging market. The steepness of the moving average line shows us the type of market condition. It also should align with the horizontal line, which means the market condition ranges. Remember that it will be approximately horizontal; however, it will still make short sine waves.

Tips for range trading

Before trading with a method, the first step is always to check the trading environment, whether the price is ranging, trending, or choppy. So if the market is trending or choppy, you should always avoid trading in the range.

It would be best to always wait for the best setup and open a trade once your strategy rules are fulfilled.

Trading session

The trading session is the most critical parameter in range trading because you should pick the session in which the price usually makes a range. Like range forms mainly in the Asian session due to low trading activity. That’s why it is best to trade the range in the session.

Timeframe

If trading within an Asian session, you shouldn’t pick the higher timeframes because a price range that forms in Asian sessions can only be traded on intraday timeframes or in scalping trading. On higher timeframes, you shouldn’t use the parameter of the trading session, but you should only use support and resistance levels.

Candlestick patterns

In range trading, candlestick patterns are the most important to find an exact entry level. For example, to open a buy order from the support zone, we will look for a bullish pin bar or bullish engulfing candlestick pattern at the support zone. This will be a safe entry point.

Oscillators

One of the best confluence of range trading is oscillators, like a simple RSI indicator that gives overbought and oversold levels. The rsi indicator works the best in the ranging market compared to the trending market.

You can add a confluence of RSI indicators to the range trading strategy. For example, before opening a buy order, ensure the rsi indicator line is below the oversold level.

How to trade the range?

I will add the confluence of candlestick patterns and the rsi indicator in the range trading strategy. Before proceeding to the strategy, following the above guidelines, you must confirm that you have drawn the proper support and resistance zone on the chart.

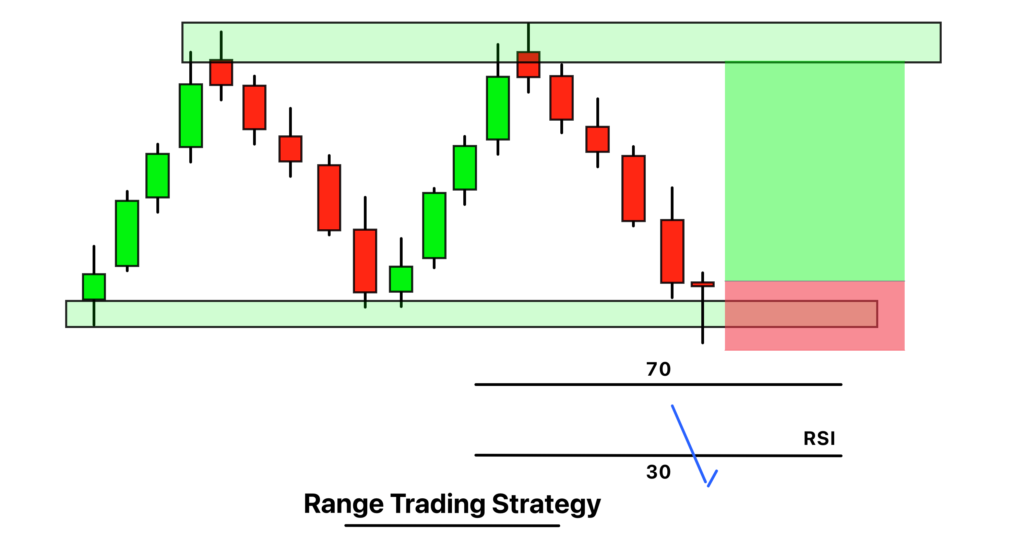

Conditions to open buy order

When the price touches the support zone, please wait for it to make a bullish candlestick pattern like a pin bar or engulfing, and then confirm the signal with the help of the rsi indicator. The RSI indicator line will be in the oversold region.

Now open a buy order, place a stop loss below the lowest low, and take the profit level above the resistance zone.

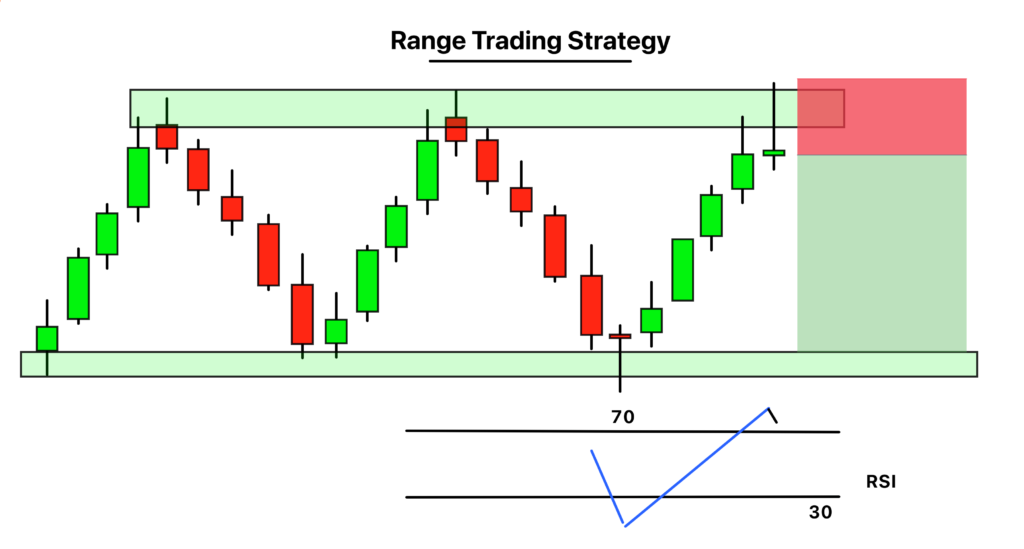

Conditions to open a sell order

When the price reaches the resistance zone, wait for the formation of a bearish candlestick pattern along with confirmation of the rsi indicator. The rsi indicator line must be in the overbought region.

Now open a sell order and place a stop loss above the highest high or the zone. Below the support zone is the take profit level.

The bottom line

The simplicity of range trading is that it gives an apparent stop loss and takes a profit. Most trades needed clarification in the target levels and closed them prematurely without taking the entire profit from the market. This also needs to be clarified for the risk management. But range trading has no complex rules, so it is easy to follow.

I recommend you backtest the range trading and practice the zones to grasp range trading fully.